Professional Documents

Culture Documents

FM

Uploaded by

ashraf0 ratings0% found this document useful (0 votes)

12 views9 pagesFinancial Management

Original Title

FM PPT

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFinancial Management

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views9 pagesFM

Uploaded by

ashrafFinancial Management

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 9

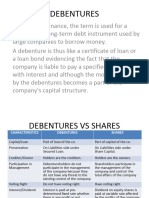

DEBENTURE

MEANING

debenture is a medium to long-term

debt Instrument used by large companies

to borrow money, at a fixed rate of interest.

A debentures is a long-term debt instrument or

security.

It is also known as BOND.

Bond issued by government do not have any

risk of default.

A company in India can issue secured or

unsecured debentures.

In case of debentures, the rate of debentures

are fixed and known to investors

FEATURES OF DEBENTURES

Maturity period: Debentures consist of long-term fixed maturity

period. Normally, debentures consist of 10–20 years maturity

period and are repayable with the principle investment at the end

of the maturity period.

Residual claims in income: Debenture holders are eligible to get

fixed rate of interest at every end of the accounting period.

Debenture holders have priority of claim in income of the company

over equity and preference shareholders.

Residual claims on asset: Debenture holders have priority of claims

on Assets of the company over equity and preference shareholders.

The Debenture holders may have either specific change on the

Assets or floating change of the assets of the company. Specific

change of Debenture holders are treated as secured creditors and

floating change of Debenture holders are treated as unsecured

creditors.

No voting rights: Debenture holders are

considered as creditors of the company. Hence

they have no voting rights. Debenture holders

cannot have the control over the performance

of the business concern.

Fixed rate of interest: Debentures yield fixed

rate of interest till the maturity period. Hence

the business will not affect the yield of the

debenture

TYPES OF DEBENTURES

Non Convertible Debentures (NCD):

These instruments retain the debt character and

can not be converted into equity shares.

Partly Convertible Debentures (PCD):

A part of these instruments are converted into

Equity shares in the future at notice of the issuer. The

issuer decides the ratio for conversion. This is

normally decided at the time of subscription.

Fully convertible Debentures (FCD):

These are fully convertible into Equity shares at

the issuer's notice. The ratio of conversion is decided

by the issuer. Upon conversion the investors enjoy the

same status as ordinary shareholders of the company.

Optionally Convertible Debentures (OCD):

The investor has the option to either

convert these debentures into shares at price decided by

the issuer/agreed upon at the time of issue.

On the basis of security

Secured Debentures: These instruments are secured by a

charge on the fixed assets of the issuer company. So if the

issuer fails on payment of either the principal or interest

amount, his assets can be sold to repay the liability to the

investors.

Unsecured Debentures: These instrument are unsecured

in the sense that if the issuer defaults on payment of the

interest or principal amount, the investor has to be along

with other unsecured creditors of the company.

On The Basis Of Redemption

Redeemable debentures: These debentures

are to be redeemed on the expiry of a certain

period. The interest is paid periodically and

the initial investment is returned after the

fixed maturity period.

Irredeemable debentures: These kind of

debentures cannot be redeemable during the

life time of the business concern..

You might also like

- A Project Report On DebenturesDocument16 pagesA Project Report On DebenturesVivek RoyNo ratings yet

- Fixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2From EverandFixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2No ratings yet

- Assignment of Corporate LawDocument4 pagesAssignment of Corporate LawawaisdotcomNo ratings yet

- Debt Instruments - FAQ: Personal FinanceDocument9 pagesDebt Instruments - FAQ: Personal FinanceSandeep AgrawalNo ratings yet

- Debt InstrumentsDocument8 pagesDebt InstrumentsparulshinyNo ratings yet

- Business Finance Project - DebenturesDocument16 pagesBusiness Finance Project - DebenturesMuhammad TalhaNo ratings yet

- New Financial InstrumentsDocument9 pagesNew Financial Instrumentsmanisha guptaNo ratings yet

- Long Term Finance SourcesDocument54 pagesLong Term Finance Sourcesyaatin dawarNo ratings yet

- What Are The Different Types of DebenturesDocument2 pagesWhat Are The Different Types of DebenturesUsman NadeemNo ratings yet

- DEBENTURES and WarrantsDocument7 pagesDEBENTURES and Warrantspurehearts100% (1)

- What is an FCD? Guide to Fully Convertible DebenturesDocument3 pagesWhat is an FCD? Guide to Fully Convertible DebenturesNiño Rey LopezNo ratings yet

- CBSE Quick Revision Notes and Chapter Summary: Book Recommended: WarningDocument8 pagesCBSE Quick Revision Notes and Chapter Summary: Book Recommended: WarningiisjafferNo ratings yet

- Types of DebenturesDocument3 pagesTypes of DebenturesTerfa JesseNo ratings yet

- BBA VI TH Sem Financial Institution & MarketsDocument2 pagesBBA VI TH Sem Financial Institution & MarketsJordan ThapaNo ratings yet

- Types of DebenturesDocument3 pagesTypes of DebenturesMadhumitaSinghNo ratings yet

