Professional Documents

Culture Documents

Lecture 4 Covid Impact On BFSI

Lecture 4 Covid Impact On BFSI

Uploaded by

shagun0 ratings0% found this document useful (0 votes)

19 views12 pagesThis document discusses the impact of COVID-19 on the service industry, particularly banking, NBFC, insurance, and health insurance. Key impacts include increased credit risk for banks; liquidity issues; emerging risks like inability to operate branches; and deterioration of NBFC loan portfolios. For insurance, there are increased financial and operational risks, and rises in health insurance claims from 8-15% and inquiries up 30-40%. General insurance is impacted by lack of new vehicle purchases and claims processing challenges due to lockdowns. Life insurance may see an escalation of deaths and claims. The next lecture will continue discussing changes to the service sector during COVID times.

Original Description:

Original Title

Lecture 4 Covid impact on BFSI.pptx

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses the impact of COVID-19 on the service industry, particularly banking, NBFC, insurance, and health insurance. Key impacts include increased credit risk for banks; liquidity issues; emerging risks like inability to operate branches; and deterioration of NBFC loan portfolios. For insurance, there are increased financial and operational risks, and rises in health insurance claims from 8-15% and inquiries up 30-40%. General insurance is impacted by lack of new vehicle purchases and claims processing challenges due to lockdowns. Life insurance may see an escalation of deaths and claims. The next lecture will continue discussing changes to the service sector during COVID times.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

19 views12 pagesLecture 4 Covid Impact On BFSI

Lecture 4 Covid Impact On BFSI

Uploaded by

shagunThis document discusses the impact of COVID-19 on the service industry, particularly banking, NBFC, insurance, and health insurance. Key impacts include increased credit risk for banks; liquidity issues; emerging risks like inability to operate branches; and deterioration of NBFC loan portfolios. For insurance, there are increased financial and operational risks, and rises in health insurance claims from 8-15% and inquiries up 30-40%. General insurance is impacted by lack of new vehicle purchases and claims processing challenges due to lockdowns. Life insurance may see an escalation of deaths and claims. The next lecture will continue discussing changes to the service sector during COVID times.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 12

BBA (SERVICE INDUSTRY

MANAGEMENT)

Lecture 4 - SEMESTER 3

‘Impact of

COVID-19 on INTRODUCTION TO SERVICE INDUSTRY

service industry’ BBASM 303-18

Faculty In charge: Ms. Shagun Smith

shagun.cgc@gmail.com

TOPIC TO BE COVERED IN THIS

LECTURE

Detailed discussion on changed scenario of

Service sector in COVID-19 times

BFSI (Banking, Financial Services and Insurance)

BANKING

IMPACT

Credit Risk Assessment

Banks may be additional disclosures required in

the financial statements and the computation of

capital adequacy for COVID-19

Work on risk management functions and track

their borrowers individually to determine and

segregate the permanent impact from the

temporary impact

to pay principal and interest with relaxation on

their classification as a non-performing asset or a

restructured asset.

Liquidity

CRR – 4% to 3%

SLR – 18.5% to 18%

Policy repo rate– 5.15% to 4%

Reverse Repo rate- 4.9% to 3.35%

bank rate- 5.40% to 4.25%.

Emerging risks such as

inability to man branches and call centers,

asset-liability mismatch due to deposit flight,

inability of clients to service debt due to job or

business losses,

increased cyber-crimes,

inability of vendors to provide services

Increased market volatility

IMFchief has called the current business

environment as recessionary

Need strict regulation and supervision of banking

and financial markets

NBFC

IMPACT

deterioration in credit quality of loan portfolio

industry-wise classification of loans necessary

Macro-economic factors – RBI, government

Valuation of collateral to be reconsidered

Collateral :

shares or bonds prices,

real-estate values and

credit standing of guarantor(s).

INSURANCE

IMPACT

Increased financial risk, operational risk and

business continuity planning.

to cover loss arising due to certain unforeseen

circumstances - Coronavirus ?

