Professional Documents

Culture Documents

Audit Risk

Uploaded by

papon0 ratings0% found this document useful (0 votes)

24 views36 pagesCopyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

24 views36 pagesAudit Risk

Uploaded by

paponCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 36

Audit Risk

Risk-based approach to auditing

Key feature of modern auditing is the ‘risk-

based’ approach that is taken in most

audits.

At the planning stage, as required by BSA 315,

the auditor will identify and assess the

main risks associated with the business

to be audited.

Audit Risk

Audit risk is the risk (chance) that the auditor

reaches an inappropriate (wrong)

conclusion on the area under audit.

For example, if the audit risk is 5%, this means

that the auditor accepts that there will be a 5%

risk that the audited item will be misstated in the

financial statements, and only a 95% probability

that it is materially correct.

Audit Risk Model

IR (Inherent Risk)

Inherent risk is the risk that items may be

misstated as a result of their inherent

characteristics. Inherent risk may result

from either:

• the nature of the items themselves. For

example, estimated items are inherently

risky because their measurement depends on

an estimate rather than a precise measure; or

IR

• the nature of the entity and the

industry in which it operates. For

example, a company in the construction

industry operates in a volatile and high-risk

environment, and items in its financial

statements are more likely to be

misstated than items in the financial

statements of companies in a more low-risk

environment, such as a manufacturer of food

and drinks.

IR

When inherent risk is high,

this means that there is a high

risk of misstatement of an

item in the financial statements.

CR (Control Risk)

Control risk is the risk that a misstatement

would not be prevented or detected by

the internal control systems that the client

has in operation.

In preparing an audit plan, the auditor needs to

make an assessment of control risk for

different areas of the audit. Evidence about control

risk can be obtained through ‘tests of control’.

DR (Detection risk)

Detection risk is the risk that the audit testing

procedures will fail to detect a misstatement

in a transaction or in an account balance. For

example, if detection risk is 10%, this means that

there is a 10% probability that the audit tests will fail

to detect a material misstatement.

Detection risk can be lowered by carrying out more

tests in the audit. For example, to reduce the

detection risk from 10% to 5%, the auditor should

carry out more tests.

Audit Risk

The detection risk can be managed by the auditor in order to control

the overall audit risk through increasing audit work.

Inherent risk cannot be controlled.

Control risk can be reduced by improving the quality of internal

controls.

However, recommendations to the client about improvements in its

internal controls can only affect control risk in the future,

not control risk for the financial period that is subject to audit.

So, audit risk can be reduced by increasing testing, and

reducing detection risk.

Example

An auditor has set an overall level of acceptable audit risk

in respect of a client of 10%. Assessed Inherent risk is 50%

and control risk is 80%.

Required

• Explain the meaning of a 10% level of audit risk

• What level of detection risk is implied by this

information.

• If the level of audit risk needs to be maintain only at 5%,

how would this affect the level of detection risk and how

would the audit work be affected by this change?

Answer

a) A 10% level of audit risk means that the auditor will be

90% certain that his opinion on the financial

statements is correct.

b) AR = IR × CR × DR

then DR = AR / (IR × CR)

DR = 0.10 / (0.50 × 0.80)

Therefore DR = 0.25 = 25%

c) If AR is reduced to 5%, DR would now be 12.5%. More

audit work will be needed to achieve this lower level of

detection risk.

Risk of material misstatement

• Exists at the financial statements level and

assertion level

– Categories of risk within these levels

• Inherent risk

• Control risk

• Risk of material misstatement high -

Auditor accepts less audit risk

• Risk of material misstatement lower -

Auditor accepts more audit risk

What Makes a Risk Significant?

