Professional Documents

Culture Documents

Receivable Management: The Term Receivable Is Defined

Receivable Management: The Term Receivable Is Defined

Uploaded by

puga0 ratings0% found this document useful (0 votes)

8 views4 pagesReceivables are debts owed to a business by customers from credit sales of goods and services. Receivables management aims to maximize returns on investment in receivables by promoting sales until the point where returns are less than the cost of financing additional credit. There are costs associated with extending credit like collection costs, capital costs of funds that could be used elsewhere, administrative costs of maintaining receivable records, and default costs from unrecoverable overdue debts.

Original Description:

Aaaa

Gghhh

Original Title

Receivables Mgt

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentReceivables are debts owed to a business by customers from credit sales of goods and services. Receivables management aims to maximize returns on investment in receivables by promoting sales until the point where returns are less than the cost of financing additional credit. There are costs associated with extending credit like collection costs, capital costs of funds that could be used elsewhere, administrative costs of maintaining receivable records, and default costs from unrecoverable overdue debts.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views4 pagesReceivable Management: The Term Receivable Is Defined

Receivable Management: The Term Receivable Is Defined

Uploaded by

pugaReceivables are debts owed to a business by customers from credit sales of goods and services. Receivables management aims to maximize returns on investment in receivables by promoting sales until the point where returns are less than the cost of financing additional credit. There are costs associated with extending credit like collection costs, capital costs of funds that could be used elsewhere, administrative costs of maintaining receivable records, and default costs from unrecoverable overdue debts.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 4

RECEIVABLE MANAGEMENT

The term receivable is defined as debt owed to the

concern by customers arising from sale of goods or

services in the ordinary course of business.

Receivables are also one of the major parts of the

current assets of the business concerns. It arises only

due to credit sales to customers, hence, it is also

known as Account Receivables or Bills Receivables.

Management of account receivable is defined as the

process of making decision resulting to the investment

of funds in these assets which will result in maximizing

the overall return on the investment of the firm.

• The objective of receivable management is to

promote sales and profit until that point is reached

where the return on investment in further funding

receivables is less than the cost of funds raised to

finance that additional credit.

• The costs associated with the extension of credit

and accounts receivables are identified as follows:

• A. Collection Cost

• B. Capital Cost

• C. Administrative Cost

• D. Default Cost.

• Collection Cost

• This cost incurred in collecting the receivables from

the customers to whom credit sales have been

made.

• Capital Cost This is the cost on the use of

additional capital to support credit sales which

alternatively could have been employed

elsewhere.

• Administrative Cost This is an additional

administrative cost for maintaining account

receivable in the form of salaries to the staff

kept for maintaining accounting records relating

to customers, cost of investigation etc.

• Default Cost(BAD DEBTS) Default costs are the

over dues that cannot be recovered. Business

concern may not be able to recover the over

dues because of the inability of the customers.

You might also like

- Audit ReportDocument5 pagesAudit ReportRandy Rosigit100% (1)

- Vice President of Operations in Phoenix AZ Resume Carol LivingstonDocument3 pagesVice President of Operations in Phoenix AZ Resume Carol LivingstonCarol LivingstonNo ratings yet

- 1 Order To Cash (O2C) ProcessesDocument6 pages1 Order To Cash (O2C) ProcessesanupriyaNo ratings yet

- Receivables ManagementDocument11 pagesReceivables ManagementPuneet JindalNo ratings yet

- Fabm1 PPT Q1W2Document89 pagesFabm1 PPT Q1W2giselleNo ratings yet

- FM II CH-4-1Document12 pagesFM II CH-4-1Fãhâd Õró ÂhmédNo ratings yet

- Receivables Management SelfDocument36 pagesReceivables Management Selfnitik chakmaNo ratings yet

- Unit 4 Receivable ManagementDocument7 pagesUnit 4 Receivable ManagementNeelabh67% (3)

- CHAPTER FOUR Receivable ManagementDocument16 pagesCHAPTER FOUR Receivable ManagementeferemNo ratings yet

- Financial Planning and Pro Forma Statements Simplistic Approach Part 2Document17 pagesFinancial Planning and Pro Forma Statements Simplistic Approach Part 2ishaNo ratings yet

- Account Receivable ManagemntDocument12 pagesAccount Receivable ManagemntmehmuddaNo ratings yet

- Presentation On Introduction To Receivables Management: Presented By: Rumeet Kaur MBA-3 SEMDocument9 pagesPresentation On Introduction To Receivables Management: Presented By: Rumeet Kaur MBA-3 SEMrumeetkaurNo ratings yet

- Working Capital Management: Roll No: PGC 18007 Mcom Part IiDocument12 pagesWorking Capital Management: Roll No: PGC 18007 Mcom Part Iiravina inchalkarNo ratings yet

- Receivable ManagementDocument14 pagesReceivable Managementfinance.bba8thbatchNo ratings yet

- Chapter Four Receivables Management Nature and Importance of ReceivablesDocument10 pagesChapter Four Receivables Management Nature and Importance of ReceivablesBenol MekonnenNo ratings yet

- Account Receivable ManagementDocument49 pagesAccount Receivable ManagementAli Mubin FitranandaNo ratings yet

- MBA SEM II FM Receivalbles Management Unit VDocument16 pagesMBA SEM II FM Receivalbles Management Unit VRaghuNo ratings yet

- School of Commerce - Financial Management (Unit II) - MBA (FT) 2 Years II SemDocument16 pagesSchool of Commerce - Financial Management (Unit II) - MBA (FT) 2 Years II Semvintu pvNo ratings yet

- Accounts Receivable ManagementDocument4 pagesAccounts Receivable Managementsubbu2raj3372No ratings yet

- Account ReceivablesDocument5 pagesAccount Receivablessubbu2raj3372No ratings yet

- Receivable Management KanchanDocument12 pagesReceivable Management KanchanSanchita NaikNo ratings yet

- Receivables and Payables ManagementDocument16 pagesReceivables and Payables ManagementDony ZachariasNo ratings yet

- Accounts ReceivableDocument27 pagesAccounts ReceivableJomar TeofiloNo ratings yet

- Management of Account RecivablesDocument16 pagesManagement of Account RecivablesSumit SamtaniNo ratings yet

- Working Capital ManagementDocument52 pagesWorking Capital ManagementPrashanth GowdaNo ratings yet

- Working Capital and Receivables ManagementDocument18 pagesWorking Capital and Receivables ManagementQayenat KhanNo ratings yet

- What Is Receivable ManagementDocument5 pagesWhat Is Receivable Management5077 Aniket malikNo ratings yet

- Types of Revenues: Operating Revenues Non-Operating RevenuesDocument4 pagesTypes of Revenues: Operating Revenues Non-Operating RevenuesSina RahimiNo ratings yet

- Teamwork Presentation: Credit ManagementDocument26 pagesTeamwork Presentation: Credit ManagementSashi RajNo ratings yet

- Receivables Management: Dr.K.P.Malathi ShiriDocument19 pagesReceivables Management: Dr.K.P.Malathi ShiriSruthy KrishnaNo ratings yet

- Sai Kiran Print PDFDocument53 pagesSai Kiran Print PDFThanuja BhaskarNo ratings yet

- Receivable Manage, EntDocument12 pagesReceivable Manage, Entajay.gole2325pNo ratings yet

- Minimalist Business Report-WPS OfficeDocument21 pagesMinimalist Business Report-WPS Officewilhelmina romanNo ratings yet

- Receivables ManagementDocument18 pagesReceivables Managementnancy bhatiaNo ratings yet

- Unit 2Document9 pagesUnit 2syoganand10No ratings yet

- "Any Fool Can Lend Money, But It Takes Lot of Skills To Get It Back" Presented By-Anisha.NDocument20 pages"Any Fool Can Lend Money, But It Takes Lot of Skills To Get It Back" Presented By-Anisha.NShalini NagavarapuNo ratings yet

- Presented By: Neha Chopra Mba Sem IiiDocument14 pagesPresented By: Neha Chopra Mba Sem IiiyashsviNo ratings yet

- Receivables Management: Chapter - 4Document7 pagesReceivables Management: Chapter - 4Hussen AbdulkadirNo ratings yet

- Module 2 AccountingDocument25 pagesModule 2 AccountingChristian JacobNo ratings yet

- Receivables Management: Chapter - 4Document7 pagesReceivables Management: Chapter - 4Hussen AbdulkadirNo ratings yet

- Receivables: Credit Standards, Length of Credit Period, Cash Discount, Discount Period EtcDocument7 pagesReceivables: Credit Standards, Length of Credit Period, Cash Discount, Discount Period EtcKristine RazonabeNo ratings yet

- Unit Vi: Receivables ManagementDocument18 pagesUnit Vi: Receivables ManagementDevyansh GuptaNo ratings yet

- Sample of Accounts ReceivablesDocument11 pagesSample of Accounts ReceivablesA BNo ratings yet

- Cash, Rec and Inv MGTDocument9 pagesCash, Rec and Inv MGTmagartu kalbessaNo ratings yet

- CHAPTER II Credit in The CompanyDocument8 pagesCHAPTER II Credit in The CompanyReiner GGayNo ratings yet

- Account Receivable Management OverviewDocument21 pagesAccount Receivable Management OverviewLlyod Daniel Paulo0% (1)

- Module 2-Receivables ManagementDocument36 pagesModule 2-Receivables Managementgaurav shettyNo ratings yet

- Receivables ManagementDocument30 pagesReceivables Managementjibinjohn140No ratings yet

- Learning Activity 5.2 Concept ReviewDocument4 pagesLearning Activity 5.2 Concept ReviewJames CantorneNo ratings yet

- Capital Management Assignment1 BEDocument20 pagesCapital Management Assignment1 BESoham DNo ratings yet

- Montanez, Padua (Accounts Receivable Management - FM, Reporting)Document24 pagesMontanez, Padua (Accounts Receivable Management - FM, Reporting)Emilio Joshua PaduaNo ratings yet