- IM Module 3Document7 pagesIM Module 3Ravikumar KanniNo ratings yet

- Kinds of Debentures (A) Bearer DebenturesDocument4 pagesKinds of Debentures (A) Bearer Debenturesdeepakarora201188No ratings yet

- DebenturesDocument16 pagesDebenturesJenice Victoria CrastoNo ratings yet

- Debentures ProjectDocument28 pagesDebentures ProjectMT RA100% (1)

- DebentureDocument9 pagesDebenturedrsurendrakumarNo ratings yet

- Types of DebenturesDocument3 pagesTypes of DebenturesNidheesh TpNo ratings yet

- Meaning and DefinitionDocument8 pagesMeaning and DefinitionSuit ChetriNo ratings yet

- Dit School of Business Presentation ON Debentures: Presented By:-Saju Thomas Abhishek Singh Sunil SharmaDocument13 pagesDit School of Business Presentation ON Debentures: Presented By:-Saju Thomas Abhishek Singh Sunil Sharmasajuthomas1987No ratings yet

- Definition DebenturesDocument8 pagesDefinition DebenturesDipanjan DasNo ratings yet

- DebentureDocument34 pagesDebentureSOHEL BANGINo ratings yet

- DebenturesDocument7 pagesDebenturesHina KausarNo ratings yet

- Deb An TuresDocument10 pagesDeb An TuresWeNo ratings yet

- Specimen Presentation of Debentures Certificate For Different Kinds of DebenturesDocument3 pagesSpecimen Presentation of Debentures Certificate For Different Kinds of Debenturessunil61% (18)

- FIXED DEPOSIT Vs DEBT FUNDSDocument15 pagesFIXED DEPOSIT Vs DEBT FUNDSsam111987No ratings yet

- Types of Bonds ExplainedDocument26 pagesTypes of Bonds ExplainedAlit AbrahamNo ratings yet

- Understanding Bonds and DebenturesDocument16 pagesUnderstanding Bonds and Debenturesbishal bothraNo ratings yet

- Finance Mgmt. Final PresentationDocument31 pagesFinance Mgmt. Final PresentationDevesh KhattarNo ratings yet

- Portfolio Management Module 4Document7 pagesPortfolio Management Module 4Ayush kashyapNo ratings yet

- Various Types of Corporate BondsDocument7 pagesVarious Types of Corporate BondsAbdul LatifNo ratings yet

- Types of BondsDocument17 pagesTypes of BondsChowdary PurandharNo ratings yet

- DebentureDocument3 pagesDebentureVaibhav SharmaNo ratings yet

- Basics of Bond With Types & FeaturesDocument10 pagesBasics of Bond With Types & FeaturesradhikaNo ratings yet

- What is Equity ShareDocument4 pagesWhat is Equity ShareDea khushi SharmaNo ratings yet

- Investment AvenuesDocument44 pagesInvestment Avenueshimanshi sharmaNo ratings yet

- debenture_vs_shares-2Document19 pagesdebenture_vs_shares-2nemewep527No ratings yet

- Investment Alternative: By: Samriti JainDocument24 pagesInvestment Alternative: By: Samriti Jainthensuresh1No ratings yet

- 1.2 and Short TermDocument18 pages1.2 and Short TermDeeNo ratings yet

- Leac202 DebenturesDocument75 pagesLeac202 DebenturesMidhunidharNo ratings yet

- Financial Management of Preference Shares and DebenturesDocument25 pagesFinancial Management of Preference Shares and DebenturesAbhinita PoojaryNo ratings yet

- Long-Term FinancingDocument15 pagesLong-Term FinancingMir MusadiqNo ratings yet

- Issue and Redemption of DebenturesDocument78 pagesIssue and Redemption of DebenturesApollo Institute of Hospital Administration50% (2)

- E BusinessfinanceDocument15 pagesE BusinessfinanceDipannita RoyNo ratings yet

- Fixed Income Securities - Understanding Bonds & Their TypesDocument24 pagesFixed Income Securities - Understanding Bonds & Their TypesSHRIRAJ LIGADENo ratings yet

- Debentures - ProjectDocument30 pagesDebentures - ProjectCsAnkita Agarwal50% (16)

- 10 - Overview of Financing ChoicesDocument11 pages10 - Overview of Financing ChoicesAmarnath JvNo ratings yet

- Types of Business Ownership & Capital Financing MethodsDocument15 pagesTypes of Business Ownership & Capital Financing MethodsshaitoNo ratings yet

- Company LawDocument19 pagesCompany LawAakankshaNo ratings yet

- Unsecured Bond: Why Issue Unsecured Bonds?Document2 pagesUnsecured Bond: Why Issue Unsecured Bonds?aeman hassan100% (1)

- Sabbir Hossain 111 161 350Document37 pagesSabbir Hossain 111 161 350Sabbir HossainNo ratings yet

- Fin Eco 9 PDFDocument8 pagesFin Eco 9 PDFRajesh GargNo ratings yet

- INVESTMENT MANAGEMENT CHAPTER 1Document44 pagesINVESTMENT MANAGEMENT CHAPTER 1Divya SindheyNo ratings yet

- Types of SharesDocument4 pagesTypes of SharesMARNo ratings yet

- Understanding Debentures: Key TakeawaysDocument8 pagesUnderstanding Debentures: Key TakeawaysRichard DuniganNo ratings yet

- Unit7 BondsDocument21 pagesUnit7 BondsVinay Gowda D MNo ratings yet

- DVM Enterprises Financial Statements AnalysisDocument6 pagesDVM Enterprises Financial Statements AnalysisNicole AlexandraNo ratings yet

- T4Q - TaxationDocument4 pagesT4Q - Taxation吕仙姿No ratings yet

- Balance Sheet 20 21Document2 pagesBalance Sheet 20 21Mishra SanjayNo ratings yet

- Philippine School of Business Administration - PSBA ManilaDocument12 pagesPhilippine School of Business Administration - PSBA ManilaephraimNo ratings yet

- E5-11 (Statement of Financial Position Preparation) Presented Below Is TheDocument7 pagesE5-11 (Statement of Financial Position Preparation) Presented Below Is Thedebora yosika100% (1)

- BALAMURUGAN D - CibilDocument3 pagesBALAMURUGAN D - CibilVijay UNo ratings yet

- CLD - Bao3404 Tutorial GuideDocument7 pagesCLD - Bao3404 Tutorial GuideShi MingNo ratings yet

- 1ETHEA2020003Document38 pages1ETHEA2020003Edlamu AlemieNo ratings yet

- Problems-Chapter 3Document4 pagesProblems-Chapter 3An VyNo ratings yet

- 2 - BuscomDocument9 pages2 - BuscomDeryl GalveNo ratings yet

- Hsslive-XII-english NotesDocument3 pagesHsslive-XII-english NotesAreej HassanNo ratings yet

- The Foreign Exchange Market and International Parity ConditionsDocument19 pagesThe Foreign Exchange Market and International Parity ConditionsMarcia PattersonNo ratings yet

- Macro Cheat SheetDocument3 pagesMacro Cheat SheetMei SongNo ratings yet

- Vouched For Top Adviser 2020Document20 pagesVouched For Top Adviser 2020DhawalChandanNo ratings yet

- Chapter 29 The Monetary SystemDocument4 pagesChapter 29 The Monetary SystemThan NguyenNo ratings yet

- CEEMAForum 2013Document3 pagesCEEMAForum 2013Marius RusNo ratings yet

- Chapter 06: Dividend Decision: ................ Md. Jobayair Ibna Rafiq.............Document62 pagesChapter 06: Dividend Decision: ................ Md. Jobayair Ibna Rafiq.............Mohammad Salim Hossain0% (1)

- Tutorial 3 - Topic 3: Accounting For Partnership - Part 2 Question 1 - Argy and BargyDocument6 pagesTutorial 3 - Topic 3: Accounting For Partnership - Part 2 Question 1 - Argy and BargyWen Xin GanNo ratings yet

- Test Series: April, 2021 Mock Test Paper 2 Intermediate (New) : Group - I Paper - 1: AccountingDocument7 pagesTest Series: April, 2021 Mock Test Paper 2 Intermediate (New) : Group - I Paper - 1: AccountingHarsh KumarNo ratings yet

- Marketing Management - Individual Assigment 2Document5 pagesMarketing Management - Individual Assigment 2francis MallyaNo ratings yet

- Nanyang Business School AB1201 Financial Management Tutorial 9: Cash Flow Estimation (Common Questions)Document8 pagesNanyang Business School AB1201 Financial Management Tutorial 9: Cash Flow Estimation (Common Questions)asdsadsaNo ratings yet

- Accounting For Non-Profit Making Org-1Document14 pagesAccounting For Non-Profit Making Org-1Amelia Bailey100% (1)

- CAPM MentoringDocument8 pagesCAPM MentoringKashish AroraNo ratings yet

- Philippines vs. Philippine National Bank on unclaimed balances subject to escheatDocument2 pagesPhilippines vs. Philippine National Bank on unclaimed balances subject to escheatCha BL100% (2)

- Wholesale Banking Operation HDFCDocument43 pagesWholesale Banking Operation HDFCVishal Sonawane50% (2)

- Chapter 2 - Mechanics of Futures MarketsDocument29 pagesChapter 2 - Mechanics of Futures Marketsabaig2011No ratings yet

- Section B - Group 2 - DHFL Governance Failure - Final ReportDocument14 pagesSection B - Group 2 - DHFL Governance Failure - Final Reportpgdm22srijanbNo ratings yet

- Financial Management On Catfish Farms (PDFDrive)Document61 pagesFinancial Management On Catfish Farms (PDFDrive)AmiibahNo ratings yet

- Soal Mankeu1-5Document8 pagesSoal Mankeu1-5iwak_pheNo ratings yet

- Lease Accounting - Lessee CompDocument5 pagesLease Accounting - Lessee CompAngel DomingoNo ratings yet