Professional Documents

Culture Documents

Applying Shariah Principles to Modern Finance

Uploaded by

nadeemuzairOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Applying Shariah Principles to Modern Finance

Uploaded by

nadeemuzairCopyright:

Available Formats

CANONICAL SHARIAH CONTRACTS

APPLIED TO MODERN FINANCE

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 1

CANONICAL SHARIAH CONTRACTS

APPLIED TO MODERN FINANCE

Dr. Muhammad Imran Usmani

Shariah Advisor

Guidance Financial Group

Washington DC

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 3

Prohibition of Riba

Those who take riba (usury or interest) will not stand but as stands the one whom the

demon has driven crazy by his touch. That is because they have said: Trading is but

like riba. So, whoever receives an advice from his Lord and stops, he is allowed what

has passed, and his matter is upto Allah. And the ones who revert back, those are the

people of Fire. There they remain forever.

Allah destroys riba and nourishes charities. And Allah does not like any sinful

disbeliever.

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 4

Definition of Riba

Sale (Bai):

To sell the commodities with specified

consideration

Lease (Ijarah):

To sell a particular usage with specified

compensation

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 5

Permissibility and Reward of Trade and

Joint Business Activities

Islam encourages trade and business activities

Allah (SWT) has ordained in Holy Quran

“Allah has permitted trade and prohibited Riba”

AHADITH

“If you leave behind wealthy heirs, it’s better than that of

leaving them needy and dependent on others and under

their control”

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 6

Prophet (SAW) once said

“Listen! Whoever becomes a guardian of an orphan who owns

some wealth, he should use it in trade and not leave it unutilized

in order to be consumed by sadaqah.

at another occasion he said

“An honest and trustworthy trader on the day of judgment will

be among Siddiqueen”

Prophet (SAW) also encouraged Shirkah in various

maxims and sayings

Prophet (SAW) once said that Allah (SWT) has stated: “He will

become a partners in a business between two Mushariks until

they indulge in cheating or breach of trust (Khayanat)

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 7

Importance of Purifying the

Source of Income in Islam

The body which is nourished by non-pure sources

is bound to hellfire.

On the day of Judgment, a person will not be

moved from the place which he stands until he is

asked about the sources of his income, and the

ways he spent it.

Purifying the source of ones’ nourishment is one

of the important reasons for the acceptance of

supplications by Allah.

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 8

SHARI’AH

1. Lexical meaning: Plain Way

(Siratul Mustaqim)

2. Technical meaning: The Divine

Law

Then We have put you (O prophet) on a plain way

of (our) commandment. So follow it and do not

follow the desires of those who do not know.

(45:18)

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 10

SOURCES OF SHARIAH

1. The Holy Qur’an

2. The Sunnah of the Holy Prophet (SAW)

3. Ijma’ (consensus of the Ummah)

4. Qiyas (Anology)

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 11

RULES OF SHARIAH

1. Three Prohibited Transaction

2. 1. Riba

• Riba Al Nase’ah

• Riba Al Fadhl

1. 2. Maysir

2. 3. Gharar :

3. Al Jahalah, Bai Qablal Qubz etc.

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 12

First Revelation about Riba

– “That which you give as interest to increase the

peoples' wealth increases not with God; but that which

you give in charity, seeking the goodwill of God,

multiplies manifold.” (Surah Rome, Verse 39)

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 13

Second Revelation

– “And for their taking interest even though it was forbidden

for them, and their wrongful appropriation of other peoples'

property. We have prepared for those among them who reject

faith a grievous punishment ” (Surah al-Nisa', verse 161)

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 14

Third Revelation

– “Believers! Do not swallow riba, doubled and

redoubled, and be mindful of Allah so that you

may attain true success” ( Al Imran, Ayat 130)

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 15

Fourth Revelation

Surah Al

Baqarah

Verses 274-281

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 16

Those who spend their wealth night and day, secretly and openly, they have their

reward with their Lord, and there is no fear for them, nor shall they grieve.

Those who take riba (usury or interest) will not stand but as stands the one whom

the demon has driven crazy by his touch. That is because they have said: Trading

is but like riba. So, whoever receives an advice from his Lord and stops, he is

allowed what has passed, and his matter is upto Allah. And the ones who revert

back, those are the people of Fire. There they remain forever.

Allah destroys riba and nourishes charities. And Allah does not like any sinful

disbeliever. Surely, those who believe and do good deeds, establish Salah and

Zakah have their reward with their Lord, and there is no fear for them,nor shall

they grieve.

O those who believe, fear Allah and give up what still remains of the riba if you

are believers. But if you don not, then listen to the declaration of war from Allah

and His Messenger. And if you repent, yours is your principal. Neither you

wrong, nor be wronged.

