Professional Documents

Culture Documents

Rohit Desai M00653255

Uploaded by

ROHIT0 ratings0% found this document useful (0 votes)

4 views10 pagesInternet banking provides convenience but also risks, as hackers have increasingly targeted bank accounts. While two-factor authentication adds security for online transactions, credit card purchases in stores still rely on passwords alone. Researchers have found flaws in EMV chip-and-PIN technology that allow stealing cards and verifying PINs without knowing the actual number, potentially enabling fraud to go undiscovered. Users can reduce risks by carefully handling passwords, regularly reviewing accounts, and promptly logging out of banking sessions.

Original Description:

Presentation on Banking Security

Original Title

m 00653255

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentInternet banking provides convenience but also risks, as hackers have increasingly targeted bank accounts. While two-factor authentication adds security for online transactions, credit card purchases in stores still rely on passwords alone. Researchers have found flaws in EMV chip-and-PIN technology that allow stealing cards and verifying PINs without knowing the actual number, potentially enabling fraud to go undiscovered. Users can reduce risks by carefully handling passwords, regularly reviewing accounts, and promptly logging out of banking sessions.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views10 pagesRohit Desai M00653255

Uploaded by

ROHITInternet banking provides convenience but also risks, as hackers have increasingly targeted bank accounts. While two-factor authentication adds security for online transactions, credit card purchases in stores still rely on passwords alone. Researchers have found flaws in EMV chip-and-PIN technology that allow stealing cards and verifying PINs without knowing the actual number, potentially enabling fraud to go undiscovered. Users can reduce risks by carefully handling passwords, regularly reviewing accounts, and promptly logging out of banking sessions.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 10

Rohit Desai M00653255

•The technology that is considered

Fast and Convenient by many

people, is still a big question to a

large population of the world

whether Internet banking is a boon

or a bane to the current

generation.

•Internet banking indeed helps us

in day to day life greatly.

For ex: We can sit at home and pay

our bills and access the banks and

our credit-cards (associated with

the banks we have our credit in) to

withdraw money from the banks.

•But over a decade now unethical-

hacking cases have been

increasing more and more

especially in the Banks, where the

money from one bank account

would be transferred to another

bank account without the

knowledge of the rightful owner.

•Usually when transaction took

place from one bank accounts to

another there is was a one-way

security passage which required

the pin code or pass code to

complete the transaction.

•Also the transaction was

encrypted which meant that the

plain text was not visible or would

•But now technology has become

more advanced and so have

unethical hackers. Recent events

have shown that now unethical

hackers can also hack the one way

security passage password too.

•Usually the one way security

passage password is just the pin

code of credit card (associated with

the banks we have our credit in)

which the user needs to input as a

proof that he is the legal owner of

the card and the bank account.

•Nowadays unethical hackers have

developed their own software's

that can decrypt and decode the

pin code of the owner’s credit card.

Thus the two way security passage

password was introduced. In this

passage is more encryption and an

additional set of passage which

includes either a SMS or a

verification code.

•But the banking security stays

secure this way only when

transactions are made online.

Credit cards that are used to make

purchases elsewhere are still

vulnerable as they still follow the

one way security passage

password system.

The EMV (widely known as Euro

pay, MasterCard and Visa) protocol

is used worldwide for credit and

debit card payments and is

commonly known as “Chip and

PIN” in the UK. The analysis of

EMV has discovered flaws which

allow criminals to use stolen cards

without knowing the correct PIN. In

some cases where these types of

flaws are exploited – in the

“wedge” attack – the receipt and

bank records would show that the

PIN was correctly verified, leading

to the victim of this fraud to have a

request for refund denied.

This has been confirmed by the

Department of Computer Science

and Technology, that this type of

attack works in the UK, for online

transactions (where the terminal

contacts the bank for authorization

before completing the purchase). It

does not apply to UK ATM

transactions, which use a different

method for PIN verification.

There are some precautions that users

can take to make sure that their

chances of getting hacked reduces.

Some of them are:

•To not disclose passwords to anyone

else.

•To periodically change their password.

•To regularly check their account

balances and statements so that there

is no suspicious activity over a long

time.

•To promptly log out of services you

will be using.

