Professional Documents

Culture Documents

Basics of Risk Management: Dr. Rakesh Kumar Sharma

Uploaded by

HarshSingh0 ratings0% found this document useful (0 votes)

8 views15 pagesrisk

Original Title

risk

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentrisk

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views15 pagesBasics of Risk Management: Dr. Rakesh Kumar Sharma

Uploaded by

HarshSinghrisk

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 15

Basics of Risk Management

Dr. Rakesh Kumar Sharma

Risk

• Risk in a Traditional Sense Risk in holding

securities is generally associated with

possibility that realized returns will be less

than the returns that were expected.

Risk

• Risk is a state of Uncertainty where some of

the possibilities involve a loss. Normally when

the outcome of an event is not known and a

probability or What if element is attached to

it, then there is a risk.

Systematic risk

• Systematic risk is due to risk factors that affect

the entire market such as investment policy

changes, foreign investment policy, change in

taxation clauses, shift in socio-economic

parameters, global security threats and

measures etc.

Market Risk

• Finding stock prices falling from time to time

while a company’s earnings are rising, and

vice versa, is not uncommon.

• The price of a stock may fluctuate widely

within a short span of time even though

earnings remain unchanged.

Contd.....

• The causes of this phenomenon are varied,

but it is mainly due to a change in investors’

attitudes toward equities in general, or toward

certain types or groups of securities in

particular.

Interest-Rate Risk

• Interest-rate risk refers to the uncertainty of

future market values and of the size of future

income, caused by fluctuations in the general

level of interest rates.

Contd......

• The root cause of interest-rate risk lies in the

fact that, as the rate of interest paid on U.S.

government securities (USGs) rises or falls, the

rates of return demanded on alternative

investment vehicles such as stocks and bonds

issued in the private sector, rise or fall.

Purchasing-Power Risk

• Purchasing-power risk is the uncertainty the

purchasing power of the amounts to be

received. In more everyday terms, purchasing-

power risk refers to the impact of inflation or

deflation on an investment.

Contd....

• If we think of investment as the

postponement of consumption, we can see

that when a person purchases a stock, he has

foregone the opportunity to buy some good

or service for as long as he owns the stock.

• If, during the holding period, good or services

rise, the investor actually loses purchasing

power.

Contd....

• Rising prices on goods and services are

normally associated with what is referred to as

inflation. Falling prices on goods and services

are termed deflation.

Unsystematic Risk

• Unsystematic risk is the portion of total risk

that is unique or peculiar to a firm or an

industry, above and beyond that affecting

securities market in general.

Contd....

• Factors such as management capability,

consumer preferences, and labor strikes can

cause unsystematic variability of returns for a

company’s stock.

Techniques of Risk Measurement

• Following are the different types of statistical

and financial techniques, which are used to

measure the degree of financial risk:

• Range

• Standard Deviation

• Variance

• Coefficient of Variance

You might also like

- Investment vs Gambling: Key Differences & Risk FactorsDocument24 pagesInvestment vs Gambling: Key Differences & Risk Factorsseena15No ratings yet

- Sapm 1 & 2Document73 pagesSapm 1 & 2Vandita KhudiaNo ratings yet

- Introduction To The Concept of Risk and ReturnDocument31 pagesIntroduction To The Concept of Risk and ReturnSaish ChavanNo ratings yet

- Risk and Return Fundamentals: Portfolio-A Collection, or Group, of AssetsDocument104 pagesRisk and Return Fundamentals: Portfolio-A Collection, or Group, of AssetsSagorNo ratings yet

- Unit 1Document61 pagesUnit 1shreyasNo ratings yet

- Investment Analysis & Portfolio ManagementDocument40 pagesInvestment Analysis & Portfolio ManagementShuhab KhosoNo ratings yet

- Investment vs Gambling: Key Differences & Risk FactorsDocument18 pagesInvestment vs Gambling: Key Differences & Risk Factorsseena15No ratings yet

- Market Risk-Part 1Document29 pagesMarket Risk-Part 1Brenden KapoNo ratings yet

- Risk Management with Financial DerivativesDocument24 pagesRisk Management with Financial DerivativesChirag ParakhNo ratings yet

- Financial Risk Management & Derivatives: Unit 1Document30 pagesFinancial Risk Management & Derivatives: Unit 1DEEPIKA S R BUSINESS AND MANAGEMENT (BGR)No ratings yet