And if there be one in misery, then deferment till ease. And that you leave it as

alms is far better for you, if you really know. And be fearful of a day when you

shall be returned to Allah, then everybody shall be paid, in full, what he has

earned. And they shall not be wronged. (Verses of Surah Al Baqarah: 274-281)

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 17

Prohibition of Riba in Hadith

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 18

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 19

The prohibition of Interest is not limited to Islam, but

it is shared by Judaism and Christianity.

Some of the old testaments have rendered riba as haram (See Exodus 22:25,

Leviticus 25:35-36, Deutronomy 23:20, Psalms 15:5, Proverbs 28:8,

Nehemiah 5:7 and Ezakhiel 18:8,13,17 & 22:12).

Agibi Bank was established circa 700 B.C. in Babylonian

and functioned exclusively on equity basis.

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 20

ISLAMIC BANKING

CLASSIFICATION OF RIBA

– Riba-un-Nasiyah or Riba-al-Jahiliya

– Riba-al-Fadl or Riba-al-Bai

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 21

ISLAMIC BANKING

CLASSIFICATION OF RIBA

– Riba-un-Nasiyah or Riba-al-Jahiliya

“that kind of loan where specified repayment period

and an amount in excess of capital is

predetermined”( Imam Abu Bakr Jassas Razi)

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 22

ISLAMIC BANKING

CLASSIFICATION OF RIBA

– Riba-un-Nasiyah or Riba-al-Jahiliya

“all loans that draw interest is riba”(Hadith quoted

by Ali ibn Talib)

“the loan that draws profit is one of the forms of

riba”(definition from Sahabi Fazala Bin Obaid)

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 23

ISLAMIC BANKING

CLASSIFICATION OF RIBA

– Riba-un-Nasiyah or Riba-al-Jahiliya

real and primary form of riba

premium paid to the lender in return for his waiting

giving or taking of every excess amount in exchange

of a loan at an agreed rate irrespective of whether it

is low or high

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 24

ISLAMIC BANKING

CLASSIFICATION OF RIBA

– Riba-al-Fadl

Definition: Any excess that is without due consideration

For example: excess taken in exchange of specific commodities

(Al amwal Ur Ribawiyyah) which are homogeneous

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 25

ISLAMIC BANKING

CLASSIFICATION OF RIBA

– Hadith prohibiting Riba-al-Fadl

‘sell gold in exchange of equivalent gold

sell silver in exchange of equivalent silver

sell dates in exchange of equivalent dates

sell wheat in exchange of equivalent wheat

sell salt in exchange of equivalent salt

sell barley in exchange of equivalent barley

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 26

ISLAMIC BANKING

CLASSIFICATION OF RIBA

– Hadith prohibiting Riba-al-Fadl

sell barley in exchange of equivalent barley but if a person

transacts in excess, it will be riba.

However sell gold for silver anyway you please on the condition

it is hand-to-hand(spot sales) and sell barley for date anyway you

please on the condition it is hand-to-hand(spot sales)

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 27

ISLAMIC BANKING

CLASSIFICATION OF RIBA

– Imam Abu Hanifa on Riba-al-Fadl

commodities must have two common characteristics

– Weight

– Volume

includes all commodities having weight or volume

and are being exchanged

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 28

ISLAMIC BANKING

CLASSIFICATION OF RIBA

– Imam Shafi on Riba-al-Fadl

commodities must have two common characteristics

– be a medium of exchange

– be edible

includes all commodities that are edible or can be

used as a medium of exchange(currency)

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 29

ISLAMIC BANKING

CLASSIFICATION OF RIBA

– Imam Maalik on Riba-al-Fadl

commodities must have two common characteristics

– can be preserved

– be edible

includes all commodities that are edible and can be

preserved

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 30

ISLAMIC BANKING

CLASSIFICATION OF RIBA

– Imam Ahmad Bin Hanbal on Riba-al-Fadl

first citation conforms to the opinion of Imam Abu

Hanifa

second citation conforms to the opinion of Imam

Shafi

third citation includes three characteristics at the

same time i.e. edible, weight and volume

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 31

RIBA IN BANKING

On the both sides of the conventional banks

Riba exists:

On the Liabilities Side, through borrowing

from depositors on fixed and guaranteed

return

On the Assets side, through lending on

Interest basis.

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 32

Basic Difference between Islamic and

Conventional Modes of Finance

Conventional

money

Bank Client

money + money (interest)

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 33

Basic Difference between Islamic and

Conventional Modes of Finance

Islamic

Bank Goods & Client

Services

money

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 34

Theoretical Comparison

CONVENTIONAL ISLAMIC

BANKING BANKING

--------------------------- ---------------------------

Is based on interest.