Assest Laibility Management

Staff to work from home

dedicated support via call centres

organised webinars on policy conditions, possible

claims and cyber security policies to create

awareness

reduced bond interest and repo rates

HEALTH INSURANCE

IMPACT

Rise in Claims from 8 to 15%

Some studies have shown that COVID-19 affects

those with co-morbidities such as diabetes, renal

and other chronic diseases adversely,6 and hence

prolonging of such co-morbidities can result in a

longer trail of non-Covid-19 chronic claims

Greater concern and awareness about health, and

enquiries about health insurance policies have

increased by 30–40%

GENERAL INSURANCE

Motor Insurance

Lack of purchase of new vehicles

Claim surveying impacted by lockdown as

surveyors not be able to go out to survey vehicular

damage

social distancing means more private vehicles and

Purchase of more two-wheelers, used cars or low-

end cars

Burglary insurance: likely to be a rise in demand

for unoccupied commercial property insurance.

accident insurance: Low claims are expected due

to lack of activity and movement, and also lower

renewal of policies.

LIFE INSURANCE

escalation of deaths and claims

DOUBTS AND QUERIES

TOPICS FOR NEXT LECTURE

Detailed discussion on changed scenario of

Service sector in COVID times

You might also like

- Meet Your Strawman and Whatever You Want To Know EditabilDocument83 pagesMeet Your Strawman and Whatever You Want To Know Editabilyakee795% (125)

- Additional Revision QuestionsDocument3 pagesAdditional Revision QuestionsShivneel Naidu100% (1)

- Innovation Opportunities in Insurance: Crisis ManifestoDocument27 pagesInnovation Opportunities in Insurance: Crisis Manifestomoctapka088100% (3)

- Maldives Law of Public Finances 2006 PDFDocument17 pagesMaldives Law of Public Finances 2006 PDFNabil RASHEED100% (1)

- Final Banking Law OutlineDocument95 pagesFinal Banking Law OutlineQuinton JohnsonNo ratings yet

- Individual Assignment 1 (Rienah Binti Sanari, 2019231122)Document9 pagesIndividual Assignment 1 (Rienah Binti Sanari, 2019231122)Rienah SanariNo ratings yet

- Impact of Covid-19 On Banking SectorDocument2 pagesImpact of Covid-19 On Banking SectorAtia KhalidNo ratings yet

- Careers-WPS OfficeDocument4 pagesCareers-WPS OfficeAtia KhalidNo ratings yet

- The Impact of Covid-19 On Accounting ProfessionDocument9 pagesThe Impact of Covid-19 On Accounting ProfessionShuvo HowladerNo ratings yet

- Covid Impact On FS-2077-78Document17 pagesCovid Impact On FS-2077-78Rohit ThakuriNo ratings yet

- Banking and Insurance Laws Project AssigmentDocument7 pagesBanking and Insurance Laws Project AssigmentmandiraNo ratings yet

- Financial Difficulty of Banking Management During COVID 19 in BangladeshDocument10 pagesFinancial Difficulty of Banking Management During COVID 19 in BangladeshSabbir AhmmedNo ratings yet

- Consumer Federation of AmericaDocument5 pagesConsumer Federation of AmericaANo ratings yet

- SFM A Note On Financial Distress NewDocument2 pagesSFM A Note On Financial Distress NewKaushali WeerakkodyNo ratings yet

- Impact of Covid 19 On Banking and Insurance SectorDocument6 pagesImpact of Covid 19 On Banking and Insurance SectorPrasanna KumarNo ratings yet

- CRM - ZuariDocument9 pagesCRM - ZuariKhaisarKhaisarNo ratings yet

- Impact of COVID-19 On The Insurance SectorDocument19 pagesImpact of COVID-19 On The Insurance SectorJulius mera smithNo ratings yet

- Advisory Note On COVID-19 Impact On Financial Reporting and AuditingDocument24 pagesAdvisory Note On COVID-19 Impact On Financial Reporting and AuditingNarayan PrajapatiNo ratings yet