- SampleDocument1 pageSamplesumi chanNo ratings yet

- Unit - 5 Working Capital FinancingDocument82 pagesUnit - 5 Working Capital FinancinganmolpahawabsrNo ratings yet

- Chapter 03 Receivable MGTDocument8 pagesChapter 03 Receivable MGTNitesh BansodeNo ratings yet

- Working CapitalDocument3 pagesWorking Capitalsurendra92No ratings yet

- Chapter 8Document67 pagesChapter 8JOHN MARK ARGUELLESNo ratings yet

- Marketing Finance01 1Document8 pagesMarketing Finance01 1Anand YadavNo ratings yet

- Chapter 8-2Document69 pagesChapter 8-2Joel Sam Bilji100% (1)

- Accounts Receivable Management ExplainedDocument12 pagesAccounts Receivable Management ExplainedPurushottam KumarNo ratings yet

- Unit 4 Working Capital ReceivablesDocument8 pagesUnit 4 Working Capital Receivablesshubh sharmaNo ratings yet

- 642 - Exam NotesDocument29 pages642 - Exam NotesGaneshNo ratings yet

- FM Pointers For ReviewDocument12 pagesFM Pointers For ReviewAngelyne GumabayNo ratings yet

- LoadShare Networks Company Profile Apr 2019Document21 pagesLoadShare Networks Company Profile Apr 2019Haresh B. RaneNo ratings yet

- Banking in EthiopiaDocument3 pagesBanking in EthiopiaTilaye AleneNo ratings yet

- Audit Director Risk Management in Dallas FT Worth TX Resume Randy WatterworthDocument2 pagesAudit Director Risk Management in Dallas FT Worth TX Resume Randy WatterworthRandyWatterworthNo ratings yet

- The Off Campus Playhouse Adjusts Its Accounts Every Month Below IsDocument1 pageThe Off Campus Playhouse Adjusts Its Accounts Every Month Below IsAmit PandeyNo ratings yet

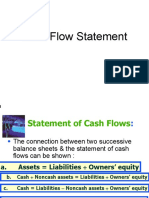

- Cash Flow StatementDocument15 pagesCash Flow StatementSoumendra RoyNo ratings yet

- Employee Stock Option Plan 264Document21 pagesEmployee Stock Option Plan 264TejalTamboliNo ratings yet

- Unit 1Document22 pagesUnit 1Om HandeNo ratings yet

- Financial ServicesDocument5 pagesFinancial ServicesYunus AhamedNo ratings yet

- Final Bill Checklist SynergyDocument3 pagesFinal Bill Checklist Synergymudassir mNo ratings yet

- OPMT-620 Assignment-2Document6 pagesOPMT-620 Assignment-2hanhdung.0595No ratings yet

- Exchange Rate Regimes of Sri Lanka and Their Impact On UnileverDocument4 pagesExchange Rate Regimes of Sri Lanka and Their Impact On UnileverSudeesha Wenura BandaraNo ratings yet

- Gardner DenverDocument25 pagesGardner DenverConstantin WellsNo ratings yet

- Quantwater Tech Investments - Fund MemoDocument17 pagesQuantwater Tech Investments - Fund MemoshawnmathewNo ratings yet

- Boston Consulting GroupDocument4 pagesBoston Consulting GroupAmit SoniNo ratings yet

- Annual General Meeting Agenda: Income Tax Exemption and Sporting ClubsDocument2 pagesAnnual General Meeting Agenda: Income Tax Exemption and Sporting ClubsStacey-Ann SteeleNo ratings yet

- LDocument1 pageLYahoo SterlingNo ratings yet

- Introduction To CRM: Session-1 DateDocument17 pagesIntroduction To CRM: Session-1 DateBhaskar SahaNo ratings yet

- Home Assignment - 1Document2 pagesHome Assignment - 1Pankaj kumarNo ratings yet

- IS in Organization: Fajar Pradana S.ST., M.EngDocument38 pagesIS in Organization: Fajar Pradana S.ST., M.Engsyahri100% (1)

- Ucsp Economic OrganizationDocument10 pagesUcsp Economic OrganizationKrianne KilvaniaNo ratings yet

- Latest Social Science Reviewer Part 22Document7 pagesLatest Social Science Reviewer Part 22Akmad Ali AbdulNo ratings yet

- Multiple Choice QuestionsDocument14 pagesMultiple Choice QuestionsVince ManahanNo ratings yet

- LOKHANDEDocument1 pageLOKHANDELaxman ShindeNo ratings yet

- Managing in The Global MarketplaceDocument3 pagesManaging in The Global Marketplacerbshri75% (4)

- Entrepreneur of Nirma LTDDocument20 pagesEntrepreneur of Nirma LTDManthan SolankiNo ratings yet

- Case Study of Takeover of Raasi Cements by India CementsDocument8 pagesCase Study of Takeover of Raasi Cements by India CementsJasdeep SinghNo ratings yet

- Marketing of Toyota Fortuner CarDocument3 pagesMarketing of Toyota Fortuner CarNidhish VijayNo ratings yet