Is based on profit or rent

Deals in money or papers. Deals in assets.

Is based on profit sharing on

Isbased on fixed return on both deposits side, and on profit

Sides of the balance sheet. on assets side.

Actively participates in

Does not involve itself in trade trade, production and valid

and business

services through valid

contracts.

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 35

CONTRACT IN ISLAM

CONTRACT

SUBJECT CONTRACTORS WORDING OF

MATTER CONTRACT

•Non-restricted •Present/immediate

•Specified •Unconditional

•Sane

•Quantified •Non-contingent

•Mature

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 36

CONTRACT IN ISLAM

CONDITIONAL CONTRACTS:

1. A condition, which is not against the contract, is a valid

condition.

For example a condition of free delivery to buyer’s

premises.

2. A condition, which seems to be against the contract, but it

is in the market practice, is not void, if its voidness is not

proved with the clear injunctions of the Holy Quran and

Sunnah.

For example a condition that the seller will provide five-

year guarantee and one year free service.

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 37

CONTRACT IN ISLAM

3. A condition that is against the contract and not in market

practice but is in favor of one of the contractors or subject

matter, the condition is void.

For example if ‘A’ sells a car with a condition that will

use it on a fixed date every month, this contract will be

void he.

4. A condition, which is against the contract, not in the

market practice and not in favor of any contractor, that is

not a void condition.

For example if both A and B decide to give to charity, a

certain percentage of both subject matter and

cosideration, upon completion of sale.

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 38

CONTRACT IN ISLAM

VOID CONDITIONS AND VOID CONTRACTS:

The contracts of compensation (Uqood Muawadha) like

sale, purchase, lease agreements become void by putting

void condition.

Non-compensatory (voluntary) agreements (Uqood Ghair

Muawadha) like contract of loan (Qard-e-Hasanah), do not

become void because of void condition. The void

condition, however, becomes itself ineffective.

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 39

ISLAMIC SALE CONTRACT

DEFINITION OF SALE(BAI)

– exchange of a thing of value with another thing

of value with mutual consent.

– the sale of a commodity in exchange of cash.

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 40

ISLAMIC SALE CONTRACT

TYPES OF SALE

1. Valid sale ( Bai Sahih)

2. Void/Non existing Sale ( Bai Baatil )

3. Existing sale but void due to defect ( Bai Fasid )

4. Valid but disliked sale ( Bai Makrooh )

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 41

ISLAMIC SALE CONTRACT

VALID SALE ( Bai Sahih)

– a sale is valid if all elements together with their

conditions are present

– elements of valid sale are

Contract ( Aqd )

Subject matter ( Mabe’e)

Price ( Thaman )

Possession or delivery ( Qabza )

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 42

ISLAMIC SALE CONTRACT

V a lid S a le

(B a i S a h i h )

C o n tra c t o r tra n s a c ti o n S o ld g o o d s o r P ri c e D e l i v e ry o r p o s s e s s i o n

(A q d ) s u b j e c t m a tte r (T h a m a n ) (Q a b z a )

(M u ta ' a q u a d e e n ) o n l y i n re s p e c t o f m o v a b l e

1 2 3 g o o d s , n o t im m o v a b le 4

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 43

ISLAMIC BANKING

ELEMENTS OF A VALID Contract

– Wording of the CONTRACT ( Aqd )

Offer & Acceptance ( Ijab-o-Qobool)

– Oral ( Qauli )

– Implied ( Hukmi)

• Credit sales (e.g. Istijrar )

• Hand to Hand ( e.g. Taati )

The contractors ( Muta’aquadeen ) must be

– Sane

– Mature

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 44

ISLAMIC BANKING

– Wording of the Contract( Aqd )

– Contract must be immediate

– Contract must be non-contingent

• unconditional contract

• under reasonable conditions

• under unreasonable conditions but at market practice

and not against the clear injunctions of Islam

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 45

ISLAMIC BANKING

C o n tra c t o r T ra n s a c tio n

(A q d )

O ffe r & A c c e p ta n c e B u y e r & S e lle r C o n d itio n s o f C o n tra c t

(Ija b -o -Q o b o o l) (M u ta ' a q u a d e e n ) (S h a ra e t-e -A q d )

1 .1 1 .2 1 .3

O ra l Im p lie d S ane M a tu re S a le m u s t b e S a le m u s t b e im m e d ia te

(Q a u li) (Is h a ra a ) (If m in o r, m u s t u n d e rs ta n d n o n -c o n tin g e n t N o t d e fe rre d to fu tu r e

(In p a s t te n s e ) (In p a s t te n s e ) n a tu re o f tra n s a c tio n ) (e g p ro p e rty m u s t p a s s 1 .3 .2 .

