Professional Documents

Culture Documents

Session 11

Uploaded by

Akshat Prakash0 ratings0% found this document useful (0 votes)

21 views30 pagesDebt market

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentDebt market

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

21 views30 pagesSession 11

Uploaded by

Akshat PrakashDebt market

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 30

Debt market

"Copyright © 2018 Pearson India Education Services Pvt. Ltd".

By: Bharati V. Pathak

Indian Financial System, 5e

Chapter Objectives

"Copyright © 2018 Pearson India Education Services Pvt. Ltd".

To understand:

1. Meaning, history and characteristics of Debt market

2. Participants in the Debt Market

3. The Private Corporate Debt Market

4. The Public Sector Undertaking Bond Market

5. The Government Securities Market

6. Tools for managing liquidity in the Government

Securities Market

7. Measures to strengthen the Government Securities

Market Infrastructure

8. Impact of Reforms on the Government Securities

Market

Indian Financial System, 5e

By: Bharati V. Pathak

Debt market: Long Term Fixed

Income Securities Market

"Copyright © 2018 Pearson India Education Services Pvt. Ltd".

Segment: Private Corporate Debt market, Public

Sector Undertaking Bond Market, Government

Securities Market

Importance: Helps in

Mobilization and allocation of resources

Financing development activities

Facilitating liquidity management

Pricing of non-government securities

Regulation: Government Securities Market and

repo market in corporate debt securities– RBI

Corporate Debt Market - SEBI

Indian Financial System, 5e

By: Bharati V. Pathak

Participants in the Debt Market

"Copyright © 2018 Pearson India Education Services Pvt. Ltd".

Participants in the Debt market

Central and State Governments

Primary Dealers

Public Sector Undertakings

Corporates

Banks

Mutual funds

Foreign Institutional Investors

Provident Funds

Charitable Institutions and trusts

Indian Financial System, 5e

By: Bharati V. Pathak

Types of Instruments Traded in

the Debt Market

"Copyright © 2018 Pearson India Education Services Pvt. Ltd".

Indian Financial System, 5e

By: Bharati V. Pathak

The Private Corporate Debt

Market

"Copyright © 2018 Pearson India Education Services Pvt. Ltd".

Primary Market:

Funds raised through prospectus or private placement

Debt issues compromise debentures and bonds

Dominant investors: Mutual funds, Insurance companies,

banks

Secondary Market:

Securities traded on the WDM segment of NSE, OTCEI and

on the BSE.

Indian Financial System, 5e

By: Bharati V. Pathak

Significance of the Corporate

Debt Market

"Copyright © 2018 Pearson India Education Services Pvt. Ltd".

Aids in economic growth by providing long-term capital.

Supplements the banking system.

A stable source of finance.

Reduces cost of capital of corporates.

Fosters market discipline and nurtures credit culture.

Enables investors to hold a diversified portfolio.

Enables a better asset-liability match for banks and

corporates.

Facilitates infrastructure financing.

Enables development of the municipal bond market.

Indian Financial System, 5e

By: Bharati V. Pathak

Explained: Why a corporate

bond market

"Copyright © 2018 Pearson India Education Services Pvt. Ltd".

Indian Financial System, 5e

By: Bharati V. Pathak

"Copyright © 2018 Pearson India Education Services Pvt. Ltd".

Why has the Indian corporate bond

market failed to take off?

Have the recent corporate defaults been

a dampener?

What are the measures to improve the

debt market? How it will help?

Indian Financial System, 5e

By: Bharati V. Pathak

Factors Inhibiting the Growth of

Private Corporate Debt Market

"Copyright © 2018 Pearson India Education Services Pvt. Ltd".

Private corporate debt market

Narrow issuer and investor base

Primary issuance through private placement

Lack of transparency

Absence of a benchmark rate

Absence of Market Making

Dull secondary market

Accessible only to high rated borrowers

Foreign funds not allowed to invest

Differential stamp duties levied by different states inhibiting the

growth of primary market

Indian Financial System, 5e

By: Bharati V. Pathak

New measures

"Copyright © 2018 Pearson India Education Services Pvt. Ltd".

Credit Guarantee Enhancement

Corporation

Infrastructure Debt Funds

what else?

Indian Financial System, 5e

By: Bharati V. Pathak

The Government Securities

Market (GSM)

"Copyright © 2018 Pearson India Education Services Pvt. Ltd".

Gilt edged securities and SLR securities

Constitutes the principal segment of

the debt market

Issuers: Central government, State

government, Semi-government authorities

including local government authorities

Investors: Nationalized banks, Insurance

companies, State Governments, Provident

funds and trusts, Individuals, Corporates,

NBFCs, Primary dealers, FIs, FIIs and NRIs

Types: Treasury bills, Government dated

securities

Indian Financial System, 5e

By: Bharati V. Pathak

GSM in the pre- 1991 period

"Copyright © 2018 Pearson India Education Services Pvt. Ltd".