- Covid 19 Learnings Final v2Document15 pagesCovid 19 Learnings Final v2Xaidi axrinNo ratings yet

- Covid-19 Implications On Financial Reporting: Marija Mitevska, Olivera Gjorgieva-Trajkovska, Vesna Georgieva SvrtinovDocument8 pagesCovid-19 Implications On Financial Reporting: Marija Mitevska, Olivera Gjorgieva-Trajkovska, Vesna Georgieva SvrtinovSang PhamNo ratings yet

- IFRS in Focus: Accounting Considerations Related To The Coronavirus 2019 DiseaseDocument25 pagesIFRS in Focus: Accounting Considerations Related To The Coronavirus 2019 DiseaseTaskin Reza KhalidNo ratings yet

- Group 18 PresentationDocument5 pagesGroup 18 Presentationgoitsemodimoj31No ratings yet

- Assignment 1 CB Vishal Vangwad FinalDocument4 pagesAssignment 1 CB Vishal Vangwad FinalVishal VangwadNo ratings yet

- Accounting HammadDocument7 pagesAccounting Hammadshan khanNo ratings yet

- Probable Impact of COVIDDocument7 pagesProbable Impact of COVIDRaiyan RabbaniNo ratings yet

- Corporate Reconstruction SaceDocument13 pagesCorporate Reconstruction Sacemuskan khatriNo ratings yet

- 2019 Zambia Insurance Industry ReportDocument40 pages2019 Zambia Insurance Industry ReportWakari MastaNo ratings yet

- A Brief Overview of Impact of Pandemic On Insurance Industry in PakistanDocument2 pagesA Brief Overview of Impact of Pandemic On Insurance Industry in PakistanAhsan NisarNo ratings yet

- Airlines Financial Reporting Implications of Covid 19Document15 pagesAirlines Financial Reporting Implications of Covid 19Rama KediaNo ratings yet

- Potential Impacts of COVID19 On Financial Reporting (25001)Document15 pagesPotential Impacts of COVID19 On Financial Reporting (25001)Hossain AlmasNo ratings yet

- Financial Risk ManagementDocument19 pagesFinancial Risk ManagementScribd007No ratings yet

- Ajay StatsDocument4 pagesAjay StatsAkhil RawatNo ratings yet

- Business Models of Banking in FutureDocument5 pagesBusiness Models of Banking in FuturebishwajitNo ratings yet

- Credit RiskDocument5 pagesCredit Riskaz-waniey sempoyNo ratings yet

- Case Study 2 - First DraftDocument4 pagesCase Study 2 - First DraftCyra EllaineNo ratings yet

- Bkar3033 A221 Assignment 5Document5 pagesBkar3033 A221 Assignment 5Patricia TangNo ratings yet

- IFRS Buletin CovidDocument13 pagesIFRS Buletin CovidMuhammad RezaNo ratings yet

- Audit Asignment 1 and 2Document21 pagesAudit Asignment 1 and 2Kurauone MuswereNo ratings yet

- Can Micro Finance Attain Industry StatusDocument3 pagesCan Micro Finance Attain Industry StatusGeetha MohanNo ratings yet

- Main For Details STRAMA - Paper - On - BPI PDFDocument129 pagesMain For Details STRAMA - Paper - On - BPI PDFDesmond Williams100% (3)

- (IMF Working Papers) COVID-19 and SME FailuresDocument49 pages(IMF Working Papers) COVID-19 and SME FailuresDR. OMID R TabrizianNo ratings yet

- Financial Stability Report Desc QuesDocument22 pagesFinancial Stability Report Desc QuesKranti TejanNo ratings yet

- Pandemic and Banking IndustryDocument6 pagesPandemic and Banking IndustryHiyakishu SanNo ratings yet

- Risk Protection and MitigationDocument114 pagesRisk Protection and MitigationomoyegunNo ratings yet