1 .1 .1 1 .1 .2 1 .2 .1 . 1 .2 .2 1 .3 .1 o n s a le d a te n o t o n fu tu re d a te

C re d it S a le C a s h S a le U n c o n d itio n a l c o n tra c t U n d e r re a s o n a b le c o n d itiio n s U n d e r u n re a s o n a b le c o n d itio n

(Is tijra r) (T a a ti) b u t in m a rk e t p ra c tic e

(e g s e ttle m e n t a t th e e n d (e g a s in s u p e rm a rk e ts ) (e g . w a rra n ty o f 1 y e a r

o f th e m o n th ) 1 .1 .2 (a ) 1 .1 .2 (b ) 1 .3 .1 (a ) 1 .3 .1 (b ) o n s a le o f frid g e 1 .3 .1 .(c )

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 46

ISLAMIC BANKING

ELEMENTS OF A VALID SALE ( Bai Sahih)

– SOLD GOOD OR SUBJECT MATTER

( Mube’e )

Existing

Valuable

Usable

Capable of ownership/title

Capable of delivery/possession

Specific & Quantified

Seller must have title & risk

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 47

ISLAMIC BANKING

ELEMENTS OF A VALID SALE ( Bai

Sahih)

– PRICE ( Saman )

Quantified ( Maloom )

Specified & certain ( Muta’aiyan )

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 48

ISLAMIC BANKING

ELEMENTS OF A VALID SALE ( Bai Sahih)

– DELIVERY OR POSSESSION (QABZA)

Physical ( Haqiqi )

Constructive ( Hukmi )

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 49

Major Contracts Used in

Islamic Banking

Buying & Selling (Murabaha, Musawama,

Tawarruq)

Mudaraba/Qiradh: Investment management

Musharaka: Partnership

Ijarah: Leasing

Wakalatul Istismar/Ijaratu Alashkas: Agency

Istisna’/ Muqawala: Contract of works

Salam: Forward sale contract

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 50

Inception of Islamic Banking

Dubai Islamic Bank - 1975

- modest beginnings

- Initiated by businessmen who did not

want to deal with interest based system

- Hostile environment

- Challenged by conventional banking

system

- Lack of public awareness

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 51

Success Story

200 + Islamic financial institutions

$ 100 - 200 billions in funds

Issuance of Islamic Bonds (Sukuk)

Post graduate degrees offered in Islamic

banking by major academic institutions

Important database system (HIFIP)

Standards for the Industry (AAOIFI)

Recognition by IMF, World Bank and Basel

Committee

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 52

TYPES OF ISLAMIC

INSTITUTIONS

• Islamic Commercial Banks

• DMI, Al Barakah, Al Rajihi)

• Islamic Investment Banks

• First Islamic Investment Bank, Amana Investment

(HSBC), Noriba (UBS), CitiIslamic Inv. Bank.

• Islamic Units of conventional banks

• UBS, Deuche Bank, Credit Swiss, Standard Chart.

Dresdner Bank.

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 53

TYPES OF ISLAMIC

INSTITUTIONS

•Islamic Funds:

•Property fund, Equity fund, Islamic Hedge Fund, Murabaha fund,

Capital Protected fund, investment fund, trade fund etc.

•Islamic House Financing Schemes

UBK, Al Manzil, Guidance group US, Lariba, Al

Maskan LLC

•International Financial Market (e.g.

AAOIFI, ICD etc.)

•International Institutions of Islamic Banking

•Islamic Market Index (DJIM, TII)

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 54

Uniqueness of Islamic Banking

Commingling between Finance & Religion and

ethics

Sharia Supervisory Boards (SSB)

– Studies Articles of associations and bylaws

– Approval of all contracts

– Contribute in designing new products

– Audit the actual implementations

– Issuance of Fatwas (Responsas)

– Conferences - Research - Training

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 55

Principles of Islamic Business

1. The Objectives and philosophies of Islamic

banks must thus be in line with the teachings of

Quran and Sunnah of the Prophet (PBUH)

2. Eliminating riba is an important task, but Islamic

banks, by default, must conform to all other

Islamic business principles

3. All teachings imposed on Muslim individuals are

also applicable to Islamic banks

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 56

Important Achievements

Encouraging and attracting depositors for Halal

investments

Channeling depositors’ funds into productive and

commercially beneficial activities

Relieving Muslims from trading in prohibited

sectors or activities (e.g. opening an LC for

alcoholic beverages

Encouraging Zakat and charity

Disseminating knowledge in the field of Islamic

transaction law (Fiqh al-Mu’amalat)

