Professional Documents

Culture Documents

Recent Foreign Taxation Issues and Vodafone Judgement Impact

Uploaded by

Raghu MarwahOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Recent Foreign Taxation Issues and Vodafone Judgement Impact

Uploaded by

Raghu MarwahCopyright:

Available Formats

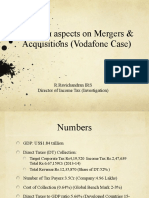

RECENT FOREIGN

TAXATION ISSUES

GGI ASIAN CONFERENCE,

ITPG MEET,

BEIJING, CHINA

OCTOBER 2010

VODAFONE JUDGEMENT

2

The tax department had raised a demand for US$ 2.6

billion as tax on the Vodafone-Hutch deal in 2007

In 2007, Vodafone Group bought the Indian telecom

assets of Hong Kong's Hutchison Telecommunications

International Ltd. It paid US$11 billion for a 67% stake

in Hutchison Essar. Hutchison, the seller, made huge

capital gains.

The Supreme Court on 27th Sept 2010 refused to offer

any immediate relief to Vodafone, which has challenged

the Bombay high court order allowing the government

to tax the company’s deal with Hutch

VODAFONE JUDGEMENT CONTD.

3

The moot issue is whether transfer of effective

control of Indian assets thru transfer of shares

outside India of foreign companies can be taxed in

India.

The issue is all the more complicated due to the web

of holdings and companies involved.

VODAFONE JUDGEMENT CONTD.

4

VODAFONE JUDGEMENT CONTD.

5

The Bombay High Court’s 8 September judgement

upholding the income tax department’s right to tax

the deal has made life difficult for the department by

allowing tax only on the part of the transaction that

has an Indian “nexus”, rather than the entire

transaction value.

The Supreme Court has directed the tax department

to evaluate the quantum of tax as per the Bombay

HC order.

VODAFONE JUDGEMENT CONTD.

6

Vodafone is resisting the demand because if it pays as

per the $2.6-billion demand raised by the IT

department, it won’t get the refund because Hutchison

Telecommunications (the seller) has exited India after

the sale.

The Department is imposing the liability under the

witholding tax provisions on Vodafone.

The Bombay HC judgement has set a precedent that

change of ownership of Indian assets at the hands of

foreign owners, in foreign shores, is liable to tax in

India.

VODAFONE JUDGEMENT CONTD.

7

Other cases directly impacted by the judgement:-

US$ 200 mil in the Mitsui-Vedanta deal to Vedanta for

acquisition of shares of Sesa Goa

US$ 10 mil in Tata-AT&T deal to Tatas for Idea

Cellular

US$ 10 mil in Indian Rayon-AT&T deal to Indian

Rayon for Idea Cellular

US$ 13 mil in SABMiller-Foster deal to SABMiller for

Foster’s India

US$ 145 mil in Sanofi Aventis-Merieux deal to Sanofi

Aventis for Shantha Biotech.

POSITION UNDER THE DTC 2010

8

The current ambiguity will remain until the

proposed new Direct Tax Code (DTC) which provides

for tax on indirect transactions (even overseas)

relating to assets.

The Finance Minister has tabled the Direct Taxes

Code, 2010 (DTC 2010) in the Parliament on 30

August 2010 which is proposed to come into force on

1 April 2012

Some of the new concepts introduced under the DTC

have been briefly discussed.

CFC RULES INTRODUCED IN DTC 2010

9

CFC rules have been incorporated to provide for the taxation of income attributable

to a CFC to be taxed in the hands of the resident as gross residuary income.

A foreign company would be considered as a CFC which

for the purposes of tax is a resident of a country or territory with a lower rate of tax, where the

amount of tax paid in that country or territory in respect of the profits accruing is less than half of the

corresponding tax payable on those profits computed under DTC;

the shares of the company are not traded on any stock exchange recognized by the law of the

territory;

one or more persons individually or collectively exercise control over the company through specified

percentages by way of ownership of shares, or over assets or income of the income, or exercise

dominant influence, or exert a decisive influence in a shareholder meeting;

it is not engaged in any active trade or business and 50 percent or more of its income is of the nature

of dividend, interest, income from house property, capital gains, royalty, annuity, income from sale

or licensing of intangible property, income from sale of goods or supply of services to associated

concerns, income from management, holding or investments in financial assets etc;

the specified income exceeds Rs 2.5 million.

CFC rules would override the provisions of a tax treaty.

BRANCH PROFIT TAX IN DTC 2010

10

It is proposed that every foreign company would be liable

to Branch Profit Tax (BPT) in respect of the profits in a

financial year.

This tax shall be in addition to corporate income-tax

payable.

Branch Profits would refer to income directly or

indirectly attributable to the permanent establishment or

to an immovable property situated in India and included

in the total income of the foreign company, as reduced by

corporate income-tax payable on such income.

BPT would be chargeable at 15 percent.

GAAR IN DTC 2010

11

General Anti Avoidance Rules (GAAR) would be applicable to both domestic

and international arrangements where such arrangement’s (in part or in whole)

main purpose is to a obtain a tax benefit and has been entered or carried on in a

manner not normally employed for bona-fide business purposes or is not at

arm’s length or abuses the provisions of the DTC or lacks commercial substance.

It is additionally proposed that an arrangement would be presumed for

obtaining a tax benefit which would result in reduction in tax bases including

increase in loss.

The tax payer would be required to prove that the obtaining the tax benefit was

not the main purpose of the arrangement.

In accordance with the revised discussion paper on the DTC-it has been

provided that the provisions would apply in accordance with such guidelines as

may be prescribed by the Central Government.-the forum of Dispute Resolution

Panel would be available where GAAR provisions are invoked.

GAAR would override tax treaty provisions

12

THE END

Contact: raghu.m@rnm.in

You might also like

- Investment in India The Vodafone EffectDocument4 pagesInvestment in India The Vodafone Effectaruba ansariNo ratings yet

- Vodafone Taxation Case StudyDocument20 pagesVodafone Taxation Case Studygauravtu06No ratings yet

- Taxguru - In-Vodafone Case AnalysisDocument22 pagesTaxguru - In-Vodafone Case AnalysisGokul RaviNo ratings yet

- The Vodafone - Hutchison Case and Its Implications: Shantanu SurpureDocument10 pagesThe Vodafone - Hutchison Case and Its Implications: Shantanu Surpuredeath_wishNo ratings yet

- Vodafone Tax CaseDocument15 pagesVodafone Tax CaseBharti BansalNo ratings yet

- Vodafone International Holdings B.V. vs. Union of India 1. About Hutchision Essar LimitedDocument6 pagesVodafone International Holdings B.V. vs. Union of India 1. About Hutchision Essar LimitedasdfqwerasdNo ratings yet

- Vodafone tax case verdict impacts foreign investments in IndiaDocument2 pagesVodafone tax case verdict impacts foreign investments in Indiaimahere_suryaNo ratings yet

- Double Taxation Avoidance AgreementDocument20 pagesDouble Taxation Avoidance AgreementSukhdeep RandhawaNo ratings yet

- JP K Tax Newsletter India Budget Pan en 210709Document2 pagesJP K Tax Newsletter India Budget Pan en 210709networkedNo ratings yet

- International TaxationDocument23 pagesInternational Taxationmuskansethi2001No ratings yet

- Analysis of Vodafone Tax CaseDocument9 pagesAnalysis of Vodafone Tax Caserjt163100% (1)

- Controlled Foreign Companies: International TaxationDocument4 pagesControlled Foreign Companies: International TaxationEshaan ShindeNo ratings yet

- 04 - Vodafone Case AnalysisDocument17 pages04 - Vodafone Case AnalysisSakthi NathanNo ratings yet

