0% found this document useful (0 votes)

246 views14 pagesCustoms Procedures for Importing Goods

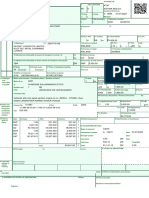

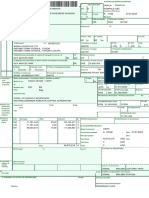

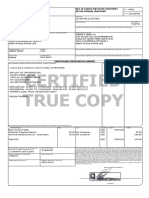

Customs is responsible for collecting tariffs and controlling the flow of goods across borders. Goods can be imported or exported via sea, air, or land, and must pass customs procedures. These include submitting a bill of entry detailing the goods, providing required documentation like invoices and licenses, assessing and paying any applicable customs duties, and examining the goods. Prior entry allows filing customs documents before arrival to expedite clearance. Goods may also be cleared for warehousing until duties are paid.

Uploaded by

Hamza MasalawalaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

246 views14 pagesCustoms Procedures for Importing Goods

Customs is responsible for collecting tariffs and controlling the flow of goods across borders. Goods can be imported or exported via sea, air, or land, and must pass customs procedures. These include submitting a bill of entry detailing the goods, providing required documentation like invoices and licenses, assessing and paying any applicable customs duties, and examining the goods. Prior entry allows filing customs documents before arrival to expedite clearance. Goods may also be cleared for warehousing until duties are paid.

Uploaded by

Hamza MasalawalaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd