Professional Documents

Culture Documents

Henry 2018 Corporate Tax Avoidance

Uploaded by

Tiara Sistha0 ratings0% found this document useful (0 votes)

43 views12 pagesppt seminar akuntansi

Original Title

henry 2018 Corporate tax avoidance

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentppt seminar akuntansi

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

43 views12 pagesHenry 2018 Corporate Tax Avoidance

Uploaded by

Tiara Sisthappt seminar akuntansi

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 12

Corporate tax

avoidance: data

truncation and loss

firms

1. Intan Saras Wati (20171112094)

2. Astri Widya Permata (20171112098)

3. Rosalia Setya Utami (20171112117)

4. Siti Saripah Noviyanti (20171112124)

Purpose

This study is examine the extent to which

inferences about corporate tax avoidance over the

past twenty-seven years (1988-2014) change

when we examine the full population of firms, as

opposed to a profitable and/or taxable subsample.

Your Date Here Your Footer Here 2

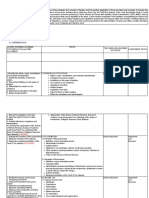

Introduction

• These studies primarily

measure the extent to • Focus on the

• To date, our which a firm is tax-

population of

understanding of favored using:

domestic

corporate tax 1) an effective tax rate corporations and

avoidance is limited measure, constructed as the construct one-, five-

to firms with positive ratio of financial statement

and ten-year

pre-tax income tax expense to pretax book

income (GAAP ETR) or measures of Δ/MVA

and/or current tax

cash taxes paid to pretax for both our full

expense because book income (Cash ETR), sample and the

most extant studies

2) a book-tax difference subsample of firms

of tax avoidance

(BTD) measure that with positive income

omit loss firm-year

observations. captures the difference and current tax

between pre-tax book expense.

income and estimated

taxable income.

3

Sample

• U.S. corporations from 1988 to 2014

• One-year tax avoidance measures

• Full sample of 124,514 one-year observations

Your Date Here Your Footer Here 4

Variable

• Dependent • Independent

Variable : Variable :

Corporate tax Data truncation

avoidance and loss firms

Your Date Here Your Footer Here 5

Approach

• The author choose the statutory tax rate as the

benchmark because ETR studies routinely frame

their analyses in terms of why the ETR deviates

from the statutory rate, and we follow the same

approach (e.g., GAO 2016; Dyreng, Hoopes, and

Wilde 2016) .

Measurement of Tax Avoidance

• If there were no book-tax differences (either permanent or

temporary), no deferral of U.S. tax on foreign earnings (i.e.,

immediate repatriation of foreign earnings), no general

business tax credits, no alternative minimum tax, no state income

tax, and immediate refunds for taxable losses, then Δ would be

zero for all firms.

• If Δ is less than zero, the firm is tax-favoured

• If Δ is greater than zero, the firm is taxdisfavored.

Your Date Here Your Footer Here 7

Limitation

• Corporate tax avoidance is limited to firms with

positive pre-tax income and/or current tax

expense because most extant studies of tax

avoidance omit loss firm-year observations.

• The measure overcomes a significant limitation

of previous measures of tax avoidance but the

author note its shortcomings so that researchers

may carefully consider its use.

Your Date Here Your Footer Here 9

Findings

• Find that domestic firms are more tax-disfavored

than multinationals for every year in our sample

period.

• Domestic firms become more tax-disfavored

over time, while tax avoidance within

multinational firms appears to remain relatively

constant, which is opposite the conclusion

gleaned from the positive PTI and CTE

subsample.

Your Date Here Your Footer Here 10

Contribution

• Introduce a • Contrary to the • The primary

meaningful tax conventional wisdom, contribution of

the average domestic our measure is

avoidance corporation and many

measure for all that, unlike most

industries thought to

observations.. be aggressive tax measures of

avoiders are actually corporate tax

tax-disfavored due to avoidance, it is

the tax system’s defined for the

asymmetric treatment full population of

of profits and losses.

publicly traded

firms.

Your Date Here Your Footer Here 11

Result

• This result is further supported by a significant negative

association between the linear time trend variable (TIME) and

both CETR1 and Δ/MVA1 in the positive PTI and CTE

subsample.

• The literature excludes the effect of company losses on the

level of corporate tax avoidance.

Your Date Here Your Footer Here 12

You might also like

- Canadian Income Tax - Buckwold Kitunen - 14e SolutionsDocument104 pagesCanadian Income Tax - Buckwold Kitunen - 14e SolutionsMilica Kalinic40% (5)

- Week 1 Multiple Choice Questions - SolutionDocument3 pagesWeek 1 Multiple Choice Questions - SolutionXirui gao67% (3)

- Canadian Tax Planning and Decision Making GuideDocument33 pagesCanadian Tax Planning and Decision Making Guidendaguiam100% (1)

- Homework (AC 423) CHP 5&6 - Loh Yi ChengDocument12 pagesHomework (AC 423) CHP 5&6 - Loh Yi ChengDavid LohNo ratings yet

- Corporate Tax Avoidance: Data Truncation and Loss FirmsDocument49 pagesCorporate Tax Avoidance: Data Truncation and Loss FirmsSarasefeika mutiara RifkasariNo ratings yet

- Financial Reporting - Advanced - Tax Rate ReconciliationsDocument6 pagesFinancial Reporting - Advanced - Tax Rate ReconciliationsTami ChitandaNo ratings yet

- Long-Run Corporate Tax Avoidance: Prevalence and CharacteristicsDocument48 pagesLong-Run Corporate Tax Avoidance: Prevalence and CharacteristicsAbdulAzeemNo ratings yet

- EbitdaDocument4 pagesEbitdaVenugopal Balakrishnan NairNo ratings yet

- Factors Influencing Tax Avoidance PDFDocument6 pagesFactors Influencing Tax Avoidance PDFJoseNo ratings yet

- 25 Questions on DCF ValuationDocument4 pages25 Questions on DCF ValuationZain Ul AbidinNo ratings yet

- 03-Measures of Perfomance in Private SectorDocument5 pages03-Measures of Perfomance in Private SectorHastings KapalaNo ratings yet

- Operation Management: Leopando Mahilom Maru Matugas Mayhew VilloriaDocument28 pagesOperation Management: Leopando Mahilom Maru Matugas Mayhew VilloriaYna CabreraNo ratings yet

- DeferredTaxAccountingandFinancialPerformance. Olaoye ClementDocument9 pagesDeferredTaxAccountingandFinancialPerformance. Olaoye ClementOlanrewaju JoeNo ratings yet

- Long-Run Corporate Tax Avoidance: The University of North Carolina at Chapel HillDocument22 pagesLong-Run Corporate Tax Avoidance: The University of North Carolina at Chapel HillHendrawanNo ratings yet

- M1 TaxmanDocument13 pagesM1 TaxmanIris GamiaoNo ratings yet

- Effective Tax Planning: Casey - Schwab@unt - EduDocument51 pagesEffective Tax Planning: Casey - Schwab@unt - EduIlham FajarNo ratings yet

- Mind The (Tax) Gap-Its Bigger Than You Probably Think! Tax Gap Research: Concepts, Methodologies and FindingsDocument37 pagesMind The (Tax) Gap-Its Bigger Than You Probably Think! Tax Gap Research: Concepts, Methodologies and Findingsxilo10No ratings yet

- SAVANT FrameworkDocument19 pagesSAVANT Frameworkmarjorie blancoNo ratings yet

- Tax Planning Strategies and Effective Tax RatesDocument27 pagesTax Planning Strategies and Effective Tax RatesDewaZaidyNo ratings yet

- Factors Affecting Earnings Management THDocument18 pagesFactors Affecting Earnings Management THIbrahim Dhia FurqoniNo ratings yet

- Effect of Good Corporate Governance, Profitability and Leverage On Tax Avoidance Behavior Before and After Tax AmnestyDocument6 pagesEffect of Good Corporate Governance, Profitability and Leverage On Tax Avoidance Behavior Before and After Tax AmnestyAli FarhanNo ratings yet

- Accounting in A Nutshell 4: Deferred TaxesDocument3 pagesAccounting in A Nutshell 4: Deferred TaxesBusiness Expert PressNo ratings yet

- Multinational Tax Avoidance: Is It All About Profit Shifting?Document46 pagesMultinational Tax Avoidance: Is It All About Profit Shifting?ROGER ALVARADO ARENASNo ratings yet

- Inventory: Change Comparatives AlsoDocument3 pagesInventory: Change Comparatives AlsoLennyNo ratings yet

- Roxanne Project ICT 104Document13 pagesRoxanne Project ICT 104Temitope AdekoyaNo ratings yet

- Financial Management Class Part 2-KasetsartDocument66 pagesFinancial Management Class Part 2-KasetsartKong KrcNo ratings yet

- Profitability RatiosDocument24 pagesProfitability RatiosEjaz Ahmed100% (1)

- Effect of Corporate Tax Aggressiveness On Firm Growth in Nigeria An Empirical AnalysisDocument12 pagesEffect of Corporate Tax Aggressiveness On Firm Growth in Nigeria An Empirical AnalysisEditor IJTSRDNo ratings yet

