Professional Documents

Culture Documents

Global Marketing

Uploaded by

Atakan Erdogan0 ratings0% found this document useful (0 votes)

12 views32 pagesdadasd

Original Title

161

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentdadasd

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views32 pagesGlobal Marketing

Uploaded by

Atakan Erdogandadasd

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 32

Global

Marketing

Warren J. Keegan Mark C. Green

Global Market Entry

Strategies: Licensing,

Investment and

Strategic Alliances

Chapter 9

© 2015 by Pearson Education 9-1

Learning Objectives

•Licensing and forms of

foreign investments

•Global strategic

partnerships

•Asian cooperatives

•Virtual corporation

•Market expansion

strategies

In 2012, Starbucks had 18,000 cafes in 62

countries and sales of $13.3 billion. Its goal

is to reach 40,000 units worldwide.

© 2015 by Pearson Education 9-2

Investment Cost of

Marketing Entry Strategies

© 2015 by Pearson Education 9-3

Which Strategy

Should Be Used?

• It depends on:

– Vision

– Attitude toward

risk

– Available

investment capital

– How much control

is desired

© 2015 by Pearson Education 9-4

Licensing

• A contractual agreement whereby one company (the

licensor) makes an asset available to another

company (the licensee) in exchange for royalties,

license fees, or some other form of compensation

– Patent

– Trade secret

– Brand name

– Product formulations

© 2015 by Pearson Education 9-5

Advantages to Licensing

• Provides additional profitability with little

initial investment

• Provides method of circumventing tariffs,

quotas, and other export barriers

• Attractive ROI

• Low costs to implement

• License agreements should have cross-

technology agreements to share

developments and create competitive

advantage for each party

© 2015 by Pearson Education 9-6

Disadvantages to Licensing

• Limited participation

• Returns may be lost

• Lack of control

• Licensee may become competitor

• Licensee may exploit company resources

© 2015 by Pearson Education 9-7

Special Licensing Arrangements

• Contract manufacturing

– Company provides technical specifications to a

subcontractor or local manufacturer

– Allows company to specialize in product design while

contractors accept responsibility for manufacturing facilities

• Franchising

– Contract between a parent company-franchisor and a

franchisee that allows the franchisee to operate a business

developed by the franchisor in return for a fee and

adherence to franchise-wide policies

© 2015 by Pearson Education 9-8

Franchising Questions

• Will local consumers buy your product?

• How tough is the local competition?

• Does the government respect trademark and

franchiser rights?

• Can your profits be easily repatriated?

• Can you buy all the supplies you need locally?

• Is commercial space available and are rents affordable?

• Are your local partners financially sound and do they

understand the basics of franchising?

© 2015 by Pearson Education 9-9

Investment

• Partial or full ownership of operations outside of

home country

– Foreign Direct Investment (FDI)

• Forms

– Joint ventures

– Minority or majority

equity stakes

– Outright acquisition

IKEA spent $2 billion to enter Russia.

© 2015 by Pearson Education 9-10

Joint Ventures

• Entry strategy for a single target country in

which the partners share ownership of a

newly-created business entity

• Builds upon each partner’s strengths

• Examples: Budweiser and Kirin (Japan), GM

and Toyota, GM and Daewoo in S. Korea, Ford

and Mazda, Chrysler and BMW

© 2015 by Pearson Education 9-11

Joint Ventures

• Advantages • Disadvantages

– Allows for risk sharing– – Requires more investment

financial and political than a licensing agreement

– Provides opportunity to – Must share rewards as well

learn new environment as risks

– Provides opportunity to – Requires strong

achieve synergy by coordination

combining strengths of – Potential for conflict

partners among partners

– May be the only way to – Partner may become a

enter market given barriers competitor

to entry

© 2015 by Pearson Education 9-12

Investment via

Direct Foreign Investment

• Start-up of new operations

– Greenfield operations or

– Greenfield investment

• Merger with an existing enterprise

• Acquisition of an existing enterprise

• Examples: Volkswagen, 70% stake in Skoda

Motors, Czech Republic (equity), Honda, $550

million auto assembly plant in Indiana (new

operations)

© 2015 by Pearson Education 9-13

Examples of Market Entry &

Expansion by Joint Venture

© 2015 by Pearson Education 9-14

Examples of Equity Stake

© 2015 by Pearson Education 9-15

Examples of Acquisitions

© 2015 by Pearson Education 9-16

Global Strategic Partnerships

• Possible terms:

– Collaborative

agreements

– Strategic alliances

– Strategic international

alliances

– Global strategic The Star Alliance is a GSP

made up of six airlines.

