0% found this document useful (0 votes)

1K views36 pagesBusiness Applications of Ratios & Proportions

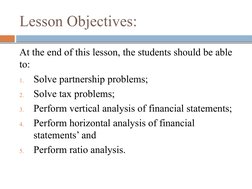

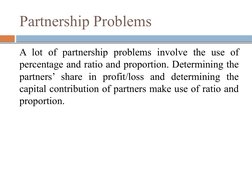

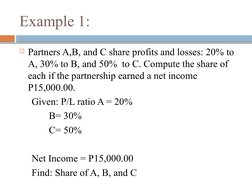

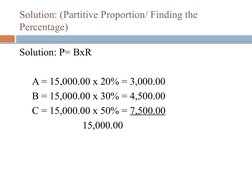

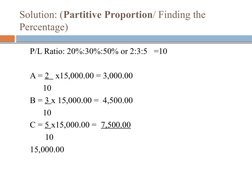

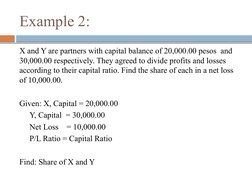

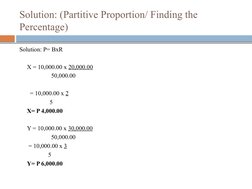

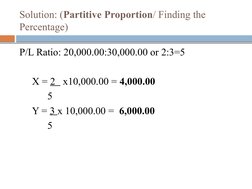

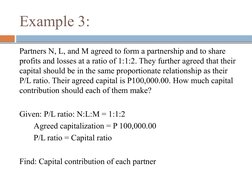

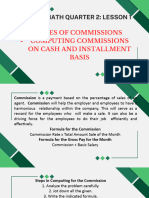

The document discusses how concepts like percentages, ratios, and proportions are used to solve various business problems involving partnerships, taxes, and financial statement analysis. It provides examples of how to determine partners' share of profits/losses, calculate tax liability, perform vertical and horizontal analysis of financial statements, and calculate common profitability, liquidity, and solvency ratios. The goal is for students to understand how to apply mathematical concepts to analyze business performance and make financial decisions.

Uploaded by

VevianJavierCervantesCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

1K views36 pagesBusiness Applications of Ratios & Proportions

The document discusses how concepts like percentages, ratios, and proportions are used to solve various business problems involving partnerships, taxes, and financial statement analysis. It provides examples of how to determine partners' share of profits/losses, calculate tax liability, perform vertical and horizontal analysis of financial statements, and calculate common profitability, liquidity, and solvency ratios. The goal is for students to understand how to apply mathematical concepts to analyze business performance and make financial decisions.

Uploaded by

VevianJavierCervantesCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd