Professional Documents

Culture Documents

Economics of Corona

Uploaded by

Harry Singh0 ratings0% found this document useful (0 votes)

11 views34 pagesCopyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views34 pagesEconomics of Corona

Uploaded by

Harry SinghCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 34

The Economics of Pandemics

Rajiv Sethi and the CORE Team

Current Version: March 27, 2020

Overview

• COVID-19 - another hockey stick?

• Externalities: testing and distancing

• Social preferences and the choice to self-quarantine

• Disruption of global supply chains

• Individual markets: masks, sanitizers, cruises, and flights

• Income, employment, and aggregate demand

• Asset prices: stock market indexes and Zoom Video Communications

• Composition effects and scale effects

Additional Readings

Thomas Pueyo, Coronavirus: Why You Must Act Now and

Coronavirus: The Hammer and the Dance (Medium)

Noreen Qualls et al.,

Community Mitigation Guidelines to Prevent Pandemic Influenza

(Centers for Disease Control and Prevention)

Safra Center for Ethics at Harvard University,

COVID-19 Response White Papers

CORE COVID-19 Collection

COVID-19 Hockey Sticks?

COVID-19 Growth Rates

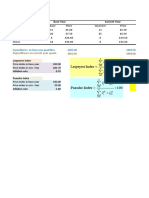

•• Suppose

daily growth rate of confirmed cases is g

• With n cases today, cases after t days

• If g is or about 41.42%,

• At this growth rate cases double every two days

• 100 cases grows to 1,131 in a week, over 46,000 in a month

• Eventually growth slows because more recover or succumb

• Assuming recovery comes with immunity

• So, not another hockey stick

• See more by comparing paths with linear and ratio (log) scales

Number of days for confirmed cases to double from OWiD

Data

• Valuable Data Source: Our World in Data

• Search for COVID

• Examine Total Confirmed COVID-19 cases (select your own countries)

• Examine Total COVID-19 tests performed per capita (select your own

countries)

• Compare tests in total and per capita (per million people)

OWiD chart - select your own countries

OWiD chart - select your own countries

OWiD chart - select your own countries

OWiD chart select your countries

COVID-19 Total Cases

• Data on total cases doesn’t account for population

• Also doesn’t account for extent of testing

• High growth can arise from greater testing or spread of virus

• Differences across countries can also arise from reliability of reporting

• Still, cross-country comparisons can be informative

Flattening the Curve

Flattening the Curve

• If growth is rapid, peak number of cases will be high

• Possibly exceeding capacity of health care system

• How can growth be slowed?

• Those exposed or infected must self-quarantine (or be isolated)

• Those not exposed must take precautions

• Washing hands, avoid touching face, and social distancing

• Closing of schools, cancellation of events and travel, distance learning

OWiD data - select your countries

External Effects

• Social distancing has private costs and social benefits

• Similar to contributions to a public good

• If people only equate private benefits and costs, insufficient distancing

• Policy response: closings, cancellations, restrictions on mobility

• Testing also has private costs and social benefits

• If people only equate private benefits and costs, insufficient testing

• Policy response: subsidization of testing, mandatory testing

• Vaccine development also not profitable (before or after pandemic)

• Policy response: subsidies and grants for vaccine development

Social Preferences

• Those with exposure or symptoms should self-quarantine

• But this also has private costs and social benefits

• In fact private benefits are few (too late to prevent infection)

• Benefits may even be negative: loss of wages

• So why do many people self-quarantine?

