Professional Documents

Culture Documents

CH3 Risk

Uploaded by

Mohamed Hassan0 ratings0% found this document useful (0 votes)

17 views32 pagesrisk management

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentrisk management

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views32 pagesCH3 Risk

Uploaded by

Mohamed Hassanrisk management

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 32

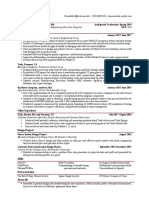

Chapter 3

Introduction to

Risk Management

12/22/20 © Abas M. Hassan 2017 1

Agenda

Meaning of Risk Management

Objectives of Risk Management

Steps in the Risk Management Process

Benefits of Risk Management

Personal Risk Management

12/22/20 © Abas M. Hassan 2017 2

Meaning of Risk Management

Risk Management is a process that identifies loss

exposures faced by an organization and selects the

most appropriate techniques for treating such

exposures

A loss exposure is any situation or circumstance in

which a loss is possible, regardless of whether a

loss occurs

E.g., a plant that may be damaged by an earthquake, or

an automobile that may be damaged in a collision

12/22/20 © Abas M. Hassan 2017 3

Objectives of Risk Management

Risk management has objectives before and

after a loss occurs

Pre-loss objectives:

Prepare for potential losses in the most

economical way

Reduce anxiety

Meet any legal obligations

12/22/20 © Abas M. Hassan 2017 4

Continued…

Post-loss objectives:

Survival of the firm

Continue operating

Stability of earnings

Continued growth of the firm

Minimize the effects that a loss will have on

other persons and on society

12/22/20 © Abas M. Hassan 2017 5

Risk Management Process

Identify potential losses

Measure and analyze the loss exposures

Select the appropriate combination of

techniques for treating the loss exposures

Implement and monitor the risk management

program

12/22/20 © Abas M. Hassan 2017 6

Exhibit 3.1 Steps in the Risk Management Process

12/22/20 © Abas M. Hassan 2017 7

Identify Loss Exposures

Property loss exposures

Liability loss exposures

Business income loss exposures

Human resources loss exposures

Crime loss exposures

Employee benefit loss exposures

Foreign loss exposures

Intangible property loss exposures

Failure to comply with government rules and regulations

12/22/20 © Abas M. Hassan 2017 8

Continued…

Risk Managers have several sources of information

to identify loss exposures:

Risk analysis questionnaires and checklists

Physical inspection

Flowcharts

Financial statements

Historical loss data

Industry trends and market changes can create new

loss exposures.

e.g., exposure to acts of terrorism

12/22/20 © Abas M. Hassan 2017 9

Measure and Analyze Loss Exposures

Estimate for each type of loss exposure:

Loss frequency refers to the probable number of losses

that may occur during some time period

Loss severity refers to the probable size of the losses

that may occur

Rank exposures by importance

Loss severity is more important than loss frequency:

The maximum possible loss is the worst loss that could

happen to the firm during its lifetime

The probable maximum loss is the worst loss that is

likely to happen

12/22/20 © Abas M. Hassan 2017 10

Select the Appropriate Combination of Techniques

for Treating the Loss Exposures

Risk control refers to techniques that reduce

the frequency and severity of losses

Methods of risk control include:

Avoidance

Loss prevention

Loss reduction

12/22/20 © Abas M. Hassan 2017 11

Continued…

Avoidance means a certain loss exposure is

never acquired or undertaken, or an existing

loss exposure is abandoned

The chance of loss is reduced to zero

It is not always possible, or practical, to avoid all

losses

12/22/20 © Abas M. Hassan 2017 12

Continued…

Loss prevention refers to measures that

reduce the frequency of a particular loss

e.g., installing safety features on hazardous

products

Loss reduction refers to measures that reduce

the severity of a loss after it occurs

e.g., installing an automatic sprinkler system

12/22/20 © Abas M. Hassan 2017 13

Continued…

Risk financing refers to techniques that

provide for the payment of losses after they

occur

Methods of risk financing include:

