Professional Documents

Culture Documents

Kinds of Shares

Kinds of Shares

Uploaded by

Anand Hitesh Sharma0 ratings0% found this document useful (0 votes)

4 views45 pagesOriginal Title

2. Kinds of Shares.ppt

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views45 pagesKinds of Shares

Kinds of Shares

Uploaded by

Anand Hitesh SharmaCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 45

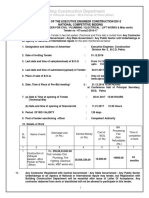

SEBI (ESO Scheme & ESP

Scheme) Guidelines, 1999

S. 63 (2013)

‘A’ - 200 shares

Co. declares 4:1 bonus

Every one share - gets 4

shares

800 shares

Total holding – 1000

Bonus Shares

See Rule 39 & 40 – Sch. I, CA, 2013

Additional Shares - Issued to - Existing SH’s (Holding

Parent Shares)

Without receiving any amount from SH’s.

Want of liquid resources ?

Shall not be paid in cash?

Conversion of a Co’s equity reserves / surplus to SC

Allotted by capitalization of reserves / surplus

(Capitalization of Co’s Profits)

Issued proportionately to the SH’ing

Share prices increases after BS are distributed?

Value of Earnings Per Share (EPS) will go down?

Reduced share price

Increase in - Trading Volume?**

Issue of Bonus Shares - S. 63 (2013) – (1) Co. may issue

P… no issue of BS shall be made by capitalizing reserves

created by the revaluation of assets.

Advantages / Benefits of Bonus Shares

When SH receives dividend in cash &

Tax benefits adds to the income & is taxed as a

usual IT when received in cash

Increases the wealth of Can sell the shares when

SH requires cash.

Indication of higher Because it is always issued when its

future profits earnings are expected to increase

SH is entitled to receive more

Increased shares &

dividends to the increased shares in

Dividends

the account

Perceived highly / positively in the

High Psychological

market – creates high demand for

Value

shares of Co.

Conditions – Sec. 63(2)

63 (2) & (3)

(3) Shall not be issued in lieu of dividend

Sweat Equity Shares – Sec. 2 (88) R/W Sec. 54

(Old - Sec. 79 A – Expl. II)

Allows - Co. to retain - Employees by rewarding them

for their services?

Equity shares as are issued

To its directors / employees

At a discount / for consideration other than cash

Sweat Equity Shares

Rule 8(1) - Expl. (ii) - Co’s (Share Capital & Debentures)

Rules, 2014

Issue of Sweat Equity Shares –

S. 54 - 2013 (OL - 79A)

Rights – Limitations - Restrictions & Provisions?

Rank pari passu with other equity SH’s

Conditions

Issue SES of a class of shares already issued

Authorised by a Spl. Res.

Not less than 1 year has elapsed - (date on which the

Co. had commenced business)

SES… are issued If

2(b) ‘Associate’ includes a person

(i) Who directly / indirectly by himself / in combination with

relatives, exercise control over the Co.; /

(ii) Whose employee, officer / director is also a director, officer /

employee of Co.

2(d) ‘Control’ *

SES…

2(g) ‘Employee’ means -

(i) A permanent employee of Co. working in India /

abroad; /

(ii) A director of Co. whether a WTD / not;

Rule 8(1) - Expl. (i) - Co’s (SC & Debentures) Rules,

2014

A Permanent Employee… who has been working in

India / outside India, for at least last one year; /

A director… whether a WTD / not; /

An employee / a director as defined in S. Cl. (a) / (b)

above

Of a subsidiary, in India / outside India / of a HC

of SC;

Reg 3 - 5

R. 3 - Nothing contained in T/Reg. shall apply to

an unlisted Co.;

P… unlisted Co. coming out with IPO & seeking

listing of its securities on SE, pursuant to issue

of SES

Shall comply with SEBI (DIP) Guidelines,

2000 (SEBI (ICDR) Reg. 2009)

Chapter II - Reg. 4

A Co. whose ES are listed on a RSE may issue

SES in accordance with Sec. 79A, CA, 1956 &

T/ Reg. to its – To employee & Promoter

Reg 3 - 5

Spl. Res. Reg. 5

(1) For T/P/ of passing a Spl. Res. U/S 79(1)(a),

CA, 1956

Explanatory statement to be annexed to the

notice for GM pursuant to S 173, CA, 1956

Shall contain disclosures as specified in the Sch.