- Week 2Document63 pagesWeek 2RajyaLakshmiNo ratings yet

- 1.introduction To Risk 2Document34 pages1.introduction To Risk 2leamae.cuarenta.20No ratings yet

- Common types of investment riskDocument3 pagesCommon types of investment riskshubhamgaurNo ratings yet

- Risk and Return AnalysisDocument12 pagesRisk and Return AnalysisBasavaraj GadachintiNo ratings yet

- Risk and ReturnDocument18 pagesRisk and ReturnJagrityTalwarNo ratings yet

- Topic: Portfolio Management: Presented By: Akshi Chandyoke Manohar Gupta Pooja Shukla Vinod PanigrahiDocument22 pagesTopic: Portfolio Management: Presented By: Akshi Chandyoke Manohar Gupta Pooja Shukla Vinod PanigrahiRavikant ShuklaNo ratings yet

- TRISEM14-2020-21 BMT6135 TH VL2020210200036 Reference Material I 21-Jul-2020 Lnotes-RiskDocument2 pagesTRISEM14-2020-21 BMT6135 TH VL2020210200036 Reference Material I 21-Jul-2020 Lnotes-RiskSiva MohanNo ratings yet

- First Cut-Commodity A Must Asset in Your PortfolioDocument19 pagesFirst Cut-Commodity A Must Asset in Your PortfoliorashsandyNo ratings yet

- Risk - Return ConceptsDocument25 pagesRisk - Return ConceptssahanaNo ratings yet

- Risk & Ret P-I (2022)Document6 pagesRisk & Ret P-I (2022)hardik jainNo ratings yet

- Business Finance Risk Types Reduction MethodsDocument20 pagesBusiness Finance Risk Types Reduction MethodsJannah FrancineNo ratings yet

- Systematic and Unsystematic RiskDocument12 pagesSystematic and Unsystematic Risknilvemangesh89% (9)

- Investment Required Rates of Return and Risk Premium DeterminantsDocument16 pagesInvestment Required Rates of Return and Risk Premium DeterminantsChing ZhiNo ratings yet

- Risk Systematic and UnsystematicDocument4 pagesRisk Systematic and UnsystematicMohin UddinNo ratings yet

- Unit 2 Investment AnalysisDocument148 pagesUnit 2 Investment AnalysisAbhishekSinghNo ratings yet

- F#1 Credit Risk ManagementDocument8 pagesF#1 Credit Risk Managementahsan saeedNo ratings yet

- Reviewer MidtermsDocument32 pagesReviewer MidtermsSK Schreave0% (1)

- Risk Factors ExplainedDocument7 pagesRisk Factors Explainednehateotia2011No ratings yet

- UNIT 3 RiskDocument4 pagesUNIT 3 RiskAnkush SharmaNo ratings yet

- Module 1 A Investment ProcessDocument46 pagesModule 1 A Investment ProcesssateeshjorliNo ratings yet

- ACFrOgCV6T8JDBWHJVLlqAZ6QtEZdCNWdQHiotVcbMLPjSpZsndByWDjam8WNEalNIHxp6nmWcchJCv1nmBz7TyLDN4ChFJtvfNXRmYo8xkpmXsN41bnxzj5G79DuN_3LAzsoB5xTo4H5BDAH9VLDocument25 pagesACFrOgCV6T8JDBWHJVLlqAZ6QtEZdCNWdQHiotVcbMLPjSpZsndByWDjam8WNEalNIHxp6nmWcchJCv1nmBz7TyLDN4ChFJtvfNXRmYo8xkpmXsN41bnxzj5G79DuN_3LAzsoB5xTo4H5BDAH9VLjeneneabebe458No ratings yet

- Investment: Instructor Ahmed GillaniDocument15 pagesInvestment: Instructor Ahmed GillaniMubashir AliNo ratings yet

- Capital Market AnalysisDocument86 pagesCapital Market AnalysisalenagroupNo ratings yet

- Concept of Return and RiskDocument3 pagesConcept of Return and RiskNabila SadiaNo ratings yet

- Financial Risk MGNTDocument32 pagesFinancial Risk MGNTpalaiphilip23No ratings yet

- IAPM AssignmentDocument29 pagesIAPM Assignmentpreeti royNo ratings yet

- Risk and ReturnDocument19 pagesRisk and ReturnLeny MichaelNo ratings yet

- NISM Series 5A Chapter 1Document20 pagesNISM Series 5A Chapter 1sachinaman.2016No ratings yet