- Income Statement and Accrual AccountingDocument7 pagesIncome Statement and Accrual AccountingJordan Neo Yu Hern100% (1)

- Module 9 - Basic Principles of Tax PlanningDocument15 pagesModule 9 - Basic Principles of Tax PlanningAlice WuNo ratings yet

- Dividend Policy Analysis and Equity Valuation TechniquesDocument13 pagesDividend Policy Analysis and Equity Valuation TechniquesKhan UmairNo ratings yet

- Lecture 1Document31 pagesLecture 1api-275959008No ratings yet

- Earnings Before Interest, Taxes, Depreciation and AmortizationDocument4 pagesEarnings Before Interest, Taxes, Depreciation and AmortizationGaurav KukadeNo ratings yet

- Tax Planning Strategies Impact on Firm Value in Nigerian Consumer Goods SectorDocument12 pagesTax Planning Strategies Impact on Firm Value in Nigerian Consumer Goods SectorIlham FajarNo ratings yet

- What Is Synergy?: Why Is There A Large Difference Between Share Value and Stockholders' Equity?Document71 pagesWhat Is Synergy?: Why Is There A Large Difference Between Share Value and Stockholders' Equity?vinodhategirlsNo ratings yet

- Chapter 3 FINDocument15 pagesChapter 3 FINVince HernandezNo ratings yet

- Preface: What Is The Tax Planning ?Document29 pagesPreface: What Is The Tax Planning ?SpUnky RohitNo ratings yet

- Corporate Tax Rates Guide: An Overview of Global Tax SystemsDocument56 pagesCorporate Tax Rates Guide: An Overview of Global Tax SystemsKundan PrasadNo ratings yet

- Financial Terms Related To TaxDocument11 pagesFinancial Terms Related To TaxGustavoNo ratings yet

- The Effect of Corporate Income Tax On Financial Performance of Listed Manufacturing Firms in GhanaDocument8 pagesThe Effect of Corporate Income Tax On Financial Performance of Listed Manufacturing Firms in GhanaAlexander DeckerNo ratings yet

- Workbook On Corporate TaxDocument19 pagesWorkbook On Corporate TaxMrityunjayChauhanNo ratings yet

- Determinants of Corporate Tax Avoidance: Non-Tax Costs and Tax Authority ScrutinyDocument55 pagesDeterminants of Corporate Tax Avoidance: Non-Tax Costs and Tax Authority Scrutinysga_centerNo ratings yet

- Corporate TaxDocument29 pagesCorporate Taxsu_pathriaNo ratings yet

- Preface: What Is The Tax Planning ?Document29 pagesPreface: What Is The Tax Planning ?su_pathriaNo ratings yet

- Reducing TaxesDocument1 pageReducing TaxesRob MalcolmNo ratings yet

- Fundamentals of Accounting Notes Types of Businesses and UsesDocument4 pagesFundamentals of Accounting Notes Types of Businesses and UsesSALENE WHYTENo ratings yet

- Taxation Dissertation TopicsDocument7 pagesTaxation Dissertation TopicsInstantPaperWriterCanada100% (1)

- Amin Tax PackDocument12 pagesAmin Tax Packsimonlakeman81No ratings yet

- 1 s2.0 S1059056096900350 MainDocument15 pages1 s2.0 S1059056096900350 Maineyob abrhaNo ratings yet

- Tax Avoidance and Tax EvasionDocument11 pagesTax Avoidance and Tax EvasionYashVardhan100% (1)

- Finance Concepts: Question & AnswersDocument21 pagesFinance Concepts: Question & AnswersArnab DebNo ratings yet

- Evaluate The MattersDocument3 pagesEvaluate The MattersLennyNo ratings yet

- Manage business taxes and expensesDocument2 pagesManage business taxes and expensesHarryNo ratings yet

- Tax Accounting vs GAAP ForumDocument4 pagesTax Accounting vs GAAP Forumadhi anoragaNo ratings yet

- PK Tax News Dec 2008Document2 pagesPK Tax News Dec 2008PKTaxServicesNo ratings yet

- Financial Ratios Guide: Liquidity, Management, Profitability & Risk MetricsDocument26 pagesFinancial Ratios Guide: Liquidity, Management, Profitability & Risk MetricsrajeshNo ratings yet

- Tax AccountingDocument7 pagesTax Accountingjeka0521No ratings yet

- Tata SteelDocument3 pagesTata SteelBinodini SenNo ratings yet

- Public Finance Reporting. 1.2Document44 pagesPublic Finance Reporting. 1.2Axel Jhon FabayosNo ratings yet