– Whether the risk is a risk of fraud

– Complexity of transactions

– Whether the risk involves transactions with

related parties

– Degree of subjectivity in measurement of

financial information related to risk

– Whether the risk involving significant

transactions outside normal course

of business

Factors For assessment of inherent risk

• Lack of expertise to deal with changes in industry

• Uncertain likelihood of successful introduction of

new product and acceptance by market

• Information technology being incompatible across

systems

• Expansion of business for which demand not

accurately estimated

• Implementation of incomplete business strategy

• New regulatory requirements increase legal

exposure

Factors For assessment of inherent risk

• Alternative products, services, competitors, or

providers posing a threat to current business

• Significant supply chain risks

• Complex production and delivery processes

• Mature and declining industry

• Inability to control costs with possibility of

unforeseen costs

• Producing products that have multiple substitutes

Example: identifying inherent risks

A charitable organisation relies for its funding on donations from

the general public, which is mainly in the form of cash collected in

the streets by volunteers and cheques sent in by post to the

charity’s head office. Wealthy individuals occasionally provide

large donations, sometimes on condition that the money is used

for a specific purpose. The constitution of the charity specifies the

purpose of the charity, and also states that no more than 15% of

the charity’s income each year may be spent on administration

costs.

Required

Identify the inherent risks for this charitable organisation that an

auditor of its financial statements would need to consider.

Solution

• Volunteers collecting cash from the general public may

keep for themselves some or all of the cash they

collect.

• There are no controls that can ensure that all the

money received by the charity is properly recorded.

This is because there are no sales invoices against which

receipts of income can be checked.

• When money is given to the charity for spending on a

specific purpose, there are no controls to ensure that

the money is actually spent on its intended purpose.

• Similarly there are no controls to ensure that

the money collected by the charity is spent on

the purposes specified in the

constitution of the charity.

• There are possibly no controls to ensure that

money spent on administration is

actually recorded as

administration costs.

Assessing Factors Affecting Control Risk

• Difficulty gaining access to the organization

or determining the controllers of the organization

• Little interaction between senior

management and operating staff

• Weak tone at the top leading to a poor

control environment

• Inadequate accounting staff and

information systems

Assessing Factors Affecting Control Risk

• Growth of organization exceeding accounting system

infrastructure

• Disregard of regulations for prevention of illegal acts

• No internal audit function, or lack of respect for

internal audit function by management

• Weak design, implementation, and monitoring

of internal controls

• Lack of supervision of accounting personnel

Determining Detection Risk and Audit Risk

• Auditor determines level of

detection risk on the basis of:

– Assessment of risk of material

misstatement at all levels

– Consideration of desired level of audit

risk

Detection Risk and Audit Risk

• Detection risk is affected by:

• Effectiveness of substantive auditing procedures

performed

• Extent to which the procedures were performed

with due professional care

• High level of detection risk

• Audit firm is willing to take higher risk of not

detecting a material misstatement

• Audit risk is also high

Detection Risk and Audit Risk

• Low level of detection risk

– Audit firm is not willing to take as much of a risk of

not detecting material misstatement

– Audit risk is also low

• Audit risk usually set at between 1% and 5%

• Detection risk ranges from 1% to 100%

Risks and Their Effects on Audit Work

Risks and Their Effects on Audit Work

High Risk of Material Misstatement

• Assuming an account with many complex

transactions and weak internal controls

– Inherent risk and control risk assessed at their

maximum

– Audit risk set at a low level

• Audit risk model

Audit Risk = Inherent Risk × Control Risk × Detection Risk

0.01 = 1.00 × 1.00 × Detection Risk

Detection Risk = 0.01 / (1.0 × 1.0) = 1%

Low Risk of Material Misstatement

• Assuming an account with simple transactions

and well-trained personnel with no incentive

to misstate financial statements

• Inherent risk and control risk assessed at 50% and

20% respectively

• Audit risk set at 5%

Audit Risk = Inherent Risk × Control Risk × Detection Risk

0.05 = 0.50 × 0.20 × Detection Risk

Detection Risk = 0.05 / (0.50 × 0.20) = 50%

Planning Audit Procedures to Respond to the

Assessed Risks of Material Misstatement

• Auditor should design:

– Controls reliance audit

– Substantive audit

• When considering risk responses, auditor

should:

– Evaluate reasons for assessed risk of material

misstatement

– Estimate likelihood of material misstatement due

to inherent risks of client

Planning Audit Procedures to Respond to the Assessed

Risks of Material Misstatement

– Consider the role of internal controls, and

determine whether control risk is relatively high or

low

– Obtain more relevant and reliable evidence with

increase in assessment of risk of material

misstatement

Nature of Risk Response

• Types of audit procedures applied given the

nature of account balance and relevant

assertions regarding that account balance

• Procedures

• Assembling audit team with more experienced auditors

• Including on audit team outside specialists

• Increasing emphasis on professional skepticism

Timing of Risk Response

• When audit procedures are conducted and

whether they are conducted at announced or

predictable times

• When risk of material misstatement is

heightened

– Audit procedures conducted closer to year end on

an unannounced basis

– Some element of unpredictability included in

timing

Timing of Risk Response

• Introducing unpredictability

– Performance of some audit procedures on low risk

accounts, disclosures, and assertions

– Change in timing of audit procedures from year to

year

– Selection of items for testing that are lower than

prior-year materiality

– Performance of audit procedures on a surprise or

unannounced basis

– Varying location or procedures year to year

Timing of Risk Response

• Procedures that can be completed only at or

after period end

– Comparison of financial statements to accounting

records

– Evaluation of adjusting journal entries made by

management in preparing financial statements

– Conduct procedures to respond to risks that

management may have engaged in improper

transactions at period end

Thank You for Your Attention

Any Questions?

You might also like

- Auditing - A Risk-Based ApproachDocument22 pagesAuditing - A Risk-Based ApproachSaeed AwanNo ratings yet

- Summary of CH 9 Assessing The Risk of Material MisstatementDocument19 pagesSummary of CH 9 Assessing The Risk of Material MisstatementMutia WardaniNo ratings yet

- CH - 9 Assessing The Risk of Material MisstatementDocument14 pagesCH - 9 Assessing The Risk of Material MisstatementOmar C100% (1)

- Chapter 6 Risk AssessmentDocument29 pagesChapter 6 Risk AssessmentOmer UddinNo ratings yet

- Advanced Auditing Chapter FourDocument52 pagesAdvanced Auditing Chapter FourmirogNo ratings yet

- Chapter 5 Audit RiskDocument33 pagesChapter 5 Audit RiskAbdurahman MankovicNo ratings yet

- nhóm 2 kiểm toánDocument21 pagesnhóm 2 kiểm toánNguyễn SơnNo ratings yet

- Auditing For BBADocument10 pagesAuditing For BBAMahr Irfan Ahmad TahirNo ratings yet

- Audit Risk Model: Inherent, Control & Detection RisksDocument2 pagesAudit Risk Model: Inherent, Control & Detection RisksYasir RafiqNo ratings yet

- Audit RiskDocument11 pagesAudit RiskAswathy SathyanNo ratings yet

- Understanding Audit Risk and Its ComponentsDocument99 pagesUnderstanding Audit Risk and Its ComponentsChing XueNo ratings yet

- AuditingDocument99 pagesAuditingWen Xin GanNo ratings yet

- Tutorial Chapter 6 - 7Document15 pagesTutorial Chapter 6 - 7BishalNo ratings yet

- Audit RiskDocument5 pagesAudit RiskFermie Shell100% (1)

- Audit Risk Model Acc 309FDocument6 pagesAudit Risk Model Acc 309FTHATONo ratings yet

- Audit and AssuaranceDocument131 pagesAudit and AssuaranceApala EbenezerNo ratings yet

- Audit risk factors and materiality limitsDocument3 pagesAudit risk factors and materiality limitsPrativa RegmiNo ratings yet

