Professional Documents

Culture Documents

Chapter 16

Uploaded by

Haripriya Cherekar0 ratings0% found this document useful (0 votes)

19 views5 pagesOriginal Title

Chapter16

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

19 views5 pagesChapter 16

Uploaded by

Haripriya CherekarCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 5

‘Negotiable Instrument’ is any ‘document, necessarily in

writing’, through which rights, vested in one person, could

be transferred in favour of another person, in accordance

with the provisions of N I Act. Any violation of Sections

31 and 32 of the RBI Act, is punishable under law with

fine.

Section 31 of the RBI Act stipulates that ‘no person

(other than RBI or Central Government), can draw,

accept, make or issue any bill of exchange or a

promissory note payable to bearer on demand’.

Section 32 of the RBI Act provides that, if a person issues

any bill of exchange or a promissory note, payable to bearer,

on demand, shall be punishable with fine. Because, in case

banks’ promissory note, bank drafts, or banker’s cheques

(which are widely accepted without any fear of dishonour) is

made payable to the bearer, the title of such negotiable

instruments could be transferred to any other person, for

any number of times, just by mere delivery, without

endorsements. This way, these instruments, would be

changing hands as currency notes.

‘A negotiable instrument means a promissory note, bill of

exchange or cheque, payable either to order or to bearer’.

(Section 13). But other instruments, having characteristics

of being negotiable, are also treated as Negotiable

Instruments; e.g. bank notes, bank drafts, interest warrants,

dividend warrants, bearer debentures, share certificates, and

treasury bills. Later, under Section 85A, bank drafts have

also been included as a negotiable instrument.

Main features of Negotiable Instruments

(i) Freely transferable, without restrictions, by delivery (if

a bearer instrument), and by endorsement and delivery

(if an order instrument). Thus, actual delivery is of

essence.

(ii) Title of the holder must be free from defects. But,

‘holder in due course’ [who gets title to the

instrument, for consideration, and in good faith (i.e.

without any notice of defect in the title of the previous

endorser], acquires good title even in cases of some

defect in the title of the last endorser.

(iii)Holder in due course can sue in his own name.

(iv)A negotiable instrument can be transferred any

number of times during its maturity, currency or

validity.

Presumptions regarding all negotiable instruments, unless

proved otherwise: [Sections 118 and 119]:

(i) That, all instruments have been drawn, made, accepted,

endorsed, negotiated (or purchased), discounted, or

transferred, for some consideration.

(ii) That, every instrument must bear date of its execution

or drawing or acceptance for payment.

(iii)That every time a bill of exchange was accepted, within a

reasonable time, after the date appearing thereon, and

before the date of its maturity.

(iv)That, every transfer of a time instrument was made before

the date of its maturity.

(v) That, the sequencing of the endorsements was made in

the same order, as appearing on the instrument or on the

‘allonge’.

(vi) That, if the instrument gets lost or destroyed, it is

presumed that it was duly stamped, and that such

stamps were duly cancelled.

(vii)That, the holder of the instrument is its ‘holder in due

course’; unless proved to be only a ‘holder’.

(viii)That, where a suit has been filed, involving the

dishonour of an instrument, Court will, on production of

proof of its having been duly protested, presume that the

bill of exchange was dishonoured.

You might also like

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Convention on International Interests in Mobile Equipment - Cape Town TreatyFrom EverandConvention on International Interests in Mobile Equipment - Cape Town TreatyNo ratings yet

- Corporate legal environment study notesDocument13 pagesCorporate legal environment study notesHardik KothiyalNo ratings yet

- Negotiable Instruments: The Reserve Bank of India Act, 1934Document13 pagesNegotiable Instruments: The Reserve Bank of India Act, 1934sistla.suneethaNo ratings yet

- Unit 4 BL MadeDocument38 pagesUnit 4 BL Madesagar dafareNo ratings yet

- What Is Negotiable Instrument and Different Kinds of Negotiable InstrumentDocument47 pagesWhat Is Negotiable Instrument and Different Kinds of Negotiable Instrumentefaf00750% (2)

- Negotiable Instruments Act ExplainedDocument28 pagesNegotiable Instruments Act ExplainedShrikant RathodNo ratings yet

- 30 Negotiable InstrumentDocument100 pages30 Negotiable InstrumentA100% (2)

- NSB-PGDM - (Em) - Batch-5 Term-3-2022-24-Blcg-Ppt-5-Law Relating To Negotiable Instruments ActDocument23 pagesNSB-PGDM - (Em) - Batch-5 Term-3-2022-24-Blcg-Ppt-5-Law Relating To Negotiable Instruments ActVij88888No ratings yet

- Ni PDFDocument67 pagesNi PDFShubham SharmaNo ratings yet

- FM PDFDocument235 pagesFM PDFProfessor Sameer Kulkarni100% (2)

- The Negotiable Instrument Act, 1881Document18 pagesThe Negotiable Instrument Act, 1881GarimaNo ratings yet

- Business Law AssignmentDocument7 pagesBusiness Law AssignmentRahul Kumar100% (1)

- TPB - Module 3 - Reference MaterialDocument12 pagesTPB - Module 3 - Reference MaterialYashitha CaverammaNo ratings yet

- Negotiable Instruments Act, 1881Document33 pagesNegotiable Instruments Act, 1881Vinayak Khemani100% (1)

- Faareha Insurance Project SqueezedDocument14 pagesFaareha Insurance Project Squeezedaisha aliNo ratings yet

- Q: Define Negotiable Instrument. What Are Its Features and Characteristics? Which Are The Different Type of Negotiable InstrumentsDocument2 pagesQ: Define Negotiable Instrument. What Are Its Features and Characteristics? Which Are The Different Type of Negotiable InstrumentsshantonumondlNo ratings yet

- D-Negotiable Instrument ActDocument37 pagesD-Negotiable Instrument Actharsh100% (1)

- BLL 12 - Introduction to the Negotiable Instruments ActDocument3 pagesBLL 12 - Introduction to the Negotiable Instruments Actsvm kishoreNo ratings yet

- Negotiable Instruments Act 1881Document101 pagesNegotiable Instruments Act 1881Bidyut Biplab DasNo ratings yet

- Negotiable Instrument Act, 1881Document25 pagesNegotiable Instrument Act, 1881Viney VermaNo ratings yet

- 4) The Negotiable Instrument ActDocument53 pages4) The Negotiable Instrument Actakash nakkiranNo ratings yet

- Dishonour of Negotiable InstrumentDocument10 pagesDishonour of Negotiable Instrumentvishal bagariaNo ratings yet

- 1007 Negotiable InstrumentshgsdghamgsDocument24 pages1007 Negotiable InstrumentshgsdghamgsXirkul TupasNo ratings yet

- Banking Law Lecture on Negotiable InstrumentsDocument3 pagesBanking Law Lecture on Negotiable Instrumentsshreya patilNo ratings yet

- The Negotiable Instruments ActDocument14 pagesThe Negotiable Instruments ActPrasanna Subramanian100% (1)

- The Reserve Bank of India Act, 1934Document10 pagesThe Reserve Bank of India Act, 1934FRANCIS TAKYINo ratings yet

- The Negotiable Instruments ActDocument38 pagesThe Negotiable Instruments ActPJr MilleteNo ratings yet

- Critical Analysis of Negotiable Instruments ActDocument32 pagesCritical Analysis of Negotiable Instruments ActUdoy PaulNo ratings yet

- Negotiable InstrumentsDocument11 pagesNegotiable Instrumentsannmiraflor100% (1)

- Characteristics and Types of Negotiable InstrumentsDocument10 pagesCharacteristics and Types of Negotiable InstrumentsRishabh jainNo ratings yet

- Negotiable Instruments AssignmentDocument15 pagesNegotiable Instruments Assignmentnancy shamim100% (1)

- An Assignment on the Negotiable Instruments Act, 1881Document25 pagesAn Assignment on the Negotiable Instruments Act, 1881GarimaNo ratings yet

- Unit II Banking and Insurance Law Study NotesDocument12 pagesUnit II Banking and Insurance Law Study NotesSekar M KPRCAS-CommerceNo ratings yet

- NEGOTIABLE INSTRUMENTS ACT DEFINITIONDocument11 pagesNEGOTIABLE INSTRUMENTS ACT DEFINITIONkallasanjay100% (1)

- Introduction To Ni ActDocument17 pagesIntroduction To Ni ActfahadsustNo ratings yet

- Negotiable Instrument Act, 1881Document25 pagesNegotiable Instrument Act, 1881Garima100% (1)

- The Negotiable Instruments ActDocument63 pagesThe Negotiable Instruments ActRavi KumarNo ratings yet

- 5554 Negotiable Instrument ActDocument19 pages5554 Negotiable Instrument Actbrollsports250No ratings yet

- Brief Note On Negotiable Instruments ActDocument6 pagesBrief Note On Negotiable Instruments Actnazimuddin703597No ratings yet

- Effect of Material Alterations in Negotiable InstrumentsDocument18 pagesEffect of Material Alterations in Negotiable InstrumentsMohit Mittal50% (4)

- Negotiable Insutruments Act 1881: 5.1 Definition of A Negotiable InstrumentDocument12 pagesNegotiable Insutruments Act 1881: 5.1 Definition of A Negotiable InstrumentAshrafNo ratings yet

- Negotiable Instruments Act GuideDocument7 pagesNegotiable Instruments Act GuideKamlesh TarachandaniNo ratings yet

- Negotiable Instruments Law: Learning OutcomesDocument14 pagesNegotiable Instruments Law: Learning OutcomesHuzzain PangcogaNo ratings yet

- Shadaan Qadri - Sem X - Sec A - R No 28 - Law Relating To Dishonour of Cheques in IndiaDocument39 pagesShadaan Qadri - Sem X - Sec A - R No 28 - Law Relating To Dishonour of Cheques in IndiaAnshuman SrivastavaNo ratings yet

- Business Law: Certificate LevelDocument14 pagesBusiness Law: Certificate LevelRafidul IslamNo ratings yet

- Chapter 05 Negotiable Instruments Act 1881 1229869805849562 1Document11 pagesChapter 05 Negotiable Instruments Act 1881 1229869805849562 1अरुण शर्माNo ratings yet

- Negotiable Instruments - MemorizeDocument3 pagesNegotiable Instruments - MemorizeKenneth AbuanNo ratings yet

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsFrom EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsNo ratings yet

- Consumer Protection in India: A brief Guide on the Subject along with the Specimen form of a ComplaintFrom EverandConsumer Protection in India: A brief Guide on the Subject along with the Specimen form of a ComplaintNo ratings yet

- Simple Guide for Drafting of Civil Suits in IndiaFrom EverandSimple Guide for Drafting of Civil Suits in IndiaRating: 4.5 out of 5 stars4.5/5 (4)

- Bar Review Companion: Remedial Law: Anvil Law Books Series, #2From EverandBar Review Companion: Remedial Law: Anvil Law Books Series, #2Rating: 3 out of 5 stars3/5 (2)

- Drafting Written Statements: An Essential Guide under Indian LawFrom EverandDrafting Written Statements: An Essential Guide under Indian LawNo ratings yet

- Dishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintFrom EverandDishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintRating: 4 out of 5 stars4/5 (1)

- The 9 Essential Skills of Human Resources ManagementDocument5 pagesThe 9 Essential Skills of Human Resources ManagementHaripriya CherekarNo ratings yet

- Annual Report Library Services - Get reports from sansco.netDocument10 pagesAnnual Report Library Services - Get reports from sansco.netHaripriya CherekarNo ratings yet

- 10 1 1 106Document10 pages10 1 1 106Haripriya CherekarNo ratings yet

- Unit One: Social and Political LifeDocument16 pagesUnit One: Social and Political LifeHiren PatelNo ratings yet

- Consumer Buying Behaviour in Fashion Retailing: Empirical EvidenciesDocument15 pagesConsumer Buying Behaviour in Fashion Retailing: Empirical EvidenciesHaripriya CherekarNo ratings yet

- Claims Verification Form.Document1 pageClaims Verification Form.Anas MuhammedNo ratings yet

- Non Banking Financial InstitutionsDocument10 pagesNon Banking Financial InstitutionsFachri DwiansyahNo ratings yet

