Professional Documents

Culture Documents

Estimation of Cash Flows and Terminal Value

Uploaded by

akash yadav0 ratings0% found this document useful (0 votes)

15 views4 pagesOriginal Title

Estimation of Cash Flows and Terminal Value.pptx

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views4 pagesEstimation of Cash Flows and Terminal Value

Uploaded by

akash yadavCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 4

Estimation of Cash Flows

Principles should be applied during Estimation of Cash Flows

• Cash Flows should be measured on an Incremental Basis.

• Cash Flows should be measured on an after-tax basis.

• All the indirect effects of a project should be included in the Cash Flow

calculations.

• Sunk costs should not be considered when evaluating a project.

• The value of resources used in a project should be measured in terms of

their opportunity costs.

Determination of Cash Inflows: Single Investment Proposal (t = I - n)

Particulars Years

1 2 3 4

… n

Cash Sales Revenues

Less: Cash Opening Cost

Cash Inflows Before Taxes (CFBT)

Less: Depreciation

Taxable Income

Less: Tax

Earning After Tax

Plus: Depreciation

Cash Inflows after tax (CFAT)

Plus: Salvage Value (in nth year)

Plus: Recovery of Working Capital (in nth year)

Cash Outflows of New Project [Beginning of the Period at

Zero Time(t=0)]

1. Cost of New Project

2. + Installation cost of plant and equipments

3. + Working Capital Requirements

Terminal Value

Terminal value (TV) is the value of a business or project beyond the forecast period

when future cash flows can be estimated. Terminal value assumes a business will

grow at a set growth rate forever after the forecast period. Terminal value often

comprises a large percentage of the total assessed value.

• Terminal value (TV) determines a company's value into perpetuity beyond a set forecast

period—usually five years.

• Analysts use the discounted cash flow model (DCF) to calculate the total value of a

business. DCF has two major components—the forecast period and terminal value.

• There are two commonly used methods to calculate terminal value—perpetual growth

(Gordon Growth Model) and exit multiple.

• The perpetual growth method assumes that a business will continue to generate cash

flows at a constant rate forever, while the exit multiple method assumes that a business

will be sold for a multiple of some market metric.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Financial Management-Capital BudgetingDocument24 pagesFinancial Management-Capital Budgetingakash yadavNo ratings yet

- E-Commmerce NotesDocument29 pagesE-Commmerce Notesakash yadavNo ratings yet

- Human Resource ManagementDocument15 pagesHuman Resource Managementakash yadav50% (6)

- HRM 2017-8 Notes (IV-sem Bms Sscbs Du)Document38 pagesHRM 2017-8 Notes (IV-sem Bms Sscbs Du)Rishabh GuptaNo ratings yet

- Business Research 2017-18 NOTES (IV-SEM-BMS-SSCBS-DU)Document28 pagesBusiness Research 2017-18 NOTES (IV-SEM-BMS-SSCBS-DU)akash yadav100% (2)

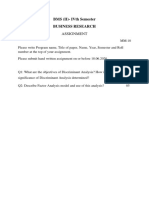

- BR Assignment PDFDocument1 pageBR Assignment PDFakash yadavNo ratings yet

- Estimation of Cash Flows and Terminal ValueDocument4 pagesEstimation of Cash Flows and Terminal Valueakash yadavNo ratings yet

- Business Accounting Assignment: Submitted By: Akash Yadav Course: Bms 1 Year ROLL No.: 6538Document9 pagesBusiness Accounting Assignment: Submitted By: Akash Yadav Course: Bms 1 Year ROLL No.: 6538akash yadavNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)