0% found this document useful (0 votes)

72 views11 pagesIntroduction to Securitization Concepts

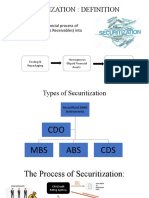

This document provides an introduction to securitization. It discusses how securitization works by packaging financial promises into a form that can be transferred among investors. This is done through a process called structuring that segments cash flows and risks. The document includes tables and figures showing the growth of various securitized asset classes from 1995 to 2001 and the key concepts, players, and investment characteristics involved in securitization.

Uploaded by

ranjan.riku19846548Copyright

© Attribution Non-Commercial (BY-NC)

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPT, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

72 views11 pagesIntroduction to Securitization Concepts

This document provides an introduction to securitization. It discusses how securitization works by packaging financial promises into a form that can be transferred among investors. This is done through a process called structuring that segments cash flows and risks. The document includes tables and figures showing the growth of various securitized asset classes from 1995 to 2001 and the key concepts, players, and investment characteristics involved in securitization.

Uploaded by

ranjan.riku19846548Copyright

© Attribution Non-Commercial (BY-NC)

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPT, PDF, TXT or read online on Scribd