partnerships

© 2015 by Pearson Education 9-17

The Nature of

Global Strategic Partnerships

© 2015 by Pearson Education 9-18

The Nature of

Global Strategic Partnerships

• Participants remain independent following

formation of the alliance

• Participants share benefits of alliance as well

as control over performance of assigned tasks

• Participants make ongoing contributions in

technology, products, and other key strategic

areas

© 2015 by Pearson Education 9-19

Five Attributes of True Global Strategic

Partnerships

• Two or more companies develop a joint long-

term strategy

• Relationship is reciprocal

• Partners’ vision and efforts are global

• Relationship is organized along horizontal lines

(not vertical)

• When competing in markets not covered by

alliance, participants retain national and

ideological identities

© 2015 by Pearson Education 9-20

Success Factors of Alliances

• Mission: Successful GSPs create win-win

situations, where participants pursue objectives

on the basis of mutual need or advantage.

• Strategy: A company may establish separate

GSPs with different partners; strategy must be

thought out up front to avoid conflicts.

• Governance: Discussion and consensus must be

the norms. Partners must be viewed as equals.

© 2015 by Pearson Education 9-21

Success Factors (Con’t)

• Culture: Personal chemistry is important, as is

the successful development of a shared set of

values.

• Organization: Innovative structures and designs

may be needed to offset the complexity of

multi-country management.

• Management: Potentially divisive issues must

be identified in advance and clear, unitary lines

of authority established that will result in

commitment by all partners.

© 2015 by Pearson Education 9-22

Examples of

Global Strategic Alliances

© 2015 by Pearson Education 9-23

Alliances with Asian Competitors

• Four common problem areas

– Each partner had a different dream

– Each must contribute to the alliance and each

must depend on the other to a degree that

justifies the alliance

– Differences in management philosophy,

expectations, and approaches

– No corporate memory

© 2015 by Pearson Education 9-24

Cooperative Alliance in Japan:

Keiretsu

• Inter-business alliance or enterprise groups in

which business families join together to fight for

market share

• Often cemented by bank ownership of large

blocks of stock and by cross-ownership of stock

between a company and its buyers and non-

financial suppliers

• Keiretsu executives can legally sit on each

other’s boards, share information, and

coordinate prices© 2015 by Pearson Education 9-25

Horizontal Keiretsu

• Big Six: Mitsui, Mitsubishi, Sumitomo, Fuyo, Sanwa,

DKB Groups

• Horizontal keiretsu: intragroup relationships involve

shared stock holdings and trading relations

• Large, powerful with revenues in hundreds of

billions

• Can block foreign suppliers causing higher prices

• Promotes corporate stability, risk sharing, long-term

employment

© 2015 by Pearson Education 9-26

Keretsui

• Vertical keretsui: Hierarchical alliances

between manufacturers and retailers

– Matshusita sells its products through its chain of

National stores; 50-80% of products are Matshusita

brands Panasonic, Technics, and Quasar

• Manufacturing keretsui: vertical hierarchical

alliances between automakers suppliers, and

component manufacturers

© 2015 by Pearson Education 9-27

Cooperative Strategies in South Korea:

Chaebol

• Composed of dozens of companies, centered

around a bank or holding company, and

dominated by a founding family

– Samsung

– LG

– Hyundai

– Daewoo

© 2015 by Pearson Education 9-28

21st Century Cooperative Strategies: Targeting

the Digital Future

• Alliances between companies in several

industries that are undergoing transformation

and convergence

– Computers

– Communications

– Consumer electronics

– Entertainment

© 2015 by Pearson Education 9-29

Beyond Strategic Alliances

• Semantech: Consortium of 14 tech companies tasked

with saving the U.S. chip-making industry

• Relationship enterprise: groupings of firms from

different industries and countries with common goals

and act as one entity

• Next stage of evolution of the strategic alliance

– Super-alliance

– Virtual corporation

© 2015 by Pearson Education 9-30

Market Expansion Strategies

• Companies must decide to expand by:

– Seeking new markets in existing countries

– Seeking new country markets for already

identified and served market segments

© 2015 by Pearson Education 9-31

Looking Ahead to Chapter 10

The Global Marketing Mix–Product and Brand

Decisions

© 2015 by Pearson Education 9-32

You might also like

- Lecture 4.2 - Global Market - Entry Strategies - Licensing, Investment, and Strategic AlliancesDocument24 pagesLecture 4.2 - Global Market - Entry Strategies - Licensing, Investment, and Strategic AlliancesronNo ratings yet