- The Sammons Associates Annual Heads of Equity Research SurveyDocument4 pagesThe Sammons Associates Annual Heads of Equity Research SurveytcawarrenNo ratings yet

- Interest: DiscounrDocument16 pagesInterest: DiscounrAjai AjaiNo ratings yet

- ICARNEH Vendor Salary BillDocument2 pagesICARNEH Vendor Salary BillOlivia-i Pa KhsaiNo ratings yet

- Mortgage Schedule Calculator.Document40 pagesMortgage Schedule Calculator.samNo ratings yet

- 1A. HDFC Apr2018 EstatementDocument5 pages1A. HDFC Apr2018 EstatementNanu PatelNo ratings yet

- 01 Credit Card Enrollment Form 2022 FILLABLE v2Document2 pages01 Credit Card Enrollment Form 2022 FILLABLE v2Shashi Mae BonifacioNo ratings yet

- ATM Test ConditionsDocument28 pagesATM Test ConditionsRebecca ImmarajuNo ratings yet

- Repayment Schedule - 100343948Document2 pagesRepayment Schedule - 100343948Nani RocksNo ratings yet

- MR - Vipin SharmaDocument1 pageMR - Vipin SharmaVIPIN SHARMANo ratings yet

- 5 Lee Chua Siok Suy Vs CADocument17 pages5 Lee Chua Siok Suy Vs CAcertiorari19No ratings yet

- Letter of CreditDocument6 pagesLetter of CreditVarun ChandwaniNo ratings yet

- Uas Bahasa InggrisDocument2 pagesUas Bahasa InggrisKiki AfridaNo ratings yet

- E-Wallet Impact On Shopping Mall: A Submitted ForDocument17 pagesE-Wallet Impact On Shopping Mall: A Submitted ForMaulik M RafaliyaNo ratings yet

- Monetary Policy of State Bank of PakistanDocument16 pagesMonetary Policy of State Bank of PakistanAli Imran JalaliNo ratings yet

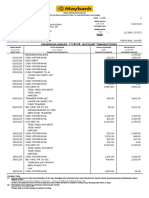

- View / Download Account StatementDocument3 pagesView / Download Account StatementGenial Manifold GroupNo ratings yet

- 112380-237973 20190331 PDFDocument5 pages112380-237973 20190331 PDFKutty KausyNo ratings yet

- Statement of Account: Transaction Date Description Debit Credit Available BalanceDocument3 pagesStatement of Account: Transaction Date Description Debit Credit Available BalanceRashid ShahNo ratings yet

- Conventional RatesDocument1 pageConventional RatesRiaz AhmedNo ratings yet

- HDFC Bank's Mission as a World Class Indian BankDocument24 pagesHDFC Bank's Mission as a World Class Indian BankYogi GandhiNo ratings yet

- RBG - RCBC'S Deposit Products For EOPDocument63 pagesRBG - RCBC'S Deposit Products For EOPTimothy AngNo ratings yet

- General List of Banks of The PhilippinesDocument16 pagesGeneral List of Banks of The PhilippinesOkin Nawa100% (1)

- Journal Entry Voucher: Municipal Government of Lambunao Disbursement VoucherDocument12 pagesJournal Entry Voucher: Municipal Government of Lambunao Disbursement VoucherFrancisco Lubas Santillana IVNo ratings yet

- A Study On Subprime Crisis and Its Effects On India Mba ProjectDocument75 pagesA Study On Subprime Crisis and Its Effects On India Mba ProjectSagar ChitrodaNo ratings yet

- Jyske AftalerDocument15 pagesJyske AftalerFa JM0% (1)

- Theories and Problem Solving AKDocument19 pagesTheories and Problem Solving AKJob CastonesNo ratings yet

- MSU-CBA Receivables Financing Pre-Review ProgramDocument2 pagesMSU-CBA Receivables Financing Pre-Review ProgramAyesha RGNo ratings yet

- 20220606125603-Banking Sector - Q1-22 enDocument9 pages20220606125603-Banking Sector - Q1-22 enHadeel NoorNo ratings yet

- Compound Interest1Document6 pagesCompound Interest1Biomass conversionNo ratings yet

- BS Delhi EnglishDocument20 pagesBS Delhi EnglishAshisNo ratings yet