Professional Documents

Culture Documents

Chapter Three: Accounting For General Capital Assets & Capital Project Funds

Uploaded by

Tilahun Mikias0 ratings0% found this document useful (0 votes)

82 views46 pagesOriginal Title

PG-Govt CH3

Copyright

© © All Rights Reserved

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document0 ratings0% found this document useful (0 votes)

82 views46 pagesChapter Three: Accounting For General Capital Assets & Capital Project Funds

Uploaded by

Tilahun MikiasYou are on page 1of 46

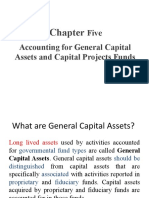

CHAPTER THREE

ACCOUNTING FOR GENERAL CAPITAL ASSETS

&

CAPITAL PROJECT FUNDS

3.1 Accounting for General capital Assets

• Long-lived assets used by activities financed by

the General Fund or other governmental funds

are called general capital assets.

• General capital assets should be distinguished

from capital assets that are specifically

associated with activities financed by proprietary

and fiduciary funds.

• Capital assets acquired by proprietary and

fiduciary funds are accounted for by those funds.

Cont…

• Acquisitions of general capital assets that

require major amounts of money ordinarily

cannot be financed from General Fund or

special revenue fund appropriations.

• Major acquisitions of general capital assets are

commonly financed by issuance of long-term

debt to be repaid from tax revenues or by

special assessments against property deemed

to be particularly benefited by the long-lived

asset.

Cont…

• Other sources for financing the acquisition of

long-lived assets include grants from other

governments, transfers from other funds, gifts

from individuals or organizations, capital leases,

or a combination of several of these sources.

• If money received from these sources is

restricted, legally or morally, to the purchase or

construction of specified capital assets, it is

recommended that a capital projects fund be

created to account for resources to be used for

such projects.

Cont…

• When deemed useful, capital projects funds

may also be used to account for the

acquisition of major general capital assets,

such as buildings, under a capital lease

agreement.

• Leases involving equipment are more

commonly accounted for by the General Fund.

Cont…

• Proprietary and Fiduciary funds account for

capital assets (property, plant, equipment, and

intangibles) used in their operations.

• Since governmental funds account only for

current financial resources, these funds do not

account for capital assets acquired by the funds.

• Rather, general capital assets purchased or

constructed with governmental fund resources

are recorded in the governmental activities

general ledger at the government-wide level.

Cont…

• Governmental Accounting Standards Board (GASB)

standards require that general capital assets be

recorded at historical cost, or fair value at time of

receipt if assets are received by donation.

• Historical cost includes acquisition cost plus

ancillary costs necessary to put the asset into use.

• Ancillary costs may include items such as freight

and transportation charges, site preparation costs,

and set-up costs.

Cont…

• If the cost of a capital asset was not recorded

when the asset was acquired and is unknown

when accounting control over the asset

occurred, it is acceptable to record an

estimated cost.

• Under the GASB reporting model, general

capital assets are reported in the

Governmental Activities column of the

statement of net assets, net of accumulated

depreciation, when appropriate.

Cont…

• Any rational and systematic depreciation

method is allowed.

• Depreciation is not reported for inexhaustible

assets such as land and land improvements,

non-capitalized collections of works of art or

historical treasures, and infrastructure assets.

cont

• Even though general capital assets are

acquired for the production of general

governmental services rather than for the

production of services that are sold, reporting

depreciation on general capital assets may

provide significant benefits to users and

managers alike.

Cont…

• Reporting depreciation expense as part of the

direct expenses of functions and programs in

the Governmental Activities column of the

government wide statement of activities helps

to determine the full cost of providing each

function or program.

• Depreciation expense on capital assets used in

the operations of a government grant–

financed program is often an allowable cost

under the terms of a grant.

Cont…

• To a limited extent, a comparison of the

accumulated depreciation on an asset with

the cost of the asset may assist in budgeting

outlays for replacement of capital assets.

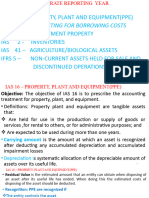

3.1.1 Required Disclosures about Capital Assets

• GASB standards require certain disclosures

about capital assets in the notes to the basic

financial statements,

• both the general capital assets reported in the

Governmental Activities column and those

reported in the Business-type Activities

column of the government-wide financial

statements.