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 57

Educating Muslim scholars in modern

banking

Encouraging Takaful (Islamic Insurance)

Gaining wide acceptance in the

international financial community

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 58

The Way Ahead

Islamic banks must develop the concept of Musharakah

(participating in profit & loss) and Mudaraba, and use it

more aggressively

Adopt new financing policies to encourage development

and support for the small scale traders

Develop the Islamic liquidity management and Islamic

money market

Must improve its services to be competitive with the best

in the market

Must arrange the Train The Trainers programs for

scholars, bankers, businessmen and professionals

07/20/20 Dr. Muhammad Imran Usmani- Pakistan 59

Thank You

You might also like

- OLW 103 THE LAW OF CONTRACT (Part Three)Document46 pagesOLW 103 THE LAW OF CONTRACT (Part Three)Moza Abdallah60% (5)

- Bentham Princ LegislationDocument324 pagesBentham Princ LegislationShawn Louis TickleNo ratings yet

- Becoming A Solicitor November 2019 PDFDocument13 pagesBecoming A Solicitor November 2019 PDFVladimir KandinskiNo ratings yet

- Tort Law Oct Nov 2009Document4 pagesTort Law Oct Nov 2009Gabrielle MyersNo ratings yet

- Assignment 1 Business LawDocument16 pagesAssignment 1 Business LawGoabaone Motsele100% (2)

- Alpine Bulk Transport Company Inc. V Saudi Eagle Shipping Company LimitedDocument5 pagesAlpine Bulk Transport Company Inc. V Saudi Eagle Shipping Company LimitedKomba John100% (1)

- Acrow (Automation) Ltd. V Rex Chainbelt Inc. and Another (1971) - 1-W.L.R.-1676 PDFDocument9 pagesAcrow (Automation) Ltd. V Rex Chainbelt Inc. and Another (1971) - 1-W.L.R.-1676 PDFTan KSNo ratings yet

- Seat, lex arbitri, merits law in international arbitrationDocument10 pagesSeat, lex arbitri, merits law in international arbitrationfaaderinto5964No ratings yet

- Chapter 26 BLDG and Construction LawDocument17 pagesChapter 26 BLDG and Construction Lawlwin_oo2435No ratings yet

- Dispute Resolution Contract The Ultimate Step-By-Step GuideFrom EverandDispute Resolution Contract The Ultimate Step-By-Step GuideNo ratings yet

- R V Panel On Takeovers and MergersDocument2 pagesR V Panel On Takeovers and Mergersanon_826995160No ratings yet

- 1047 Wells V Army and NavyDocument1 page1047 Wells V Army and Navyfhsn84No ratings yet

- Ca 2016 PDFDocument33 pagesCa 2016 PDFMelvin OngNo ratings yet

- Chapter 5 Intention To Create Legal RelationDocument7 pagesChapter 5 Intention To Create Legal RelationZuhyri MohamadNo ratings yet

- Sale of GoodsDocument42 pagesSale of Goodsjohn7tagoNo ratings yet

- Department of Law Bahria University Islamabad Assignment On "Right of Stoppage in Transit"Document12 pagesDepartment of Law Bahria University Islamabad Assignment On "Right of Stoppage in Transit"Muhammad IbrahimNo ratings yet

- Zimbabwean Courts' Approach to Statutory InterpretationDocument5 pagesZimbabwean Courts' Approach to Statutory Interpretationzee samkangeNo ratings yet

- Eisen Con Law Full Year LsaDocument143 pagesEisen Con Law Full Year LsaJjjjmmmmNo ratings yet

- Stabilization Clauses in International Investment LawDocument6 pagesStabilization Clauses in International Investment LawMulugeta AkaluNo ratings yet

- Sierra Leone Legal System AssignmentDocument6 pagesSierra Leone Legal System AssignmentEmmanuel Steven Koroma100% (1)

- 9084 s16 QP 41 PDFDocument4 pages9084 s16 QP 41 PDFAbbas Khan Mirani100% (1)

- Cosmic Insurance Corp Inc Vs C.P. KhooDocument5 pagesCosmic Insurance Corp Inc Vs C.P. KhooAzeera YahyaNo ratings yet

- I T A T, PDocument43 pagesI T A T, PAditya WadhwaNo ratings yet

- CQS Application Form 2018Document13 pagesCQS Application Form 2018rthomsanNo ratings yet

- TABL1710 AssignmentDocument7 pagesTABL1710 AssignmentAsdsa Asdasd100% (1)