• Social preferences: concern for others and civic responsibility

• Policy response: acknowledge and encourage civic responsibility

• But not all are responsive to such initiatives, or can afford to stay home

• Policy response: screening and isolation, paid sick leave

Demand and Supply

Demand Shifts

• Significant contraction in demand for some goods and services

• Examples: restaurants, hotels, flights, cruises

• Supply and demand model suggests lower price and quantity

• With lower profits and significant debt: increased incidence of bankruptcy

• Reduced hiring, increased layoffs

• But some goods/services see higher demand

• Healthcare, sanitizers, masks, cleaning supplies

• Incentives for panic buying, hoarding and profiteering

Supply Shifts

• Disruption of global supply chains

• With inability to source components quickly elsewhere, supply falls

• Greater employee absence also lowers supply

• Supply and demand model suggests higher price and lower quantity

• Opposite effects on profits, but negative on balance

• Again resulting in reduced hiring, increased layoffs, more bankruptcy

Asset Prices

Asset Prices

• Prices of shares reflect expectations of future profitability

• Demand contraction lowers expected profits and stock prices

• Somewhat mitigated by wage effects of higher unemployment

• So stock market indexes (Dow Jones, S&P 500) fall

• Stocks of airline, cruise lines fall especially far

• But some assets rise in price: Zoom Video Communications (ZM)

Composition and Scale Effects

Composition and Scale

• Economic effects of COVID-19 can be partitioned into two categories

• Composition effects refer to collapse in demand for some goods/services

• Even as there is surging demand for others

• Collapsing demand: travel, lodging, meals, entertainment, durables

• Surging demand: health services, masks, ventilators, sanitizers, software

• Scale effects refer to the collapse in aggregate output and employment.

• Predicted contraction in second quarter: 14% (JPM) and 24% (GS)

• Treasury Secretary: unemployment rate of 20% possible

• Different types of effects call for different policies

Composition Effects

• For goods/ services in high demand, incentives needed for more supply

• Market will respond to some extent

• AMZN hired 100,000 more workers, raised pay

• Some distilleries converting operations to produce disinfectants

• But market solutions not adequate on both efficiency and equity grounds

• Ventilator production relies on disrupted global supply chains

• Role for government mandated or subsidized production (as in wartime)

• Should affluent individuals be allowed to buy and store ventilators?

• Should hoarding and profiteering be monitored and punished?

Local Governments

• State and local governments face hard budget constraints

• Face possibility of bankruptcy (unlike federal government)

• Sharp fall in revenues just as expenditure needs rise substantially

• Cannot simply borrow to finance shortfall

• Role for Federal Reserve in buying municipal bonds

Scale Effects

• As layoffs and bankruptcies rise, aggregate demand falls further

• Multiplier effect amplifies decline, lead to recession

• Mitigated by automatic stabilizers: lower taxes, higher expenditure

• Policy response: Expansionary fiscal and monetary policy

• Federal Reserve: lower interest rates, asset purchases

• Treasury: tax cuts, delayed filing, increased benefits, cash payments

• Other policies: suspension of loan repayments and evictions

• Discussion: should we have a flexible universal basic income?

• Discussion: should we allow individual accounts at the Fed?

Glossary

aggregate demand fiscal stimulus social preferences

asset income stock exchange

automatic stabilizers monetary policy supply side

cooperation Pareto efficient

demand side private benefit

employment rate private cost

external effect prudential policy

fairness public bad

fiscal multiplier public good

fiscal policy social interactions

You might also like

- Lecture4 CMDocument54 pagesLecture4 CMHarry SinghNo ratings yet

- Lecture3 CMDocument45 pagesLecture3 CMHarry SinghNo ratings yet

- ECN105 Week 8 Class Activities - Indicative SolutionsDocument5 pagesECN105 Week 8 Class Activities - Indicative SolutionsHarry SinghNo ratings yet

- Lecture5 CMDocument74 pagesLecture5 CMHarry SinghNo ratings yet

- Lecture1 CMDocument64 pagesLecture1 CMHarry SinghNo ratings yet

- Lecture2 CMDocument72 pagesLecture2 CMHarry SinghNo ratings yet

- Climate Change: ECN105 Contemporary Economic IssuesDocument31 pagesClimate Change: ECN105 Contemporary Economic IssuesHarry SinghNo ratings yet

- The Sugar Tax: ECN105 Contemporary Economic IssuesDocument25 pagesThe Sugar Tax: ECN105 Contemporary Economic IssuesHarry SinghNo ratings yet