(2) Issue of SES to Promoters shall be subject to

the requirements specified in Reg. 6

Reg. 6 -

(1) Shall also be approved by simple majority of SH’s

in GM;

P… for passing such Res. - Voting through postal ballot

as specified U/C (Passing of the Res. by Postal Ballot)

Rules, 2001 shall also be adopted;

P… Promoters to whom such SES are proposed to be

issued shall not participate in such resolution.

(2) Each transaction of issue of SES be voted by a

separate Res.

(3) Res. for issue of SES shall be valid for a period of

not more than 12 months from the date of passing of

Res.

(4) … Explanatory statement shall contain - Disclosures

as specified in the Sch.

Sch. - Explanatory statement Contain the following information:

Explanatory Statement

Pricing of SES – Reg. 7

(1) Price of SES shall not be less than the higher of the

following:

Expl: “Relevant Date” - Means - Date which is 30 days prior to

date on which GM is convened, in terms of S. 79A (1) (a), CA.

(2) If - Shares are listed on > Price on SE shall be

one SE, but quoted only on considered

one SE on given date

SE where there is highest

(3) Share price is quoted on trading volume during that

> one SE date shall be considered

Share Price on the next

(4) Shares are not quoted on

trading day shall be

the given date

considered.

Valuation of IP - Reg.8

(1) Valuation of IPR’s / of know-how provided /

other value addition… shall be carried out by a

MB.

(2) MB may consult - Experts & valuers… may

deem fit having regard to

Nature of Industry &

Nature of Property /

Other value addition.

(3) MB - Shall obtain a certificate from an

independent CA that - Valuation of IP / other

value addition is in accordance with the relevant

accounting standards.

Accounting Treatment Reg. 9

(1) Where SES are issued for a non-cash consideration,

such non-cash consideration shall be treated in the

following manner in the books of account of Co.:-

(a) Where non-cash consideration takes the

form of a depreciable / amortizable asset*,

it shall be carried to the balance sheet of the

Co. I/A/W - relevant accounting standards; /

(Spreading an intangible asset’s cost over that

asset’s useful life)*

(b) Where Cl. (a) is not applicable, it shall be

expensed as provided in the relevant accounting

standards.

Placing of Auditors Certificate before AGM – Reg. 10

In GM subsequent to - issue of SES –

BOD shall place before SH’s - Certificate

from Auditors of Co.

That the issue of SES has been made in

accordance with – Reg.’s & Res. Passed…

authorizing the issue of such SES.

Ceiling on Managerial Remuneration – Reg. 11

Amount of SES issued shall be treated as part of

managerial remuneration for the purpose of SS

198, 309, 310, 311 & 387, CA, 1956, (S. 197, CA

2013) if the following conditions are fulfilled:

(i) SES are issued to any director /

manager;

(ii) Issued for non cash consideration,

which does not take the form of an asset

which can be carried to the balance sheet

of the Co. I/A/W - relevant accounting

standards.

Lock-in of SES - Reg.12

(1) Shall be locked in for a period of 3 years

from the date of allotment.

(2) SEBI (DIP) Guidelines, 2000 (ICDR, 2009) on

public issue in terms of lock-in & computation of

promoters’ contribution

Shall apply - if a Co. makes a public issue after it has

issued SES.

Listing – Reg. 13

SES issued by a listed Co. shall be eligible for listing

only if such issues are in accordance with T/Reg’s

Applicability of Takeover Reg. 14

Any acquisition of SES shall be subject to the provision

of SEBI (SAST) Reg. 1997 (SEBI (SAST) 2011)

SES…

Chapter III – General Obligations

Reg. 15 Obligations of the Co.