Cont…

• In addition to disclosure of their general policy

for capitalizing assets and for estimating the

useful lives of depreciable assets,

governments should provide certain other

disclosures in the notes to the financial

statements.

• These disclosures should be divided into the

major classes of capital assets of the primary

government and should distinguish between

general capital assets and those reported in

business-type activities.

Cont…

• Capital assets that are not being depreciated

are disclosed separately from those assets

that are being depreciated.

• Required disclosures about each major class of

capital assets include:

Beginning-of-year and end-of-year balances

showing accumulated depreciation separate

from historical cost.

Capital acquisitions during the year.

Sales or other dispositions during the year.

Cont…

Depreciation expense for the current period

with disclosure of the amounts charged to

each function in the statement of activities.

Disclosures describing works of art or

historical treasures that are not capitalized

and explaining why they are not capitalized.

3.1.2 Classification of General Capital Assets

• The following paragraphs present a brief

review of generally accepted principles of

accounting for each category of capital assets

based on applicable GASB and Financial

Accounting Standards Board (FASB) standards.

LAND

• The cost of land acquired by a government

through purchase should include not only the

contract price but also such other related

costs as taxes and other liens assumed, title

search costs, legal fees, surveying, filling,

grading, draining, and other costs of preparing

for the use intended.

Cont…

• Governments are frequently subject to

damage suits in connection with land

acquisition, and the amounts of judgments

levied are considered capital costs of the

property acquired.

• Land acquired through forfeiture should be

capitalized at the total amount of all taxes,

liens, and other claims surrendered plus all

other costs incidental to acquiring ownership

and perfecting title.

Cont…

• Land acquired through donation should be

recorded on the basis of appraised value at

the date of acquisition; the cost of the

appraisal itself should not be capitalized,

however.

Building and Improvements Other than Buildings

• Anything you do to your building that changes

its function, increases its value or extends its

useful life is an improvement.

• Renovating the lobby to make it more

attractive is an example of an improvement as

is replacing all of the building's lighting

fixtures with new high-efficiency fixtures.

Cont…

• The determination of the cost of buildings and

improvements acquired by purchase is

relatively simple, although some peripheral

costs may be of doubtful classification.

• The price paid for the assets constitutes most

of the cost of purchased items, but legal and

other costs plus expenditures necessary to put

the property into acceptable condition for its

intended use are proper additions.

Cont…

• The same generalizations may be applied to

acquisitions by construction under contract;

that is, purchase or contract price plus

positively identified incidentals, should be

capitalized.

• The value of buildings and improvements

acquired by donation should be established by

appraisal.

Equipment, or Machinery and Equipment

• The cost of machinery and equipment

purchased should include items conventional

under business accounting practice:

• purchase price, transportation costs if not

included in purchase price, installation cost, and

other direct costs of making ready for use.

Cont…

• Cash discounts on machinery and equipment

purchased should be treated as a reduction of

costs.

• Donated equipment should be recorded in the

same manner and for the same reasons as

donated buildings and improvements.

Infrastructure Assets

• Infrastructure assets are capital assets, such

as highways, streets, sidewalks, storm

drainage systems, and lighting systems, that

are stationary in nature and normally can be

preserved for a longer life than most other

capital assets.

Intangible Assets

• Intangible assets are defined by the GASB as

capital assets that lack physical substance,

have a useful life of more than one reporting

period, and are nonfinancial in nature.

• Examples of government intangible assets

include patents, copyrights, easements, water

rights, and computer software.

(Assignment: explain each of these intangible

assets=5%)

Cont…

• The GASB standards allow for recognition of

intangible assets if the asset is separable or if the

asset arises from contractual or other legal rights.

• An asset would be considered separable from

the government if, for example, it could be sold,

transferred, or exchanged, either individually or

in combination with a related asset, liability, or

contract.

• Because intangible assets are considered general

capital assets, all guidance related to general

capital assets is applicable.

General Capital Assets Acquired under Capital

Lease Agreements

• State and local governments generally have

limits on the amount of long-term debt they

may issue.

• Consequently, governments that are reaching

their legal debt limit often use leases to

acquire capital assets.

• Operating leases and capital leases, are of

importance in governmental accounting.

Cont…

• If a particular lease meets any one of the

following classification criteria, it is a capital

lease.

1. The lease transfers ownership of the property

to the lessee by the end of the lease term.

2. The lease contains an option to purchase the

leased property at a bargain price.

3. The lease term is equal to or greater than 75

percent of the estimated economic life of the

leased property.

Cont…

• The present value of rental or other minimum

lease payments equals or exceeds 90 % of the

fair value of the leased property less any

investment tax credit retained by the lessor.

• If no criterion is met, the lease is classified as

an operating lease by the lessee.

• Rental payments under an operating lease for

assets used by governmental funds are

recorded by the using fund as expenditures of

the period.

3.1.3 Asset Impairments and Insurance Recoveries

• The GASB defines an asset impairment as a

significant, unexpected decline in the service

utility of a capital asset.

• Impairments occur as a result of unexpected

circumstances or events, such as physical

damage, obsolescence, enactment of laws or

regulations or other environmental factors,

or change in the manner or duration of the

asset’s use.

Cont…

• The amount of impairment should be

measured using one of three approaches:

• (1) restorative cost approach, the estimated

cost to restore the utility of the asset

(appropriate for impairments from physical

damage);

• (2) service units approach, the portion of

estimated service utility life of the asset that

has been estimated lost due to impairment

(appropriate for impairments due to

environmental factors or obsolescence);

Cont…

• (3) Deflated depreciated replacement cost

approach, an approach that quantifies the

cost of the service currently being provided by

the capital asset and converts that cost to

historical cost

(appropriate for impairment due to change in

the manner or duration of use).

• When an asset impairment has occurred, the

estimated amount of impairment is reported

as a write-down in the carrying value of the

asset.

Cont…

• The loss due to impairment is recorded as a program

expense in the government-wide statement of

activities for the function using the asset,

• and as an operating expense in the statement of

revenues, expenses, and changes in fund net assets

of proprietary funds, if applicable.

• If the impairment is significant in amount and results

from an event that is unusual in nature or

infrequently occurring, or both,

• then the loss should be reported as either a special

item or extraordinary item, as appropriate

Cont…

• Impairment losses are reported net of any insurance

recoveries that occur during the same fiscal year.

• Insurance recoveries occurring in a subsequent year

should be reported:

as other financing sources in governmental fund

operating statements,

as program revenues in the government-wide

statement of net assets, and

as non-operating revenues in proprietary fund

operating statements.

3.2 Accounting for Capital project funds

• Capital Projects Funds (CPFs) are established to

account for resources that are to be used to

acquire major long-lived capital Assets.

• CPFs are useful for holding resource managers

accountable, thereby helping to assure that the

resources for such projects are used legally, and

also in the most economic manner.

• To put in another way, CPFs should provide

information for legal compliance as well as

sound financial management.

Cont…

• CPFs exist only for the period of acquisition/

construction of the fixed asset.

• After the acquisition/construction is completed, the

CPF will be abolished.

• In some jurisdictions, governments are allowed to

account for all capital projects within a single

capital projects fund.

• In other jurisdictions, laws require each project to be

accounted for by a separate capital projects fund.

Cont…

• After completion of the acquisition or

construction of the asset, the asset itself will

be accounted for in the general fixed asset

account group (GFAAG).

Ways/Sources of Financing CPFs

• The major source of finance for capital projects

funds is the issuance of long-term debt.

• In addition to debt proceeds, capital projects may

receive funds from:

Grants from other governmental units,

Gifts from individuals or organizations

Proceeds of dedicated taxes,

Transfers from other funds, or

A combination of several of these above sources.

Accounting treatment for the sources of finance

• GASB standards require capital project fund-

basis statements to be reported using the

modified accrual basis of accounting.

• Proceeds of debt issues should be recognized

by a capital projects fund at the time the

debt is actually incurred, rather than at the

time it is authorized.

Cont…

• Proceeds of debt issues are recorded as

Proceeds of Bonds or Proceeds of Long-Term

Notes rather than as Revenues and are

reported in the Other Financing Sources

section of the Statement of Revenues,

Expenditures, and Changes in Fund Balances.

• Bonds might be issued at (a) Premium or

(b) Discount

Cont…

• Premium Bonds

–All premiums are transferred to the debt

services fund

• Discount Bonds

–Amount of discount must either:

• Be transferred in from the general fund, or

• The project must reduce its costs by the

amount of the discount

Cont…

• Similarly, revenues raised by the General Fund or a

special revenue fund and transferred to a capital

projects fund are recorded as Transfers In and

reported in the Other Financing Sources section of

the operating statement.