- Corporate Tax PlanningDocument5 pagesCorporate Tax PlanningAravind Swamy NathanNo ratings yet

- Compendium PetitionerDocument5 pagesCompendium PetitionerShreeji PatelNo ratings yet

- Foreign Investment Inflows (Amount in Billion US $) : Source: Reserve Bank of India Data WarehouseDocument10 pagesForeign Investment Inflows (Amount in Billion US $) : Source: Reserve Bank of India Data WarehouseYatish JainNo ratings yet

- Vodafone Tax Saga: Group 4Document17 pagesVodafone Tax Saga: Group 4Saharsh SaraogiNo ratings yet

- Vodafone Casse SummaryDocument4 pagesVodafone Casse SummaryAman D SharanNo ratings yet

- International Taxation in India - Recent Developments & Outlook (Part - Ii)Document6 pagesInternational Taxation in India - Recent Developments & Outlook (Part - Ii)ManishJainNo ratings yet

- VODAFONE TAX CASE RULING ENABLES IPO & M&A PLANSDocument1 pageVODAFONE TAX CASE RULING ENABLES IPO & M&A PLANSbhatnagarriteshNo ratings yet

- DTC ProvisionsDocument3 pagesDTC ProvisionsrajdeeppawarNo ratings yet

- International Tax Alert: Vodafone RulingDocument6 pagesInternational Tax Alert: Vodafone RulingSanghita ChakrabortyNo ratings yet

- Taxability of offshore share transactionsDocument5 pagesTaxability of offshore share transactionsNishit SaraiyaNo ratings yet

- Vodafone Tax Case AnalysisDocument10 pagesVodafone Tax Case AnalysisShishir SinghNo ratings yet

- Involved Stakeholders (Parties)Document3 pagesInvolved Stakeholders (Parties)shrutNo ratings yet

- Direct Tax Code: Term ProjectDocument22 pagesDirect Tax Code: Term Projectvikaschugh01No ratings yet

- Tax Implications On Cross Border Mergers and Acquisitions-Indian PerspectiveDocument5 pagesTax Implications On Cross Border Mergers and Acquisitions-Indian Perspectivesiddharth pandeyNo ratings yet

- Tax Rates for CorporationsDocument14 pagesTax Rates for CorporationsMendoza Khlareese AndreaNo ratings yet

- Tax Law Assignment, Brahm Sareen - 01716503820Document8 pagesTax Law Assignment, Brahm Sareen - 01716503820Brahm SareenNo ratings yet

- CREATE Act summary: Key tax reforms and incentivesDocument10 pagesCREATE Act summary: Key tax reforms and incentivesTreb LemNo ratings yet

- Retrospective Tax Case Against VodafoneDocument8 pagesRetrospective Tax Case Against Vodafoneshantanu_malviya_1No ratings yet

- Vodafone Tax Case: Arindam Daschowdhury (PGDM 100109) Deepak B.S. (PGDM 100110)Document16 pagesVodafone Tax Case: Arindam Daschowdhury (PGDM 100109) Deepak B.S. (PGDM 100110)vishala4No ratings yet

- KPMG FLASH NEWS - Vodafone Supreme Court Decision SummaryDocument6 pagesKPMG FLASH NEWS - Vodafone Supreme Court Decision SummaryManisha SinghNo ratings yet

- Once The Direct Taxes CodeDocument6 pagesOnce The Direct Taxes Codevipzjain007No ratings yet

- Ashish Kumar AFB 2011-13003Document26 pagesAshish Kumar AFB 2011-13003Kumar BishalNo ratings yet

- Tax Treaty Arbitration: IndonesiaDocument12 pagesTax Treaty Arbitration: IndonesiaGanda Christian TobingNo ratings yet

- Vodafone Case Analysis: Internal Assignment-2Document7 pagesVodafone Case Analysis: Internal Assignment-2KK SinghNo ratings yet

- CREATE Bill Lowers CIT and Provides Tax IncentivesDocument31 pagesCREATE Bill Lowers CIT and Provides Tax IncentivesJanet PaglingayenNo ratings yet

- Double Tax Avoidance AgreementDocument20 pagesDouble Tax Avoidance AgreementSuchismita PatiNo ratings yet

- BIR Ruling 101-18 wPEDocument8 pagesBIR Ruling 101-18 wPEKathyrn Ang-ZarateNo ratings yet

- Directly or IndirectlyDocument5 pagesDirectly or IndirectlyBavithra SeljaNo ratings yet

- Tax Alert No. 91 (Senate Bill (SB) No. 1357 or The Corporate Recovery and Tax Incentives For Enterprises Act (CREATE) )Document9 pagesTax Alert No. 91 (Senate Bill (SB) No. 1357 or The Corporate Recovery and Tax Incentives For Enterprises Act (CREATE) )Karina PulidoNo ratings yet

- Overview of Indian Tax Laws: Company Law and Modes of FinanceDocument20 pagesOverview of Indian Tax Laws: Company Law and Modes of FinanceSelva KumarNo ratings yet

- 2015 ITAD - BIR - Ruling - No. - 335 1520210622 12 19ad6s6Document4 pages2015 ITAD - BIR - Ruling - No. - 335 1520210622 12 19ad6s6rian.lee.b.tiangcoNo ratings yet

- Ass TaxationDocument4 pagesAss TaxationVin M.No ratings yet

- Law Budget Highlights: Tax Changes & ImpactsDocument45 pagesLaw Budget Highlights: Tax Changes & ImpactsAhmed RazaNo ratings yet

- Slaughter and May: Vodafone's Supreme Court Victory in IndiaDocument3 pagesSlaughter and May: Vodafone's Supreme Court Victory in IndiaKundan PrasadNo ratings yet

- Material Moot Income TaxDocument9 pagesMaterial Moot Income TaxSatya Vrat PandeyNo ratings yet

- Cbtax01 Chapter4Document11 pagesCbtax01 Chapter4Christelle JosonNo ratings yet

- Taxation aspects of the Vodafone Case/TITLEDocument110 pagesTaxation aspects of the Vodafone Case/TITLEravichandranNo ratings yet

- Vodafone-Hutch Tax Case AnalysisDocument51 pagesVodafone-Hutch Tax Case AnalysisNiroopa RaniNo ratings yet

- Hong Kong Profits Tax 1: Answer 1 (A)Document18 pagesHong Kong Profits Tax 1: Answer 1 (A)CYNo ratings yet

- EY Tax Alert Vodafone Case StudyDocument9 pagesEY Tax Alert Vodafone Case Studyrbharat87No ratings yet

- Tds GuidelineDocument23 pagesTds GuidelineYash BhayaniNo ratings yet

- Corporate Tax PlanningDocument8 pagesCorporate Tax PlanningTumie Lets0% (1)

- Tax Bulletin Dec 2008-Jan 2009 Highlights India Intl Taxation Rulings on Capital GainsDocument4 pagesTax Bulletin Dec 2008-Jan 2009 Highlights India Intl Taxation Rulings on Capital GainsdecheNo ratings yet

- Article - Shefali Goradia - Jul 121341305754Document9 pagesArticle - Shefali Goradia - Jul 121341305754Alok Kumar ShuklaNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- BACC 2 INCOME TAXATION CHAPTER 2Document1 pageBACC 2 INCOME TAXATION CHAPTER 2Jaeun SooNo ratings yet

- USOnline PayslipDocument2 pagesUSOnline PayslipTami SariNo ratings yet

- The Negative Impact of GST On Indian EconomyDocument9 pagesThe Negative Impact of GST On Indian EconomyRaveena JangidNo ratings yet