Reg. 16 Action against intermediaries

Chapter IV - Penalties & Procedure

Reg. 17 Power of SEBI to order inspection /

investigation

Reg. 18 Duty to produce records etc

Reg. 19 Submission of Report to SEBI

Reg. 20 Power of SEBI to Issue directions

Employees Stock Option Plan (ESOP - Sec. 2 (37))

& Employee Stock Purchase Scheme (ESPS)

2(h) ‘ESOS’ means - An ESOS as defined in SEBI

(ESOS & ESPS) Guidelines, 1999;

ESOP Means the option given to

Directors - Officers / Employees of a Co. /

of its HC / Sub. Co. / Co’s, If any -

Which gives… the benefit / right to purchase, / TO

SUBSCRIBE FOR - the shares of the Co.

At a future date at a Pre-determined price;

Employee does not exercise the option within a

time prescribed by Co. - Option automatically

expires.

Non-cash compensation - to compete for the best

human resources.

Gives an opportunity to corporate to pay

without a reduction in book profits (accounting

advantage)

No ESOS can be offered to employees of a

Co. unless SH’s of Co. - Approve ESOS by

Passing a Spl. Res.

(5) Exercise – Means

Making of an application by employee to the

Co. for issue of shares against option vested in

him in pursuance of the ESOS.

(6) “Exercise period – Means

Time period after vesting within which the

employee should exercise his right to apply for

shares against the option vested in him in

pursuance of ESOS.

(7) Exercise price – Means

Price payable by - Employee for exercising option

granted to him in pursuance of ESOS.

(11) Option grantee - Means

An employee having right but not an obligation to

exercise in pursuance of ESOS.

(8) Grant – Means

Issue of option to employees U/ ESOS.

(7a) Fair value of an option – Means

Fair value calculated in accordance with Sch. III

(9a) Intrinsic value – Means

Excess of the market price of the share U/ ESOS over

the exercise price of the option (including up-front

payment, if any)

(10) Market price – Means

Latest available closing price,

Prior to the date of meeting of BOD in which

options are granted / shares are issued,

On SE on which - Shares of Co. are listed.

If the shares are listed on more than one SE,

then SE where there is highest trading volume

on the said date shall be considered.

4. Eligibility to participate in ESOS

4.1 An employee shall be eligible to participate in ESOS of Co.

Explanation:

Where such employee is a director nominated by an

institution as its representative on BOD of the Co. –

(i) Contract / agreement entered into between the institution

nominating its employee as director of a Co. & director so

appointed shall, inter-alia, specify the following:

(a) Whether options granted by Co. under its ESOS can be

accepted by the said employee in his capacity as director of

Co.;

(b) that options, if granted to director, shall not be renounced

in favour of nominating institution; &

(c) Conditions subject to which fees, commissions, ESOSs,

other incentives, etc. can be accepted by director from Co.

4. Eligibility to participate in ESOS

(ii) Institution nominating its employee as

a director of a Co.

Shall file a copy of the contract / agreement

with the said Co.,

Which shall, in turn, file the copy with all

SE’s on which its shares are listed.

(iii) Director so appointed

Shall furnish a copy of the contract/

agreement at 1st BOD meeting of Co.

attended by him after his nomination.

Not be eligible

4.2 - An employee who is

Promoter / belongs to the Promoter

group shall not be eligible

4.3

Director directly / indirectly holds more

than 10% of the outstanding equity

shares*

5. Compensation Committee

CC shall be a Committee of BOD’s

consisting of a majority of Independent

Directors.

Formulate the detailed terms & conditions

of ESOS

6. Approve ESOS by passing a Spl. Res.

Co. shall not vary the terms of ESOS in

any manner, which may be detrimental to

the interests of the employees.

ESOP Advantages

9. Lock-in period & rights of the option-holder

Minimum period of one year between the

grant of options & vesting of option.

9.3 – Right to a sses

Employee shall not have right to receive any

dividend / to vote / in any manner enjoy the

benefits of a SH

In respect of option granted to him - Till shares

are issued on exercise of option.

BOD shall, inter alia, disclose

Either in Directors’ Report / in the annexure to the

Directors’ Report

10. Consequence of failure to exercise option:

10.1 - Amount payable by the employee, if any,

at the time of grant of option;-

(a) May be forfeited by the Co. if the option is not

exercised by the employee within the exercise

period; /

(b) Amount may be refunded to the employee if the

option are not vested due to non-fulfillment of

condition relating to vesting of option as per ESOS.