- Audit RiskDocument37 pagesAudit RiskTaimur ShahidNo ratings yet

- Lecture 3-Risk Materiality-JUNE 2023 Revised 1Document103 pagesLecture 3-Risk Materiality-JUNE 2023 Revised 1Sheany LinNo ratings yet

- Audit Risk AssessmentDocument31 pagesAudit Risk AssessmentSadrul Amin SujonNo ratings yet

- Auditing - Chapter 3Document54 pagesAuditing - Chapter 3Tesfaye SimeNo ratings yet

- Lesson 3 - Terms of Engagement and Audit PlanningDocument23 pagesLesson 3 - Terms of Engagement and Audit PlanningSANDALI FERNANDONo ratings yet

- Audit Risk, Business Risk, and Audit PlanningDocument45 pagesAudit Risk, Business Risk, and Audit PlanningPei WangNo ratings yet

- Audit Risk & MaterialityDocument23 pagesAudit Risk & MaterialityandreNo ratings yet

- Chapter 5 Audit RiskDocument6 pagesChapter 5 Audit Riskrishi kareliaNo ratings yet

- Audit RiskDocument1 pageAudit RiskSUBMERINNo ratings yet

- AAA IRC Dec 2021 - ACCA VietnamDocument134 pagesAAA IRC Dec 2021 - ACCA VietnamNguyen Thi HuyenNo ratings yet

- Week 4 Risk AssessmentDocument46 pagesWeek 4 Risk Assessmentptnyagortey91No ratings yet

- Audit Opinion Audited Financial Statements An Unqualified Opinion Financial StatementsDocument4 pagesAudit Opinion Audited Financial Statements An Unqualified Opinion Financial StatementsTahrimNaheenNo ratings yet

- Chapter # 3.2 External Audit Risk ModelDocument10 pagesChapter # 3.2 External Audit Risk ModelMustafa patelNo ratings yet

- Internal ControlDocument14 pagesInternal ControlHemangNo ratings yet

- C3 Inter AuditDocument7 pagesC3 Inter Auditbroabhi143No ratings yet

- Audit PlanningDocument29 pagesAudit PlanningReshyl HicaleNo ratings yet

- Identify and Describe The Two Forms of Accounts Receivable Confirmation Requests and Indicate What Factors Vicktor Should Consider in Determining When To Use Each. (6 Marks)Document4 pagesIdentify and Describe The Two Forms of Accounts Receivable Confirmation Requests and Indicate What Factors Vicktor Should Consider in Determining When To Use Each. (6 Marks)shanelka FernandoNo ratings yet

- Audit Risk Definition and ComponentsDocument4 pagesAudit Risk Definition and ComponentsRiz WanNo ratings yet

- A - 3 Ch01 Audit Risk The IT AuditDocument25 pagesA - 3 Ch01 Audit Risk The IT AuditBlacky PinkyNo ratings yet

- Audit 2 l7 Audit and Business RiskDocument43 pagesAudit 2 l7 Audit and Business RiskGen AbulkhairNo ratings yet

- The Risk-Based Audit ModelDocument2 pagesThe Risk-Based Audit ModelJoshel MaeNo ratings yet

- Chapter 3Document14 pagesChapter 3Donald HollistNo ratings yet

- Tugas Audit Chpter9 Risk PrintDocument11 pagesTugas Audit Chpter9 Risk PrintKazuyano DoniNo ratings yet

- Understanding client risk guides audit strategyDocument27 pagesUnderstanding client risk guides audit strategyDuc BuiNo ratings yet

- Audit Risk.2022Document43 pagesAudit Risk.2022One AshleyNo ratings yet

- Brave BraveDocument20 pagesBrave BraveAnonymous F4E4myNo ratings yet

- Risk Assesment and Internal Control Sa 400Document4 pagesRisk Assesment and Internal Control Sa 400Amit SaxenaNo ratings yet