1930s - Cheap money policy

1950s - Programme of borrowing stepped up

- Interest rates stepped up

- Brokers and Jobbers carried out OMOs

- Government securities more popular with

individuals

1960s and 1970s - GSM dormant

1980s - Volume of debt expanded

Maturity structure skewed in favour of long- term debt

passive internal debt management

Indian Financial System, 5e

By: Bharati V. Pathak

Objectives of Reforms in the GSM

"Copyright © 2018 Pearson India Education Services Pvt. Ltd".

Increase operational autonomy of RBI

Improve institutional infrastructure

Improve breadth and depth of the market

Enable sound legal framework

Bring in technology related improvements

Improve transparency

Indian Financial System, 5e

By: Bharati V. Pathak

Some Policy Measures

Undertaken in 1990s

"Copyright © 2018 Pearson India Education Services Pvt. Ltd".

Introduction of Repos

Introduction of auction system

Elimination of ad hoc T-bills

Introduction of delivery v/s payment system

Introduction of scheme of Ways and Advances

FIIs permitted to invest

Setting up of an electronic Negotiated Dealing System (NDS) and

Clearing Corporation of India Ltd (CIL)

Introduction of the system of publishing a calender by RBI

Introduction of Screen based order driven trading on stock exchanges

Introduction of Retail trading

Debt buy-back scheme

Interest rate derivatives

Introduction of Real time Gross Settlement (RTGS)

Indian Financial System, 5e

By: Bharati V. Pathak

STRIPS

"Copyright © 2018 Pearson India Education Services Pvt. Ltd".

Conversion of one underlying security into a

number of zero coupon securities

Improves liquidity

Benefits both issuers and investors

Indian Financial System, 5e

By: Bharati V. Pathak

Retailing of Government

Securities

"Copyright © 2018 Pearson India Education Services Pvt. Ltd".

Individuals can buy government securities from

the RBI’s public debt office during auctions.

Measures to Promote Retail Trading in

Government Securities

Banks allowed to freely buy and sell securities.

Exempted from TDS.

Support to primary dealers.

Dematerialization of securities.

Setting up of mutual funds dealing exclusively in these securities.

A non-competitive bidding facility

Depositories allowed to open a second SGL account.

Retail trading in stock exchanges.

Indian Financial System, 5e

By: Bharati V. Pathak

Retailing of Government

Securities

"Copyright © 2018 Pearson India Education Services Pvt. Ltd".

Advantages of investing in Government securities

• Offer maximum safety Can be held in book

entry i.e., dematerialized or scrip less form.

• Available in wide range of maturities.

• Can be sold easily in the secondary market.

• Can be used as collateral to borrow funds in the

repo market.

• Simple, safe and efficient system of settlement.

Indian Financial System, 5e

By: Bharati V. Pathak

Investment by Foreign Portfolio

Investors (FPI) in Government

Securities

"Copyright © 2018 Pearson India Education Services Pvt. Ltd".

The RBI has permitted Foreign Portfolio

Investors to invest in government securities

and state development loans (SDL).

The limits for investment are revised by the

RBI on a quarterly basis.

Indian Financial System, 5e

By: Bharati V. Pathak

‘When-issued’ Market in

Government Securities

"Copyright © 2018 Pearson India Education Services Pvt. Ltd".

When issued trading is trading of government

securities between the time a new issue is

announced and the time it is actually issued.

When-issued Trading

A tool to hedge risk.

Facilitates distribution process.

Facilitates price discovery.

Enables PDs to bid and underwrite accordingly.

Enhances liquidity in the government securities

market.

Indian Financial System, 5e

By: Bharati V. Pathak

The System of Ways and Means

Advances (WMA) for the Centre

"Copyright © 2018 Pearson India Education Services Pvt. Ltd".

Financing of Ad hocs led to:

increase in money supply, inflation, passive

internal debt management

Elimination of ad hocs in 3 stages:

through limits on creation of ad-hocs, through a

transtition period of 2 years, the full- fledged

system of WMA

Ways and Means advances:

Accomodates temporary mismatches in

government receipts and payments,, Charged at

market related interest rates, Limit for WMA and

interest rate mutually agreed between the RBI and

government from time to time.

Indian Financial System, 5e

By: Bharati V. Pathak

Primary Market of Government

Securities

"Copyright © 2018 Pearson India Education Services Pvt. Ltd".

Types: Treasury bills – 91- day

- 182-day

- 364- day

Government dated securities

Issue Mechanism: (a) Auctions – Uniform Price Auction

Multiple Price Auction

Competitive bidding

Non-competitive bidding

(b) Sale

(c) Private Placement with the Reserve Bank

Indian Financial System, 5e

By: Bharati V. Pathak

Market Borrowings, Ownership

Pattern, Maturity Structure and

Interest Rates

"Copyright © 2018 Pearson India Education Services Pvt. Ltd".

Market borrowing increased more than ten-

fold

Captive investors are banks and insurance

companies

Maturity structure tilted at the short end

but now shifted to long term

Weighted Average coupon rates on a

declining trend

Yield spread narrowed

Indian Financial System, 5e

By: Bharati V. Pathak

Government Dated Securities –

Secondary Market

"Copyright © 2018 Pearson India Education Services Pvt. Ltd".

Two segments : Wholesale institutional segment

Retail segment

Trading system: Earlier on telephone

Now screen based order- driven system

Trades: Outright trades

Repo transactions

Settlements: Physical form

Dematerialised SGL form: SGL I and SGL II

DVP system of settlement

-DVP III system – allows netting of transactions

– Improves liquidity

Indian Financial System, 5e

By: Bharati V. Pathak

Order Matching System (OMS) for

Trading in Government Securities

"Copyright © 2018 Pearson India Education Services Pvt. Ltd".

OMS is an anonymous platform on the NDS

of RBI

Banks and Primary dealers allowed to trade

Allows sellers and buyers to interface by

placing quotes. Transactions executed by

matching quotes.

Bond brokers will be out of business

Indian Financial System, 5e

By: Bharati V. Pathak

Secondary Market Transactions

in Government Securities

"Copyright © 2018 Pearson India Education Services Pvt. Ltd".

Turnover increased

Outright transactions predominant

Factors inhibiting the growth:

Hardening interest rates

A long only market (cannot short sell)

Higher inflation

Rigid regulations

A bearish outlook

Indian Financial System, 5e

By: Bharati V. Pathak

Tools for Managing Liquidity in

GSM

"Copyright © 2018 Pearson India Education Services Pvt. Ltd".

Open market Operations:- Sale/Purchase of government

securities by the Central Bank

Uses: Neutralises excess liquidity

: Contains wide fluctuations in money and

foreign

exchange markets

Types: Open market sales

Open market purchase

Indian Financial System, 5e

By: Bharati V. Pathak

Infrastructure Development of

the GSM

"Copyright © 2018 Pearson India Education Services Pvt. Ltd".

Primary dealer system : Act as market makers

At present 19 PDs

Subsidiaries of banks and FIs

Categorised as NBFCs

Obligations of PDs and Facilities extended to them

Underwrite primary issues

Offer two-way prices

Facilities

Prcurrent account and SGL

A favoured ovision of access to the Repo market

Access to LAF

Guidelines – Capital adequacy

Brought under the purview of the Board for Financial Supervision

Permitted to borrow upto 200 % of their funds

Guidelines for non- government securities

Indian Financial System, 5e

By: Bharati V. Pathak

Measures to Strengthen GSM

Infrastructure

"Copyright © 2018 Pearson India Education Services Pvt. Ltd".

Negotiated Dealing System (NDS)

Screen based electronic dealing and reporting of

transactions

Clearing Corporation of India Limited

Acts as the Central counterparty in the settlement of

all trades

Manages various risks

Clears all transactions in government securities and

repos reported on NDS

Recognised as a systemically important payment

system

Indian Financial System, 5e

By: Bharati V. Pathak

Impact of Reforms on GSM

"Copyright © 2018 Pearson India Education Services Pvt. Ltd".

Increased operational autonomy of RBI

Introduction of a new instrument

Improvement of infrastructure

Increase in transparency

Increase in trading volumes

Retail participation encouraged

Improvement in clearing and settlement systems

Indian Financial System, 5e

By: Bharati V. Pathak

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Financial Management - Group 1Document26 pagesFinancial Management - Group 1Ha Anh Nguyen MaiNo ratings yet

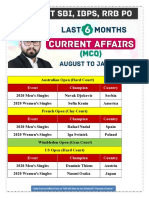

- Event Champion Country: Daily Current Affairs Class at 7:00 AM Mon To Sat @adda247 Youtube ChannelDocument5 pagesEvent Champion Country: Daily Current Affairs Class at 7:00 AM Mon To Sat @adda247 Youtube ChannelAkshat PrakashNo ratings yet

- National Bank of Belgium: Working Papers - Research SeriesDocument29 pagesNational Bank of Belgium: Working Papers - Research SeriesAkshat PrakashNo ratings yet