Retention

Non-insurance Transfers

Commercial Insurance

12/22/20 © Abas M. Hassan 2017 14

Continued…

Retention means that the firm retains part or

all of the losses that can result from a given

loss

Retention is effectively used when:

No other method of treatment is available

The worst possible loss is not serious

Losses are highly predictable

The retention level is the dollar amount of losses

that the firm will retain

12/22/20 © Abas M. Hassan 2017 15

Continued…

A risk manager has several methods for paying

retained losses:

Current net income: losses are treated as current

expenses

Unfunded reserve: losses are deducted from a

bookkeeping account

Funded reserve: losses are deducted from a liquid

fund

Credit line: funds are borrowed to pay losses as they

occur

12/22/20 © Abas M. Hassan 2017 16

Continued…

A captive insurer is an insurer owned by a

parent firm for the purpose of insuring the

parent firm’s loss exposures

A single-parent captive is owned by only one

parent

An association or group captive is an insurer

owned by several parents

12/22/20 © Abas M. Hassan 2017 17

Continued…

Reasons for forming a captive include:

The parent firm may have difficulty obtaining

insurance

To take advantage of a favorable regulatory

environment

Costs may be lower than purchasing commercial

insurance

A captive insurer has easier access to a reinsurer

A captive insurer can become a source of profit

12/22/20 © Abas M. Hassan 2017 18

Continued…

Premiums paid to a single parent (pure) captive are

generally not income-tax deductible.

They may be tax deductible if:

The transaction is a bona fide insurance transaction

A brother-sister relationship exists

The captive insurer writes a substantial amount of

unrelated business

The insureds are not the same as the shareholders

of the captive

Premiums paid to a group captive are usually income-

tax deductible.

12/22/20 © Abas M. Hassan 2017 19

Continued…

Self-insurance, or self-funding is a special form of

planned retention by which part or all of a given

loss exposure is retained by the firm

A risk retention group (RRG) is a group captive

that can write any type of liability coverage except

employers’ liability, workers compensation, and

personal lines

They are exempt from many state insurance laws

12/22/20 © Abas M. Hassan 2017 20

Continued…

Advantages Disadvantages

Save on loss costs Possible higher losses

Save on expenses Possible higher

Encourage loss expenses

prevention Possible higher taxes

Increase cash flow

12/22/20 © Abas M. Hassan 2017 21

Continued…

A non-insurance transfer is a method other

than insurance by which a pure risk and its

potential financial consequences are

transferred to another party

Examples include: contracts, leases, hold-

harmless agreements

12/22/20 © Abas M. Hassan 2017 22

Continued…

Advantages Disadvantages

Can transfer some Contract language may

losses that are not be ambiguous, so

insurable transfer may fail

Less expensive If the other party fails

Can transfer loss to to pay, firm is still

someone who is in a responsible for the loss

better position to Insurers may not give

control losses credit for transfers

12/22/20 © Abas M. Hassan 2017 23

Continued…

Insurance is appropriate for low-probability, high-

severity loss exposures

The risk manager selects the coverages needed, and

policy provisions

A deductible is a specified amount subtracted from the

loss payment otherwise payable to the insured

In an excess insurance policy, the insurer pays only if the

actual loss exceeds the amount a firm has decided to

retain

The risk manager selects the insurer, or insurers, to

provide the coverages

12/22/20 © Abas M. Hassan 2017 24

Continued…

The risk manager negotiates the terms of the insurance

contract

A manuscript policy is a policy specially tailored for

the firm

The parties must agree on the contract provisions,

endorsements, forms, and premiums

Information concerning insurance coverages must be

disseminated to others in the firm

The risk manager must periodically review the

insurance program

12/22/20 © Abas M. Hassan 2017 25

Continued…

Disadvantages Advantages

Premiums may be costly Firm is indemnified for

Negotiation of contracts losses

takes time and effort

Uncertainty is reduced

The risk manager may

become lax in exercising Insurers can provide

loss control valuable risk

management services

Premiums are income-

tax deductible

12/22/20 © Abas M. Hassan 2017 26

Exhibit 3.2 Risk Management Matrix

12/22/20 © Abas M. Hassan 2017 27

Market Conditions and the Selection of Risk

Management Techniques

Risk managers may have to modify their choice of

techniques depending on market conditions in the

insurance markets

The insurance market experiences an underwriting cycle

In a “ hard” market, profitability is declining,

underwriting standards are tightened, premiums

increase, and insurance is hard to obtain

In a “ soft” market, profitability is improving,

standards are loosened, premiums decline, and

insurance become easier to obtain

12/22/20 © Abas M. Hassan 2017 28

Implement and Monitor the Risk

Management Program

Implementation of a risk management program

begins with a risk management policy statement

that:

Outlines the firm’s objectives and policies

Educates top-level executives

Gives the risk manager greater authority

Provides standards for judging the risk manager’s

performance

A risk management manual may be used to:

Describe the risk management program

Train new employees

12/22/20 © Abas M. Hassan 2017 29

Continued…

A successful risk management program requires

active cooperation from other departments in the

firm

The risk management program should be

periodically reviewed and evaluated to determine

whether the objectives are being attained

The risk manager should compare the costs and

benefits of all risk management activities

12/22/20 © Abas M. Hassan 2017 30

Benefits of Risk Management

Enables firm to attain its pre-loss and post-loss

objectives more easily

A risk management program can reduce a firm’s

cost of risk

Reduction in pure loss exposures allows a firm to

enact an enterprise risk management program to

treat both pure and speculative loss exposures

Society benefits because both direct and indirect

losses are reduced

12/22/20 © Abas M. Hassan 2017 31

Personal Risk Management

Personal risk management refers to the

identification of pure risks faced by an

individual or family, and to the selection of

the most appropriate technique for treating

such risks

The same principles applied to corporate risk

management apply to personal risk

management

12/22/20 © Abas M. Hassan 2017 32

You might also like

- Introduction To Risk Management: 12/22/20 © Ibrahim Hassan 1Document32 pagesIntroduction To Risk Management: 12/22/20 © Ibrahim Hassan 1Mohamed HassanNo ratings yet

- Financial Operations of Insurers: 12/22/20 © Ibrahim Hassan 1Document24 pagesFinancial Operations of Insurers: 12/22/20 © Ibrahim Hassan 1Mohamed HassanNo ratings yet

- Types of Insurers and Marketing Systems: 12/22/20 © Ibrahim Hassan 1Document30 pagesTypes of Insurers and Marketing Systems: 12/22/20 © Ibrahim Hassan 1Mohamed HassanNo ratings yet

- 12/22/20 © Ibrahim Hassan 1: Insurance Company OperationsDocument29 pages12/22/20 © Ibrahim Hassan 1: Insurance Company OperationsMohamed HassanNo ratings yet

- Chapter Two: The Risk ManagementDocument25 pagesChapter Two: The Risk Managementabadiryasin309No ratings yet

- Topic 6 - The Management of RiskDocument34 pagesTopic 6 - The Management of RiskArun GhatanNo ratings yet

- Introduction To Insurance: Soumendra Roy NimsDocument59 pagesIntroduction To Insurance: Soumendra Roy NimsbapparoyNo ratings yet

- Credit Risk Analysis - Control - GC - 2Document176 pagesCredit Risk Analysis - Control - GC - 2Keith Tanaka MagakaNo ratings yet

- RISK MANAGEMENT METHODs Lesson Ten NotesDocument7 pagesRISK MANAGEMENT METHODs Lesson Ten NotesteckmeruNo ratings yet

- 12/22/20 © Ibrahim Hassan 1: Life InsuranceDocument39 pages12/22/20 © Ibrahim Hassan 1: Life InsuranceMohamed HassanNo ratings yet

- Lecture 4 Business Risks Management and InsuranceDocument37 pagesLecture 4 Business Risks Management and InsuranceBright BlayNo ratings yet

- Key Trends in Risk Management Further ReadingDocument6 pagesKey Trends in Risk Management Further ReadingSiddhantpsinghNo ratings yet

- Risk Management (SM) ICMAP Attempts Qs - xlsx-1Document8 pagesRisk Management (SM) ICMAP Attempts Qs - xlsx-1Sibgha FayyazNo ratings yet

