Professional Documents

Culture Documents

Customer Onboarding

Customer Onboarding

Uploaded by

Amba TiwariOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Customer Onboarding

Customer Onboarding

Uploaded by

Amba TiwariCopyright:

Available Formats

CUSTOMER ONBOARDING

Copyright © 2017 HCL Technologies Limited | www.hcltech.com

BANKING

Definition:-

Banking has been defined as “Accepting for the purpose of lending & investment, of deposit of money from the

public, repayable on demand order or otherwise and withdraw able by cheque, draft or otherwise.”

Meaning:-

Banking means transacting business with a bank; depositing or withdrawing funds or requesting a loan etc.

2 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

PRIMARY FUNCTIONS

The main functions of banks are accepting deposit and lending loans:

A – accepting deposits

1. Fixed deposits:- These deposits mature after a considerable long period like 1 year or more than that the

rate of interest is fixed the amount deposited cannot be withdrawn before maturity date.

2. Current A/C deposit:- These are mainly maintain by business community to facilitate frequent transaction

with big amounts. Generally no rate of interest or very low rate of interest is paid on this account.

3. Savings bank A/C:- It is kind of demand deposits which is generally kept by the people for the sake of

safety. These facility is given for small saver and normally a small rate of interest is paid.

4. Recurring deposit A/C:- In case of recurring deposit the fixed amount is deposited in a bank every month

for a fixed period of time.

3 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

CONT…

B-Lending loans

1. Call loans:- These loan are called back at any time. Normally, this loans are taken by bill brokers or stock

brokers.

2. Short term loans:- These are sanctioned for a period up to 1 year.

3.Medium term loans:- These are sanctioned for the period varying between 1 and 5 years.

4.Long Term loans:- These loan are sanctioned for a period of more than 5 years

4 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

SECONDARY FUNCTIONS

Apart from the main functions, the banks also provide financial services to the corporate sector and business

and society. They are as follows:

1.Merchant Banking:- Merchant banking is an organization which underwrites securities for companies, advises

in various activities. No person is allowed to carry out any activity as a Merchant Banker unless holds a

certificate granted by SEBI. Thus, merchant banks are financial institutions which provide specialized services

including acceptance of bills of exchange, corporate finance, portfolio management and other services.

2. Leasing:- Banks have started funding the fixed assets through leasing. It refers to the renting out of immovable

property by the bank to the businessmen on a specified rent for a specific period on terms which may be

mutually agreed upon. A written agreement is made in this respect.

3.Mutual funds:- The main function of mutual fund is to mobilize the savings of the general public and invest

them in stock market and money market.

4. Venture Capital (VC):-Venture Capital is financial capital provided to early-stage, high-potential, high risk,

growth startup companies. The venture capital fund makes money by owning equity in the companies it invests

in, which usually have a novel technology or business model in high technology industries, such as

biotechnology, IT, software, etc.

5 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

CONT…

5. ATM:- An ATM is also known as cash point. The banks nowadays provide ATM facilities. The customers can

withdraw money easily and quickly 24 hours a day.

6. Telebanking:- Telebanking is a throwback to the days when people would call into a central number at their

bank/financial institution in order to get balance, check status and other account-related information. Most

financial organizations offer telebanking services today; however, the public representation is known as

telephone-based customer service or just customer service.

7. Credit cards:- Credit cards allow a person to buy goods and services up to a certain limit without immediate

payment. The amount is paid to the shops, hotel, etc. by the commercial banks.

8. Locker Service:- Under this service, lockers are provided to the public in various sizes on payment of fixed

rent. Customers can deposit their valuables, documents, jewellery, securities, etc. in these lockers.

6 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

TYPES OF BANKS

7 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

WHO IS CUSTOMER OF BANK?

A customer is someone who has an account with a bank or who is in such a relationship with the bank that the

relationship of a banker and customer exists… The legal position implies that opening an account is the crucial

element in establishing the banker-customer relationship.

8 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

TYPES OF CUSTOMERS

Depositors

Borrowers

Third Party Provider

NRIs

Walkin

9 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

BANK – CUSTOMER RELATIONSHIP

Banking relationship is a contract between the bank and he customer.

The relationship between a banker and a customer depends on the type of transaction; products or services

offered by bank to its customers.

10 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

SATISFACTION WITH PAPER ONBOARDING

Small corporations are less satisfied with the time it takes to implement a new service

The more complex the service, the less satisfied corporations are with the process

Corporations feel there’s room for improvement in their bank’s Paper Onboarding process.

If the implementation process is shortened, almost 70% of banks believe it would free up their sales force to

generate more sales.

Corporations are experiencing pain in every area listed below more than ½ the time:

Lack of clear view into implementation status

Poor communication with bank

Too many paper forms

Implementation process too lengthy

Redundant information requested by bank

11 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

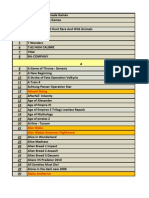

BANKS NEED HELP MANAGING/GATHERING DOCUMENTS

“Outdated home-grown platform used today. No workflow capabilities, no doc

image retention, virtually zero status reports.”

Q: Describe your greatest implementation pain points.

0% 5% 10% 15% 20% 25%

Missing documentation/gathering effo... 22%

Coordination with custo... 16%

Manual contr... 15%

Tracking sta... 12%

Test documents or fi... 11%

Cycle time/time to rev... 8%

Lack of solu... 7%

Lack of business knowledge (IT&... 3%

Training custo... 2%

P 2%

Lack of self serv... 2%

12 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

KEY TAKEAWAYS – BANK SURVEY

The greatest pain point that banks experience regardless of size is the use of paper in

the implementation process.

Banks see an opportunity to accelerate revenue through shortening the

implementation cycle.

90% of banks surveyed believe they can accelerate revenue by shortening their implementation cycle time

Banks see an opportunity to free up sales resources by improving the implementation

process.

70% of banks surveyed believe improving the process will free up their sales force to generate more sales

Internal communication is seen as a major detriment to bank implementation

processes.

Small banks in particular cited more pain with implementation processes.

13 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

WHAT SHOULD PAPERLESS LOOK LIKE?

A The Sales Meeting: Improve Onboarding for new & existing clients.

B + C Multi-task on Autopilot: Solution workflow eliminates redundancy.

D Dashboard Deliverables: Simple, clear progression updates.

E Consider Compliance Covered: Streamline the auditing process.

F On-Demand Analytics: Improves communication between you & your clients.

G Give Satisfaction, Gain Opportunity: Satisfied clients spur new potentials.

14 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

THE SALES MEETING: NEW CLIENT, AUTOMATED ONBOARDING

Collect data from new clients

anytime, anywhere, with iPads

& other mobile devices

Generate agreements

automatically

Standard agreement

templates can be generated

on-the-fly

Complex/consolidated

agreements can be sent back

to a mobile device or made

available online

15 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

THE SALES MEETING: NEW CLIENT, AUTOMATED ONBOARDING

Enter data once and apply to

agreements & set-up forms

Sign & submit

Sign & review documents on

the iPad or online

Instantly send secure

documents to downstream

processes

16 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

THE SALES MEETING: EASIER FOR EXISTING CLIENTS

The benefits of going paperless

extend beyond new clients

Current customers can sign-up

for new services online

Data from their existing services

can be applied to new services

Improve & enhance their

Onboarding experiences

Make new impressions on

established relationships

17 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

MULTI-TASK ON AUTOPILOT

Business rules ensure consistent

processing – designed using

250+ predefined workflow rules

without development

Repetitive tasks are eliminated

through automation

Multiple implementation

processes can occur in parallel

18 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

MULTI-TASK ON AUTOPILOT

+ C

Email/mobile integration for all

workflow decisions

Forms designed & implemented

without development

Quickly deployed by business

users including validation

19 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

DASHBOARD DELIVERABLES

A clean, simple dashboard view

delivers:

24-7 access to your customer’s

onboarding status & progression

Progress notifications can be

sent internally and to the

customer

SLA warning notifications can be

sent to operations and Treasury

Sales Officers

20 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

COMPLIANCE – CONSIDER IT COVERED

• Reduce audit efforts

• Ensure all required signatures are captured

• Safeguard appropriate access to sensitive information

Easily identify customers who require updated agreements

Automate the collection/review/distribution processes

21 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

ON-DEMAND ANALYTICS, IMPROVED COMMUNICATION

If problems do occur, surprises

won’t

Identify potential bottlenecks that

may delay the go-live date

Immediately notify clients and

stakeholders of issues

Real-time information empowers

clients & stakeholders to make

informed business decisions

Exceptions, pipeline &

productivity statistics generated

automatically

22 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

GIVE SATISFACTION, GAIN OPPORTUNITY

Clients are involved & informed

• More opportunities to cross-sell

develop when Onboarding is:

Easier

Less work

Delivered on-time

Revenue is accelerated by up to

35%

23 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

DEFINITION – WHAT IS CLIENT ONBOARDING?

Client onboarding is the process of welcoming new clients into your business, addressing their questions and

concerns, and ensuring they understand the services available to them.

Don’t make the mistake of assuming your current customer service structure will taking care of the client

onboarding process as this can lead to clients that become frustrated and cancel their account.

Client onboarding is one of the most important functions for any business because it directly affects the client’s

experience with your company, which will affect profits.

24 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

THE CLIENT ONBOARDING PROCESS

Different people will have different ideas about how to successfully onboard new clients. But in general, a

successful client onboarding process can be summed up by two questions:

Have you successfully introduced your new client to your business and addressed all their questions and

concerns early on?

Have you gathered information on your client so you have insight into what products and services would

benefit them?

To summarize, a successful onboarding process will meet both the needs of your clients and your business

needs. To do this you must have a full understanding of your business’s needs and goals. How much data

collection does your business require? If the client onboarding process fails to meet the needs of your business

then it is ultimately useless. A good client onboarding process should not only retain your client but encourage

them to continue to buy new products and services.

25 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

REQUIREMENT FOR A SUCCESSFUL CLIENT ONBOARDING PROCESS

Assess your client’s current needs

One of the most important parts of the onboarding process is learning about your client’s needs. Every client is

different and will have different resources to work with. When you understand their strengths and weaknesses

you will be able to develop a plan for how to work with them.

Make a list of your client’s current assets as well as any areas that need improvement. When you review this

with your client use it as an opportunity to position yourself as an expert.

Outline the client’s desired outcomes and goals

All successful marketing campaigns have a goal in mind. You should already have an idea of what your client is

hoping to accomplish, you have a clear understanding of what you are working with, and now it is time to

develop a goal and a plan to move forward.

You need to take your assessment and turn it into measurable goals that your team can act on. The more clearly

you articulate your goals to your client and your team, the easier it will be for everyone will stay on track. Be

sure that you don’t promise anything you can’t deliver on and make sure everyone is involved in the goal-setting

process.

26 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

CONT…

Be sure your team is briefed on your client

Before your team becomes involved with the client you need to make sure they have a clear understanding of

your client, their industry, and the work involved. Assign your team any necessary reading materials, be sure

they have access to the assessment and contract, and provide any notes available on your client. Once your

team knows your client’s desired outcomes and objectives they will be better prepared for the client kickoff call.

Have a kickoff call

It is important to have a great kickoff call so everyone is on the same page and has all the information they need.

Your client needs to have a good impression of your entire team, not just you. Be sure your team demonstrates

that they fully understand the scope of the work and have everything they need to move forward. Give your

client time to articulate their objectives and expectations.

Check-in after 30 days

This is an opportunity for you to gain feedback from your client, get a sense of how the process is going so far,

and address any concerns they may have. Use this check-in call as an opportunity to build on your relationship

with your client and let them know you value their business. Have a list of questions prepared and summarize all

the work that has been done in the past 30 days. When the call is over your client should feel confident that

they made the right choice by doing business with your company.

27 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

STEPS FOR ONBOARDING

Step-1

Assign a specific employee for Customer On boarding. His activities include;

A single point-of-contact for on boarding process

Managing budgets, goals, measurement of program success, work across product, channel & marketing

Departments

Without a person dedicated to this, on boarding process will lack focus/may never get initiated

28 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

CONT…

Step-2

Include all Account Holders(Old & New)

On boarding is an ongoing process that should include both new & old account holders. Also On boarding

process should be done for all types of accounts like Deposit & Advances

29 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

CONT…

Step-3

Target the Right Account Holders

A strong targeting strategy helps to acquire households willing to build a broader relationship than just one

account. The more targeted the acquisition strategy, the greater the potential for on boarding success

Another way to improve your acquisition results is to continuously engage with customer like “Direct

Mails/Mass Media” that can optimize your overall investment

30 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

CONT…

Step-4

Collect Data/Insights from day One

The ability to personalize communications & provide targeted solutions is based on the;

Demographic

Behavioral

Social insights

The collection of insight doesn’t stop at the new accounts, but should continue during the entire on boarding

process using surveys that should build a customer profile.