- Ch.9 Pemasaran GlobalDocument33 pagesCh.9 Pemasaran Globaldina100% (1)

- Global Marketing: Global Market-Entry Strategies: Licensing, Investment and Strategic AlliancesDocument34 pagesGlobal Marketing: Global Market-Entry Strategies: Licensing, Investment and Strategic AlliancesHoang HaNo ratings yet

- Chp9 MKT Entry - Licence, Invest & Strag AllDocument38 pagesChp9 MKT Entry - Licence, Invest & Strag All李新鹏No ratings yet

- ch9 150807164930 Lva1 App6891Document32 pagesch9 150807164930 Lva1 App6891Sadia Islam 2125181660No ratings yet

- Chap 9 PPT - Global Market Entry Strategies Licensing Investment and Strategic AlliancesDocument28 pagesChap 9 PPT - Global Market Entry Strategies Licensing Investment and Strategic AlliancesMuhammad TahaNo ratings yet

- Global Market Entry Strategies: Licensing, Investment, and Strategic AlliancesDocument26 pagesGlobal Market Entry Strategies: Licensing, Investment, and Strategic AlliancesAhmad Fauzan Fiqri, S.ENo ratings yet

- Amity Business School Global Market Entry StrategiesDocument23 pagesAmity Business School Global Market Entry StrategiesRohit JainNo ratings yet

- STM CH10 Corp Strategy (2) .183969.1584426601.8263 PDFDocument35 pagesSTM CH10 Corp Strategy (2) .183969.1584426601.8263 PDFNattanonSirirungruangNo ratings yet

- global market group 4Document32 pagesglobal market group 4Cherry Joy OyanonNo ratings yet

- Alliances MergedDocument87 pagesAlliances MergedSiddhant SinghNo ratings yet

- Keegan 5e 09Document28 pagesKeegan 5e 09api-3695734No ratings yet

- Module - 3 Modes of International Entry: Amity School of BusinessDocument23 pagesModule - 3 Modes of International Entry: Amity School of BusinessanashussainNo ratings yet

- Chap006 Merged PDFDocument132 pagesChap006 Merged PDFEnith ArriagaNo ratings yet

- FDI and Political RiskDocument59 pagesFDI and Political RiskannNo ratings yet

- Global Market Entry Strategies (Licensing, Investment, and Strategic Alliances)Document25 pagesGlobal Market Entry Strategies (Licensing, Investment, and Strategic Alliances)Kanta Ganguly100% (1)

- Strategic Management and Business Policy 15e: Strategy Implementation: Global StrategyDocument27 pagesStrategic Management and Business Policy 15e: Strategy Implementation: Global StrategyAnnisa Dewi0% (2)

- Inter-Firm RelationshipsDocument12 pagesInter-Firm RelationshipsPRAJWAL S NNo ratings yet

- Competitive Advantages SlidesDocument41 pagesCompetitive Advantages SlidesBích ChâuNo ratings yet

- Choosing the Right Global Market Entry StrategyDocument26 pagesChoosing the Right Global Market Entry StrategynoorNo ratings yet

- Daniels14 - Direct Investment and Collaborative StrategiesDocument27 pagesDaniels14 - Direct Investment and Collaborative StrategiesHuman Resource ManagementNo ratings yet

- Strategic Alliances & Joint Ventures: Prof. Arindam Mondal XLRI JamshedpurDocument23 pagesStrategic Alliances & Joint Ventures: Prof. Arindam Mondal XLRI JamshedpurSiddhant SinghNo ratings yet

- IPPTChap 008Document81 pagesIPPTChap 008Nia ニア MulyaningsihNo ratings yet

- Cooperative StrategyDocument24 pagesCooperative StrategysiddharthbhargavaofficialNo ratings yet

- Global education through local partnershipsDocument26 pagesGlobal education through local partnershipsAlexa BlissNo ratings yet

- Alliances and Joint VenturesDocument18 pagesAlliances and Joint VenturessukeshNo ratings yet

- Chapter 16 IfDocument47 pagesChapter 16 Ifcuteserese roseNo ratings yet

- Joint VentureDocument23 pagesJoint VentureArun MishraNo ratings yet

- Joint Ventures - Key Success FactorsDocument16 pagesJoint Ventures - Key Success Factorssandycse2005No ratings yet

- Barney SMCA4 07Document24 pagesBarney SMCA4 07Anggi Gayatri SetiawanNo ratings yet

- Max-Tata JV insuranceDocument26 pagesMax-Tata JV insuranceDeepali Dhingra0% (2)

- Topic 9 Cooperative StrategyDocument46 pagesTopic 9 Cooperative Strategy--bolabolaNo ratings yet

- Global - Environment Week 5Document37 pagesGlobal - Environment Week 5Melanie Cruz ConventoNo ratings yet

- 6.1. The Design and Management of International Joint VenturesDocument14 pages6.1. The Design and Management of International Joint VenturesGrace SaragihNo ratings yet

- Global StrategyDocument19 pagesGlobal StrategyFernando Alfonso RamirezNo ratings yet

- Direct Investment and Collaborative Strategies Chapter FourteenDocument26 pagesDirect Investment and Collaborative Strategies Chapter FourteenMohammad Tawhidul IslamNo ratings yet

- Chapter 9 - April 21Document28 pagesChapter 9 - April 21api-299080505100% (1)

- Strategy For AlliancesDocument13 pagesStrategy For AlliancesGautamNo ratings yet

- Chapter 8 SMDocument34 pagesChapter 8 SMYber LexNo ratings yet

- International StrategiesDocument18 pagesInternational StrategiesMostafa MamdouhNo ratings yet

- Why Study International Business ??Document38 pagesWhy Study International Business ??Dullur ManasaNo ratings yet

- Hitt13e PPT Ch09Document47 pagesHitt13e PPT Ch09Alaa ShaathNo ratings yet

- Corporate Strategy Ch. 8Document15 pagesCorporate Strategy Ch. 8Batool AbbasNo ratings yet

- Involvement/Risk/ Reward of Market Entry StrategiesDocument13 pagesInvolvement/Risk/ Reward of Market Entry StrategiesOk HqNo ratings yet

- Crafting a Diversification Strategy: 4 Key StepsDocument73 pagesCrafting a Diversification Strategy: 4 Key StepssushmithaNo ratings yet

- Ch09 Roth3e Enhanced PPT AccessibleDocument72 pagesCh09 Roth3e Enhanced PPT AccessibleSwastik AgarwalNo ratings yet

- استراتيجية 5Document63 pagesاستراتيجية 5ShahadNo ratings yet

- Chapter 7 Entry Strategies and Organizational StructuresDocument36 pagesChapter 7 Entry Strategies and Organizational StructuresAMAL WAHYU FATIHAH BINTI ABDUL RAHMAN BB20110906No ratings yet

- Ibm 3 UnitDocument37 pagesIbm 3 UnitAJEETH GOKUNo ratings yet

- Bba Eim Group No 2Document13 pagesBba Eim Group No 2hamidumajid033No ratings yet

- Lesson 3 International Cooperation DecisionDocument24 pagesLesson 3 International Cooperation DecisionRumeysha rujubNo ratings yet

- IBE NDIM M & A and Strategic Alliance Lecture 20Document21 pagesIBE NDIM M & A and Strategic Alliance Lecture 20Kunal AgarwalNo ratings yet

- Summary - Chapter 9Document21 pagesSummary - Chapter 9chun88100% (2)

- Chap 8 Corporate Strategy Diversification and The Multibusiness CompanyDocument81 pagesChap 8 Corporate Strategy Diversification and The Multibusiness CompanySharif Ul Ahasan3335No ratings yet

- Strategies For Firm Growth: Bruce R. Barringer R. Duane IrelandDocument28 pagesStrategies For Firm Growth: Bruce R. Barringer R. Duane IrelandKannan Prakash100% (1)

- PowerPoint Lecture 9Document40 pagesPowerPoint Lecture 9hrleenNo ratings yet

- Engaging in Cross Border CollaborationDocument29 pagesEngaging in Cross Border CollaborationJason WidagdoNo ratings yet

- International Strategy: Johnson, Whittington and Scholes, Exploring Strategy, 9 Edition, © Pearson Education Limited 2011Document34 pagesInternational Strategy: Johnson, Whittington and Scholes, Exploring Strategy, 9 Edition, © Pearson Education Limited 2011ridhiNo ratings yet

- Wise Money: Using the Endowment Investment Approach to Minimize Volatility and Increase ControlFrom EverandWise Money: Using the Endowment Investment Approach to Minimize Volatility and Increase ControlNo ratings yet

- Emd MPC 543Document25 pagesEmd MPC 543jaskaran singhNo ratings yet

- I Am Sharing 'ASSIGNMENT MAT099 - E08G5 - WRTTEN REPORT' With YouDocument23 pagesI Am Sharing 'ASSIGNMENT MAT099 - E08G5 - WRTTEN REPORT' With YouaqilNo ratings yet

- Romeo and Julliet - Close Read AnalysisDocument5 pagesRomeo and Julliet - Close Read Analysisapi-514407929No ratings yet

- Practice Reading GraphsDocument4 pagesPractice Reading GraphsSharon TaylorNo ratings yet

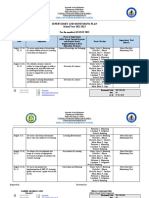

- Lesson Plan For Demonstration (COT) : School Grade Level Teacher Learning Area Teaching Dates and Time QuarterDocument6 pagesLesson Plan For Demonstration (COT) : School Grade Level Teacher Learning Area Teaching Dates and Time Quartermaritel dawaNo ratings yet

- RIZAL: INSPIRATION FOR A NEW GENERATIONDocument11 pagesRIZAL: INSPIRATION FOR A NEW GENERATIONErica B. DaclanNo ratings yet

- Institute of Graduate Studies (Igs)Document46 pagesInstitute of Graduate Studies (Igs)Syara Shazanna ZulkifliNo ratings yet

- The Bourne Identity ReviewDocument3 pagesThe Bourne Identity ReviewBoldizsár Zeyk AnnaNo ratings yet

- Medical Services Recruitment Board (MRB)Document20 pagesMedical Services Recruitment Board (MRB)durai PandiNo ratings yet

- EN3: Introduction To Engineering and Statics: 3. Resultant of Systems of ForcesDocument6 pagesEN3: Introduction To Engineering and Statics: 3. Resultant of Systems of ForceskarthikaNo ratings yet

- The University of QueenslandDocument2 pagesThe University of Queenslandimmanuel nauk elokpereNo ratings yet

- Supervisory Plan 2022 2023Document4 pagesSupervisory Plan 2022 2023Jesieca Bulauan100% (12)

- Basic Life Support Checklist CSLLFIDocument1 pageBasic Life Support Checklist CSLLFIShane Frances SaborridoNo ratings yet

- The Right Help at The Right Time: MatterDocument24 pagesThe Right Help at The Right Time: MattermariustudoracheNo ratings yet

- Pharmacist Licensing Requirements by StateDocument21 pagesPharmacist Licensing Requirements by StateBio DataNo ratings yet

- Probability and Statistics. ASSIGNMENT 2Document5 pagesProbability and Statistics. ASSIGNMENT 2ByhiswillNo ratings yet

- Chapter 2 Study Questions Solution ManualDocument12 pagesChapter 2 Study Questions Solution ManualSebastiàn Valle100% (3)

- Power Over Ethernet - Wikipedia, The Free EncyclopediaDocument7 pagesPower Over Ethernet - Wikipedia, The Free EncyclopediaManitNo ratings yet

- Senior Power Apps Engineer JobDocument3 pagesSenior Power Apps Engineer JobMichałNo ratings yet

- Biotensegrity and Myofascial Chains A Global Approach To An Integrated Kinetic ChainDocument8 pagesBiotensegrity and Myofascial Chains A Global Approach To An Integrated Kinetic ChainMohamed ElMeligieNo ratings yet

- Quotation SS20230308 100KVAR APFC PANEL VIDHYA WIRESDocument4 pagesQuotation SS20230308 100KVAR APFC PANEL VIDHYA WIRESsunil halvadiyaNo ratings yet

- Questions Scope PDFDocument10 pagesQuestions Scope PDFabdou madjidNo ratings yet

- Growatt Warranty Procedure - 07-09-2020Document9 pagesGrowatt Warranty Procedure - 07-09-2020Design TeamNo ratings yet

- Excerpts From The Way of The Samurai (Shīdo) : Primary Source Document With Questions (DBQS)Document2 pagesExcerpts From The Way of The Samurai (Shīdo) : Primary Source Document With Questions (DBQS)Valeria MontalvaNo ratings yet

- AP - Quiz PDFDocument1 pageAP - Quiz PDFDymphna Ann CalumpianoNo ratings yet

- Strategic Planning Assignment - TescoDocument16 pagesStrategic Planning Assignment - TescoKayode Trinity Omosebi100% (1)

- Marivy Abella ResearchDocument43 pagesMarivy Abella ResearchRo Gi LynNo ratings yet

- Asme A112.4.14-2004 PDFDocument14 pagesAsme A112.4.14-2004 PDFAmer AmeryNo ratings yet

- Sidhil - ICT Design EngineerDocument3 pagesSidhil - ICT Design Engineeratif_aman123No ratings yet

- Individualized Learning Program Project Evaluation FormDocument3 pagesIndividualized Learning Program Project Evaluation Formakbisoi1No ratings yet