- Labour Market and Income Distribution: The Effects of Education and The Gig-EconomyDocument19 pagesLabour Market and Income Distribution: The Effects of Education and The Gig-EconomyHarry SinghNo ratings yet

- ECN105 Lecture 2 Slides For QMplusDocument31 pagesECN105 Lecture 2 Slides For QMplusHarry SinghNo ratings yet

- Inequality: Income and Wealth Distribution: ECN105 Contemporary Economic IssuesDocument42 pagesInequality: Income and Wealth Distribution: ECN105 Contemporary Economic IssuesHarry SinghNo ratings yet

- Labour Market and Income Distribution: ECN105 Contemporary Economic IssuesDocument24 pagesLabour Market and Income Distribution: ECN105 Contemporary Economic IssuesHarry SinghNo ratings yet

- Technological Progress, Productivity and Living Standards . The UK Productivity Puzzle RevisitedDocument34 pagesTechnological Progress, Productivity and Living Standards . The UK Productivity Puzzle RevisitedHarry SinghNo ratings yet

- ECN105 Contemporary Economic IssuesDocument48 pagesECN105 Contemporary Economic IssuesHarry SinghNo ratings yet

- ECN102 World Economy: Lecture 8: International Trade IIIDocument37 pagesECN102 World Economy: Lecture 8: International Trade IIIHarry SinghNo ratings yet

- ECN105 Week 2 Class Activities - Indicative SolutionsDocument9 pagesECN105 Week 2 Class Activities - Indicative SolutionsHarry SinghNo ratings yet

- Ecn105 190091479Document4 pagesEcn105 190091479Harry SinghNo ratings yet

- Module Handbook: ECN105 Contemporary Economic IssuesDocument5 pagesModule Handbook: ECN105 Contemporary Economic IssuesHarry SinghNo ratings yet

- Lecture Notes PDFDocument116 pagesLecture Notes PDFHarry SinghNo ratings yet

- The Catastrophic Consequences of Climate ChangeDocument4 pagesThe Catastrophic Consequences of Climate ChangeHarry SinghNo ratings yet

- School of Economics and Finance: ECN102 World EconomyDocument3 pagesSchool of Economics and Finance: ECN102 World EconomyHarry SinghNo ratings yet

- ECN102 Lecture 7 19.20 S PDFDocument43 pagesECN102 Lecture 7 19.20 S PDFHarry SinghNo ratings yet

- ECN102 Lecture 10 19.20 SDocument50 pagesECN102 Lecture 10 19.20 SHarry SinghNo ratings yet

- School of Economics and Finance Queen Mary University of London ECN 113 Principles of EconomicsDocument3 pagesSchool of Economics and Finance Queen Mary University of London ECN 113 Principles of EconomicsHarry SinghNo ratings yet

- Compound Growth and Present Discounted ValueDocument26 pagesCompound Growth and Present Discounted ValueHarry SinghNo ratings yet

- ECN115 G. Renshaw ch.20: Difference & Differential EquationsDocument29 pagesECN115 G. Renshaw ch.20: Difference & Differential EquationsHarry SinghNo ratings yet

- 100 Index LaspeyresDocument4 pages100 Index LaspeyresHarry SinghNo ratings yet

- Week 11 FormulaeDocument5 pagesWeek 11 FormulaeHarry SinghNo ratings yet

- ECN115 Lec09aDocument12 pagesECN115 Lec09aHarry SinghNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Econ 301 MT 1 NotesDocument24 pagesEcon 301 MT 1 NotesNicolle YhapNo ratings yet

- International Business AU PDFDocument264 pagesInternational Business AU PDFNiranjan Kumar100% (1)

- InflationismDocument15 pagesInflationismsulamsheena2No ratings yet

- Home Care in VietnamDocument35 pagesHome Care in Vietnamvinhpp0308No ratings yet