11. Non transferability of option:

11.1 Option granted to an employee shall not be

transferable to any person.

11.2 (a) No person other than the employee to whom

the option is granted shall be entitled to exercise the

option.

ESPP

(4) ESPP -

ESPP a scheme under which Co. offers shares to

employees as part of a public issue / otherwise

Allow employees to use their salary to purchase the

stock of Co., usually at a discounted price

Holders do not have any option - But are mandated to

pay the exercise price usually by way of monthly

deductions from their salary

Part of a public issue – Shares issued to employees at the

same price as in the public issue - ESPS shall not be

subject to any lock-in.

Lock-in period – one year Lock-in period – one year

ESOP Sell shares - From - Date ESPP - From - Date of

of the grant for ESOP’s allotment of Shares.

16. Eligibility to participate in ESPS:

An employee shall be eligible to participate in the ESPS (16.1)

An employee who is a promoter / belongs to the promoter group

shall not be eligible to participate in the ESPS (16.2)

A director who either by himself / through his relatives / through

any body corporate,

Directly / indirectly holds more than 10% of the outstanding

equity shares… - Shall not be eligible to participate in ESPS

(16.3)

17 - Shareholder Approval:

No ESPS shall be offered to employees… Unless – approve… by

passing Spl. Res. in the meeting. (17.1)

Explanatory statement to the notice shall specify the details

(17.2)

Pricing & Lock-in (18)

Disclosure & Accounting Policies (19)

Conditions

(a) Total No. of options to be granted;

(b) Identification of classes of employees entitled to participate in ESOS

(c) Requirements of vesting & period of vesting;

(d) Maximum period (Sub. to cl. 9.1) within which the options shall be vested;

(e) Exercise price / pricing formula;

(f) Exercise period & process of exercise;

(g) Appraisal process for determining the eligibility of employees to ESOS;

(h) Maximum No. of options to be issued per employee & in aggregate;

(i) Statement to the effect that - Co. shall conform to the accounting policies

(j) Method which Co. shall use to value its options whether fair value /

intrinsic value

CIT, Bangalore v Infosys Technologies Ltd., (2008) 2 SCC

272, JJ. S.H. Kapadia & B. Sudarshan Reddy

Additional CIT v Bharat V. Patel, 2018 Indlaw SC 240

https://www.casemine.com/judgement/in/5b49fd9f9eff431

c29b655d9

M. Seethapathy Rao v UOI, 2018 Indlaw KAR 5117*

(Condonation of Delay)

CIT v A. K. Khosla, 2010 Indlaw MAD 1486

CEO – Received Rs. 22,00,000/- as non-compete fee after his

retirement - Claimed exemption as it was of capital nature

Whether any lump sum amount received from the employer

by the employee on / after cessation of his employment would

be profits in lieu of salary? (S. 17(3)(i), IT Act, 1961)

Was paid for restraining - Assessee from engaging in gainful

• Bharat V. Patel The revenue argued that the amount received on redemption of SARs should be taxed as

salary since they were perquisites under Section 17(2). They contended that the amount was received by

the Assessee as an employee during the subsistence of an employer-employee relationship and, hence,

the amount so received must be treated as taxable salaries. The tax authorities relied on the

judgment[3] of the ITAT Special Bench wherein it was held that the amount received on redemption of

SARs was a revenue receipt liable to tax as ‘income from salaries’, since the nature of the payment is

primarily a deferred wage or bonus payment in cash or otherwise.

• The Assessee on the other hand contended that the amount received from redemption of SARs can only

be treated as ‘capital gains’. He also contended that he did not pay anything to acquire SARs. The Assessee

also relied on an earlier SC judgment[4], which held that a benefit received by a person is not taxable as

income unless the legislature makes the same taxable. The intention behind amending Section 17(2) of the

legislature was to bring the benefits transferred by the employer to the employees by offering stock

options within the ambit of tax. Through this amendment, direct or indirect transfer of specified securities

from the employer to the employees have been covered with effect from April 1, 2000. Said provisions

would not apply to the instant case since the transactions took place before April 1, 2000.