REFERENCES:

•www.info.ssl.com

•www.cl.cam.ac.uk

•www.thestandard.com

•www.bankinfosecurity.com

You might also like

- Un Attack 20130Document21 pagesUn Attack 20130bkaraqaNo ratings yet

- Banking Security and AtmDocument10 pagesBanking Security and AtmChhaya ChyNo ratings yet

- Jean Martins: Jeanfmc - Github.ioDocument5 pagesJean Martins: Jeanfmc - Github.ioSean Raphael YeoNo ratings yet

- Security of Online TransactionsDocument46 pagesSecurity of Online Transactionshaleem81No ratings yet

- Electronic Banking: Electronic Money, or E-Money, Is The Money Balance Recorded Electronically On ADocument8 pagesElectronic Banking: Electronic Money, or E-Money, Is The Money Balance Recorded Electronically On AKarlene BacorayoNo ratings yet

- Exercise 1Document28 pagesExercise 1Kien Nguyen TrungNo ratings yet

- Credit Card FraudDocument13 pagesCredit Card FraudNinad SamelNo ratings yet

- Electronic Payment System An Implementation Through CryptographyDocument8 pagesElectronic Payment System An Implementation Through CryptographyYamla SrinuNo ratings yet

- Use of Biometrics To Tackle ATM Fraud: Lawan Ahmed MohammedDocument5 pagesUse of Biometrics To Tackle ATM Fraud: Lawan Ahmed MohammedalamsboyNo ratings yet

- Intruders: Tran Song Dat Phuc Department of Computer Science and Engineering Seoultech 2014Document65 pagesIntruders: Tran Song Dat Phuc Department of Computer Science and Engineering Seoultech 2014Pavan Kumar NNo ratings yet

- Chip and Pin Is BrokenDocument14 pagesChip and Pin Is BrokenPacketerrorNo ratings yet

- Tutorial ParasoftDocument78 pagesTutorial Parasoftmathiece100% (3)

- Mtcse Training MaterialsDocument313 pagesMtcse Training MaterialsJosé Alfredo García DávalosNo ratings yet

- Frauds Related To Digital Payments and Legal Framework: Add A Footer 1Document8 pagesFrauds Related To Digital Payments and Legal Framework: Add A Footer 1Ayush GuptaNo ratings yet

- E BankingDocument23 pagesE Bankingdakzr0% (1)

- Intro To Crypto: The Ultimate Beginners Guide To Cryptocurrency and Its TechnologiesFrom EverandIntro To Crypto: The Ultimate Beginners Guide To Cryptocurrency and Its TechnologiesNo ratings yet

- Blockchain Technology Revolution in Business Explained: Why You Need to Start Investing in Blockchain and Cryptocurrencies for your Business Right NOWFrom EverandBlockchain Technology Revolution in Business Explained: Why You Need to Start Investing in Blockchain and Cryptocurrencies for your Business Right NOWRating: 5 out of 5 stars5/5 (1)

- Online BankingDocument116 pagesOnline BankingVictoria Doureen NamubiruNo ratings yet

- A Beginners Guide To Bitcoin and Cryptocurrencies: Learn How To Buy And Mine Bitcoin, Advantages and Disadvantages of Investing in Bitcoin, How Bitcoin and Other Currencies Works And MoreFrom EverandA Beginners Guide To Bitcoin and Cryptocurrencies: Learn How To Buy And Mine Bitcoin, Advantages and Disadvantages of Investing in Bitcoin, How Bitcoin and Other Currencies Works And MoreRating: 1 out of 5 stars1/5 (1)

- Negative Impacts of Technology in Banking SectorDocument5 pagesNegative Impacts of Technology in Banking Sectorapaman100% (1)

- English Economic .QDocument1 pageEnglish Economic .QPuan Paquita Maharani SaragihNo ratings yet

- English EconomicDocument1 pageEnglish EconomicPuan Paquita Maharani SaragihNo ratings yet

- Electronic Payment SystemDocument8 pagesElectronic Payment SystemSK Sayeed SidNo ratings yet

- E-Banking FeaturesDocument3 pagesE-Banking FeaturesMd.Shakhawat HossainNo ratings yet

- Electronic MoneyDocument6 pagesElectronic Moneyjason1987martisNo ratings yet

- Debate NotesDocument2 pagesDebate NotesByenz Hanerie JimenezNo ratings yet

- E Commerce AssignDocument4 pagesE Commerce AssignMargo ShaezNo ratings yet

- E-Banking: Dr. Rana Singh Associate ProfessorDocument45 pagesE-Banking: Dr. Rana Singh Associate ProfessorBinny TalatiNo ratings yet

- Chip y Skin Ataques de Replay A Tarjetas de Credito Emv (ENG)Document16 pagesChip y Skin Ataques de Replay A Tarjetas de Credito Emv (ENG)ninaduran123No ratings yet

- Online Banking 2013Document49 pagesOnline Banking 2013Naveen HegdeNo ratings yet