• Proceeds received from dedicated taxes,

Grants/gifts from other governmental units,

individuals or organizations for a capital project are

recorded as revenues of the capital projects fund.

Ways of Acquiring Fixed Assets

• The successful accomplishment of a capital

project may be brought about in one or more

of the following ways:

– Outright purchase from fund cash.

– By construction, utilizing the government’s own

workforce.

– By construction, utilizing the services of private

contractors.

– By capital lease agreement.

• .

Thank you

You might also like

- Moles and Equations - Worksheets 2.1-2.11 1 AnsDocument19 pagesMoles and Equations - Worksheets 2.1-2.11 1 Ansash2568% (24)

- Philippine Accounting Standards 38 (Intangible Assets2)Document72 pagesPhilippine Accounting Standards 38 (Intangible Assets2)Princess Edreah NuñalNo ratings yet

- Self Contained ClassroomsDocument3 pagesSelf Contained ClassroomsTilahun MikiasNo ratings yet

- Ethics Performance Task RevisedDocument4 pagesEthics Performance Task Revisedapi-337051062No ratings yet

- A History of The Methodist Episcopal Church Volume I (Nathan D.D.bangs)Document244 pagesA History of The Methodist Episcopal Church Volume I (Nathan D.D.bangs)Jaguar777xNo ratings yet

- Accounting For General Capital Assets and Capital Projects: Chapter FiveDocument70 pagesAccounting For General Capital Assets and Capital Projects: Chapter FiveshimelisNo ratings yet

- GNP CHP 6Document21 pagesGNP CHP 6fentaw melkieNo ratings yet

- Lecture Notes Iass 16 EtcDocument31 pagesLecture Notes Iass 16 Etcmayillahmansaray40No ratings yet

- IAS 16 GuideDocument100 pagesIAS 16 GuideClarkMaasNo ratings yet

- Facilitators Guide For Accenture-IGNOU Diploma Program: Unit 4Document20 pagesFacilitators Guide For Accenture-IGNOU Diploma Program: Unit 4Vinay SinghNo ratings yet

- Property, Plant and EquipmentDocument16 pagesProperty, Plant and EquipmentnurthiwnyNo ratings yet

- Fundamentals of AccountingDocument76 pagesFundamentals of AccountingNo MoreNo ratings yet

- Presentationprint TempDocument67 pagesPresentationprint TempMd EndrisNo ratings yet

- Unit 6Document16 pagesUnit 6YonasNo ratings yet

- Chapter 7: Ppe and Intangibles: 1. Types of Non-Current AssetsDocument14 pagesChapter 7: Ppe and Intangibles: 1. Types of Non-Current AssetsMarine De CocquéauNo ratings yet

- GNFP CH 5Document33 pagesGNFP CH 5Bilisummaa GeetahuunNo ratings yet

- LMT School of Management, Thapar University Masters of Business AdministrationDocument23 pagesLMT School of Management, Thapar University Masters of Business Administrationgursimran jit singhNo ratings yet

- Acc Standards PPTDocument15 pagesAcc Standards PPTsanjeev singhNo ratings yet

- T7 Accounting For Non Current AssetsDocument45 pagesT7 Accounting For Non Current AssetsHD D100% (1)

- G-U2Document19 pagesG-U2Belay Mekonen100% (1)

- International Accounting Standard 16 Property, Plant and EquipmentDocument29 pagesInternational Accounting Standard 16 Property, Plant and EquipmentAbdullah Shaker TahaNo ratings yet

- Financial Reporting Framework For CooperativesDocument46 pagesFinancial Reporting Framework For CooperativesIsaac joule100% (1)

- C17 - MFRS 116 PpeDocument15 pagesC17 - MFRS 116 Ppe2022478048No ratings yet

- Financial Accounting: Indian Institute of Management, RaipurDocument21 pagesFinancial Accounting: Indian Institute of Management, RaipurJHANVI LAKRANo ratings yet

- Section 17Document33 pagesSection 17Abata BageyuNo ratings yet

- Government Grant and Borrowing CostsDocument5 pagesGovernment Grant and Borrowing CostsEDMARK LUSPENo ratings yet

- Chapter-Six Accounting For General, Special Revenue and Capital Project FundsDocument31 pagesChapter-Six Accounting For General, Special Revenue and Capital Project FundsMany Girma100% (1)

