Professional Documents

Culture Documents

Notes Rec. Valix Intermediate Account

Uploaded by

Ji Baltazar0 ratings0% found this document useful (0 votes)

467 views9 pagesNotes in notes receivable intermediate accounting I Valix

Original Title

Notes Rec. Valix intermediate account

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentNotes in notes receivable intermediate accounting I Valix

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

467 views9 pagesNotes Rec. Valix Intermediate Account

Uploaded by

Ji BaltazarNotes in notes receivable intermediate accounting I Valix

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 9

NOTES RECEIVABLE

Notes Receivable

Notes Receivable are claims supported by formal

promises to pay usually in the forms of notes.

A negotiable promissory note is an unconditional

promise in writing made by one person to another,

signed by the maker engaging to pay on demand or at

a fixed determinable future time a sum certain in

money to order or to bearer.

**take note that “notes receivable” represents only claims arising

from sale of merchandise or service in the ordinary course of

business, thus, notes received from officers, employees,

shareholders and affiliates shall be designated separately.

Dishonored notes shall be removed from the notes

receivable account and transferred to accounts

receivable at an amount to include, if any, interest and

other charges.

Accounts receivable xxx

Notes Receivable xxx

Interest Income xxx

Initial Measurement of Notes

Receivable

Initially, notes receivable shall be measured at present

value.

Present value is the sum of all future cash flows

discounted using the prevailing market rate of interest

for similar notes.

The prevailing market rate of interest is actually the

effective interest rate.

Short Term Notes Receivable

Short Term Notes receivable are measured at

face value.

Long Term Notes Receivable

Interest bearing long tem notes are measured at face

value which is actually the present value upon issuance

Non-interest bearing long term notes are measure at

present value which is the discounted value of the

future cash flows using the effective interest rate.

Subsequent Measurement

Notes receivable shall be measure at amortized cost subsequently.

Amortized cost is the amount at which the note receivable is

measure initially minus principal repayment, plus or minus the

cumulative amortization of any difference between the initial

carrying amount and the principal maturity amount minus

reduction for impairment or uncollectibility.

For long-term non-interest bearing notes receivable, the

amortized cost is the present value plus amortization of

the discount, or the face value minus the unamortized

unearned interest income.

You might also like

- Accounting concepts and principles quizDocument7 pagesAccounting concepts and principles quizjessamae gundanNo ratings yet

- Fin Mar-Chapter9Document2 pagesFin Mar-Chapter9EANNA15No ratings yet

- Which Statement Is Incorrect Regarding The Application of The Equity Method of Accounting For Investments in AssociatesDocument1 pageWhich Statement Is Incorrect Regarding The Application of The Equity Method of Accounting For Investments in Associatesjahnhannalei marticio0% (1)

- INTACC1 Inventory ProblemsDocument3 pagesINTACC1 Inventory ProblemsButterfly 0719No ratings yet

- Chapter 13Document2 pagesChapter 13Jomer FernandezNo ratings yet

- Break-Even Analysis: Cost-Volume-Profit AnalysisDocument64 pagesBreak-Even Analysis: Cost-Volume-Profit AnalysisKelvin LeongNo ratings yet

- SEO-Optimized Title for Lease Accounting Questions Under 40 CharactersDocument4 pagesSEO-Optimized Title for Lease Accounting Questions Under 40 CharactersAEHYUN YENVYNo ratings yet

- Acctg201 IntroductionDocument10 pagesAcctg201 Introductionaaron manacapNo ratings yet

- Midterm Quiz 2Document11 pagesMidterm Quiz 2SGwannaBNo ratings yet

- Fin Mar 2.1 Determinants of Int RatesDocument3 pagesFin Mar 2.1 Determinants of Int RatesMadelyn EspirituNo ratings yet

- Finished Goods Inventory: Exercise 1-1 (True or False)Document16 pagesFinished Goods Inventory: Exercise 1-1 (True or False)Isaiah BatucanNo ratings yet

- Diagnostic Exercises2Document32 pagesDiagnostic Exercises2HanaNo ratings yet

- Regulatory Framework and Legal Issues in Business Activity 1Document4 pagesRegulatory Framework and Legal Issues in Business Activity 1x xNo ratings yet

- Included Investment Related Problems/questionsDocument22 pagesIncluded Investment Related Problems/questionsJanine LerumNo ratings yet

- Cash and Cash EquivalentsDocument408 pagesCash and Cash EquivalentsJanea ArinyaNo ratings yet

- AEC12 - Governance, Business Ethics, Risk Management and Internal ControlDocument1 pageAEC12 - Governance, Business Ethics, Risk Management and Internal ControlRhea May BaluteNo ratings yet

- Midterm Exam - BSAIS 2ADocument6 pagesMidterm Exam - BSAIS 2AMarilou DomingoNo ratings yet

- Financial PositionDocument4 pagesFinancial PositionBeth Diaz Laurente100% (2)

- Investments AssignmentDocument3 pagesInvestments AssignmentKhai Supleo PabelicoNo ratings yet

- Cost Concept, Terminologies and BehaviorDocument8 pagesCost Concept, Terminologies and BehaviorANDREA NICOLE DE LEONNo ratings yet

- Petty Cash and Cash Reconciliation ProblemsDocument9 pagesPetty Cash and Cash Reconciliation ProblemsKenncyNo ratings yet

- Compilation of ExercisesDocument15 pagesCompilation of ExercisesHazel MoradaNo ratings yet

- Bond Valuation Exam 1Document2 pagesBond Valuation Exam 1Ronah Abigail BejocNo ratings yet

- C8 Statement of Financial PositionDocument14 pagesC8 Statement of Financial PositionAllaine ElfaNo ratings yet

- Reviewer in Intermediate Accounting IDocument9 pagesReviewer in Intermediate Accounting ICzarhiena SantiagoNo ratings yet

- Problems 3 PRELIM TASK FINALDocument4 pagesProblems 3 PRELIM TASK FINALJohn Francis RosasNo ratings yet

- 6 Variable Full Costing Ue Caloocan May 2023Document8 pages6 Variable Full Costing Ue Caloocan May 2023Trisha Marie LeeNo ratings yet

- PRACTICE EXERCISES INTANGIBLES Students 2021Document3 pagesPRACTICE EXERCISES INTANGIBLES Students 2021Nicole Anne Santiago SibuloNo ratings yet

- Chapter 11 Other Long Term InvestmentsDocument10 pagesChapter 11 Other Long Term InvestmentsChristian Jade Lumasag NavaNo ratings yet

- Simulates Midterm Exam. IntAcc1 PDFDocument11 pagesSimulates Midterm Exam. IntAcc1 PDFA NuelaNo ratings yet

- Summary Note. Land - Building.machineryDocument3 pagesSummary Note. Land - Building.machineryRazel TercinoNo ratings yet

- Predetermined Overhead Rates, Flexible Budgets, And: True/FalseDocument52 pagesPredetermined Overhead Rates, Flexible Budgets, And: True/FalseJohnnoff BagacinaNo ratings yet

- MAS 8 FS Analysis AnswersDocument15 pagesMAS 8 FS Analysis AnswersKatherine Cabading InocandoNo ratings yet

- 2022 BS AIS 3B Law On Partnerships Chapter 3 AssignmentDocument11 pages2022 BS AIS 3B Law On Partnerships Chapter 3 AssignmentRose Jane AtabayNo ratings yet

- Reviewer - Accounting FOR Labor Reviewer - Accounting FOR LaborDocument3 pagesReviewer - Accounting FOR Labor Reviewer - Accounting FOR LaborJuan FrivaldoNo ratings yet

- Financial Markets (Chapter 10)Document3 pagesFinancial Markets (Chapter 10)Kyla Dayawon100% (1)

