Professional Documents

Culture Documents

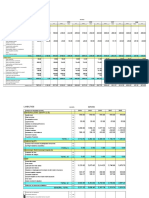

Innovation Management: Financial Business Planning Yvon Schollaert

Uploaded by

Vincent Suryajaya Guntoro0 ratings0% found this document useful (0 votes)

18 views4 pagesAnalysis

Original Title

Innovation Management

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAnalysis

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

18 views4 pagesInnovation Management: Financial Business Planning Yvon Schollaert

Uploaded by

Vincent Suryajaya GuntoroAnalysis

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 4

Innovation Management

Financial Business Planning

Yvon Schollaert

WORKSHOP : PREPARING THE FINANCIAL

FORECASTS FOR THE ORAL PITCH

• STEP 1 : START from your business model canvas

• List the needs (for the moment just identify list, do not estimate in euros):

• Human ressources

• Investments & fixed assets, Other : inventories

• Key costs and expenses

• Size your market and the potential sales you can reach

• Based on the size of your company now evaluate :

• The sales (Quantity x Price)

• The key costs

• The key investments

• The financing needs

WORKSHOP : PREPARING THE FINANCIAL

FORECASTS

• STEP 2 : for each individual fixed assets in which you are investing in :

• Compute the yearly depreciation cost

• Summ up all depreciation costs this is a fixed cost

• Summ up all fixed costs that you identified and estimated in your business

• Depreciation expenses

• Salaries, wages

• Marketing costs, commercial costs

• Mantenance, electricity, rent…

• All other fixed costs

• STEP 3 : Define your variable cost per unit

• Raw material cost per unit

• If you are externalising your production, the production cost per unit

• Other variable costs : sales commission & bonuses…

• Distribution & transportation cost per unit

• STEP 4 : Use the break even analysis to define your sales level :

• BEP = Fixed Costs / (Selling price per unit – Variable costs per unit)

• Then you get the level of quantity that you need to reach in order to break even

• Then compare with your market potential and see if it is consistent

COURSE 6 : ORAL PITCHES = 5/7 minutes

• BUSINESS MODEL

• FINANCIALS :

• Income Statement simplified : 3 years

• Sales

• Key costs

• Profit/loss

• Break Even How many customers or quantity you need to sell

• Needs : assets, equipement

• Financing requested

You might also like

- Controlling Sales ForceDocument28 pagesControlling Sales ForceAvinash OrtanNo ratings yet

- Valuing Firms: Rules and ApproachesDocument25 pagesValuing Firms: Rules and ApproachesVaibhav GuptaNo ratings yet

- Valuation MethodsDocument21 pagesValuation Methodsbluisss100% (1)

- Digital Marketing Planning, Budgeting, ForecastingDocument51 pagesDigital Marketing Planning, Budgeting, ForecastingJinny AsyiqinNo ratings yet

- 1 Writing A Business PlanDocument31 pages1 Writing A Business Planocallagr100% (6)

- Introduction To Management AccountingDocument49 pagesIntroduction To Management AccountingGuruKPO75% (4)

- Startup India Seed Fund Scheme: Startup Sample Pitch DeckDocument13 pagesStartup India Seed Fund Scheme: Startup Sample Pitch DeckSimran KhuranaNo ratings yet

- Cost and Management AccountingDocument29 pagesCost and Management AccountingAks SinhaNo ratings yet

- Unit 4 Sales Territory and QuotaDocument37 pagesUnit 4 Sales Territory and QuotaShubham Chhabra100% (1)

- Week 6: Break-Even & Final Account: Management and OrganizationDocument9 pagesWeek 6: Break-Even & Final Account: Management and OrganizationLinh Anh Nguyen Ngoc100% (1)

- Topic 7Document23 pagesTopic 7AB RomillaNo ratings yet

- MNG Accounting Week 4Document16 pagesMNG Accounting Week 4jesslynNo ratings yet

- CH 7 - Operational Issues Marketing OMDocument49 pagesCH 7 - Operational Issues Marketing OMKey OnNo ratings yet

- CHP 3.2 Costs and RevenuesDocument19 pagesCHP 3.2 Costs and RevenuesDana MneimneNo ratings yet

- IRS Tax Advice For Direct SellersDocument41 pagesIRS Tax Advice For Direct SellersKevin ThompsonNo ratings yet

- Topic 8Document35 pagesTopic 8Áliyà ÀliNo ratings yet

- Sessions 28, 29 and 30Document23 pagesSessions 28, 29 and 30Deedra ColeNo ratings yet

- Sustainable Economies: (Corporate Strategy)Document20 pagesSustainable Economies: (Corporate Strategy)Bella Martos PérezNo ratings yet

- Sem in Finance-Notes To Final Exam Readings Part 2Document82 pagesSem in Finance-Notes To Final Exam Readings Part 2hantrankha75No ratings yet

- BYOBB Business Plan Financial ProjectionsDocument11 pagesBYOBB Business Plan Financial ProjectionsUmangNo ratings yet

- Break Even SalesDocument48 pagesBreak Even SalesAaria Jayaraj AnishNo ratings yet

- Sales Force ContolDocument27 pagesSales Force ContolrichuNo ratings yet

- Sales & Distribution Management: Dr. Atul Kumar Agarwal Professor School of Business Sushant University GurugramuDocument25 pagesSales & Distribution Management: Dr. Atul Kumar Agarwal Professor School of Business Sushant University GurugramuSahil RaoNo ratings yet

- Session 5 and 6 PDFDocument32 pagesSession 5 and 6 PDFmilepnNo ratings yet

- Forecasting Financial StatementsDocument25 pagesForecasting Financial Statementstarun slowNo ratings yet

- AccountingManagers 09Document22 pagesAccountingManagers 09Alenne FelizardoNo ratings yet

- Management of Sales Territories and Quotas: SDM-Ch.4 1Document15 pagesManagement of Sales Territories and Quotas: SDM-Ch.4 1AKSHAJ GOENKANo ratings yet

- Management of Sales Territories and Quotas: SDM-Ch.4 1Document24 pagesManagement of Sales Territories and Quotas: SDM-Ch.4 1Shubham DixitNo ratings yet

- Costing: Approaches and TechniquesDocument51 pagesCosting: Approaches and TechniquescolinNo ratings yet

- Controlling SFDocument26 pagesControlling SFMitika TutejaNo ratings yet

- c4 6 Entrepreneurship CostingDocument5 pagesc4 6 Entrepreneurship CostingRodrick MumbaNo ratings yet

- MNG Accounting Week 4Document16 pagesMNG Accounting Week 4Seung Hyun BaeNo ratings yet

- Management of Sales Territories and Quotas: SDM-Ch.4 1Document27 pagesManagement of Sales Territories and Quotas: SDM-Ch.4 1AnjnaKandariNo ratings yet

- Methos of PricingDocument18 pagesMethos of PricingKhelin ShahNo ratings yet

- Controlling The Salesforce: SDM-Ch.7 1Document29 pagesControlling The Salesforce: SDM-Ch.7 1sumit negiNo ratings yet

- Objectives: - Learners Will Be Able ToDocument69 pagesObjectives: - Learners Will Be Able ToDhanashree ChavanNo ratings yet

- Cost & Management Accounting: Prof. Shilpa PeswaniDocument45 pagesCost & Management Accounting: Prof. Shilpa PeswaniAvinash MathiasNo ratings yet

- Elements of A Business PlanDocument13 pagesElements of A Business Plancallamira0No ratings yet

- Controlling The SalesforceDocument29 pagesControlling The SalesforceekkarajNo ratings yet

- Lecture 2-BEPDocument12 pagesLecture 2-BEPharsimran KaurNo ratings yet

- Week 9-10. Basic Concepts Costs, Revenue, Profit and Breakeven AnalysisDocument33 pagesWeek 9-10. Basic Concepts Costs, Revenue, Profit and Breakeven Analysisqxz92cdyjbNo ratings yet

- Strategy Execution - DiscussionDocument22 pagesStrategy Execution - DiscussionAayushya ChaturvediNo ratings yet