- TOPIC 3 (Relationship Between International and National Law)Document12 pagesTOPIC 3 (Relationship Between International and National Law)Putry Sara RamliNo ratings yet

- Privity of Contracts ExplainedDocument6 pagesPrivity of Contracts ExplainedShashank Surya100% (1)

- Citizenship Act, 2000: Ghana's Citizenship LawsDocument9 pagesCitizenship Act, 2000: Ghana's Citizenship LawsTIMORENo ratings yet

- GammonDocument9 pagesGammonLouis LaiNo ratings yet

- Course Outline Department of Law City UniversityDocument6 pagesCourse Outline Department of Law City UniversityFotik BiswasNo ratings yet

- Au Kong Weng v. Bar Committee, PahangDocument5 pagesAu Kong Weng v. Bar Committee, PahangsymphonymikoNo ratings yet

- (Yas Center) - Tài Liệu Đào Tạo Anh Văn Pháp Lý Hợp ĐồngDocument27 pages(Yas Center) - Tài Liệu Đào Tạo Anh Văn Pháp Lý Hợp ĐồngTrãi NguyễnNo ratings yet

- Conveyancing Questions AnsweredDocument6 pagesConveyancing Questions Answeredsimdumise magwalibaNo ratings yet

- Section 114a A Presumption of GuiltDocument13 pagesSection 114a A Presumption of GuiltHanenFamNo ratings yet

- Sources of Law: Public Law Week 2 Prof Javier García OlivaDocument23 pagesSources of Law: Public Law Week 2 Prof Javier García OlivaJadeMysteryNo ratings yet

- The Malaysian Legal System ExplainedDocument143 pagesThe Malaysian Legal System ExplainednnnnnnnNo ratings yet

- Cyber SpaceDocument10 pagesCyber SpaceKOTAMRAJUNo ratings yet

- Customary LawDocument26 pagesCustomary LawNor Karmila RoslanNo ratings yet

- The Construction Industry of Zimbabwe ConstitutionDocument26 pagesThe Construction Industry of Zimbabwe ConstitutionMajaya JonasNo ratings yet

- TUTORIAL - 3 Certainties (Sample Answer)Document4 pagesTUTORIAL - 3 Certainties (Sample Answer)billyboy221No ratings yet

- Interpretation of ContractDocument18 pagesInterpretation of Contractkumar PritamNo ratings yet

- Alternative Dispute ResolutionDocument158 pagesAlternative Dispute ResolutionBesnner SungwaNo ratings yet

- Right To Fair TrialDocument21 pagesRight To Fair TrialE-zool AzryNo ratings yet

- Natural Resource Governance: New Frontiers in Transparency and AccountabilityDocument69 pagesNatural Resource Governance: New Frontiers in Transparency and Accountabilitymahdi sanaeiNo ratings yet

- Ingraham v. McEwanDocument13 pagesIngraham v. McEwanKrysie Fenty100% (1)

- Qatari Civil CodeDocument297 pagesQatari Civil CodeSandbucketNo ratings yet

- Overview of Financial Services Act 2013Document11 pagesOverview of Financial Services Act 2013FatehahNo ratings yet

- Casebook Vol 1 International SalesDocument168 pagesCasebook Vol 1 International SalesLion YangNo ratings yet

- Making Off Without Payment NotesDocument5 pagesMaking Off Without Payment Notes259bjfcsc9No ratings yet

- Legal Research Trail for Jessica Java CaseDocument14 pagesLegal Research Trail for Jessica Java CaseClement LingNo ratings yet

- Distinction Between Joint Venture andDocument5 pagesDistinction Between Joint Venture andashnajananNo ratings yet

- Study Guide 3 - Actus ReusDocument14 pagesStudy Guide 3 - Actus ReusSurihya101No ratings yet

- Part 1 - Hand Book NEWDocument31 pagesPart 1 - Hand Book NEWKamal GhafurNo ratings yet

- Lau Siew Kim V Yeo Guan Chye Terence and Another (2008) 2 SLR (R) 0108Document66 pagesLau Siew Kim V Yeo Guan Chye Terence and Another (2008) 2 SLR (R) 0108contestantlauNo ratings yet

- WAINCYMER. Procedure and Evidence in International ArbitrationDocument48 pagesWAINCYMER. Procedure and Evidence in International ArbitrationFernanda Magni BerthierNo ratings yet

- Case Report On Salford Estates (No. 2) Limited V AltoMart LimitedDocument2 pagesCase Report On Salford Estates (No. 2) Limited V AltoMart LimitedIqbal MohammedNo ratings yet