- Introduc Tio NtoeDocument22 pagesIntroduc Tio NtoeNadine ShaheenNo ratings yet

- E Banking 130826111407 Phpapp01Document20 pagesE Banking 130826111407 Phpapp01ANITTA M. AntonyNo ratings yet

- Elemente Card Epayments WhiDocument10 pagesElemente Card Epayments WhiFlaviub23No ratings yet

- 1.1 Project Background: Chapter No.1: IntroductionDocument4 pages1.1 Project Background: Chapter No.1: IntroductionShrikant ChamlateNo ratings yet

- Final Individual ProjectDocument46 pagesFinal Individual ProjectSurbhi SinghalNo ratings yet

- Irene Jepkosgei Kemu BUSS 342-E-Commerce Assignment 1st Trimester 2019 Instructions: Answer All QuestionsDocument9 pagesIrene Jepkosgei Kemu BUSS 342-E-Commerce Assignment 1st Trimester 2019 Instructions: Answer All QuestionsKevin ObaraNo ratings yet

- The International Journal of Engineering and Science (The IJES)Document8 pagesThe International Journal of Engineering and Science (The IJES)theijesNo ratings yet

- Three Tier With Vertical Partitioning SystemDocument1 pageThree Tier With Vertical Partitioning System3201313No ratings yet

- General Structure of Digital Cash TransactionsDocument9 pagesGeneral Structure of Digital Cash Transactionsbaranidharan .kNo ratings yet

- Srinivasa Institute of Technology & ScienceDocument19 pagesSrinivasa Institute of Technology & ScienceshivanyaNo ratings yet

- 56Document2 pages56caihaiyang918No ratings yet

- An Automated Teller Machine (ATM) Is A Computerized Telecommunications Device That EnablesDocument2 pagesAn Automated Teller Machine (ATM) Is A Computerized Telecommunications Device That EnablesParvesh GeerishNo ratings yet

- Unit 4 EcommerceDocument26 pagesUnit 4 Ecommerce20B81A1235cvr.ac.in G RUSHI BHARGAVNo ratings yet

- IEEE FormateDocument12 pagesIEEE FormateLekha WararkarNo ratings yet

- MR Latter Looks at The Implications of E-Commerce For The Banking and Monetary System in Hong KongDocument4 pagesMR Latter Looks at The Implications of E-Commerce For The Banking and Monetary System in Hong KongFlaviub23No ratings yet

- Features: Online Banking (Or Internet Banking) Allows Customers To Conduct Financial Transactions On ADocument4 pagesFeatures: Online Banking (Or Internet Banking) Allows Customers To Conduct Financial Transactions On ArazatughralNo ratings yet

- E CashDocument9 pagesE CashGurpreet BansalNo ratings yet

- UNIT 3 E-COMM NotesDocument13 pagesUNIT 3 E-COMM NotesVikash kumarNo ratings yet

- Manish Kumar Aery: Assistant Professor SVSDPG College BhatoliDocument45 pagesManish Kumar Aery: Assistant Professor SVSDPG College BhatoliManishKumarAeryNo ratings yet

- E Commerce NotesDocument3 pagesE Commerce NotesBlack CloverNo ratings yet

- E-Commerce - BUS426 - Topic 3Document44 pagesE-Commerce - BUS426 - Topic 3Atease ProductionNo ratings yet

- Fraud Resilient Mechanism For Micro Payments at Point of SalesDocument7 pagesFraud Resilient Mechanism For Micro Payments at Point of SalesEdmund ZinNo ratings yet

- Sen MicroprojectDocument27 pagesSen MicroprojectKumar DhobaleNo ratings yet

- Case Study On Network Security in E-Banking: Group MembersDocument27 pagesCase Study On Network Security in E-Banking: Group MembersOmkar K. KadamNo ratings yet

- E - Commerce Unit 2 RGPV SylabbusDocument22 pagesE - Commerce Unit 2 RGPV SylabbusDeepak Kumar RajakNo ratings yet

- How Secure Is E-BankingDocument9 pagesHow Secure Is E-BankingLê Phương ThảoNo ratings yet

- How Secure Is E-BankingDocument9 pagesHow Secure Is E-BankingLê Phương ThảoNo ratings yet

- Money PadDocument14 pagesMoney PadRavi SawantNo ratings yet

- Security Threats To E-Commerce - Electronic Payment System - E-Cash - Credit-Debit CardsDocument3 pagesSecurity Threats To E-Commerce - Electronic Payment System - E-Cash - Credit-Debit CardsDev SharmaNo ratings yet