31 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

CONT…

32 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

CONT…

Step-5

Communicate with the New Account Holders early

The sooner you reconnect with the new account holders ,the more successful you will be in building dialogue &

engagement

“A simple SMS stating Thank You is a great way to start an on boarding process”

33 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

CONT…

Step-6

Communicate with the account holders Regularly

One of the biggest misconceptions by financial institutions is that new account holders don’t want to get a lot of

messages after opening a new account. But according to research studies-satisfaction & cross-selling success will

both improve as the number of contacts are increased up to 4 times & is till effective if the customer is

communicated with as many as 7 times during the first 90 days.

34 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

CONT…

Step-7

Personalize Communication

Show the consumer that you know them & understand their needs. The goal is to mine the data on the

customer to Generate marketing messages that are customer specific

It is important to build a communication channels strategy for each customer ‘based on the channels they use &

respond to best’

35 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

CONT…

Step-8

Start with a Simple “Thank You”

This can be done by SMS or E-Mail immediately after the customer completes account opening. Some

organizations have developed local ‘Surprise/Delight’ offers from local merchants to provide as a Thank You

36 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

CONT…

Step-9

Build engagement before selling

Nobody likes sales messages before you have earned trust.

Start your on boarding process with various solutions like Internet Banking, Mobile Banking, Bill payment option

etc.

37 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

CONT…

Step-10

Don’t forget your ‘Brand’

New customers are not necessarily familiar with your brand. Let them know what makes your organization

special. Make sure that all on boarding communications reinforces your brand & provides the customers with

reasons to refer your Bank to their friends

38 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

CONT…

Step-11

Provide Personalized Offers

Customers respond to offers that relate to accounts they hold in your Bank. Ex: You can have a reward program,

to leverage as a part of customer engagement

39 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

CONT…

Step-12

Start your Communications with Mail/E-Mail

For on boarding traditional Direct Mail/E-Mail is a great foundation for future communication.

40 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

CONT…

Step-13

Integrate all Possible Channels

Today’s Digital Customer is more likely to open your E-Mail on their phone than their desk. These customers are

also open to receiving SMS messages & targeted offers in their Mobile Bank App. Leveraging multiple channels

like e-mail, phone, SMS text, online, mobile banking, videos, ATM etc allows you to appeal to customers channel

preferences while delivering a highly personalized message that will positively impact results

41 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

CONT…

Step-14

Leverage your Local presence

Branch phone call follow-up’ can improve on boarding results significantly & is a great use of ‘Branch Down-

Time’

The use of partnering with local merchants for non-financial offers also is a great way to leverage bank’s local

presence

42 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

CONT…

Step-15

Build Custom ‘Jump Pages’

Several Banks have unique jump pages that are specifically designed for new customers providing step-by-step

instructions on how to take the best advantage of services. Many of these jump pages have links like “Go With”

service pages providing easy applications and additional education on the service

43 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

CONT…

Step-16

Measure Results

While most banks miss this or avoid this, i.e “Measurement of Results”. However measurement involves the

following steps;

How did a particular sale happen?

Who should get the credit for it?

How much credit should be attributed to each consumer interaction across channels/on what basis?

How should the investment be apportioned across channels?

44 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

BENEFITS OF CLIENT ONBOARDING

One of the most obvious benefits of a successful client onboarding process is continued service from your client.

When you lose a client it means that all the time spent on marketing, developing the relationship, drafting

proposals, and investing your time to meet with them has all gone to waste.

80 percent of a company’s future revenue will come from 20 percent of its current customers. But many

businesses allocate few marketing resources toward retaining their current customers. There is an incredible

opportunity for future revenue with repeat clients so it is in your best interest to keep your current clients

happy.

Another benefit to retaining your current clients is the opportunity for referrals. When your clients are happy

with the service you provide them they are more likely to refer you to others.

20-50 percent of all purchases came based off of recommendations made by other people. Word-of-mouth

marketing can work to your business’s benefit or detriment. If you do an exceptional job of onboarding your

new clients you will set yourself up for positive word-of-mouth marketing.

45 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

WHAT IS KYC?

Yes, Know Your Customer (KYC) is a popular term used in the banking or financial field. Know Your Customer

(KYC) is a process that has to be complied by financial institutions, whereby these set of institutions obtain

information about the identity and address of the customers.

The Government of India has notified six documents as 'Officially Valid Documents (OVDs) for the purpose of

producing proof of identity.

Even when you already submit the KYC documents once, the banks can ask again as they are required to

periodically update KYC records.