- Risk 2Document7 pagesRisk 2Vedha VetriselvanNo ratings yet

- Portfolio MGMTDocument62 pagesPortfolio MGMTchandu_jjvrpNo ratings yet

- Chapter 3Document59 pagesChapter 3Lakachew GetasewNo ratings yet

- DP 2 3Document10 pagesDP 2 3khayyumNo ratings yet

- A.P.S Iapm Unit 2Document21 pagesA.P.S Iapm Unit 2vinayak mishraNo ratings yet

- Analysis of Risk and ReturnDocument38 pagesAnalysis of Risk and ReturnSattagouda PatilNo ratings yet

- ACT1110 Fundamental Concepts of Risk ManagementDocument61 pagesACT1110 Fundamental Concepts of Risk ManagementRica RegorisNo ratings yet

- ReportDocument4 pagesReportAlexandra Denise PeraltaNo ratings yet

- Upload SapmDocument20 pagesUpload SapmQurath ul ainNo ratings yet

- Unit - 1 Risk Meaning, Types, Risk Analysis in Capital BudgetingDocument19 pagesUnit - 1 Risk Meaning, Types, Risk Analysis in Capital BudgetingPra ModNo ratings yet

- Foundation of Financial Risk ManagementDocument23 pagesFoundation of Financial Risk Managementrichard kapimpaNo ratings yet

- Portfolio MGTDocument13 pagesPortfolio MGTmaddy_muksNo ratings yet

- Unit 1 - Foundation of Financial Risk Management nDocument30 pagesUnit 1 - Foundation of Financial Risk Management niDeo StudiosNo ratings yet

- Meaning and Nature of InvestmentDocument43 pagesMeaning and Nature of InvestmentVaishnavi GelliNo ratings yet

- Insurance and Risk ManagementDocument14 pagesInsurance and Risk ManagementMukhtar Hassan OsmanNo ratings yet

- Investments: An IntroductionDocument150 pagesInvestments: An IntroductionNitin NimkarNo ratings yet

- Main BodyDocument78 pagesMain BodyAhetesham RazaNo ratings yet

- Types of RiskDocument6 pagesTypes of RiskNayan kakiNo ratings yet

- What Are The Different Types of Risks?: Macro Risk LevelsDocument7 pagesWhat Are The Different Types of Risks?: Macro Risk Levelsعباس ناناNo ratings yet

- PawanDocument9 pagesPawanRajandeep AroraNo ratings yet

- Learning From the Intelligent Investor: Strategies on how to use Value Investing in the Stock MarketFrom EverandLearning From the Intelligent Investor: Strategies on how to use Value Investing in the Stock MarketNo ratings yet

- Course BlowupDocument3 pagesCourse BlowupHarshSinghNo ratings yet

- Course BlowupDocument3 pagesCourse BlowupHarshSinghNo ratings yet

- SQLDocument9 pagesSQLHarshSinghNo ratings yet

- JEE 2016 Report PDFDocument495 pagesJEE 2016 Report PDFHarshSinghNo ratings yet

- PL/SQL Lab Assignment ProblemsDocument1 pagePL/SQL Lab Assignment ProblemsHarshSinghNo ratings yet

- Traceroute Problems On Guest OS of VMwareDocument8 pagesTraceroute Problems On Guest OS of VMwareHarshSinghNo ratings yet

- New Text DocumentDocument6 pagesNew Text Documenthemanth reddyNo ratings yet

- DiscreteDocument5 pagesDiscreteHarshSinghNo ratings yet

- ZigBee Wireless Communication Protocol OverviewDocument34 pagesZigBee Wireless Communication Protocol OverviewHarshSinghNo ratings yet

- Uma007 2018 EstDocument2 pagesUma007 2018 EstHarshSinghNo ratings yet

- Conversion of E-R Diagram To TablesDocument4 pagesConversion of E-R Diagram To TablesKabir DhankharNo ratings yet

- Ch1 - Basics of DBMSDocument21 pagesCh1 - Basics of DBMSHarshSinghNo ratings yet

- Lecture 1Document26 pagesLecture 1HarshSinghNo ratings yet

- Chap3 Data ModelsDocument15 pagesChap3 Data ModelsRhy TechNo ratings yet

- Ch2 - Three Level ArchitectureDocument18 pagesCh2 - Three Level ArchitectureHarshSinghNo ratings yet