- MIS ReportDocument17 pagesMIS Reportzaber chowdhuryNo ratings yet

- Recent in BankingDocument25 pagesRecent in BankingSrividya SNo ratings yet

- Online BankingDocument40 pagesOnline BankingIsmail HossainNo ratings yet

- A Beginners Guide To Bitcoin and Cryptocurrencies: Learn How To Buy And Mine Bitcoin, Advantages and Disadvantages of Investing in Bitcoin, How Bitcoin and Other Currencies Works And MoreFrom EverandA Beginners Guide To Bitcoin and Cryptocurrencies: Learn How To Buy And Mine Bitcoin, Advantages and Disadvantages of Investing in Bitcoin, How Bitcoin and Other Currencies Works And MoreNo ratings yet

- Cracking NoteZilla Passwords - PaperDocument6 pagesCracking NoteZilla Passwords - PaperClark Jan MykleNo ratings yet

- Linfeng Daniel Zhou LinkedinDocument5 pagesLinfeng Daniel Zhou Linkedinapi-289180707No ratings yet

- 4 - Advance Encryption StandardDocument33 pages4 - Advance Encryption StandardDaneil RadcliffeNo ratings yet

- Syllabus Information & Cyber Security WorkshopDocument1 pageSyllabus Information & Cyber Security Workshopjody dyandraNo ratings yet

- Cyber Threat Intelligence 2023 Edition Martin Lee Full ChapterDocument67 pagesCyber Threat Intelligence 2023 Edition Martin Lee Full Chapternova.reavis674100% (5)

- Network Security Fundamentals & Concepts (INE-converted)Document45 pagesNetwork Security Fundamentals & Concepts (INE-converted)NikoNo ratings yet

- Day 1Document70 pagesDay 1aNo ratings yet

- NTLM Is Dead - DefCon 16Document52 pagesNTLM Is Dead - DefCon 16zboubiNo ratings yet

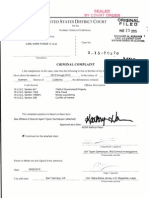

- Charges Against Former Federal Agents in SilkDocument95 pagesCharges Against Former Federal Agents in SilkDeepDotWeb.com100% (1)

- HelionCore DVB-CSA Actel DSDocument2 pagesHelionCore DVB-CSA Actel DSngayhevuiNo ratings yet

- Some Cryptography FundamentalsDocument36 pagesSome Cryptography FundamentalsAbhijith MarathakamNo ratings yet

- Efficient Computation of Full Lucas SequencesDocument6 pagesEfficient Computation of Full Lucas SequencesΟλυμπίδης ΙωάννηςNo ratings yet

- Applies To:: How To Manage A TDE Wallet Created in ASM (Doc ID 2193264.1)Document4 pagesApplies To:: How To Manage A TDE Wallet Created in ASM (Doc ID 2193264.1)Abdul RehmanNo ratings yet

- SMS Encryption Using 3D-AES Block Cipher On Android Message ApplicationDocument5 pagesSMS Encryption Using 3D-AES Block Cipher On Android Message ApplicationAsoka De' OgreNo ratings yet

- FWD - Easi Pour - EmlDocument6,166 pagesFWD - Easi Pour - EmlFranky Pinilla100% (1)

- Rsa PDFDocument15 pagesRsa PDFMani Deepak ChoudhryNo ratings yet

- TP3 Ghazi Ben YahyaDocument12 pagesTP3 Ghazi Ben Yahyakaw birthdayNo ratings yet

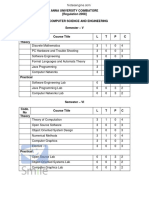

- Btech IT PDFDocument82 pagesBtech IT PDFHarshal BhattadNo ratings yet

- Help Mla Crypto SWDocument150 pagesHelp Mla Crypto SWJulio César Carroll JiménezNo ratings yet

- Bsidescyprus DropTheMICDocument20 pagesBsidescyprus DropTheMICFernando da Costa CorreaNo ratings yet

- Saft Hash Minfin ExplanationsDocument21 pagesSaft Hash Minfin ExplanationsJonas DembiNo ratings yet

- As A PDF - 59c0e90d1723dde1101f1b38 PDFDocument76 pagesAs A PDF - 59c0e90d1723dde1101f1b38 PDFDurgesh KollaNo ratings yet

- AES Encryption and Decryption in Java (CBC Mode) - Java Code Geeks - 2019Document5 pagesAES Encryption and Decryption in Java (CBC Mode) - Java Code Geeks - 2019Steve McLarenNo ratings yet

- Getting Started With Spring Security 3.1 PDFDocument159 pagesGetting Started With Spring Security 3.1 PDFayz12345100% (1)

- Cryptanalysis and Types of AttacksDocument3 pagesCryptanalysis and Types of AttacksSourav DebnathNo ratings yet