- Banking SystemDocument4 pagesBanking SystemKhaishen LamNo ratings yet

- Focus: Enterprise Risk Management (ERM)Document72 pagesFocus: Enterprise Risk Management (ERM)pressbureauNo ratings yet

- Account AssignDocument3 pagesAccount Assignshan khanNo ratings yet

- Credit Risk Management LectureDocument80 pagesCredit Risk Management LectureAbhishek KarekarNo ratings yet

- Risks in Banking OperationDocument4 pagesRisks in Banking OperationRIZA COSNo ratings yet

- CERM Assignment-Mohammad Iqbal HossainDocument8 pagesCERM Assignment-Mohammad Iqbal HossainMohammad Iqbal Hossain ArmanNo ratings yet

- COVID-19 Impact Towards Different IndustriesDocument48 pagesCOVID-19 Impact Towards Different IndustriesAnuruddha Rajasuriya100% (1)

- B&I Async - 21111336Document7 pagesB&I Async - 21111336muskanmanvi3009No ratings yet

- 2020 09 COVID Briefing Debt Restructuring in MicrofinanceDocument6 pages2020 09 COVID Briefing Debt Restructuring in MicrofinanceUnanimous ClientNo ratings yet

- 1607546412443 - final project منهجيةDocument4 pages1607546412443 - final project منهجيةSabreen IssaNo ratings yet

- Credit Risk Management LectureDocument80 pagesCredit Risk Management LectureNoaman Ahmed100% (2)

- Acct Implication Coronavirus Apr2020Document11 pagesAcct Implication Coronavirus Apr2020imranhvcNo ratings yet

- Potential Impact of COVID-19 On Indian EconomyDocument7 pagesPotential Impact of COVID-19 On Indian EconomyHarshit Kumar SinghNo ratings yet

- FRA ASSIGNMENT - AnkitAgarwal - 22620Document1 pageFRA ASSIGNMENT - AnkitAgarwal - 22620Ankit AgarwalNo ratings yet

- Non Performing AssetDocument21 pagesNon Performing AssetKajal JaswalNo ratings yet

- Credit Risk Management In and Out of the Financial Crisis: New Approaches to Value at Risk and Other ParadigmsFrom EverandCredit Risk Management In and Out of the Financial Crisis: New Approaches to Value at Risk and Other ParadigmsRating: 1 out of 5 stars1/5 (1)

- Risk Management Fundamentals: An introduction to risk management in the financial services industry in the 21st centuryFrom EverandRisk Management Fundamentals: An introduction to risk management in the financial services industry in the 21st centuryRating: 5 out of 5 stars5/5 (1)

- Restoring Financial Stability: How to Repair a Failed SystemFrom EverandRestoring Financial Stability: How to Repair a Failed SystemRating: 3 out of 5 stars3/5 (3)

- Sectors On Indian EconomyDocument15 pagesSectors On Indian EconomyshagunNo ratings yet

- Principles of Human Resource Management BBA-301: by Ms. Shagun SmithDocument7 pagesPrinciples of Human Resource Management BBA-301: by Ms. Shagun SmithshagunNo ratings yet

- Principles of Human Resource Management BBA-301: HRP ProcessDocument6 pagesPrinciples of Human Resource Management BBA-301: HRP ProcessshagunNo ratings yet

- Impact of COVID-19 On Tourism Industry in IndiaDocument8 pagesImpact of COVID-19 On Tourism Industry in Indiashagun100% (1)

- Impact of COVID-19 On Telcom SectorDocument6 pagesImpact of COVID-19 On Telcom SectorshagunNo ratings yet

- CSBS Spring Meeting Remarks - Superintendent Maria T. VulloDocument11 pagesCSBS Spring Meeting Remarks - Superintendent Maria T. VulloThe Capitol PressroomNo ratings yet

- Cambridge International AS & A Level: Accounting 9706/22Document15 pagesCambridge International AS & A Level: Accounting 9706/22Fenny PetraNo ratings yet

