Professional Documents

Culture Documents

Intro To Corporate Finance and Investments Topic: International Debt Markets

Uploaded by

Guezmenot thoughts0 ratings0% found this document useful (0 votes)

8 views20 pagesThis is a mat on Bonds

Original Title

6_1_Bond_Mkt

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis is a mat on Bonds

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views20 pagesIntro To Corporate Finance and Investments Topic: International Debt Markets

Uploaded by

Guezmenot thoughtsThis is a mat on Bonds

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 20

INTRO TO CORPORATE FINANCE AND INVESTMENTS

TOPIC: INTERNATIONAL DEBT MARKETS

Professor

M. Max Croce,

SDA Professor

SDA Bocconi Asia Center I Capital Markets

Outline

Debt Financing overview

All-In-Cost (AIC) principle

Minimizing the cost of debt

Monetary policy and market outlook (if we have time)

SDA Bocconi Asia Center I Capital Markets

Overview

SDA Bocconi Asia Center I Capital Markets

Sources of Long-Term Capital

SDA Bocconi Asia Center I Capital Markets

Characteristics of Debt Financing

Characteristics:

Maturity

Spread repayments over time; try to match duration of investments

Fixed / Floating rates

When do you go with a floating?

Expectations matter

International character:

domestic vs. international placement

Currency of denomination

SDA Bocconi Asia Center I Capital Markets

Debt Denomination: De/Centralized

Should we care if the UIP holds?

What are the benefits of decentralizing?

Lower costs

Diversification across currencies

SDA Bocconi Asia Center I Capital Markets

The Characteristics of Debt Instruments

The international character of debt

Domestic bonds

Bonds that are issued and traded in domestic market (country is country of currency denomination)

International bonds

Bonds traded outside the country of the issuer

Foreign Bonds – issued in domestic market by a foreign borrower (Ex. Indian company issuing $ bond in

the USA)

Denominated in the currency of the targeted country [WHY?]

Marketed to domestic residents

Regulated by domestic authorities

Eurobond – mature in less than 10 yrs (usually 5)

Denominated in one or more currencies

Traded in external markets outside the borders of the countries issuing the currencies

SDA Bocconi Asia Center I Capital Markets

Bond Markets are HUGE!

SDA Bocconi Asia Center I Capital Markets

International Bonds: Players and Tastes

SDA Bocconi Asia Center I Capital Markets

Cost of Debt

SDA Bocconi Asia Center I Capital Markets

All-in-Cost Principle

The Cost of a loan has 3 components:

Risk-free rate (driven by monetary policy and macro-factors)

Credit Spread (driven by both country- and company-specific default risk)

Transaction costs

Notice: hedging the currency on foreign debt matters!

Example for General Electric:

Credit spread = 1% in India or 1% in USA

US LIBOR 1.9%; M(umbai)IBOR = 6.3%; -> (Forward- Spot)/Spot ≈ -4.4%

The INR (USD) is at a discount (premium) on forward market

If GE borrows in USA, the cost is: 2.9%

If GE borrows India, the cost is ≈ 6.3% + 1% - 4.4% = 2.9%

SDA Bocconi Asia Center I Capital Markets

THANKS YOU

SDA Bocconi Asia Center I Capital Markets

If We Have Time

SDA Bocconi Asia Center I Capital Markets

Outlook

IMF / OECD

SDA Bocconi Asia Center I Capital Markets

SDA Bocconi Asia Center I Capital Markets

SDA Bocconi Asia Center I Capital Markets

SDA Bocconi Asia Center I Capital Markets

SDA Bocconi Asia Center I Capital Markets

2019 EMs

SDA Bocconi Asia Center I Capital Markets 2019 EU + US

THANKS YOU

SDA Bocconi Asia Center I Capital Markets

You might also like

- Lecture 1 (Introduction To Security Analysis)Document44 pagesLecture 1 (Introduction To Security Analysis)Devyansh GuptaNo ratings yet

- Intro To Corporate Finance and Investments Topic: International Capital BudgetingDocument6 pagesIntro To Corporate Finance and Investments Topic: International Capital BudgetingGuezmenot thoughtsNo ratings yet

- FINMAN NotesDocument11 pagesFINMAN NotesIris FenelleNo ratings yet

- Chapter 1Document18 pagesChapter 1Adda KadhilaNo ratings yet

- Chapter 02 - An Overview of Financial SystemDocument15 pagesChapter 02 - An Overview of Financial SystemGiang TonNo ratings yet

- Indian Financial System: UNIT-1Document48 pagesIndian Financial System: UNIT-1Use ThrowNo ratings yet

- A Presentation On: International Finance Instruments and IntricaciesDocument118 pagesA Presentation On: International Finance Instruments and IntricaciesRahul GuptaNo ratings yet

- Development Research Group Studies 2013 - 14: Securities and Exchange Board of IndiaDocument100 pagesDevelopment Research Group Studies 2013 - 14: Securities and Exchange Board of IndiaVaibhav SalaskarNo ratings yet

- Met West OverviewDocument88 pagesMet West OverviewRyan DeCaroNo ratings yet

- Financial Management: Topic: IntroductionDocument5 pagesFinancial Management: Topic: IntroductionIris FenelleNo ratings yet

- Overview of Capital MarketsDocument31 pagesOverview of Capital MarketsRheneir MoraNo ratings yet

- 2 Bond MKTDocument67 pages2 Bond MKTanandhuNo ratings yet

- Basic - 3 - Managing Risk and Return Through Financial InstrumentsDocument50 pagesBasic - 3 - Managing Risk and Return Through Financial InstrumentsShailjaNo ratings yet

- Fixed-Income Markets - Issuance, Trading and FundingDocument32 pagesFixed-Income Markets - Issuance, Trading and FundingShriya JanjikhelNo ratings yet

- Corporate FinanceDocument24 pagesCorporate Financeapi-3719687100% (3)

- IBS Hyderabad : Course Code Course Title Faculty Name Consultation Hours (Day/time)Document44 pagesIBS Hyderabad : Course Code Course Title Faculty Name Consultation Hours (Day/time)Adil D CoolestNo ratings yet

- IFS - Mutual FundsDocument36 pagesIFS - Mutual FundsBun From BakeryNo ratings yet

- HSBC Asian Local Bond Index (ALBI)Document17 pagesHSBC Asian Local Bond Index (ALBI)Areeys SyaheeraNo ratings yet

- International Finance: ObjectivesDocument32 pagesInternational Finance: ObjectivesNithyananda PatelNo ratings yet

- Introduction To Securities Markets For StudentsDocument32 pagesIntroduction To Securities Markets For StudentsGANAPATHY SNo ratings yet

- Financial Management - I: Introduction ToDocument18 pagesFinancial Management - I: Introduction ToShivpratap SinghNo ratings yet

- Unit Investment Trust Fund: (For Individuals and Corporates)Document20 pagesUnit Investment Trust Fund: (For Individuals and Corporates)Baba YodaNo ratings yet

- NMIMS International Finance - Assignment Answers (Sem-IV)Document7 pagesNMIMS International Finance - Assignment Answers (Sem-IV)Udit JoshiNo ratings yet

- Internatiomal Project AppraisalDocument15 pagesInternatiomal Project AppraisalTulsi RajNo ratings yet

- Treasury & Financial Derivatives (IBA)Document3 pagesTreasury & Financial Derivatives (IBA)YaarbaileeNo ratings yet

- Data Anallysis - High Income EarnersDocument3 pagesData Anallysis - High Income EarnersAdora AdoraNo ratings yet

- Submitted in The Partial Fulfillment For The Requirement of The Award of Degree ofDocument66 pagesSubmitted in The Partial Fulfillment For The Requirement of The Award of Degree ofJyoti YadavNo ratings yet

- Introduction To Capital Market: Mrunal JoshiDocument15 pagesIntroduction To Capital Market: Mrunal JoshiChand BashaNo ratings yet

- Why Mutual Fund?: AMFI IAP (Association of Mutual Funds India Investor Awareness Program)Document33 pagesWhy Mutual Fund?: AMFI IAP (Association of Mutual Funds India Investor Awareness Program)shoaib zamanNo ratings yet

- DBH 1st Mutual FundDocument34 pagesDBH 1st Mutual Fundrishav_agarwal_1No ratings yet

- Final Assignment - 2021 - International EconomicsDocument2 pagesFinal Assignment - 2021 - International EconomicsMinh Tâm ĐàoNo ratings yet

- Presentation No 1 Fixed Income IBA Fall 2021Document40 pagesPresentation No 1 Fixed Income IBA Fall 2021Food ClipsNo ratings yet

- Enabling Long Term Infrastructure Finance in Local Currency GuarantCoDocument13 pagesEnabling Long Term Infrastructure Finance in Local Currency GuarantCoMohammed BusariNo ratings yet

- AMFI IAP PresentationDocument34 pagesAMFI IAP Presentationservices mpbNo ratings yet

- Summer Internship Report: July 2017Document34 pagesSummer Internship Report: July 2017Kunal SharmaNo ratings yet

- The Foreign Exchange MarketDocument58 pagesThe Foreign Exchange MarketSHOBANA96No ratings yet

- Foreign Exchange, Treasury and Market Risk Mangement-1Document163 pagesForeign Exchange, Treasury and Market Risk Mangement-1Sandeep KumarNo ratings yet

- Fixed Income Instruments in IndiaDocument90 pagesFixed Income Instruments in Indiaapi-19459467100% (11)

- Introduction To Finance: Main IssuesDocument20 pagesIntroduction To Finance: Main IssuesJasmeet SinghNo ratings yet

- New Waste UploadDocument8 pagesNew Waste UploadGautam ShahNo ratings yet

- Mutaul Fund PresentationDocument28 pagesMutaul Fund PresentationAshwani MittalNo ratings yet

- Investment Management: CAFTA WebinarDocument38 pagesInvestment Management: CAFTA WebinarAryan PandeyNo ratings yet

- Foreign Exchange Transactions: Bid Ask Bid/ask SpreadDocument8 pagesForeign Exchange Transactions: Bid Ask Bid/ask SpreadALI SHER HaidriNo ratings yet

- Update SynopsisDocument7 pagesUpdate SynopsisAnonymous 3Yssq6No ratings yet

- DIB 02 - 202 International Trade and Finance - 03Document13 pagesDIB 02 - 202 International Trade and Finance - 03farhadcse30No ratings yet

- Overview of Capital MarketsDocument31 pagesOverview of Capital MarketsDiwakar BhargavaNo ratings yet

- External Commercial BorrowingsDocument34 pagesExternal Commercial BorrowingsVishal MadlaniNo ratings yet

- Name of Fund: SOC Cementic Fund: AuthorsDocument33 pagesName of Fund: SOC Cementic Fund: AuthorsShubhangi TerapanthiNo ratings yet

- Financial Market ManagementDocument22 pagesFinancial Market ManagementValliammai AnandNo ratings yet

- Il&Fs Project ReportDocument61 pagesIl&Fs Project Reportmahantesh123100% (32)

- Treasury Management Module CDocument58 pagesTreasury Management Module CAbhinav KumarNo ratings yet

- Civil Service ExamDocument2 pagesCivil Service ExamMunavir kNo ratings yet

- Capital Market: Presented byDocument134 pagesCapital Market: Presented byprathamesh09No ratings yet

- QUESTIONNAIRE NewDocument8 pagesQUESTIONNAIRE Newrtr_usha7916100% (3)

- Economics MrunalSir Notes AnnotatedDocument19 pagesEconomics MrunalSir Notes AnnotatedakankshaNo ratings yet

- Ch02 Financial Mkts and Institutions - MishkinEakins 2018-ENGDocument58 pagesCh02 Financial Mkts and Institutions - MishkinEakins 2018-ENGHoàng Đỗ VănNo ratings yet

- Summer Placement Presentation Final 1Document16 pagesSummer Placement Presentation Final 1deepanshu lakhyaniNo ratings yet

- Indranil Paul - 092 - Internatioanl Trade FinanceDocument61 pagesIndranil Paul - 092 - Internatioanl Trade FinanceIndranil PaulNo ratings yet

- A Practical Approach to the Study of Indian Capital MarketsFrom EverandA Practical Approach to the Study of Indian Capital MarketsNo ratings yet

- Fuel-Inefficient CarsDocument4 pagesFuel-Inefficient CarsGuezmenot thoughtsNo ratings yet

- Vermicomposting Made EasyDocument28 pagesVermicomposting Made EasyGuezmenot thoughtsNo ratings yet

- Exercise - Marketing Myopia - September 2019Document1 pageExercise - Marketing Myopia - September 2019Guezmenot thoughtsNo ratings yet

- Packaging and Consumer BehaviourDocument12 pagesPackaging and Consumer BehaviourGuezmenot thoughtsNo ratings yet

- Intro To Corporate Finance and Investments Topic: Managing Risk (Introduction)Document5 pagesIntro To Corporate Finance and Investments Topic: Managing Risk (Introduction)Guezmenot thoughtsNo ratings yet