46 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

CONT…

This is a part of their ongoing due diligence on bank accounts. The periodicity of such updation would vary from

account to account or categories of accounts depending on the bank's perception of risk.

Opening bank account, mutual fund account, bank locker, online investing in mutual fund or gold your KYC

should be updated with bank.

47 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

CONT…

The Know Your Client form is a standard form in the investment industry that ensures investment advisors know

detailed information about their clients' risk tolerance, investment knowledge and financial position.

KYC forms protect both clients and investment advisors. Clients are protected by having their investment

advisor know what investments best suit their personal situations. Investment advisors are protected by

knowing what they can and cannot include in their client's portfolio.

48 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

WHY KYC IS MANDATORY NOW

KYC norms were introduced in 2002 by the Reserve Bank of India (RBI). It directed all banks and financial

institutions to put in place a policy framework to know their customers before opening any account. The

purpose was to prevent money laundering, terrorist financing, theft and so on.

Today other regulators too have made KYC mandatory. The Securities and Exchange Board of India (Sebi) has

mandated it for mutual funds and broking accounts, the Insurance Regulatory Development Authority (IRDA)

while buying insurance and the Forwards Markets & Commission (FMC) for commodity trading.

KYC is important because it helps the banker to ensure that the application and other details are real. There

have been instances of fraud and siphoning off of money from accounts.

By ensuring the identity of individuals, it would help to prevent fraud.

The Know Your Customer practice has been in vogue for many years now. It is a must and all individuals have to

comply, if they wish to open account.

It is not possible to open a back account or account for mutual funds without KYC compliance.

49 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

DOCUMENTS REQUIRED FOR KYC

Here is a list of documents which acts Proof of identity and Proof of address

Passport, Driving Licence, Voters' Identity Card, PAN Card, Aadhaar Card issued by UIDAI

50 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

WHO NEEDS KYC?

Those who want to open a bank account, a demat and stock trading account, open FD in another bank, would

definitely need to comply with KYC requirements.

In fact, it is now mandatory as per guidelines from the Securities and Exchange Board of India to comply with

these KYC norms before you open a demat and trading account. Banks too will not open an account unless you

have the same.

51 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

BENEFITS

Improve Customer Service

Improve customer satisfaction by delivering a convenient, personalized customer experience in a timely process.

Efficient customer onboarding translates to a better customer experience.

Increase Efficiency and Productivity

Speed processing and reduce labor costs by capturing critical data and documents required to validate

information for customer onboarding.

Mitigate Risk and Promote Compliance

Lessen risk at several levels, by eliminating error-prone manual work as well as by sharing information across

multiple applications.

52 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

CONT…

Reduce Operational Costs

Reduce labor and associated costs while automating the collection of data and documents.

Increase Revenue and Maximize Profitability

Improve the customer onboarding capture experience to speed processing, improve customer satisfaction and

elevate corporate competitiveness.

Increase Data Access, Integration and Compatibility

Leverage data from multiple ECM, BPM, and workflow applications throughout the enterprise.

Improve Top Line Results

Accelerate business-critical processes (customer onboarding, customer service, etc.), shorten sales cycles and

improve customer communication.

53 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

CONT…

Thrill customers with a fast, smooth onboarding experience along with timely follow-ups, through the

customer’s preferred method of communication

Increase customer satisfaction and loyalty with better communication

Boost data accuracy and eliminate lost documents by deploying advanced data classification, transformation,

and tracking technologies that dramatically reduce human handling and error

Become agile and protect margins by scaling out the customer onboarding process to match business growth

Enhance your bottom line with streamlined business flows to reduce labor-intensive customer onboarding tasks

using advanced capture, auto-classification and workflow technologies

54 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

CONCLUSION

In conclusion…

Improving the customer onboarding experience is a major opportunity for banks to address. This first customer

interaction sets the tone for the entire relationship between bank and customer: a move from the lengthy,

paper-based, inconvenient process to a slick, genuinely omnichannel one would be a major customer experience

game-changer, not to mention bringing significant process cost savings. Incumbent banks need to recognise that

it’s all still to play for – they should look at adopting a mindset shift towards truly customer-centric design in

their current onboarding process.

Getting the onboarding journey right won’t fix all of their problems, but it’s certainly a great place to start.