- Chapter 23 - PpeDocument13 pagesChapter 23 - PpeRosee D.No ratings yet

- Ia3 Review On Notes To FSDocument11 pagesIa3 Review On Notes To FSErich Posillo AranasNo ratings yet

- Maine Media WorkshopDocument2 pagesMaine Media WorkshopBOB MARLOWNo ratings yet

- Article 1216-1221Document1 pageArticle 1216-1221Adonis ClementeNo ratings yet

- Week 4 - Lesson 4 Cash and Cash EquivalentsDocument21 pagesWeek 4 - Lesson 4 Cash and Cash EquivalentsRose RaboNo ratings yet

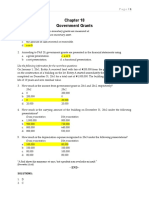

- Government Grants: Use The Following Information For The Next Three QuestionsDocument2 pagesGovernment Grants: Use The Following Information For The Next Three QuestionsJEFFERSON CUTENo ratings yet

- Intacc 3 Leases FinalsDocument9 pagesIntacc 3 Leases FinalsDarryl AgustinNo ratings yet

- CFAS FinalsDocument7 pagesCFAS FinalsMarriel Fate CullanoNo ratings yet

- ADDITIONAL PROBLEMS Variable and Absorption and ABCDocument2 pagesADDITIONAL PROBLEMS Variable and Absorption and ABCkaizen shinichiNo ratings yet

- AISDocument11 pagesAISJezeil DimasNo ratings yet

- Prelim Exam Discussion: Priority of OrderDocument3 pagesPrelim Exam Discussion: Priority of OrderMarianne Portia Sumabat100% (1)

- DLSU CPA Cash and Cash EquivalentsDocument3 pagesDLSU CPA Cash and Cash EquivalentsEuniceChungNo ratings yet

- Exercises Budgeting and Responsibility Problems W - Solutions 1Document10 pagesExercises Budgeting and Responsibility Problems W - Solutions 1Kristine NunagNo ratings yet

- 1st Semester Transfer Taxation Long Quiz No. 01 (2nd Set)Document5 pages1st Semester Transfer Taxation Long Quiz No. 01 (2nd Set)James ScoldNo ratings yet

- Week 2 Theory of Accounts Quiz - Financial Assets at Amortized CostDocument4 pagesWeek 2 Theory of Accounts Quiz - Financial Assets at Amortized CostMarilou Arcillas PanisalesNo ratings yet

- SPOUSES ANTONIO BELTRAN AND FELISA BELTRAN, Petitioners, v. SPOUSES APOLONIO CANGAYDA, JR. AND LORETA E. CANGAYDADocument6 pagesSPOUSES ANTONIO BELTRAN AND FELISA BELTRAN, Petitioners, v. SPOUSES APOLONIO CANGAYDA, JR. AND LORETA E. CANGAYDARIZZA MAE OLANONo ratings yet

- Mock 3 FARDocument10 pagesMock 3 FARRodelLaborNo ratings yet

- This Study Resource Was: Chapter 1: Succession and Transfer TaxDocument2 pagesThis Study Resource Was: Chapter 1: Succession and Transfer TaxPola PolzNo ratings yet

- Prelim Exam - Intermediate Accounting Part 1Document13 pagesPrelim Exam - Intermediate Accounting Part 1Vincent AbellaNo ratings yet

- Since 1977Document4 pagesSince 1977Edmark LuspeNo ratings yet

- Test Bank Law On Sales - CompressDocument7 pagesTest Bank Law On Sales - CompressViky Rose EballeNo ratings yet

- CH 6 (WWW - Jamaa Bzu - Com)Document8 pagesCH 6 (WWW - Jamaa Bzu - Com)Bayan Sharif100% (2)

- Chapter 4Document65 pagesChapter 4NCTNo ratings yet

- 06 Notes Receivable - LectureDocument7 pages06 Notes Receivable - Lecturekyle mandaresioNo ratings yet