- Name: Adejayan Damilola ToluDocument5 pagesName: Adejayan Damilola Tolumicheal chrisNo ratings yet

- Chapter 6. Engineering EntrepreneurshipDocument26 pagesChapter 6. Engineering EntrepreneurshipSadam EndrisNo ratings yet

- 04/02/21 © Ibrahim Hassan 1: Analysis of Insurance ContractsDocument23 pages04/02/21 © Ibrahim Hassan 1: Analysis of Insurance ContractsMohamed HassanNo ratings yet

- Chapter 1 IntroductionDocument31 pagesChapter 1 IntroductionAnil SharmaNo ratings yet

- Actuarial Statistics: by Defaru Debebe AMUDocument197 pagesActuarial Statistics: by Defaru Debebe AMUomega tekaNo ratings yet

- SynopsisDocument3 pagesSynopsisRehaan DanishNo ratings yet

- 9th Chap Insurance & Business RiskDocument9 pages9th Chap Insurance & Business Riskbaigz0918No ratings yet

- Risk and Risk Management - Session - 1Document47 pagesRisk and Risk Management - Session - 1chetangor7100% (9)

- Home Products & Services About Aon Contact Choose Country/OfficeDocument13 pagesHome Products & Services About Aon Contact Choose Country/OfficeMujo TiNo ratings yet

- Entre-CHAPTER SIXDocument27 pagesEntre-CHAPTER SIXEuielNo ratings yet

- PBI - Unit 4 & 5Document70 pagesPBI - Unit 4 & 5AdarshPanickerNo ratings yet

- Combined Chapters 3 and 5Document45 pagesCombined Chapters 3 and 5Alysia GeartyNo ratings yet

- AGI Exam 5 With Answers - EnglishDocument18 pagesAGI Exam 5 With Answers - EnglishBaskar SayeeNo ratings yet

- Role of Insurance Companies in The Economic Development of BangladeshDocument4 pagesRole of Insurance Companies in The Economic Development of BangladeshAsim Mandal60% (5)

- InsuranceDocument53 pagesInsuranceRohit VkNo ratings yet

- Research Paper Report ManishaDocument19 pagesResearch Paper Report ManishaDeep ChoudharyNo ratings yet

- Project Report On Frauds in InsuranceDocument63 pagesProject Report On Frauds in InsuranceSiddharth Goyal87% (46)

- Corp FinanceDocument27 pagesCorp FinanceMeghna Badkul JainNo ratings yet

- Risk Retention and Risk Reduction DecisionsDocument4 pagesRisk Retention and Risk Reduction DecisionsNicole BrownNo ratings yet

- Assignment 2 Ubm588 Group 4Document13 pagesAssignment 2 Ubm588 Group 42022758351No ratings yet

- Insurance Risk ManagementDocument15 pagesInsurance Risk ManagementIndrapratap singhNo ratings yet

- Function's of Insurance . by Aftab MullaDocument12 pagesFunction's of Insurance . by Aftab MullaImran Khan SharNo ratings yet

- Financial Markets & Risk ManagementDocument48 pagesFinancial Markets & Risk ManagementGabriel Alva AnkrahNo ratings yet

- ACF L10 Hedging HandoutDocument24 pagesACF L10 Hedging Handoute.mahler1997No ratings yet

- Nature of InsuranceDocument31 pagesNature of InsurancemeeyaNo ratings yet

- Introduction To Insurance ExtendedDocument68 pagesIntroduction To Insurance ExtendedMohamed AhmedNo ratings yet

- Insurance and Risk Management at Ch3Document12 pagesInsurance and Risk Management at Ch3Yuba Raj DahalNo ratings yet

- Chapter 06 RISK ManagementDocument35 pagesChapter 06 RISK ManagementMelkamu LimenihNo ratings yet

- Managing International Business Risk: Global Risk Management International Insurance Reducing Global RisksDocument19 pagesManaging International Business Risk: Global Risk Management International Insurance Reducing Global Risksmilester compNo ratings yet

