Professional Documents

Culture Documents

Tugas AKM II Kel. 1 (Ch. 13 Current Liablities & Contigencies)

Uploaded by

Rafika Rizkia0 ratings0% found this document useful (0 votes)

46 views7 pagesOriginal Title

Tugas AKM II Kel. 1 (Ch. 13 Current Liablities & Contigencies).pptx

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

46 views7 pagesTugas AKM II Kel. 1 (Ch. 13 Current Liablities & Contigencies)

Uploaded by

Rafika RizkiaCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 7

Chapter 13: Current Liabilities and

Contingencies

Kelompok 1: Dwi Rafika Rizkia Putri (43217110214)

Viki Anjarwati (43217110

Yulianingtias (43217110080)

Mega Ceria Simanjuntak (43217110328)

Akuntansi Keuangan Menengah II

Dosen Pengampu : Mariyam Chairunisa, SE, M.Ak

Current Liabilities and Contingencies

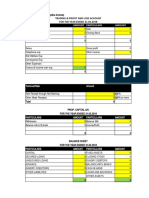

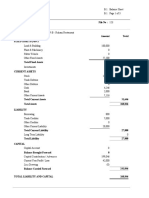

E13-2: (Accounts and Notes Payable) The following are selected

2015 transactions of Darby Corporation.

Sept. 1 - Purchased inventory from Orion Company on account

for $50,000. Darby records purchases gross and uses a

periodic inventory system.

Oct. 1 - Issued a $50,000, 12-month, 8% note to Orion in

payment of account.

Oct. 1 - Borrowed $75,000 from the Shore Bank by signing a

12-month, zero-interest-bearing $81,000 note.

Current Liabilities and Contingencies

Instructions

(a) Prepare journal entries for the selected transactions above.

(b) Prepare adjusting entries at December 31.

(c) Compute the total net liability to be reported on the December

31 statement of financial position for:

(1) The interest-bearing note.

(2) The zero-interest-bearing note

Current Liabilities and Contingencies

(a) Prepare journal entries for the selected transactions above.

Sept. 1 - Purchased inventory from Orion Company on account for

$50,000. Darby records purchases gross and uses a periodic inventory

system.

Sept. 1 Purchases 50,000

Accounts Payable 50,000

Current Liabilities and Contingencies

Oct. 1 - Issued a $50,000, 12-month, 8% note to Orion in payment of account.

Oct. 1 Accounts Payable 50,000

Notes Payable 50,000

Oct. 1 - Borrowed $75,000 from the Shore Bank by signing a 12-month, zero-

interest-bearing $81,000 note.

Oct. 1 Cash 75,000

Notes Payable 75,000

Current Liabilities and Contingencies

(b) Prepare adjusting entries at December 31.

Interest calculation = ($50,000 x 8% x 3/12) = $1,000

Dec. 31 Interest Expense 1,000

Interest Payable 1,000

Interest calculation = ($6,000 x 3/12) = $1,500

Dec. 31 Interest Expense 1,500

Notes Payable 1,500

Current Liabilities and Contingencies

(c) Compute the total net liability to be reported on the December

31 statement of financial position for:

(1) The interest-bearing note.

(2) The zero-interest-bearing note

(c) 1. Note payable......................................... $50,000

Interest payable ................................... 1,000

$51,000

2. Note payable ($75,000 + $1,500)..... $76,500

You might also like

- Treasury Finance and Development Banking: A Guide to Credit, Debt, and RiskFrom EverandTreasury Finance and Development Banking: A Guide to Credit, Debt, and RiskNo ratings yet

- E13-2 Selected 2010 Transactions of Darby CorporationDocument2 pagesE13-2 Selected 2010 Transactions of Darby CorporationEvelyn Roldan100% (6)

- 1 - Session 3 - CL and Provision - Kieso - CH 13Document50 pages1 - Session 3 - CL and Provision - Kieso - CH 13melva vionaNo ratings yet

- Acc102 W4Document26 pagesAcc102 W4Moheb RefaatNo ratings yet

- Chapter 2: Current Liabilities, Provisions, and ContingenciesDocument14 pagesChapter 2: Current Liabilities, Provisions, and ContingenciesGirma NegashNo ratings yet