- Audit Risk, Including The Risk of FraudDocument6 pagesAudit Risk, Including The Risk of Fraudandi TenriNo ratings yet

- CH 9 Assessing The Risk of Material MisstatementDocument7 pagesCH 9 Assessing The Risk of Material MisstatementNada An-NaurahNo ratings yet

- KalyDocument5 pagesKalyJurie BalandacaNo ratings yet

- Lesson 8 Identifying and Assessing The ROMMDocument5 pagesLesson 8 Identifying and Assessing The ROMMMark TaysonNo ratings yet

- Audit 2 SlidesDocument127 pagesAudit 2 SlidesZAID ALKALHANo ratings yet

- Ch5 Audit EvidenceDocument47 pagesCh5 Audit Evidencekitababekele26No ratings yet

- Chapter 7 NotesDocument7 pagesChapter 7 NotesSavy DhillonNo ratings yet

- What Are The Three Types of Audit Risk.Document3 pagesWhat Are The Three Types of Audit Risk.Yasir RafiqNo ratings yet

- Chapter 6Document7 pagesChapter 6Jam PuaNo ratings yet

- Pertemuan 11. Plan The Audit - Risk Assessment - Inherent Risk (Kuliah 12)Document43 pagesPertemuan 11. Plan The Audit - Risk Assessment - Inherent Risk (Kuliah 12)aulia fadilahNo ratings yet

- ACCA Paper F 8 AUDIT AND ASSURANCE SERVICES (INTERNATIONAL STREAM) Lecture 3 Audit Planning and Risk AssessmentDocument20 pagesACCA Paper F 8 AUDIT AND ASSURANCE SERVICES (INTERNATIONAL STREAM) Lecture 3 Audit Planning and Risk AssessmentFahmi AbdullaNo ratings yet

- The Power of Being Understood: Audit - Tax - ConsultingDocument27 pagesThe Power of Being Understood: Audit - Tax - ConsultingEmin SaftarovNo ratings yet

- Group 1 Auditing RISK AUDITDocument24 pagesGroup 1 Auditing RISK AUDITFlamive VongNo ratings yet

- Audit Risk FactorsDocument6 pagesAudit Risk Factorsakii ramNo ratings yet

- CISA Exam-Testing Concept-Knowledge of Risk AssessmentFrom EverandCISA Exam-Testing Concept-Knowledge of Risk AssessmentRating: 2.5 out of 5 stars2.5/5 (4)

- The Effect of Corona Virus Pandemic On Financial Reporting and AuditingDocument1 pageThe Effect of Corona Virus Pandemic On Financial Reporting and AuditingpaponNo ratings yet

- Internship ProjectReport GuidelineDocument7 pagesInternship ProjectReport GuidelinepaponNo ratings yet

- Audit Risk Factors and ModelDocument10 pagesAudit Risk Factors and ModelpaponNo ratings yet

- How To Write Business ReportDocument6 pagesHow To Write Business ReportpaponNo ratings yet

- Aluminio 2024-T3Document2 pagesAluminio 2024-T3IbsonhNo ratings yet

- MVP Software User Manual: MVP Maestro II - Design Client MVP System Configuration ToolDocument50 pagesMVP Software User Manual: MVP Maestro II - Design Client MVP System Configuration ToolDan CoolNo ratings yet

- IPv4 - IPv4 Header - IPv4 Header Format - Gate VidyalayDocument15 pagesIPv4 - IPv4 Header - IPv4 Header Format - Gate VidyalaySakshi TapaseNo ratings yet

- LPG Cylinder Market Player - Overview (Bangladesh)Document5 pagesLPG Cylinder Market Player - Overview (Bangladesh)ABID REZA KhanNo ratings yet

- Lead Creation v. Schedule A - 1st Amended ComplaintDocument16 pagesLead Creation v. Schedule A - 1st Amended ComplaintSarah BursteinNo ratings yet