- Jaipuria Institute of Management: 1. Course Code: Course Title: Digital MarketingDocument10 pagesJaipuria Institute of Management: 1. Course Code: Course Title: Digital MarketingAkshat PrakashNo ratings yet

- Financial Synergy Valuation TemplateDocument4 pagesFinancial Synergy Valuation TemplateAkshat PrakashNo ratings yet

- Basel Norms For BankingDocument5 pagesBasel Norms For BankingAkshat PrakashNo ratings yet

- Bonds PayableDocument39 pagesBonds PayableRuiz, CherryjaneNo ratings yet

- Financial Management: Valuation of Bonds and Shares QuizDocument12 pagesFinancial Management: Valuation of Bonds and Shares QuizSeri DiyanaNo ratings yet

- Step Up Swaps-InfoDocument3 pagesStep Up Swaps-InfoRafael Lizana ZúñigaNo ratings yet

- Chapter 8 The Credit SystemDocument20 pagesChapter 8 The Credit SystemJonavel Torres MacionNo ratings yet

- Cash Flow Statement PDFDocument18 pagesCash Flow Statement PDFPrithikaNo ratings yet

- Loan Amortization ScheduleDocument30 pagesLoan Amortization ScheduleAnonymous 8iP4hCNo ratings yet

- The Law of Labour in The Private Sector No. 6 of 2010Document15 pagesThe Law of Labour in The Private Sector No. 6 of 2010Sajin Satheesh KumarNo ratings yet

- BATELEC I Performance Study PDFDocument11 pagesBATELEC I Performance Study PDFAnonymous ic2CDkFNo ratings yet

- Home Afrika Limited V Ecobank Kenya Limited (Insol 230321 082056Document17 pagesHome Afrika Limited V Ecobank Kenya Limited (Insol 230321 082056Malcolm 'Doctore' LeeNo ratings yet

- Industry Analysis - Indian Paint IndDocument16 pagesIndustry Analysis - Indian Paint Indhsimransingh1No ratings yet

- Annual Report 2020Document11 pagesAnnual Report 2020Anika RieweNo ratings yet

- AFAR PreweekDocument8 pagesAFAR PreweekChristian Arthur VelascoNo ratings yet

- MERS ComplaintDocument92 pagesMERS ComplaintForeclosure Fraud100% (1)

- OJK2014 Denpasar&SemarangDocument39 pagesOJK2014 Denpasar&SemarangSale Sophie ParisNo ratings yet

- Bank of Uganda Act Cap 51Document20 pagesBank of Uganda Act Cap 51Moses KayimaNo ratings yet

- CIMB ASB Loan Repayment TableDocument1 pageCIMB ASB Loan Repayment Tablezephyryu0% (1)

- BAC1644 Principles of Finance AssignmentDocument33 pagesBAC1644 Principles of Finance Assignmentyuyin.gohyyNo ratings yet

- How To Buy A Business by William Bruce PDFDocument64 pagesHow To Buy A Business by William Bruce PDFNajihah Zahir100% (1)

- Credtrans Real Mortgage de Leon 2016Document10 pagesCredtrans Real Mortgage de Leon 2016Camille RegalaNo ratings yet

- Formatted Accounting Finance For Bankers AFB 2 1 PDFDocument6 pagesFormatted Accounting Finance For Bankers AFB 2 1 PDFSijuNo ratings yet

- Sia 1.bonds PayableDocument13 pagesSia 1.bonds PayableYasmin MamugayNo ratings yet

- Credit Transactions - Midterm Examination - Parts 1 - 20230317Document17 pagesCredit Transactions - Midterm Examination - Parts 1 - 20230317Anton Ric Delos ReyesNo ratings yet

- Water Resources Development Report - Arizona 2011Document58 pagesWater Resources Development Report - Arizona 2011AlanInAZNo ratings yet

- Financial Plan - Prem Ranjan & SudhaDocument35 pagesFinancial Plan - Prem Ranjan & SudhaVinay KumarNo ratings yet

- No. 2010-20 July 2010: Receivables (Topic 310)Document92 pagesNo. 2010-20 July 2010: Receivables (Topic 310)LexuzDyNo ratings yet

- JPM Mortgage ResearchDocument30 pagesJPM Mortgage ResearchflhaliliNo ratings yet

- Project Meteor Teaser Oct 2022 - V1 - INR - Investor-1Document22 pagesProject Meteor Teaser Oct 2022 - V1 - INR - Investor-1ashispatrNo ratings yet

- Harris V Manahan Harris V ManahanDocument27 pagesHarris V Manahan Harris V ManahanTyler ReneeNo ratings yet

- Kimberly Dawson DepositionDocument6 pagesKimberly Dawson DepositionRon White0% (1)