- Current LiabilityDocument38 pagesCurrent LiabilityRamadhani FirmansyahNo ratings yet

- Nisha Nur Aini - 43219110183 - TM 01 - AKM IIDocument11 pagesNisha Nur Aini - 43219110183 - TM 01 - AKM IInisha nuraini100% (1)

- PRELIM Quiz 1 Cash, CE, PCF, Bank ReconDocument8 pagesPRELIM Quiz 1 Cash, CE, PCF, Bank ReconApril Faye de la CruzNo ratings yet

- Lesson 1 - Intro To LiabilitiesDocument21 pagesLesson 1 - Intro To LiabilitiesGrace Joy MarcelinoNo ratings yet

- PS 1Document4 pagesPS 1BlackRoseNo ratings yet

- Ch13 Current Liabilities Provisions and ContingenciesDocument101 pagesCh13 Current Liabilities Provisions and ContingenciesSamuel100% (1)

- Chapter 1 Current Liabilities, Provisions, and ContingenciesDocument82 pagesChapter 1 Current Liabilities, Provisions, and ContingenciesBikila MalasaNo ratings yet

- ch13 ModifiedDocument100 pagesch13 ModifiedBertha MithaNo ratings yet

- CH 07Document8 pagesCH 07Antonios FahedNo ratings yet

- Intermediate AccountingDocument88 pagesIntermediate AccountingTiến NguyễnNo ratings yet

- Spoderman Company accounts receivable net realizable valueDocument2 pagesSpoderman Company accounts receivable net realizable valueJake Ryle0% (1)

- Intermediate Accounting 1 Quiz 1Document4 pagesIntermediate Accounting 1 Quiz 1Manuel MagadatuNo ratings yet

- Accounting Tools For Business Decision Making 6th Edition Kimmel Solutions ManualDocument7 pagesAccounting Tools For Business Decision Making 6th Edition Kimmel Solutions ManualKellyMorenootdnj100% (81)

- Current Liabilities and Contingencies: PART II: Corporate Accounting Concepts and IssuesDocument68 pagesCurrent Liabilities and Contingencies: PART II: Corporate Accounting Concepts and IssuesKashif RaheemNo ratings yet

- E13.2 (LO 1) (Accounts and Notes Payable) The Following Are Selected 2022 Transactions ofDocument4 pagesE13.2 (LO 1) (Accounts and Notes Payable) The Following Are Selected 2022 Transactions ofChupa HesNo ratings yet

- Fa2 Ch-2 Current LiabilitiesDocument82 pagesFa2 Ch-2 Current LiabilitiesTsi AwekeNo ratings yet

- Kieso Chapter 13Document98 pagesKieso Chapter 13GraceNo ratings yet

- FA II - Chapter 1, Current LiabilitiesDocument94 pagesFA II - Chapter 1, Current LiabilitiesBeamlak WegayehuNo ratings yet

- Ch1 Current Liablities P& CDocument99 pagesCh1 Current Liablities P& CLiyo MakNo ratings yet

- General Fund Trial Balances and TransactionsDocument9 pagesGeneral Fund Trial Balances and TransactionsAbdii Dhufeera100% (2)

- A. Lifo B. Fifo C. Lifo D. Fifo E. Average CostDocument3 pagesA. Lifo B. Fifo C. Lifo D. Fifo E. Average CostWesNo ratings yet

- CH 13Document83 pagesCH 13hestyNo ratings yet

- Sesi 3 - AK2 - ch13 Current Liabilities - Amend PSAK 1 10.09.21 - AnnotatedDocument50 pagesSesi 3 - AK2 - ch13 Current Liabilities - Amend PSAK 1 10.09.21 - AnnotatedandinNo ratings yet

- Ch13-Current Liabilities, Provisions, ContingenciesDocument101 pagesCh13-Current Liabilities, Provisions, ContingenciesYohanes DimasNo ratings yet

- Journal Entries for Accounting TransactionsDocument9 pagesJournal Entries for Accounting TransactionsKhushi RaiNo ratings yet

- Current Liabilities, Provisions, and ContingenciesDocument94 pagesCurrent Liabilities, Provisions, and ContingenciesBantamkak FikaduNo ratings yet