- Strategic FitDocument31 pagesStrategic FitAmelia SoniaNo ratings yet

- Aggregate PlanningDocument57 pagesAggregate PlanningSanjeev RanjanNo ratings yet

- MM-CH-4-Pricing Strategies & PracticeDocument19 pagesMM-CH-4-Pricing Strategies & PracticeSarvesh SoniNo ratings yet

- Economics 121: Zvika NeemanDocument26 pagesEconomics 121: Zvika NeemanMatteo GodiNo ratings yet

- CH 1 MR-1Document52 pagesCH 1 MR-1efrata AlemNo ratings yet

- Case Studies TLE 9Document3 pagesCase Studies TLE 9leeheeseung008No ratings yet

- Igcse Economics Rev NotesDocument86 pagesIgcse Economics Rev NotesDiya Kaulitz87% (15)

- Minimum WagesDocument42 pagesMinimum WagesHarsha Ammineni100% (1)

- Q1 Exports: Bed Wear Cotton ClothDocument10 pagesQ1 Exports: Bed Wear Cotton ClothSaqib RehanNo ratings yet

- Masicapusme: of A ofDocument49 pagesMasicapusme: of A ofERIC T. VALIENTENo ratings yet

- Business Economics: AssignmentDocument4 pagesBusiness Economics: AssignmentRaffay MaqboolNo ratings yet

- Eco C12 MicroEconomicsDocument110 pagesEco C12 MicroEconomicskane21232874100% (4)

- Simulated Examination in Agricultural Economics and Marketing (Post-Test) Name - Score - General DirectionsDocument10 pagesSimulated Examination in Agricultural Economics and Marketing (Post-Test) Name - Score - General Directionsmaica balaoasNo ratings yet

- Assignment EconomyDocument27 pagesAssignment EconomyRahimee DahlanNo ratings yet

- Demand Estimation and ForecastingDocument10 pagesDemand Estimation and ForecastingSmurti Rekha James100% (1)

- Case Analysis: "Loctite Corporation: Industrial Products Group"Document3 pagesCase Analysis: "Loctite Corporation: Industrial Products Group"Saurabh ChipadeNo ratings yet

- Test Bank For Macroeconomics in Modules 4th Edition Paul Krugman Robin Wells Full DownloadDocument25 pagesTest Bank For Macroeconomics in Modules 4th Edition Paul Krugman Robin Wells Full Downloadmichaelbirdgznspejbwa100% (18)

- Monopoly: ECONOMICS: Principles and Applications, 4e HALL & LIEBERMAN, © 2008 Thomson South-WesternDocument19 pagesMonopoly: ECONOMICS: Principles and Applications, 4e HALL & LIEBERMAN, © 2008 Thomson South-WesternDavidNo ratings yet

- 2-Forces Affecting Growth and Change in The HospitalityDocument12 pages2-Forces Affecting Growth and Change in The HospitalityRajesh GurunathanNo ratings yet

- The Las Vegas Valley Water District LVVWD Is A Not For ProfitDocument1 pageThe Las Vegas Valley Water District LVVWD Is A Not For Profittrilocksp SinghNo ratings yet

- Mankiew Chapter 15Document31 pagesMankiew Chapter 15foz100% (1)

- Managerial Economics:: Theory, Applications, and CasesDocument50 pagesManagerial Economics:: Theory, Applications, and CasesAbeer ShamiNo ratings yet

- Chap 6 Supply, Demand, and Government Policies VNDocument15 pagesChap 6 Supply, Demand, and Government Policies VNTrinh Phan Thị NgọcNo ratings yet

- Microeconomics by John BurkettDocument355 pagesMicroeconomics by John BurkettAbir GhoshNo ratings yet

- SchedulingDocument36 pagesSchedulingAbdurahman AregaNo ratings yet

- Can The Emerging Technologies Pose A Challenge For An International Marketer? Give Valid Arguments ToDocument3 pagesCan The Emerging Technologies Pose A Challenge For An International Marketer? Give Valid Arguments ToElma RejanoNo ratings yet