Professional Documents

Culture Documents

Teaching PowerPoint Slides Chapter 8

Uploaded by

Tauseef Ahmad0 ratings0% found this document useful (0 votes)

43 views28 pagesOriginal Title

Teaching PowerPoint Slides Chapter 8.ppt

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

43 views28 pagesTeaching PowerPoint Slides Chapter 8

Uploaded by

Tauseef AhmadCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 28

1

Financial Planning for

Business Start-ups 8

Synopsis

This chapter introduces students to financial

management for business start-ups and small

business enterprises. It focuses on the steps of

preparing a financial plan. A simple example is

provided as a guide for students to prepare a

financial plan for their project.

Introduction to Entrepreneurship All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 8– 3

Objectives

The objectives of this chapter are:

To introduce the basics of a financial plan and

prepare students for their practicum

entrepreneurial projects.

To introduce students to the financial plan for

small business start-ups.

Introduction to Entrepreneurship All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 8– 4

Learning Outcomes

At the end of this chapter, students should be able

to:

Discuss the basics of a financial plan for small

business start-ups.

Prepare a financial plan for small business start-

ups.

Introduction to Entrepreneurship All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 8– 5

List of Topics

Overview of Financial Management for Small

Business Start-ups

Financial Plan

Introduction to Entrepreneurship All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 8– 6

Introduction

This chapter introduces students to the basics

of financial management. It gives an example

on how to prepare a simple financial plan and

how it can be used as a guide for preparing a

financial plan for the entrepreneurial practicum

project.

Introduction to Entrepreneurship All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 8– 7

Overview of Financial

Management for Small Business

Start-ups

Money or finance to a business entity is like blood to our

body. Money circulates and flows to every part of the

business organization, i.e. administration, production,

marketing, and finance.

It begins as money paid into the company by

entrepreneur or shareholders to form start-up capital for

project implementation.

This money goes to finance for the purchase of assets, to

pay working capital (purchase of raw material, paying of

salary, rental, etc.) and buy other miscellaneous items.

Introduction to Entrepreneurship All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 8– 8

Overview of Financial

Management for Small Business

Start-ups (cont.)

Introduction to Entrepreneurship All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 8– 9

Overview of Financial

Management for Small Business

Start-ups (cont.)

From Figure 8.1, you should understand the

following:

(a) Project implementation cost is the total capital

required to finance the project cost, including cost

of purchasing assets, expenses for working capital

(monthly expenses) and other miscellaneous items.

(b) Fund sources include owner’s equity, external

borrowings and contribution of owner’s existing

assets.

Introduction to Entrepreneurship All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 8– 10

Overview of Financial

Management for Small Business

Start-ups (cont.)

(c) The cash flow projection statement represents

data on all monthly cash inflows (i.e. cash

capital injection, sales, collection of account

receivable, etc.) minus all monthly cash

outflows (i.e. purchases, salary, paying of

account payables, dividend, etc.) to yield the

monthly cash balance. Generally, a positive

monthly cash balance is a good indication that

the project is viable.

Introduction to Entrepreneurship All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 8– 11

Overview of Financial

Management for Small Business

Start-ups (cont.)

(d) The profit and loss statement represents the

total sales in a financial period minus the cost

of goods sold/used to yield the gross profit.

The gross profit minus the total expenses for

the period (i.e. salary, rental, utility, etc.) will

yield the profit for the financial period.

Introduction to Entrepreneurship All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 8– 12

Overview of Financial

Management for Small Business

Start-ups (cont.)

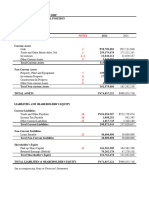

(e) The balance sheet represents the amount of

money or value at the end of a financial period

for every item listed as an asset (fixed asset

and current asset), items listed as liability

(borrowings and account payable), and equity

(capital injected and accumulated profit). The

balance sheet must be as follows:

Asset = Liability + Equity

Introduction to Entrepreneurship All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 8– 13

Financial Plan

A basic financial plan includes the following:

Step 1: Project implementation cost and sources

of fund

Step 2: Loan amortization

Step 3: Depreciation of asset

Step 4: Cash flow projection

Step 5: Projected financial statement

Step 6: Projected balance sheet

Introduction to Entrepreneurship All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 8– 14

Project Implementation Cost and

Sources of Fund

(a)Project implementation cost

The project implementation cost includes all the costs

needed to start the business, such as cost of assets

(i.e. cost of equipment, renovation, furniture, etc.)

plus working capital (i.e. cost of salary, rental, raw

material, etc.) plus other miscellaneous items (i.e.

business registration, rental deposit, contingencies,

etc.).

Introduction to Entrepreneurship All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 8– 15

Project Implementation Cost and

Sources of Fund (cont.)

Introduction to Entrepreneurship All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 8– 16

Project Implementation Cost and

Sources of Fund (cont.)

Introduction to Entrepreneurship All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 8– 17

Project Implementation Cost and

Sources of Fund (cont.)

Introduction to Entrepreneurship All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 8– 18

Project Implementation Cost and

Sources of Fund (cont.)

Introduction to Entrepreneurship All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 8– 19

Loan Amortization

Introduction to Entrepreneurship All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 8– 20

Depreciation of Asset

The value of an asset depreciates over time. The

depreciation amount per year or per month is calculated

based on the life expectancy of the asset. It is deducted

as an expense in the profit and loss statement.

Example: Cost of asset (equipment) = RM1,500

Life expectancy of asset is 100 weeks (approximately

2 years)

Depreciation per week = RM1,500/100 weeks

= RM15/1 week

Introduction to Entrepreneurship All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 8– 21

Depreciation of Asset (cont.)

Introduction to Entrepreneurship All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 8– 22

Cash Flow Projection

Cash flow projection is the estimated total cash

inflow, cash outflow and balance of cash at the end

of the day, week or month. It is done for an

accounting period (e.g. one month or one year).

The cash flow projection shows if there is going to

be cash shortage within the accounting period, in

which case, additional cash resources should be

allocated through further capital injection or

borrowings.

Introduction to Entrepreneurship All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 8– 23

Cash Flow Projection (cont.)

Introduction to Entrepreneurship All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 8– 24

Projected Financial Statement

The projected financial statement

shows the projected overall

results of each step that has been

discussed before. Table 8.6

shows the projected income

statement which gives the

expected financial performance

for the financial periods on total

sale, cost of goods sold, gross

profit, expenses and net profit.

Based on the projected income

statement,

Profit margin on sale

= Net profit/Sale ×100%

= 2,600/6,000 × 100%

= 43.33%

Introduction to Entrepreneurship All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 8– 25

Projected Balance Sheet

The balance sheet shows the balance for cash,

asset, liability and equity at the end of the

financial period. A company that is financially

healthy will have a high amount of cash and

asset, low liability and positive accumulated profit

instead of accumulated losses.

Introduction to Entrepreneurship All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 8– 26

Projected Balance Sheet (cont.)

The balance sheet shows the balance for

cash, asset, liability and equity at the end

of the financial period. A company that is

financially healthy will have a high

amount of cash and asset, low liability

and positive accumulated profit instead

of accumulated losses.

Return on investment per month

= Net profit/Project implementation cost

×100%

= 2,600/2,700×100% = 96.3%

Return on asset per month

= Net profit/Total asset ×100%

= 2,600/4,300 ×100% = 60.5%

Introduction to Entrepreneurship All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 8– 27

Summary

This chapter introduces students to the basics of

financial management. The six steps for preparing

financial statements will help students in their

entrepreneurial practicum project. The experience

will also enhance students’ understanding on

finance.

Introduction to Entrepreneurship All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 8– 28

You might also like

- Fdster 1gsgDocument28 pagesFdster 1gsgUnknown_unknown_unknownNo ratings yet

- Teaching PowerPoint Slides Chapter 7Document25 pagesTeaching PowerPoint Slides Chapter 7Tauseef AhmadNo ratings yet

- Teaching PowerPoint Slides Chapter 6 - RevisedDocument23 pagesTeaching PowerPoint Slides Chapter 6 - ReviseddanialNo ratings yet

- Chapter3-Registration of Business EntitiesDocument28 pagesChapter3-Registration of Business EntitiesEncik ComotNo ratings yet

- Chapter1-Introduction To EntrepreneurshipDocument27 pagesChapter1-Introduction To Entrepreneurshipakmal100% (3)

- ZDDZCZDocument31 pagesZDDZCZUnknown_unknown_unknownNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Investment Method of Sir John Maynard KeynesDocument3 pagesThe Investment Method of Sir John Maynard KeynesRiselda Myshku KajaNo ratings yet

- A Liquidation Case: - The Fall of The FailedDocument21 pagesA Liquidation Case: - The Fall of The FailedGarvNo ratings yet

- Republic Act No. 8799 The Securities Regulation Code Chapter Iii Registration of Securities Section 8. Requirement of Registration of SecuritiesDocument3 pagesRepublic Act No. 8799 The Securities Regulation Code Chapter Iii Registration of Securities Section 8. Requirement of Registration of SecuritiesmmeeeowwNo ratings yet

- Sea Rule 15c3 1 InterpretationsDocument236 pagesSea Rule 15c3 1 Interpretationsdestinylam123No ratings yet

- Biofuel Production Plant Pre Feasibility StudyDocument7 pagesBiofuel Production Plant Pre Feasibility StudyGeorge Tumaob Calaor0% (1)

- Changi Airport Group Annual Report 20122013 Full Version PDFDocument120 pagesChangi Airport Group Annual Report 20122013 Full Version PDFmulti nirman sewaNo ratings yet

- Industrial Grinders NVDocument6 pagesIndustrial Grinders NVCarrie Stevens100% (1)

- Oil Spill Case StudyDocument3 pagesOil Spill Case StudyprinceoffpersiaNo ratings yet

- A. K. Capital Services Limited: Flat No. N, Sagar Apartment, 6, Tilak Marg, New Delhi - 110 001Document64 pagesA. K. Capital Services Limited: Flat No. N, Sagar Apartment, 6, Tilak Marg, New Delhi - 110 001Vignesh SrinivasanNo ratings yet

- Dabur India LTDDocument7 pagesDabur India LTDdheeraj_raj_jainNo ratings yet

- Ignou Mba 1st Semester Assignment 2016Document5 pagesIgnou Mba 1st Semester Assignment 2016AiDLoNo ratings yet

- Fed Rate Cut N ImplicationsDocument8 pagesFed Rate Cut N Implicationssplusk100% (1)

- Merchant Banking (In The Light of SEBI (Merchat Bankers) Regulations, 1992)Document38 pagesMerchant Banking (In The Light of SEBI (Merchat Bankers) Regulations, 1992)Parul PrasadNo ratings yet

- FIMA 30013 FS Analysis Premium FSDocument4 pagesFIMA 30013 FS Analysis Premium FSdcdeguzman.pup.pulilanNo ratings yet

- Investment IDocument30 pagesInvestment IbarchajacNo ratings yet

- Impact of Working Capital ManagementDocument77 pagesImpact of Working Capital ManagementYasirNo ratings yet

- January 1 2017 Heckert Company Purchases A Controlling Interest inDocument1 pageJanuary 1 2017 Heckert Company Purchases A Controlling Interest inMuhammad ShahidNo ratings yet

- Afar 07 15 NpoDocument6 pagesAfar 07 15 NpoLeo M. SalibioNo ratings yet

- Chinabank ThesisDocument29 pagesChinabank ThesisApple Santos MabagosNo ratings yet

- Dividend Policy Literature ReviewDocument11 pagesDividend Policy Literature ReviewAli100% (1)

- March 2017Document352 pagesMarch 2017Govini Product TeamNo ratings yet

- Theories of MergerDocument14 pagesTheories of MergerPreemnath KatareNo ratings yet

- Introduction and Roadmap of Ind As For 1st 2nd August Pune Branch Programme CA. Zaware SirDocument51 pagesIntroduction and Roadmap of Ind As For 1st 2nd August Pune Branch Programme CA. Zaware SirPratik100% (1)

- 403Document12 pages403al hikmahNo ratings yet

- ADP Accounting 2020 SIR SALEEMDocument1 pageADP Accounting 2020 SIR SALEEMhhaiderNo ratings yet

- Indifference Curve, Which Reflects That Investor's Preferences Regarding Risk and Return, IsDocument5 pagesIndifference Curve, Which Reflects That Investor's Preferences Regarding Risk and Return, Ismd mehedi hasanNo ratings yet

- Ma 1Document36 pagesMa 1Project SiteNo ratings yet

- 4 Startup Valuation Methods Used by VCs and Angels Source - SeedrsDocument7 pages4 Startup Valuation Methods Used by VCs and Angels Source - SeedrsArun LahotiNo ratings yet

- Commercial Banks Behavior and Effect On Profitability in UaeDocument16 pagesCommercial Banks Behavior and Effect On Profitability in UaeAbdelghani RemramNo ratings yet