Professional Documents

Culture Documents

Presentation 1 Hashim

Uploaded by

ZahidRiazHaans0 ratings0% found this document useful (0 votes)

6 views7 pagesOriginal Title

Presentation1hashim.pptx

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views7 pagesPresentation 1 Hashim

Uploaded by

ZahidRiazHaansCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 7

Tax

A tax is a compulsory financial charge or

some other type of levy imposed upon a

taxpayer by a governmental organization

in order to fund various public

expenditures.

Attitudes towards behavior

Attitude toward a behavior is the degree

to which performance of the behavior is

positively or negatively valued.

Subjective Norms

The expectations from others that

influence a user to perform a particular

behavior.

Effect that other people’s opinion –family

or friends, among others– has on the

consumer’s behavior.

Perceived behavioral control

Perceivedbehavioral control refers to

people's perceptions of their ability to

perform a given behavior.

Moral obligation

A moral obligation is simply what you

have to do in order to maintain your

morality.

Forexample, if you saw a person having

an accident nearby, in order to be

considered a “ morally good” person,

you would have to undertake your moral

obligation, which is to help the victim.

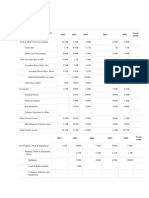

Conceptual framework

Attitudes

toward

the behavior

Subjective Tax

norms

compliance

Perceived

behavioral

behavior

control

Moral

obligation

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Complete QuestionniareDocument49 pagesComplete QuestionniareZahidRiazHaansNo ratings yet

- Signaling Theory: A Review and Assessment: Brian L. Connelly S. Trevis Certo R. Duane Ireland Christopher R. ReutzelDocument29 pagesSignaling Theory: A Review and Assessment: Brian L. Connelly S. Trevis Certo R. Duane Ireland Christopher R. Reutzeldian oktaviaNo ratings yet

- Academic Research Survey: "Perception On Justice and Tax Compliance Behaviour: The Role of Social Support"ThisDocument2 pagesAcademic Research Survey: "Perception On Justice and Tax Compliance Behaviour: The Role of Social Support"ThisZahidRiazHaansNo ratings yet

- ResearchonSocialWorkPractice 1993 Richman 288 3111Document26 pagesResearchonSocialWorkPractice 1993 Richman 288 3111ZahidRiazHaansNo ratings yet

- Kuesioner SSQDocument15 pagesKuesioner SSQNa d'Nazaie Code100% (3)

- Background of The StudyDocument35 pagesBackground of The StudyZahidRiazHaansNo ratings yet

- Report On AnshsshsDocument16 pagesReport On AnshsshsZahidRiazHaansNo ratings yet

- GUL AHMED TEXTILES No.8 Internship Report (Sfdac)Document25 pagesGUL AHMED TEXTILES No.8 Internship Report (Sfdac)raoshahbazkhan50% (6)

- ShahzaibDocument18 pagesShahzaibZahidRiazHaansNo ratings yet

- NRSP Bank, MansoorDocument18 pagesNRSP Bank, MansoorZahidRiazHaansNo ratings yet

- D. Com Result 2019Document175 pagesD. Com Result 2019Gscc bwpNo ratings yet

- The Effect of Classroom Environment On Student LearningDocument24 pagesThe Effect of Classroom Environment On Student LearningFaris Najwan Abd LatiffNo ratings yet

- GUL AHMED TEXTILES No.8 Internship Report (Sfdac)Document25 pagesGUL AHMED TEXTILES No.8 Internship Report (Sfdac)raoshahbazkhan50% (6)

- NN NNNNNNNNN NNNNNNNNNDocument21 pagesNN NNNNNNNNN NNNNNNNNNZahidRiazHaansNo ratings yet

- Zahid Riaz Corporate GovernanceDocument10 pagesZahid Riaz Corporate GovernanceZahidRiazHaansNo ratings yet

- Admission Advertisement Fall 2019 01Document2 pagesAdmission Advertisement Fall 2019 01Ahsan aliNo ratings yet

- Phone No. 051-9205075 Ext. 385, 377,236,243,241 & 298Document10 pagesPhone No. 051-9205075 Ext. 385, 377,236,243,241 & 298Asad KhanNo ratings yet

- 5 Year Bank StatementsDocument6 pages5 Year Bank StatementsZahidRiazHaansNo ratings yet

- Nestle Project Asif SahbDocument37 pagesNestle Project Asif SahbZahidRiazHaans100% (1)

- Nestle Project Asif SahbDocument37 pagesNestle Project Asif SahbZahidRiazHaans100% (1)

- 1 What Is A Research DesignDocument6 pages1 What Is A Research DesignZahidRiazHaansNo ratings yet

- 1 What Is A Research DesignDocument6 pages1 What Is A Research DesignZahidRiazHaansNo ratings yet

- Income StatementDocument7 pagesIncome StatementZahidRiazHaansNo ratings yet

- NestleDocument21 pagesNestleZahidRiazHaansNo ratings yet

- Economy of PakistanDocument15 pagesEconomy of PakistanZahidRiazHaansNo ratings yet

- Zahid Riaz Corporate GovernanceDocument10 pagesZahid Riaz Corporate GovernanceZahidRiazHaansNo ratings yet

- Bismillah TextileDocument20 pagesBismillah TextileZahidRiazHaansNo ratings yet

- Assignment: Bzu Bahadur Sub CampusDocument3 pagesAssignment: Bzu Bahadur Sub CampusZahidRiazHaansNo ratings yet

- Financial Analysis of DG Khan Cement Factory, Ratio AnalysisDocument57 pagesFinancial Analysis of DG Khan Cement Factory, Ratio AnalysisM Fahim Arshed50% (8)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)