- Legal Scholar Gukiina Patrick Musoke On The Concept of Technicalities in Uganda's Justice SystemDocument64 pagesLegal Scholar Gukiina Patrick Musoke On The Concept of Technicalities in Uganda's Justice SystemGukiina PatrickNo ratings yet

- EDP Internal Control Questionnaire-FinalDocument3 pagesEDP Internal Control Questionnaire-FinalnadeemuzairNo ratings yet

- co manual_watermarkDocument103 pagesco manual_watermarknadeemuzairNo ratings yet

- pp manuals_watermarkDocument173 pagespp manuals_watermarknadeemuzairNo ratings yet

- Difference between GAAP and IFRSDocument7 pagesDifference between GAAP and IFRSnadeemuzairNo ratings yet

- I7 - IT Service Request & Problem HandlingDocument1 pageI7 - IT Service Request & Problem HandlingnadeemuzairNo ratings yet

- In Modern Banking EnvironmentDocument2 pagesIn Modern Banking EnvironmentnadeemuzairNo ratings yet

- HandwritingresoucesDocument50 pagesHandwritingresoucesnadeemuzairNo ratings yet

- IT Audit RDC Islamabad-2009Document55 pagesIT Audit RDC Islamabad-2009nadeemuzairNo ratings yet

- AudQuerry For IT AuditorsDocument13 pagesAudQuerry For IT AuditorsnadeemuzairNo ratings yet

- Risk Rating For IT Audit of BranchDocument12 pagesRisk Rating For IT Audit of BranchnadeemuzairNo ratings yet

- Chapter 12Document8 pagesChapter 12nadeemuzairNo ratings yet

- I3 - IT Operational Change ManagementDocument1 pageI3 - IT Operational Change ManagementnadeemuzairNo ratings yet

- Class 7 Reinforcement Worksheet Algebra 2Document3 pagesClass 7 Reinforcement Worksheet Algebra 2nadeemuzairNo ratings yet

- ForceDocument24 pagesForcenadeemuzairNo ratings yet

- Algebra 1 Reinforcement WorksheetDocument2 pagesAlgebra 1 Reinforcement WorksheetnadeemuzairNo ratings yet

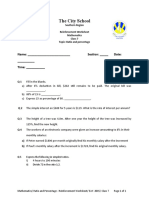

- The City School: Name: - SecDocument2 pagesThe City School: Name: - SecnadeemuzairNo ratings yet

- Class 6 9 Reinforcement Worksheet Algebra 3Document2 pagesClass 6 9 Reinforcement Worksheet Algebra 3nadeemuzairNo ratings yet

- Stability and Financial Performance of IDocument64 pagesStability and Financial Performance of InadeemuzairNo ratings yet

- Class 7 Reinforcement Worksheet Ratio and PercentageDocument1 pageClass 7 Reinforcement Worksheet Ratio and PercentagenadeemuzairNo ratings yet

- Class 7 Extended Worksheet of Ratio and RateDocument2 pagesClass 7 Extended Worksheet of Ratio and RatenadeemuzairNo ratings yet

- The City School: North Nazimabad Girls Campus Ratio and Rate Revision Worksheet (Mathematics Class - 7)Document2 pagesThe City School: North Nazimabad Girls Campus Ratio and Rate Revision Worksheet (Mathematics Class - 7)nadeemuzairNo ratings yet

- Class 7 Reinforcement Worksheet Algebra 2Document3 pagesClass 7 Reinforcement Worksheet Algebra 2nadeemuzairNo ratings yet

- Class 6 8 Reinforcement Worksheet Algebra 2Document4 pagesClass 6 8 Reinforcement Worksheet Algebra 2nadeemuzairNo ratings yet

- Algebra 1 Reinforcement WorksheetDocument2 pagesAlgebra 1 Reinforcement WorksheetnadeemuzairNo ratings yet

- Web ResourcesDocument1 pageWeb ResourcesnadeemuzairNo ratings yet

- Class 6 7 Reinforcement Worksheet Algebra 1Document2 pagesClass 6 7 Reinforcement Worksheet Algebra 1nadeemuzairNo ratings yet

- The City School: Abc BadDocument3 pagesThe City School: Abc BadnadeemuzairNo ratings yet

- Class 7 Reinforcement Worksheet Ratio and PercentageDocument1 pageClass 7 Reinforcement Worksheet Ratio and PercentagenadeemuzairNo ratings yet

- Sea Breeze - Causes, Diagram and Effects - JotscrollDocument5 pagesSea Breeze - Causes, Diagram and Effects - JotscrollnadeemuzairNo ratings yet

- Topic - Ratio Rate and SpeedDocument4 pagesTopic - Ratio Rate and SpeednadeemuzairNo ratings yet