- In PressDocument6 pagesIn PressFitriani Dwi AnggraeniNo ratings yet

- Income TaxDocument20 pagesIncome Taxjuliaysabellepepitoaguilar100% (1)

- TAX01 Basic PrinciplesDocument10 pagesTAX01 Basic Principlesanon_812164091No ratings yet

- SF-64-96 R1 - Amendment To Consultant AgreementDocument4 pagesSF-64-96 R1 - Amendment To Consultant Agreementsandee1983No ratings yet

- 2021 SBU Red Book Volume 1 - Taxation LawDocument121 pages2021 SBU Red Book Volume 1 - Taxation LawJong CjaNo ratings yet

- Income Statement For Astra Agro Lestari TBK (AALI) From Morningstar PDFDocument1 pageIncome Statement For Astra Agro Lestari TBK (AALI) From Morningstar PDFGvz HndraNo ratings yet

- COMPAÑIA GENERAL DE TABACOS DE FILIPINAS Vs ManilaDocument2 pagesCOMPAÑIA GENERAL DE TABACOS DE FILIPINAS Vs ManilaLau NunezNo ratings yet

- Advace Audit ReportDocument10 pagesAdvace Audit ReportDILIP VISHWAKARMANo ratings yet

- Payslip 03-01-2024Document1 pagePayslip 03-01-2024ernestkozar8No ratings yet

- BIR Ruling Involving CGTDocument3 pagesBIR Ruling Involving CGTGEiA Dr.No ratings yet

- Chap010 - PPT Summary For AssignmentDocument28 pagesChap010 - PPT Summary For AssignmentUmmaya MalikNo ratings yet

- Special Topics & Updates TaxationDocument7 pagesSpecial Topics & Updates TaxationMhadzBornalesMpNo ratings yet

- Chapter-8 (House Property)Document40 pagesChapter-8 (House Property)BoRO TriAngLENo ratings yet

- Capital Gains Tax (CGT) RatesDocument15 pagesCapital Gains Tax (CGT) RatesMargaretha PaulinaNo ratings yet

- Solved Assume Gail Is A Wealthy Widow Whose Husband Died Last PDFDocument1 pageSolved Assume Gail Is A Wealthy Widow Whose Husband Died Last PDFAnbu jaromiaNo ratings yet

- GSTR-9 AND GSTR-9C - OutwardDocument39 pagesGSTR-9 AND GSTR-9C - OutwardRahul KLNo ratings yet

- IT-AE-41-G02 - Guide To Complete The Tax Directive Application Forms - External GuideDocument50 pagesIT-AE-41-G02 - Guide To Complete The Tax Directive Application Forms - External GuidercpretoriusNo ratings yet

- TATA 1MG Healthcare Solutions Private LimitedDocument1 pageTATA 1MG Healthcare Solutions Private LimitedAmish JhaNo ratings yet

- Form 12BBDocument3 pagesForm 12BBAndroid TricksNo ratings yet

- Pov 5509783Document3 pagesPov 5509783Sameer MahajanNo ratings yet

- Faq: Transport & Logistics: Page 1 of 5Document5 pagesFaq: Transport & Logistics: Page 1 of 5ANKUR PARIKANo ratings yet

- FABM2 Q2 MOD3 Income and Business Taxation 1Document27 pagesFABM2 Q2 MOD3 Income and Business Taxation 1Minimi Lovely33% (3)

- MyfileDocument1 pageMyfileanon-302065No ratings yet

- Form W-9 Request for Taxpayer Identification NumberDocument4 pagesForm W-9 Request for Taxpayer Identification Numberoceanic23No ratings yet

- Ca Final: Paper 8: Indirect Tax LawsDocument499 pagesCa Final: Paper 8: Indirect Tax LawsMaroju Rajitha100% (1)

- Aaaaj5854c Q1 Ay201819 16aDocument2 pagesAaaaj5854c Q1 Ay201819 16aAnonymous V0UxsCdZo9No ratings yet

- Rent receipts Oct 2021-Sep 2022Document3 pagesRent receipts Oct 2021-Sep 2022Kambadur KarthikeyNo ratings yet

- Form 16 SummaryDocument9 pagesForm 16 SummarySujata ChoudharyNo ratings yet

- Computation of Total Income (As Per Normal Provisions) Income From Salary (Chapter IV A) 4746736Document10 pagesComputation of Total Income (As Per Normal Provisions) Income From Salary (Chapter IV A) 4746736nABSAMNNo ratings yet