- SOAL LATIHAN MATERI FINAL TESTDocument24 pagesSOAL LATIHAN MATERI FINAL TESTCarissaNo ratings yet

- Batch 17 Final Preboard (P1)Document16 pagesBatch 17 Final Preboard (P1)Jericho Pedragosa100% (1)

- Cash and Cash Equivalents Sample ProblemsDocument3 pagesCash and Cash Equivalents Sample ProblemsGee Lysa Pascua VilbarNo ratings yet

- 0318 HW2Document3 pages0318 HW2t.show0613No ratings yet

- (Academic Review and Training School, Inc.) 2F & 3F Crème BLDG., Abella ST., Naga City Tel No.: (054) 472-9104 E-MailDocument11 pages(Academic Review and Training School, Inc.) 2F & 3F Crème BLDG., Abella ST., Naga City Tel No.: (054) 472-9104 E-MailMichael BongalontaNo ratings yet

- Cash Cash Equivalents Ia 1 2020 EditionDocument3 pagesCash Cash Equivalents Ia 1 2020 EditionmarielleNo ratings yet

- Quiz - Cash and Cash Equivalents (3.3.22)Document5 pagesQuiz - Cash and Cash Equivalents (3.3.22)Nicole ValentinoNo ratings yet

- Practice Exam- Prelim Topics (Intermediate Accounting IDocument8 pagesPractice Exam- Prelim Topics (Intermediate Accounting IDe MarcusNo ratings yet

- Self-Test 1Document8 pagesSelf-Test 1Dymphna Ann CalumpianoNo ratings yet

- Af 311 Exam ReviewDocument10 pagesAf 311 Exam ReviewTedy MuliyaNo ratings yet

- Warning: Course: Financial Accounting (5004) Semester: Spring, 2022 Level: MSC Administrative ScienceDocument11 pagesWarning: Course: Financial Accounting (5004) Semester: Spring, 2022 Level: MSC Administrative ScienceSahil PuniaNo ratings yet

- First Quiz in Prac 1Document10 pagesFirst Quiz in Prac 1ai shiNo ratings yet

- Aud ProbDocument21 pagesAud ProbCarmellae OrbitaNo ratings yet

- ACC 109 2S2324 P3 QUIZ 1 AK For StudentsDocument4 pagesACC 109 2S2324 P3 QUIZ 1 AK For Studentsbrmo.amatorio.uiNo ratings yet

- Current LiabilitiesDocument94 pagesCurrent LiabilitiesDawit TilahunNo ratings yet

- Balance Sheet Presentation of Liabilities: Problem 10.2ADocument4 pagesBalance Sheet Presentation of Liabilities: Problem 10.2AMuhammad Haris100% (1)

- Working 5Document6 pagesWorking 5Hà Lê DuyNo ratings yet

- CH 10Document87 pagesCH 10Chang Chan ChongNo ratings yet

- Diamondback Company Total Current LiabilitiesDocument1 pageDiamondback Company Total Current LiabilitiesMa Teresa B. CerezoNo ratings yet

- Cash and Cash Equivalent HandoutsDocument6 pagesCash and Cash Equivalent HandoutsMichael BongalontaNo ratings yet

- Financial Accounting & Reporting 2: PX - Set SolutionDocument15 pagesFinancial Accounting & Reporting 2: PX - Set SolutionMaryrose SumulongNo ratings yet

- BONEO Pup Receivables3 SRC 2 1Document13 pagesBONEO Pup Receivables3 SRC 2 1hellokittysaranghaeNo ratings yet

- Prelim ExamDocument7 pagesPrelim ExamHoney Grace TangarurangNo ratings yet

- Problems For Cash and Cash EquivalentsDocument1 pageProblems For Cash and Cash EquivalentsTine Vasiana DuermeNo ratings yet

- Session 17Document23 pagesSession 17Serena KassabNo ratings yet

- Kewajiban LancarDocument19 pagesKewajiban LancarAtiXs Binti Zein100% (1)

- Apre 102 MidtermsDocument10 pagesApre 102 MidtermsMa Angelica BalatucanNo ratings yet

- Cash Accounts AnalysisDocument3 pagesCash Accounts Analysisyes yesnoNo ratings yet

- Landlord's Instruction FormDocument2 pagesLandlord's Instruction FormKatharina SumantriNo ratings yet

- Sale of Goods Act EssentialsDocument20 pagesSale of Goods Act EssentialssujithchandrasekharaNo ratings yet

- Semester9.Banking Law-Optional 2-Vagvi Pandey.172.ProjectDocument21 pagesSemester9.Banking Law-Optional 2-Vagvi Pandey.172.ProjectDevendra DhruwNo ratings yet

- A Study On Credit Information Bureau (India) Limited (Cibil)Document6 pagesA Study On Credit Information Bureau (India) Limited (Cibil)sums siNo ratings yet

- Frias vs. San Diego-SisonDocument18 pagesFrias vs. San Diego-SisonRoizki Edward MarquezNo ratings yet

- March 2006 Jurisprudence On CorporationsDocument26 pagesMarch 2006 Jurisprudence On CorporationsLv EscartinNo ratings yet

- Types of PartnersDocument4 pagesTypes of PartnersRAHUL RNAIRNo ratings yet

- G.C.E. (O.L) Practice Paper (2019) - Department of Education, Central ProvinceDocument12 pagesG.C.E. (O.L) Practice Paper (2019) - Department of Education, Central ProvinceXiao Shadowlord100% (1)

- Project Report - Rubber IndustryDocument17 pagesProject Report - Rubber Industryprahladjoshi67% (3)

- Profit and Loss and Balance SheetDocument2 pagesProfit and Loss and Balance SheetmuditNo ratings yet

- Financial Management Assignment AnalysisDocument5 pagesFinancial Management Assignment AnalysissleshiNo ratings yet

- Icpau Paper 15Document19 pagesIcpau Paper 15Innocent Won AberNo ratings yet

- Liquidity Risk: Aries H. Prasetyo, SE, MM, PH.D, RFP-I, CERDocument47 pagesLiquidity Risk: Aries H. Prasetyo, SE, MM, PH.D, RFP-I, CERDonny Ramanto100% (1)

- Securities Industry Essentials (SIE) Examination: ContentoutlineDocument15 pagesSecurities Industry Essentials (SIE) Examination: ContentoutlinePj GuptaNo ratings yet

- How To Configure SSL For SAP HANA XS Engine Using SAPCryptoDocument4 pagesHow To Configure SSL For SAP HANA XS Engine Using SAPCryptopraveenr5883No ratings yet

- American Bar Association - Role of The Trustee in Asset-Backed Securities July2010Document12 pagesAmerican Bar Association - Role of The Trustee in Asset-Backed Securities July20104EqltyMom100% (1)

- Capital StructureDocument4 pagesCapital StructureAdeem Ashrafi100% (2)

- Pay ChalanDocument1 pagePay ChalanSDO BUxar50% (2)

- FDCPA Edleman CombsDocument43 pagesFDCPA Edleman CombsDarren Chaker100% (5)

- Sula Wines Presentation Group 7Document21 pagesSula Wines Presentation Group 7akshaykg100% (1)

- Business Organizations Outline (Fall 2018)Document106 pagesBusiness Organizations Outline (Fall 2018)Nathan AverieNo ratings yet

- B2+ UNITS 9 and 10 CLILDocument2 pagesB2+ UNITS 9 and 10 CLILana maria csalinasNo ratings yet

- The Financial Detective CaseDocument6 pagesThe Financial Detective Caseashwini patilNo ratings yet

- MATH103 Math For Todays WorldDocument425 pagesMATH103 Math For Todays Worldalfredomedardo100% (2)

- Credit Rating ProjectDocument97 pagesCredit Rating Project1234bindu50% (2)

- Balance Shit!!Document3 pagesBalance Shit!!Irfan izhamNo ratings yet

- FNMNGT 3 Chapter 9 Credit ApplicationDocument18 pagesFNMNGT 3 Chapter 9 Credit ApplicationArlyn BautistaNo ratings yet

- Tail Risk Management: Quantifying and Hedging Extreme Market EventsDocument9 pagesTail Risk Management: Quantifying and Hedging Extreme Market EventsGeouz100% (1)

- Predatory Lending Sylacauga AlabamaDocument5 pagesPredatory Lending Sylacauga AlabamaRevRossReddickNo ratings yet