- Lect 08TVDocument29 pagesLect 08TVsalman siddiquiNo ratings yet

- Uoit Capital Assets GuidelinesDocument11 pagesUoit Capital Assets GuidelinesOrkhan AghalarovNo ratings yet

- Examender Engl 1Document23 pagesExamender Engl 1VISHAL PANDYANo ratings yet

- PPE Theory-DepDocument5 pagesPPE Theory-DepDibyansu KumarNo ratings yet

- Depreciation Accounting Depreciation AccountingDocument25 pagesDepreciation Accounting Depreciation AccountingLakshmi Prasanna BollareddyNo ratings yet

- Fixed Asset Guide For Financial ReportingDocument13 pagesFixed Asset Guide For Financial ReportingSyed Nafis JunaedNo ratings yet

- Cee 4Document13 pagesCee 4Abdullah RamzanNo ratings yet

- Borrowing Costs Lkas 23: ACC 3112 Financial ReportingDocument17 pagesBorrowing Costs Lkas 23: ACC 3112 Financial ReportingDhanushika SamarawickramaNo ratings yet

- 10 AS13 Invesment AccountingDocument8 pages10 AS13 Invesment Accountingprashantmis452No ratings yet

- Accounting Standards SummaryDocument5 pagesAccounting Standards SummaryAnkita GoelNo ratings yet

- Chapter 8 - Operating Assets: Property, Plant, and Equipment, and IntangiblesDocument9 pagesChapter 8 - Operating Assets: Property, Plant, and Equipment, and IntangiblesHareem Zoya WarsiNo ratings yet

- Chapter 2 - Tangible Non Current AssetsDocument18 pagesChapter 2 - Tangible Non Current Assetsprasad guthi100% (1)

- Accounting Standard 10Document31 pagesAccounting Standard 10Yesha ShahNo ratings yet

- Accounting For Governmental & Nonprofit Entities: Jacqueline L. Reck Suzanne L. LowensohnDocument38 pagesAccounting For Governmental & Nonprofit Entities: Jacqueline L. Reck Suzanne L. LowensohnRoite BeteroNo ratings yet

- Chap 007Document18 pagesChap 007samuel hailuNo ratings yet

- Property, Plant and Equipment (IAS 16.Pptx NEW LATESTDocument47 pagesProperty, Plant and Equipment (IAS 16.Pptx NEW LATESTNick254No ratings yet

- Chapter 4 GF & SRFDocument27 pagesChapter 4 GF & SRFSara NegashNo ratings yet

- Borrowing CostsDocument13 pagesBorrowing CostsCrizel DarioNo ratings yet

- 10 Week 10 Chpt 14n15 NCADocument47 pages10 Week 10 Chpt 14n15 NCA1621995944No ratings yet

- GNFP CH 3Document41 pagesGNFP CH 3Bilisummaa GeetahuunNo ratings yet

- BBA II Chapter 3 Depreciation AccountingDocument28 pagesBBA II Chapter 3 Depreciation AccountingSiddharth Salgaonkar100% (1)

- accountingstandard-161023112619Document24 pagesaccountingstandard-161023112619prasadNo ratings yet

- Accounting Standard 6Document208 pagesAccounting Standard 6aanu1234No ratings yet

- Property, Plant & EquipmentDocument16 pagesProperty, Plant & Equipmentjayadevsr2380No ratings yet

- Accounting for Property, Plant and EquipmentDocument26 pagesAccounting for Property, Plant and EquipmentJellai TejeroNo ratings yet

- Fixed Assets - NotesDocument8 pagesFixed Assets - NotesMuhammad Imran LatifNo ratings yet

- Fixed Asset ManagementDocument7 pagesFixed Asset ManagementJoanne FerrerNo ratings yet

- Accounting Standards AS-10, As-26: A Project ONDocument25 pagesAccounting Standards AS-10, As-26: A Project ONShivam JaiswalNo ratings yet

- Chapter 10 Investment PropertyDocument20 pagesChapter 10 Investment PropertyJi Baltazar100% (1)

- Presentation - PFRF For CoopsDocument55 pagesPresentation - PFRF For CoopsKellen HernandezNo ratings yet

- Uscpt 3Document51 pagesUscpt 3Sachin D SalankeyNo ratings yet

- Accounting Standard 2 and 19Document8 pagesAccounting Standard 2 and 19Sadhvi BansalNo ratings yet