- Nego - Check CasesDocument3 pagesNego - Check CasesRizel C. BarsabalNo ratings yet

- 2053Document41 pages2053Hiren GanganiNo ratings yet

- Islamic Finance Final ProjectDocument83 pagesIslamic Finance Final ProjectMohammed YunusNo ratings yet

- Laxmi Bank Annual Report 2073 - 74 English PDFDocument62 pagesLaxmi Bank Annual Report 2073 - 74 English PDFPrashant McFc AdhikaryNo ratings yet

- PERSONAL FINANCE Lesson Two Money ManagementDocument6 pagesPERSONAL FINANCE Lesson Two Money ManagementJohn Greg MenianoNo ratings yet

- WorkbookDocument33 pagesWorkbookapi-295284877No ratings yet

- HSBC Amfi Mock Test-1Document10 pagesHSBC Amfi Mock Test-1Ankit Sharma100% (1)

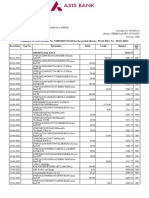

- Statement of Axis Account No:918010041712316 For The Period (From: 09-04-2022 To: 08-05-2022)Document4 pagesStatement of Axis Account No:918010041712316 For The Period (From: 09-04-2022 To: 08-05-2022)ashikNo ratings yet

- Request For Bids Goods: Standard Procurement DocumentDocument131 pagesRequest For Bids Goods: Standard Procurement DocumentkitesNo ratings yet

- Chapter 03 - A Systems-Thinking Approach To Understand The Challenge of Corporate EthicsDocument30 pagesChapter 03 - A Systems-Thinking Approach To Understand The Challenge of Corporate EthicsShekhar SinghNo ratings yet

- Philippine Deposit Insurance CorporationDocument8 pagesPhilippine Deposit Insurance CorporationWillowNo ratings yet

- Jan 2009 Shrewsbury Friends of The Earth NewsletterDocument4 pagesJan 2009 Shrewsbury Friends of The Earth NewsletterShrewsbury Friends of the EarthNo ratings yet

- Financial MarketsDocument17 pagesFinancial Marketsanilsharma7No ratings yet

- Jack Transcript Banking LawsDocument17 pagesJack Transcript Banking LawsTalitha Reneé Lopez Tan100% (1)

- Summer Training Project Report On Study of Life Insurance PoliciesDocument88 pagesSummer Training Project Report On Study of Life Insurance PoliciesSatish Sandhu0% (1)

- CH11Document31 pagesCH11Marwa HassanNo ratings yet

- Economy of RajasthanDocument12 pagesEconomy of RajasthanNaruChoudharyNo ratings yet

- BCom (H) Indian Financial System Second Year Sem 3Document24 pagesBCom (H) Indian Financial System Second Year Sem 3Santosh ThakurNo ratings yet

- Business Law: Certificate in Accounting and Finance Stage ExaminationDocument8 pagesBusiness Law: Certificate in Accounting and Finance Stage ExaminationMuhammad FaisalNo ratings yet

- CO OPERATIVE BANKS Rural Marketing SynopsisDocument3 pagesCO OPERATIVE BANKS Rural Marketing SynopsisNageshwar SinghNo ratings yet

- Merger of Banking CompaniesDocument20 pagesMerger of Banking CompaniesSapna PandeyNo ratings yet

- Short and Long Term StrategyDocument2 pagesShort and Long Term StrategyEmad TabassamNo ratings yet

- 2022-03-10 Item 6aDocument4 pages2022-03-10 Item 6a视频精选全球No ratings yet

- Financials FSODocument38 pagesFinancials FSOPeter DruckerNo ratings yet

- Application For Entering Into An Agreement With Department of Posts For Speed Post/ Express/ Business Parcel ServicesDocument9 pagesApplication For Entering Into An Agreement With Department of Posts For Speed Post/ Express/ Business Parcel ServicesChinnaappu100% (2)