- Corporate RestructuringDocument5 pagesCorporate Restructuringapi-3720563100% (6)

- Support and Resistance SimplifiedDocument128 pagesSupport and Resistance Simplifiedterrywisniewski100% (5)

- Powerful VFX Forex Trading System With 90% AccuracyDocument13 pagesPowerful VFX Forex Trading System With 90% Accuracysting74No ratings yet

- Forming and Operating Hedge Fund PDFDocument44 pagesForming and Operating Hedge Fund PDFMary Samsung Mendoza100% (2)

- Peachtree A Complete AnswersDocument5 pagesPeachtree A Complete AnswersPhilip JosephNo ratings yet

- Test Bank Financial Accounting 6E by Libby Chapter 14Document47 pagesTest Bank Financial Accounting 6E by Libby Chapter 14Ronald James Siruno MonisNo ratings yet

- Tata Family TreeDocument1 pageTata Family Treemadan321100% (1)

- PT NUSA RAYA CIPTA Tbk Interim Financial ReportsDocument89 pagesPT NUSA RAYA CIPTA Tbk Interim Financial ReportsZaelul AlfinNo ratings yet

- H Partners and Six Flags Case ValuationDocument5 pagesH Partners and Six Flags Case ValuationNiomi Golrai100% (1)

- Ican Nov 2014 Skills PathfinderDocument172 pagesIcan Nov 2014 Skills PathfinderEmezi Francis Obisike100% (3)

- Reviewer Mas 2Document56 pagesReviewer Mas 2Siena Farne0% (2)

- Cup 1Document82 pagesCup 1Andrew Benedict PardilloNo ratings yet

- Consolidations - Subsequent To The Date of AcquisitionDocument42 pagesConsolidations - Subsequent To The Date of AcquisitionAla'aEQahwajiʚîɞNo ratings yet

- Prospectus Dhaka InsuranceDocument103 pagesProspectus Dhaka InsuranceAshraful Islam RafiNo ratings yet

- Ashish Chugh Reveals Top Secrets To Finding Multibagger StocksDocument10 pagesAshish Chugh Reveals Top Secrets To Finding Multibagger StocksSreenivasulu E NNo ratings yet

- PROBLEM 7 Solution AFAR1 - DonggoDocument4 pagesPROBLEM 7 Solution AFAR1 - DonggoArj Sulit Centino DaquiNo ratings yet

- CDBLDocument5 pagesCDBLsmg_dreamNo ratings yet

- 31st AFSAP (Brochure)Document4 pages31st AFSAP (Brochure)Hanna SasilNo ratings yet

- BAB 7 Cash Flow AnalyisisDocument19 pagesBAB 7 Cash Flow AnalyisisMaun GovillianNo ratings yet

- Investment Banking Project ReportDocument84 pagesInvestment Banking Project ReportSohail Shaikh64% (14)

- Exhibit 1: Chapter 2 Analyzing TransactionsDocument1 pageExhibit 1: Chapter 2 Analyzing Transactionscons theNo ratings yet

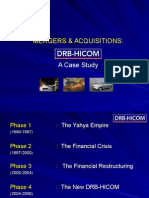

- M&a - DrbhicomDocument68 pagesM&a - DrbhicomOkay325No ratings yet

- University of Saint Louis diagnostic exam covers managerial accounting conceptsDocument8 pagesUniversity of Saint Louis diagnostic exam covers managerial accounting conceptsRommel RoyceNo ratings yet

- How To Trade SpreadsDocument92 pagesHow To Trade Spreadsbiggercapital100% (1)

- Chapter 11, 12, 13, 14, 15Document5 pagesChapter 11, 12, 13, 14, 15Nicolas JaramilloNo ratings yet

- Technical Analysis SynopsisDocument15 pagesTechnical Analysis Synopsisfinance24100% (1)

- Equity and Preference SharesDocument21 pagesEquity and Preference SharesNiraj PandeyNo ratings yet

- My-Course-Profile Pmia Bba KusomDocument7 pagesMy-Course-Profile Pmia Bba KusomSabin SubediNo ratings yet

- Crude Oil Special ReportDocument5 pagesCrude Oil Special ReportPurvi MehtaNo ratings yet

- A O F S A Through Ratio Analysis AT: Bhushan Steel LimitedDocument58 pagesA O F S A Through Ratio Analysis AT: Bhushan Steel LimitedASHIS KUMARNo ratings yet