- Unit 4Document85 pagesUnit 4Ankush Singh100% (1)

- Financial ManagementDocument53 pagesFinancial ManagementOmNo ratings yet

- Accounting Standards - 2: Valuation of InventoriesDocument22 pagesAccounting Standards - 2: Valuation of Inventoriesmahesh19689No ratings yet

- Fma - 5Document21 pagesFma - 5Hammad QasimNo ratings yet

- Understanding Business Activity: Contents-Section 1Document53 pagesUnderstanding Business Activity: Contents-Section 1Allan IshimweNo ratings yet

- Chapter 19Document51 pagesChapter 19Yasir MehmoodNo ratings yet

- Introduction To Management AccountingDocument51 pagesIntroduction To Management AccountingnikkinikkzNo ratings yet

- Break Even Analysis Roi (Return On Investment) Economic Analysis New Product DevelopmentDocument40 pagesBreak Even Analysis Roi (Return On Investment) Economic Analysis New Product DevelopmentGurpreet GillNo ratings yet

- Ignition GrantDocument13 pagesIgnition GrantKurniawan DarisNo ratings yet

- SDM-MGT of Sales TerritoriesDocument26 pagesSDM-MGT of Sales TerritoriesBhupesh BhuteNo ratings yet

- Operations Management RevisionDocument36 pagesOperations Management RevisionSonca TruongNo ratings yet

- Budget Categories - Operating BudgetDocument60 pagesBudget Categories - Operating Budgetjennifer.tuguinayNo ratings yet

- E-Commerce Companies Characteristics and Unique Accounting MethodsDocument15 pagesE-Commerce Companies Characteristics and Unique Accounting MethodsIman Nurakhmad FajarNo ratings yet

- Marginal and Absorption CostingDocument20 pagesMarginal and Absorption CostingSachin KumarNo ratings yet

- Ma - 5Document18 pagesMa - 5Zakriya KhanNo ratings yet

- The Ultimate Guide to Launching a Successful Dropshipping BusinessFrom EverandThe Ultimate Guide to Launching a Successful Dropshipping BusinessNo ratings yet

- Business Model Canvas (EasyWay)Document1 pageBusiness Model Canvas (EasyWay)Vincent Suryajaya GuntoroNo ratings yet

- Cover Letter (Up To Date)Document3 pagesCover Letter (Up To Date)Vincent Suryajaya GuntoroNo ratings yet

- Inforex Case AnswerDocument23 pagesInforex Case AnswerVincent Suryajaya GuntoroNo ratings yet

- Competitor Analysis (Go-Jek)Document1 pageCompetitor Analysis (Go-Jek)Vincent Suryajaya GuntoroNo ratings yet

- Interview Assigment EntrepreneurshipDocument2 pagesInterview Assigment EntrepreneurshipVincent Suryajaya GuntoroNo ratings yet

- Individual Assigment 6Document2 pagesIndividual Assigment 6Vincent Suryajaya GuntoroNo ratings yet

- Micro Ch17 PresentationDocument34 pagesMicro Ch17 PresentationVincent Suryajaya GuntoroNo ratings yet

- Industry AnalysisDocument12 pagesIndustry AnalysisVincent Suryajaya GuntoroNo ratings yet

- Summary of BusplanDocument48 pagesSummary of BusplanVincent Suryajaya GuntoroNo ratings yet

- Micro Ch57 PresentationDocument41 pagesMicro Ch57 PresentationfozNo ratings yet

- Cost Akun CHP 4 (Exer 3)Document2 pagesCost Akun CHP 4 (Exer 3)Vincent Suryajaya GuntoroNo ratings yet

- RIngkasan BusplanDocument56 pagesRIngkasan BusplanVincent Suryajaya GuntoroNo ratings yet

- Summary of Knowledge ManagementDocument2 pagesSummary of Knowledge ManagementVincent Suryajaya GuntoroNo ratings yet

- Nike Website AnalysisDocument3 pagesNike Website AnalysisVincent Suryajaya Guntoro100% (1)