- Chapter 9Document25 pagesChapter 9Ariane CarinoNo ratings yet

- Name:-Akash Jaiswal ROLL NO.:-0645 ROOM NO.:-045 SESSION:-2014-2017 Topic:-Accounting For FixedDocument6 pagesName:-Akash Jaiswal ROLL NO.:-0645 ROOM NO.:-045 SESSION:-2014-2017 Topic:-Accounting For FixedAKASH JAISWALNo ratings yet

- Deductions To Gross IncomeDocument45 pagesDeductions To Gross IncomeKenzel lawasNo ratings yet

- A Review of Factors For Tax ComplianceDocument9 pagesA Review of Factors For Tax ComplianceTilahun MikiasNo ratings yet

- Audit of The Sales and Collection Cycle: Tests of Controls Review Questions 12-1Document22 pagesAudit of The Sales and Collection Cycle: Tests of Controls Review Questions 12-1Tilahun MikiasNo ratings yet

- Women and DairyDocument40 pagesWomen and Dairyaroosa_qNo ratings yet

- Nestlé Case Study AnalysisDocument9 pagesNestlé Case Study AnalysisTilahun MikiasNo ratings yet

- ITP No 979 English Version1Document93 pagesITP No 979 English Version1elias worku100% (3)

- Community Participation in EducationDocument35 pagesCommunity Participation in EducationJayCesarNo ratings yet

- Sampling Methods in Research Methodology How To Choose A Sampling Technique For ResearchDocument11 pagesSampling Methods in Research Methodology How To Choose A Sampling Technique For ResearchRhem Rick CorpuzNo ratings yet

- Women and Women in ProductionDocument46 pagesWomen and Women in ProductionTilahun MikiasNo ratings yet

- Advanced 2012 AbrhaDocument29 pagesAdvanced 2012 AbrhaTilahun MikiasNo ratings yet

- Central Bank Functions ExplainedDocument7 pagesCentral Bank Functions ExplainedTilahun MikiasNo ratings yet

- Hgeiuhkl PDFDocument4 pagesHgeiuhkl PDFvj4249No ratings yet

- Chapter 1 Auditing I - 2012Document4 pagesChapter 1 Auditing I - 2012Tilahun MikiasNo ratings yet

- Policy and Strutegy of AreicultureDocument48 pagesPolicy and Strutegy of AreicultureTilahun MikiasNo ratings yet

- Women, Apiculture and Development: Evaluating The Impact of A Beekeeping Project On Rural Women's LivelihoodsDocument6 pagesWomen, Apiculture and Development: Evaluating The Impact of A Beekeeping Project On Rural Women's LivelihoodsTilahun MikiasNo ratings yet

- ITP No 979 English Version1Document93 pagesITP No 979 English Version1elias worku100% (3)

- 1 201 Integrity Objectivity and IndependenceDocument26 pages1 201 Integrity Objectivity and IndependenceAbigail SubaNo ratings yet

- NGO Staff Turn OverDocument106 pagesNGO Staff Turn OverTilahun MikiasNo ratings yet

- TADESSE SHIFERAW DIMBISSO PPM .PDF Latest VersiontDocument81 pagesTADESSE SHIFERAW DIMBISSO PPM .PDF Latest VersiontTilahun MikiasNo ratings yet

- Botoswana Employee Turn Over ResaerchDocument36 pagesBotoswana Employee Turn Over ResaerchTilahun MikiasNo ratings yet

- Justin De Jacobis' Dialogue in Divided Christian EthiopiaDocument12 pagesJustin De Jacobis' Dialogue in Divided Christian EthiopiaTilahun MikiasNo ratings yet

- RJAPS21 - Nonperforming Loans in The Banking Sector of BangladeshDocument21 pagesRJAPS21 - Nonperforming Loans in The Banking Sector of Bangladeshshovon mukitNo ratings yet

- Ej967469 PDFDocument17 pagesEj967469 PDFTilahun MikiasNo ratings yet

- Assessing Customer Knowledge and Use of E-BankingDocument45 pagesAssessing Customer Knowledge and Use of E-BankingTilahun MikiasNo ratings yet

- Effect of Accounting Information SystemDocument26 pagesEffect of Accounting Information SystemTilahun MikiasNo ratings yet