55 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

THANK YOU

56 Copyright © 2017 HCL Technologies Limited | www.hcltech.com

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Tardigrade Crochet PatterDocument9 pagesTardigrade Crochet PatterracsopitaNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Omelianenko I Hands On Neuroevolution With Python PDFDocument359 pagesOmelianenko I Hands On Neuroevolution With Python PDFAleksa Bogdanovic100% (4)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- ATM Surveillance Data Display, Distribution, ProcessingDocument31 pagesATM Surveillance Data Display, Distribution, ProcessingJoaoNo ratings yet

- Escala Del Dolor PPPDocument16 pagesEscala Del Dolor PPPMariana SuarezNo ratings yet

- Garbage Receipt: Category of The Garbage Amount of GarbageDocument2 pagesGarbage Receipt: Category of The Garbage Amount of Garbagealex kingNo ratings yet

- Costing New Year Sunrise (4 Servings) : InstructionsDocument6 pagesCosting New Year Sunrise (4 Servings) : Instructionsaira mikaela ruazolNo ratings yet

- Condominium Space ProgDocument28 pagesCondominium Space ProgBeiya MaeNo ratings yet

- Reading Data Science The Sexiest Job in The 21st CenturyDocument2 pagesReading Data Science The Sexiest Job in The 21st CenturyAtiq ur RehmanNo ratings yet

- Ex 2 6 FSC Part2 Ver3Document16 pagesEx 2 6 FSC Part2 Ver3Usama TariqNo ratings yet

- Role of RBI in Indian EconomyDocument33 pagesRole of RBI in Indian Economysachin96% (112)

- You Can Stabilize Motion With The Warp Stabilizer EffectDocument5 pagesYou Can Stabilize Motion With The Warp Stabilizer EffectMonastere De la NativiteNo ratings yet

- Consumer Bill - SNGPLDocument1 pageConsumer Bill - SNGPLKhalid YousafNo ratings yet

- ASCP Training Manual v1.2Document87 pagesASCP Training Manual v1.2xslogic100% (2)

- Shelby Bar Graph Assessment RubricDocument1 pageShelby Bar Graph Assessment Rubricapi-360512521No ratings yet

- 3 CH 6Document149 pages3 CH 6eeesolomon2124No ratings yet

- Unigains 2Document60 pagesUnigains 2Keble WongNo ratings yet

- (4198) Body Parts Song For Kids - This Is Me! by Elf Learning - Elf Kids Videos - YoutubeDocument8 pages(4198) Body Parts Song For Kids - This Is Me! by Elf Learning - Elf Kids Videos - YoutubeLenice MonteiroNo ratings yet

- FTFC PD 028 103Document32 pagesFTFC PD 028 103fazh lpsvNo ratings yet

- A Study of Ralph Vaughan Williamss An Oxford Elegy and EpithaDocument159 pagesA Study of Ralph Vaughan Williamss An Oxford Elegy and EpithagustavoalbertomaseraNo ratings yet

- Lab Report 2Document5 pagesLab Report 2Shiela Jane SebugeroNo ratings yet

- Perspectives On Consumer Behavior: EducationDocument20 pagesPerspectives On Consumer Behavior: EducationPrasad KapsNo ratings yet

- CA Rohan Nimbalkar - Summary - NotesDocument78 pagesCA Rohan Nimbalkar - Summary - NotesPrachi GuptaNo ratings yet

- Sustainable Develompent in Cement IndustryDocument9 pagesSustainable Develompent in Cement IndustrylintangnurNo ratings yet

- Microleakage A Review: Vitro Detection of MicroleakageDocument8 pagesMicroleakage A Review: Vitro Detection of MicroleakageAayushi VaidyaNo ratings yet

- The Elder Scrolls III Morrowind FAQ - WalkthroughDocument231 pagesThe Elder Scrolls III Morrowind FAQ - WalkthroughMaxWizard100% (1)

- Leonardo Da Vinci's Most Famous Masterpiece Mona Lisa, Oil On WoodDocument3 pagesLeonardo Da Vinci's Most Famous Masterpiece Mona Lisa, Oil On WoodLianna RodriguezNo ratings yet

- Checklist For Hospital For Data CollectionDocument8 pagesChecklist For Hospital For Data CollectionMuhammad Nadeem NasirNo ratings yet

- Damascus Bypass StudyDocument2 pagesDamascus Bypass StudyM-NCPPCNo ratings yet

- Games 2Document136 pagesGames 2bungnabilNo ratings yet

- Komatsu GD655-5 PDFDocument14 pagesKomatsu GD655-5 PDFlesantiago75% (4)