- The Following Is A List of Possible Transactions 1 Purchased Inventory PDFDocument2 pagesThe Following Is A List of Possible Transactions 1 Purchased Inventory PDFTaimur TechnologistNo ratings yet

- Tax Rebate Calculator of Salaried Class Indviduals 2013-14Document4 pagesTax Rebate Calculator of Salaried Class Indviduals 2013-14waheedNo ratings yet

- Calculating current and deferred taxDocument5 pagesCalculating current and deferred taxKaiWenNgNo ratings yet

- CS Income Tax Test SolutionsDocument13 pagesCS Income Tax Test Solutionsarohi guptaNo ratings yet

- Topic 9 PartnershipDocument24 pagesTopic 9 PartnershipWong Yong Sheng WongNo ratings yet

- NPV - HelicopterDocument3 pagesNPV - HelicopterAarti J. Kaushal100% (1)

- Memorandum of Agreement for Browtoeful Waxing Nails and Lashes StudioDocument2 pagesMemorandum of Agreement for Browtoeful Waxing Nails and Lashes StudioYikNo ratings yet

- CS5 SopolDocument2 pagesCS5 SopolBM10622P Nur Alyaa Nadhirah Bt Mohd RosliNo ratings yet

- Nursery Care Corp. vs. AcevedoDocument1 pageNursery Care Corp. vs. AcevedoLouana AbadaNo ratings yet

- True ValueDocument1 pageTrue ValueTonya SmithNo ratings yet

- Income Tax Ordinance.Document14 pagesIncome Tax Ordinance.Zaeem FarooquiNo ratings yet

- Prosiding Simposium Nasional Perpajakan 4 Corporate Governance, Konservatisme Akuntansi Dan Tax AvoidanceDocument15 pagesProsiding Simposium Nasional Perpajakan 4 Corporate Governance, Konservatisme Akuntansi Dan Tax AvoidanceFebianti PhangNo ratings yet

- OutlineDocument71 pagesOutlineMaxwell NdunguNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument2 pagesCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasWeng Tuiza EstebanNo ratings yet

- Local Media603729699590229664Document3 pagesLocal Media603729699590229664Mallari, Princess Diane D.No ratings yet

- 400 449 PDFDocument47 pages400 449 PDFSamuel50% (2)

- Supreme Court rules against De La Salle University's tax exemption claimDocument1 pageSupreme Court rules against De La Salle University's tax exemption claimKim CajucomNo ratings yet

- New Form 2550 M Monthly VAT Return P 1 2 1Document3 pagesNew Form 2550 M Monthly VAT Return P 1 2 1The ApprenticeNo ratings yet

- Salary Slip PDFDocument1 pageSalary Slip PDFQamar BahadarNo ratings yet

- Do 4Document1 pageDo 4Niyati MakwanaNo ratings yet

- ACCO 20133 - UNIT IX - UpdatedDocument29 pagesACCO 20133 - UNIT IX - UpdatedHarvey AguilarNo ratings yet

- CIR vs British Overseas Airways CorpDocument2 pagesCIR vs British Overseas Airways CorpCP LugoNo ratings yet

- Reimbursement Expense Receipt (RER)Document6 pagesReimbursement Expense Receipt (RER)Alex BuracNo ratings yet

- Detail Unit Price Analysis 1Document4 pagesDetail Unit Price Analysis 1Miks BideoNo ratings yet

- Capital Gains Tax - Wikipedia, The Free EncyclopediaDocument18 pagesCapital Gains Tax - Wikipedia, The Free Encyclopediatsar_philip2010No ratings yet

- Mogli Labs (India) PVT LTD: (Issued Under Section 31 of GST Act, 2017)Document3 pagesMogli Labs (India) PVT LTD: (Issued Under Section 31 of GST Act, 2017)Sahili SalveNo ratings yet

- Appendix 33 - PayrollDocument1 pageAppendix 33 - PayrollAngeli Lou Joven Villanueva100% (1)