- CorruptionDocument9 pagesCorruptionTilahun MikiasNo ratings yet

- TewodrosDocument8 pagesTewodrosTilahun MikiasNo ratings yet

- Increase productivity documentDocument31 pagesIncrease productivity documentAli AghaNo ratings yet

- Increase productivity documentDocument31 pagesIncrease productivity documentAli AghaNo ratings yet

- English 3-Q4-L7 ModuleDocument19 pagesEnglish 3-Q4-L7 ModuleZosima Abalos100% (1)

- Karmila Kristina Paladang, Siane Indriani, Kurnia P. S DirgantoroDocument11 pagesKarmila Kristina Paladang, Siane Indriani, Kurnia P. S DirgantoroDaniel DikmanNo ratings yet

- RelativeResourceManager PDFDocument113 pagesRelativeResourceManager PDFMuhammad Irfan SalahuddinNo ratings yet

- Soil MechanicsDocument117 pagesSoil MechanicsChiranjaya HulangamuwaNo ratings yet

- Medical Records Education System DesignDocument10 pagesMedical Records Education System DesignMursid ElhamNo ratings yet

- 3 Pehlke. Observations On The Historical Reliability of OT. SJT 56.1 (2013)Document22 pages3 Pehlke. Observations On The Historical Reliability of OT. SJT 56.1 (2013)Cordova Llacsahuache Leif100% (1)

- Concepts of TeachingDocument3 pagesConcepts of TeachingMoises Embalzado Bacus Jr.No ratings yet

- Repaso 5to Grado 3°trimestreDocument25 pagesRepaso 5to Grado 3°trimestreFany BalderramaNo ratings yet

- Radiohead - The King of LimbsDocument2 pagesRadiohead - The King of LimbsOsmar LaraNo ratings yet

- Analisis Debussy PDFDocument2 pagesAnalisis Debussy PDFMiguel SeoaneNo ratings yet

- TASK 9adhDocument5 pagesTASK 9adhAyan FaridiNo ratings yet

- Book of AbstractsDocument156 pagesBook of Abstractsdragance106No ratings yet

- Republic of the Philippines v. Marcos: 9th Circuit Affirms Preliminary Injunction Against Disposing AssetsDocument18 pagesRepublic of the Philippines v. Marcos: 9th Circuit Affirms Preliminary Injunction Against Disposing AssetsAaron CariñoNo ratings yet

- Proposal On The Goals For ChangeDocument5 pagesProposal On The Goals For ChangeMelody MhedzyNo ratings yet

- Nursing Care PlansDocument7 pagesNursing Care PlansNicholaiCabadduNo ratings yet

- Answer All Questions PART A - (5 2 10)Document2 pagesAnswer All Questions PART A - (5 2 10)Peer MohamedNo ratings yet

- Best Practice in Analytical Method ValidationDocument24 pagesBest Practice in Analytical Method ValidationJarvis MurrayNo ratings yet

- Group 1 Cold Reading ScriptDocument3 pagesGroup 1 Cold Reading ScriptwinonaNo ratings yet

- Kertas Kerja Projek Inovasi IPGDocument10 pagesKertas Kerja Projek Inovasi IPGTESL1-0619 Rasheed Muhammad Raffeeq Bin RizalNo ratings yet

- Is There a Batak HistoryDocument14 pagesIs There a Batak HistoryMWahdiniPurbaNo ratings yet

- AtropineDocument6 pagesAtropineNiluh Komang Putri PurnamantiNo ratings yet

- United Kindom: Stefan Casian, 5BDocument14 pagesUnited Kindom: Stefan Casian, 5BClaudia Ramona StefanNo ratings yet

- Design Thinking What It Is Owen Korea05Document17 pagesDesign Thinking What It Is Owen Korea05DanijelBaraNo ratings yet

- Assistant Director Interview QuestionsDocument2 pagesAssistant Director Interview QuestionsFayaz WaganNo ratings yet

- Experienced Computer Engineer Seeks New OpportunitiesDocument2 pagesExperienced Computer Engineer Seeks New OpportunitiesAshok KumarNo ratings yet

- Aerodynamic Validation of Emerging Projectile and Missile ConfigurationsDocument109 pagesAerodynamic Validation of Emerging Projectile and Missile Configurationssux2beedNo ratings yet

- Fulbright-Hays Dissertation Research AbroadDocument8 pagesFulbright-Hays Dissertation Research AbroadHelpMeWriteMyPaperPortSaintLucie100% (1)