- Format For Written ReportsDocument6 pagesFormat For Written ReportsJi BaltazarNo ratings yet

- BSMT - RaffleDocument1 pageBSMT - RaffleJi BaltazarNo ratings yet

- TGTDocument1 pageTGTJi BaltazarNo ratings yet

- Spring Security: Authentication and Authorization FrameworkDocument3 pagesSpring Security: Authentication and Authorization FrameworkJi BaltazarNo ratings yet

- Single Me ProprietorDocument1 pageSingle Me ProprietorJi BaltazarNo ratings yet

- JanineDocument3 pagesJanineJi BaltazarNo ratings yet

- 2 121007061501 Phpapp02Document62 pages2 121007061501 Phpapp02Ji BaltazarNo ratings yet

- SHS Business Finance Chapter 2Document24 pagesSHS Business Finance Chapter 2Ji BaltazarNo ratings yet

- Percentage Distribution ShowingDocument2 pagesPercentage Distribution ShowingJi BaltazarNo ratings yet

- PLACEDocument19 pagesPLACEJi BaltazarNo ratings yet

- SHS Business Finance Chapter 3Document17 pagesSHS Business Finance Chapter 3Ji BaltazarNo ratings yet

- Manage Personal Finances: Budget, Save, Plan for RetirementDocument3 pagesManage Personal Finances: Budget, Save, Plan for RetirementJi BaltazarNo ratings yet

- Quiz No. 2 - ReceivablesDocument1 pageQuiz No. 2 - ReceivablesJi BaltazarNo ratings yet

- SHS Business Finance Chapter 1Document19 pagesSHS Business Finance Chapter 1Ji Baltazar100% (1)

- CH 02 - Purchasing MaterialsDocument5 pagesCH 02 - Purchasing MaterialsJi BaltazarNo ratings yet

- Cost Accounting Basics and Job Order CycleDocument22 pagesCost Accounting Basics and Job Order CycleJi Baltazar100% (1)

- CH 02 - Storing and Issuing of MaterialsDocument5 pagesCH 02 - Storing and Issuing of MaterialsJi BaltazarNo ratings yet

- Estimation of Doubtful AccountsDocument5 pagesEstimation of Doubtful AccountsJi BaltazarNo ratings yet

- Quiz No. - Cash and Bank Recon - NotesDocument2 pagesQuiz No. - Cash and Bank Recon - NotesJi BaltazarNo ratings yet

- Quiz No. 1 - Intermediate AccountingDocument2 pagesQuiz No. 1 - Intermediate AccountingJi BaltazarNo ratings yet

- Cost Management SystemDocument20 pagesCost Management SystemJi BaltazarNo ratings yet

- Accounts ReceivablesDocument24 pagesAccounts ReceivablesEphreen Grace MartyNo ratings yet

- Cash and Cash Equivalents, Doubtful Accounts, Notes Receivable ImpairmentDocument1 pageCash and Cash Equivalents, Doubtful Accounts, Notes Receivable ImpairmentJi BaltazarNo ratings yet

- Chapter 11 LiabilitiesDocument5 pagesChapter 11 LiabilitiesJi BaltazarNo ratings yet

- Raise Money from Receivables with Factoring, Pledging & DiscountingDocument9 pagesRaise Money from Receivables with Factoring, Pledging & DiscountingJi BaltazarNo ratings yet

- DerivativesDocument13 pagesDerivativesJi BaltazarNo ratings yet

- Chapter 9 Property, Plant and Equipment (Autosaved)Document22 pagesChapter 9 Property, Plant and Equipment (Autosaved)Ji BaltazarNo ratings yet

- Accounts ReceivablesDocument24 pagesAccounts ReceivablesEphreen Grace MartyNo ratings yet

- Quiz in Conceptual Framework (MidtermsDocument1 pageQuiz in Conceptual Framework (MidtermsJi BaltazarNo ratings yet