- Rejda Rmi Ppt03 PBDocument34 pagesRejda Rmi Ppt03 PBraygains23No ratings yet

- Introduction To Insurance - PPT 07-09-10Document35 pagesIntroduction To Insurance - PPT 07-09-10Pooja Tripathi0% (1)

- Fundamentals of Risk and Insurance 11th Edition Vaughan Solutions ManualDocument38 pagesFundamentals of Risk and Insurance 11th Edition Vaughan Solutions Manualmohurrum.ginkgo.iabwuz100% (18)

- Concept Insurance at Chap2Document16 pagesConcept Insurance at Chap2Yuba Raj DahalNo ratings yet

- INS 21 - Chapter 1 - Insurance - What Is ITDocument9 pagesINS 21 - Chapter 1 - Insurance - What Is ITRaghuNo ratings yet

- Insurance Is The Granted To An Individual, Institution or Indeed The TradersDocument109 pagesInsurance Is The Granted To An Individual, Institution or Indeed The TradersMahesh KempegowdaNo ratings yet

- Risk - Unit 3 (B)Document23 pagesRisk - Unit 3 (B)Asan BilalNo ratings yet

- Banking and Insurance AssignmentDocument14 pagesBanking and Insurance Assignmentsalim abubakarNo ratings yet

- Analysis of Insurance Contract: Learning ObjectivesDocument16 pagesAnalysis of Insurance Contract: Learning ObjectivesAnower Zahid KhanNo ratings yet

- CH 24 ShowDocument27 pagesCH 24 ShowsidhanthaNo ratings yet

- Insurance Accounting and Finance: Lecture#1 by Dr. Muhammad UsmanDocument8 pagesInsurance Accounting and Finance: Lecture#1 by Dr. Muhammad UsmanNoor MahmoodNo ratings yet

- CH 3Document21 pagesCH 3mikiyas zeyedeNo ratings yet

- RISK MNGT - Cha-5Document36 pagesRISK MNGT - Cha-5zigiju mulatieNo ratings yet

- InvestmentDocument6 pagesInvestmentShreyas RaikarNo ratings yet

- Project Report On Frauds in InsuranceDocument60 pagesProject Report On Frauds in InsuranceNeeharika. GopisettiNo ratings yet

- Risk Management Fundamentals: An introduction to risk management in the financial services industry in the 21st centuryFrom EverandRisk Management Fundamentals: An introduction to risk management in the financial services industry in the 21st centuryRating: 5 out of 5 stars5/5 (1)

- 04/02/21 © Ibrahim Hassan 1: Analysis of Insurance ContractsDocument23 pages04/02/21 © Ibrahim Hassan 1: Analysis of Insurance ContractsMohamed HassanNo ratings yet

- CH 20Document29 pagesCH 20Mohamed HassanNo ratings yet

- Managing The Environment and THE Organization'S CultureDocument33 pagesManaging The Environment and THE Organization'S CultureMohamed HassanNo ratings yet

- 12/22/20 © Ibrahim Hassan 1: Life InsuranceDocument39 pages12/22/20 © Ibrahim Hassan 1: Life InsuranceMohamed HassanNo ratings yet

- 12/22/20 © Ibrahim Hassan 1: Fundamental Legal PrinciplesDocument18 pages12/22/20 © Ibrahim Hassan 1: Fundamental Legal PrinciplesMohamed HassanNo ratings yet

- Group Names: 1. Anisa Ahmed Farah 2. Hanad Bashir Mohamud 3. Ibrahim Hassan Mohamud 4. Kaltuma Abdirashid Ibrahim 5. Mariam Abdiqadir OsmanDocument11 pagesGroup Names: 1. Anisa Ahmed Farah 2. Hanad Bashir Mohamud 3. Ibrahim Hassan Mohamud 4. Kaltuma Abdirashid Ibrahim 5. Mariam Abdiqadir OsmanMohamed HassanNo ratings yet

- AftaDocument6 pagesAftanurnoliNo ratings yet

- BQS514 Assignment 1 NewDocument9 pagesBQS514 Assignment 1 NewDanial AkmalNo ratings yet

- Harmish Business ProfileDocument8 pagesHarmish Business Profilearmenia.harshdoshiNo ratings yet

- Contract: Organisation Details Buyer DetailsDocument3 pagesContract: Organisation Details Buyer DetailspalharjeetNo ratings yet

- Marketing SystemDocument20 pagesMarketing SystemAldrich BunyiNo ratings yet

- BCG The Digital Marketing Revolution Has Only Just Begun May 2017 Tcm9 155449Document20 pagesBCG The Digital Marketing Revolution Has Only Just Begun May 2017 Tcm9 155449Juan JesusNo ratings yet

- C03 Krugman 12e AccessibleDocument92 pagesC03 Krugman 12e Accessiblesong neeNo ratings yet

- 3M Masks - PO - CopieDocument3 pages3M Masks - PO - CopieSteven LugerNo ratings yet

- Comparation of Audit ApproachDocument1 pageComparation of Audit Approachrio HENRYNo ratings yet

- Geoffrey Rash BrookeDocument4 pagesGeoffrey Rash BrookeChartcheckerNo ratings yet

- Nestle Success StoryDocument3 pagesNestle Success StorySaleh Rehman0% (1)

- ELCD - Community OutreachDocument3 pagesELCD - Community OutreachElliot Lake Centre for DevelopmentNo ratings yet

- ANALE - Stiinte Economice - Vol 2 - 2014 - FinalDocument250 pagesANALE - Stiinte Economice - Vol 2 - 2014 - FinalmhldcnNo ratings yet

- What Is An IT ProjectDocument3 pagesWhat Is An IT ProjectPsychopath HunterNo ratings yet

- ATMDocument26 pagesATMAmishi TrivediNo ratings yet

- Stacey Rosenfeld Resume 2018Document1 pageStacey Rosenfeld Resume 2018api-333865833No ratings yet

- Running Head: YUVA: (Name) (Institute) (Date)Document29 pagesRunning Head: YUVA: (Name) (Institute) (Date)Liam GreenNo ratings yet

- Fact Sheet 29Document2 pagesFact Sheet 29Alan Cheng0% (1)

- British African F&I Terms and Fees 2021Document1 pageBritish African F&I Terms and Fees 2021EdidiongNo ratings yet

- Cir Vs Dlsu, GR No. 196596, November 9, 2016Document3 pagesCir Vs Dlsu, GR No. 196596, November 9, 2016Nathalie YapNo ratings yet

- Strategic Manage Men 1Document46 pagesStrategic Manage Men 1Ahtesham AnsariNo ratings yet

- Corporate Governance: A Study Into Westpac's Corporate Governance PoliciesDocument15 pagesCorporate Governance: A Study Into Westpac's Corporate Governance PoliciesMichael YuleNo ratings yet

- General Terms and Conditions of Purchase of The Jenoptik GroupDocument4 pagesGeneral Terms and Conditions of Purchase of The Jenoptik GroupAneelNo ratings yet

- Project - PPT 4 PlanningDocument43 pagesProject - PPT 4 PlanningBirhanu AbrhaNo ratings yet

- Corporate GovernanceDocument5 pagesCorporate GovernanceDani ShaNo ratings yet

- Classification and Occupation Services and Procedures Guide-ENG - V04Document55 pagesClassification and Occupation Services and Procedures Guide-ENG - V04Adnan QayumNo ratings yet

- Estimated Proposal PT Surya Buana Lestari Jaya (22000+HACCP)Document9 pagesEstimated Proposal PT Surya Buana Lestari Jaya (22000+HACCP)Fakhrul AnamNo ratings yet

- The Strategic Position and Action EvaluationDocument3 pagesThe Strategic Position and Action EvaluationJoel Pérez GaliciaNo ratings yet

- Company Profile 2022Document22 pagesCompany Profile 2022Irfan SatriadarmaNo ratings yet

- Chapter # 15 Solutions - Engineering Economy, 7 TH Editionleland Blank and Anthony TarquinDocument13 pagesChapter # 15 Solutions - Engineering Economy, 7 TH Editionleland Blank and Anthony TarquinMusa'b100% (1)