- Historical Development of Fiqh Al - IslamiyDocument23 pagesHistorical Development of Fiqh Al - IslamiyFatin AnatiNo ratings yet

- Dua Musbaat AasharDocument1 pageDua Musbaat AasharJaveed TajiNo ratings yet

- FINAL Ramadhan Booklet 1Document36 pagesFINAL Ramadhan Booklet 1Nurul HidayatNo ratings yet

- The Small Kindnesses SurahDocument1 pageThe Small Kindnesses SurahMuzniNo ratings yet

- Kitaabut TahaarahDocument106 pagesKitaabut TahaarahCalogero Salomon100% (1)

- Easy Good DeedsDocument2 pagesEasy Good DeedsMohamed YousufNo ratings yet

- NO Nama Mahasiswa SizeDocument16 pagesNO Nama Mahasiswa SizeMhmmd AlimNo ratings yet

- Isu-Isu Fiqh Semasa Berkaitan Zakat Pertanian Di Malaysia Current Issues Relating To Fiqh in Agricultural Zakah in MalaysiaDocument28 pagesIsu-Isu Fiqh Semasa Berkaitan Zakat Pertanian Di Malaysia Current Issues Relating To Fiqh in Agricultural Zakah in MalaysiaPI1062210 Muhammad Iman FirdausNo ratings yet

- PIP Yang Belum Atau Tidak MengajukanDocument226 pagesPIP Yang Belum Atau Tidak MengajukanNatasya NANo ratings yet

- Fatihah in PrayersDocument7 pagesFatihah in PrayersMuhammad MudasarNo ratings yet

- Tavi V Islamuri Dresaswaulebi Da Rituali 1. Hijris KalendariDocument14 pagesTavi V Islamuri Dresaswaulebi Da Rituali 1. Hijris KalendariEsmira ZeinalovaNo ratings yet

- Imam Ahmad Raza Khan Barelwi - 14th Century MujaddidDocument16 pagesImam Ahmad Raza Khan Barelwi - 14th Century Mujaddidfaisal.noori5932100% (8)

- DoaDocument2 pagesDoaMuhammad Evan AryaputraNo ratings yet

- Fiqh of TaharaDocument10 pagesFiqh of Taharaabdullah.coNo ratings yet

- Islam 4Document2 pagesIslam 4Mohamed ShameemNo ratings yet

- Dua at The Time of Sighting The MoonDocument2 pagesDua at The Time of Sighting The MoonAhmedNazeerMohammedNo ratings yet

- Lucknow, India: Monthly Prayer Times in LucknowDocument2 pagesLucknow, India: Monthly Prayer Times in LucknowAbrarul HaqueNo ratings yet

- The Best Way of Life For A MuslimDocument21 pagesThe Best Way of Life For A Muslimkhajas7No ratings yet

- 7 Prayers To Get Married Soon - Useful Best Dua For MarriageDocument4 pages7 Prayers To Get Married Soon - Useful Best Dua For MarriageHabib Mohammed100% (2)

- How To Perform PrayerDocument8 pagesHow To Perform Prayerfarezali100% (1)

- Fasting Made EasyDocument16 pagesFasting Made EasyMuhammudNo ratings yet

- Bed Time DuasDocument8 pagesBed Time DuasKAUSAR SHAIKHNo ratings yet

- Tahajjud PrayerDocument6 pagesTahajjud Prayeryasiraslam100% (1)

- The Book of Prayer (Kitaab Us Salaat)Document52 pagesThe Book of Prayer (Kitaab Us Salaat)manzoorlibraNo ratings yet

- Masa'il Min Al-Usul, Ibn Hazm Rahimahu AllahDocument30 pagesMasa'il Min Al-Usul, Ibn Hazm Rahimahu AllahAnonymous 3RHGzEvXjbNo ratings yet

- Five Pillars of IslamDocument2 pagesFive Pillars of IslamSyed HabeebUllah Quadri AlMultaniNo ratings yet

- Al Diyafah High School Prayer ChartsDocument4 pagesAl Diyafah High School Prayer ChartsMichael WestNo ratings yet

- The Contemporary Model of Waqf StructureDocument14 pagesThe Contemporary Model of Waqf StructureMOHAMAD I'SA BIN ABD JALIL -No ratings yet

- 21.pillars of Islam-FastingDocument1 page21.pillars of Islam-FastingSaad AliNo ratings yet

- Al-Kafi: The Life and Works of Muhammad bin Yaqoob Al-Kulayni (A.RDocument19 pagesAl-Kafi: The Life and Works of Muhammad bin Yaqoob Al-Kulayni (A.RFatima RajaniNo ratings yet