- GW - Energy Storage Solutions - Brochure-ENDocument24 pagesGW - Energy Storage Solutions - Brochure-ENjhtdtNo ratings yet

- AshfaqDocument9 pagesAshfaqAnonymous m29snusNo ratings yet

- 2022-2023 Enoch Calendar: Northern HemisphereDocument14 pages2022-2023 Enoch Calendar: Northern HemisphereThakuma YuchiiNo ratings yet

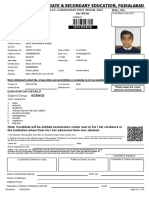

- Roll No. Form No.: Private Admission Form S.S.C. Examination First Annual 2023 9th FRESHDocument3 pagesRoll No. Form No.: Private Admission Form S.S.C. Examination First Annual 2023 9th FRESHBeenish MirzaNo ratings yet

- Vapocresolene Fast FactsDocument2 pagesVapocresolene Fast Factsapi-275817812No ratings yet

- Sources of FundsDocument22 pagesSources of FundsImtiaz RashidNo ratings yet

- Lovacka Kamera UputstvoDocument24 pagesLovacka Kamera UputstvoEmir MusijaNo ratings yet

- Detailed Lesson PlanDocument7 pagesDetailed Lesson PlanPrecious BuenafeNo ratings yet

- Preventing Needlestick Injuries Among Healthcare Workers:: A WHO-ICN CollaborationDocument6 pagesPreventing Needlestick Injuries Among Healthcare Workers:: A WHO-ICN CollaborationWasni TheresiaNo ratings yet

- Business Math - Interest QuizDocument1 pageBusiness Math - Interest QuizAi ReenNo ratings yet

- What Are Peripheral Devices??Document57 pagesWhat Are Peripheral Devices??Mainard LacsomNo ratings yet

- Group5 AssignmentDocument10 pagesGroup5 AssignmentYenew AyenewNo ratings yet

- Expert Coaching CatalogDocument37 pagesExpert Coaching CatalogJosh WhiteNo ratings yet

- 1958 - The Automatic Creation of Literature AbstractsDocument7 pages1958 - The Automatic Creation of Literature AbstractsFranck DernoncourtNo ratings yet

- Architecture Student QuestionsDocument3 pagesArchitecture Student QuestionsMelissa SerranoNo ratings yet

- CollegeMathText F2016Document204 pagesCollegeMathText F2016PauloMtzNo ratings yet

- Seven Tips For Surviving R: John Mount Win Vector LLC Bay Area R Users Meetup October 13, 2009 Based OnDocument15 pagesSeven Tips For Surviving R: John Mount Win Vector LLC Bay Area R Users Meetup October 13, 2009 Based OnMarco A SuqorNo ratings yet

- Med - Leaf - Full ReportDocument31 pagesMed - Leaf - Full ReportAdithya s kNo ratings yet

- Shading DevicesDocument4 pagesShading DevicesAyush TyagiNo ratings yet

- CUMINDocument17 pagesCUMIN19BFT Food TechnologyNo ratings yet

- Tests On Educational Interest and Its ImpactDocument2 pagesTests On Educational Interest and Its ImpactSusan BenedictNo ratings yet

- Chapter 2: 19Th Century Philippines As Rizal'S ContextDocument52 pagesChapter 2: 19Th Century Philippines As Rizal'S ContextJorielyn ApostolNo ratings yet

- South-Goa v1 m56577569830512348 PDFDocument16 pagesSouth-Goa v1 m56577569830512348 PDFXavierBoschNo ratings yet

- A Case Study On Strategies To Deal With The Impacts of COVID-19 Pandemic in The Food and Beverage IndustryDocument13 pagesA Case Study On Strategies To Deal With The Impacts of COVID-19 Pandemic in The Food and Beverage IndustryPeyman KazemianhaddadiNo ratings yet

- Jig and Fixture Design AnnaDocument22 pagesJig and Fixture Design AnnaZemariyam BizuayehuNo ratings yet