- PADD Loan Calculator Tool: Payment Amount (Monthly) : $ 6,055.81Document1 pagePADD Loan Calculator Tool: Payment Amount (Monthly) : $ 6,055.81c_b_umashankarNo ratings yet

- (Lehman Brothers) A Guide To The Lehman Global Family of Fixed Income IndicesDocument47 pages(Lehman Brothers) A Guide To The Lehman Global Family of Fixed Income IndicesSiddhantNo ratings yet

- Fair Value Vs ConservatismDocument50 pagesFair Value Vs ConservatismIslammohsenNo ratings yet

- Gmac 1998 C-1 PDFDocument276 pagesGmac 1998 C-1 PDFJane RochesterNo ratings yet

- Sanjid Mamhud - 201803067 - Working Capital Policy - Assignment 1Document5 pagesSanjid Mamhud - 201803067 - Working Capital Policy - Assignment 1Sanjid Mahmud SwarupNo ratings yet

- Simple Loan Agreement Template 3Document6 pagesSimple Loan Agreement Template 3Rem SerranoNo ratings yet

- The Basic Accounting Equation: Assets Liabilities + EquityDocument16 pagesThe Basic Accounting Equation: Assets Liabilities + EquityangeliNo ratings yet

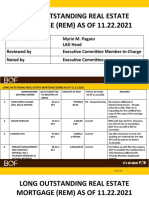

- 6.1. Long Outstanding REMDocument3 pages6.1. Long Outstanding REMApril NNo ratings yet

- Topic 3 ReportDocument114 pagesTopic 3 ReportMc John PobleteNo ratings yet

- BRPD Circular No 05Document14 pagesBRPD Circular No 05Iftekhar Ifte100% (1)

- Entrep Q2 M15 17Document16 pagesEntrep Q2 M15 17Joanna Mae PlacidoNo ratings yet

- Full Solution Manual Accounting 8th Edition by John Hoggett SLW1014Document68 pagesFull Solution Manual Accounting 8th Edition by John Hoggett SLW1014Sm Help80% (5)

- IBC Project - Preferential TransactionsDocument10 pagesIBC Project - Preferential Transactionsvedanth saiNo ratings yet

- Santiago v. Pioneer SavingsDocument1 pageSantiago v. Pioneer SavingsHaze Q.No ratings yet

- Art. 1212-1216Document5 pagesArt. 1212-1216ruth san joseNo ratings yet

- Exam General Mathematics Second QuarterDocument2 pagesExam General Mathematics Second QuarterleeNo ratings yet

- Credit Card Debt AssignmentDocument4 pagesCredit Card Debt Assignmentapi-325884538No ratings yet

- Practice Multiple Choice Test 9: .08 (1n C) /.08 (LN 2.5)Document8 pagesPractice Multiple Choice Test 9: .08 (1n C) /.08 (LN 2.5)api-3834751No ratings yet

- Comparative Statement Analysis of Vijaya DairyDocument51 pagesComparative Statement Analysis of Vijaya DairyRajkamalChicha50% (4)

- Internship Report On Sonali Bank LimitedDocument43 pagesInternship Report On Sonali Bank LimitedAbdullah MohammadNo ratings yet

- Credit Report - No Password PDFDocument5 pagesCredit Report - No Password PDFMohammed Abdul HoqueNo ratings yet

- Metrobank v. SF Naguiat MDocument2 pagesMetrobank v. SF Naguiat MGab SollanoNo ratings yet

- Chap 009Document20 pagesChap 009Ela PelariNo ratings yet

- Bonds Payable Related Standards: Pfrs 9 - Financial InstrumentsDocument4 pagesBonds Payable Related Standards: Pfrs 9 - Financial InstrumentsJulie Mae Caling MalitNo ratings yet

- Tutorial 7 Trade Receivables (Q)Document3 pagesTutorial 7 Trade Receivables (Q)lious liiNo ratings yet

- Worksheet in Credit-Scoring-CASEDocument215 pagesWorksheet in Credit-Scoring-CASEsantuNo ratings yet

- CasesDocument32 pagesCasesdollyccruzNo ratings yet

- FIN. 4828 CH. 18: CreateDocument22 pagesFIN. 4828 CH. 18: CreateSwati VermaNo ratings yet

- Billingstatement - Primo R. JulianesDocument2 pagesBillingstatement - Primo R. JulianesMaria Judith Peña Julianes100% (1)

- NPV CalculationDocument11 pagesNPV CalculationMLastTryNo ratings yet