• In the absence of any express statutory provision regarding the applicability of the amendment

retrospectively, it cannot be applied for an earlier period.

• It is a well-established rule of interpretation that taxing provisions shall be construed strictly so that no

person who is otherwise not liable to pay tax, be made liable to pay tax.

• The amount received upon the redemption of SARs could not be treated as benefits or perquisites arising

from the exercise of a business or profession, since the applicability of the provision is confined to cases

where there is any business or profession-related transaction involved. In the instant case, no such

transaction was involved.

• CIT, Bangalore v Infosys Technologies Ltd

• Respondent-assessee is public limited IT company based in Bangalore. To implement Employees Stock Option Scheme

(ESOP), the assessee created a Trust known as Technologies Employees Welfare Trust and allotted 7,50,000 warrants at Re.

1/- each to the said Trust. Each warrant entitled the Holder thereof to apply for and be allotted one equity share of the face

value of Rs. 10/- each for total consideration of Rs. 100/-. The Trust was to hold the warrant and transfer the same to the

employees of the company under the Terms and Conditions of the scheme governing ESOP. During the assessment years

1997-98, 1998-99 and 1999-2000, warrants were offered to the eligible employees at Re. 1/- each by the Trust. They were

issued to employees based on their performance, security and other criteria. Under the ESOP Scheme, every warrant had to

be retained for a minimum period of 1 year. At the end of that period, the employee was entitled to elect and obtain shares

allotted to him on payment of the balance Rs. 99. The option could be exercised at any time after 12 months but before

expiry of the period of 5 years. The allotted shares were subject to a lock in period. During the lock in period, the custody of

shares remained with the Trust. The shares were non-transferable. The employee had to continue to be in service for 5

years. If he resigned or if his services be terminated for any reason, he lost his right under the scheme and the shares were

to be re- transferred to the Trust for Rs. 100 per share. Intimation was also given to BSE that 734500 equity shares were

non- transferable and would not constitute good delivery. Till 13.9.1999 all the shares were stamped with the remark non-

transferable. Thus the said shares were incapable of being converted into money during the lock in period.

• 3. For the assessment year 1999-2000, the AO held that the total amount paid by the employees consequent to the

exercise of option was Rs. 6.64 crores whereas the market value of those shares was Rs. 171 crores. He held that the

perquisite value was the difference between the market value and the price paid by the employees for exercise of the

option. He, therefore, treated Rs. 165 crores as perquisite value on which TDS was charged at 30%. It was held that the

respondent-assessee was a defaulter for not deducting TDS under Section 192 amounting to Rs. 49.52 crores on the above

perquisite value of Rs. 165 crores. Similar orders were also passed by the AO for assessment years 1997-98 and 1998-99.

These orders were confirmed by CIT(A). No weightage was given by both the authorities to the lock in period. Both the

authorities took into account the perquisite value as on the date of exercise of option.

• Whether tax had to be deducted under Section 192 of the 1961 Act, by the respondent-assessee, on the amount earned by

its employees from exercise of stock option granted to them by the company through the Trust, is the question which arises

for determination in these civil appeals.

• the Department had erred in treating the respondent herein as an assessee in default for not deducting the TDS at 30% as

stated in the order of assessment. This is not the case of tax evasion. The assessee had floated the Trust because of the buy

back problems, which were genuine problems in cases where the employees stood dismissed, removed or in the case of

resignation in which cases they were required to return the allotment.

You might also like

- Hunter Biden ReportDocument64 pagesHunter Biden ReportZerohedge33% (3)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Absolute Beginner's Guide To Launching A - Michael MillerDocument385 pagesAbsolute Beginner's Guide To Launching A - Michael Millerlinda590100% (1)

- How Western Scientists Discovered Science in The QuranDocument6 pagesHow Western Scientists Discovered Science in The QuranDoctor Jones50% (2)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Valley Hot News Vol.2 No.08Document8 pagesValley Hot News Vol.2 No.08Philtian MarianoNo ratings yet

- CORPORATE GOVERNANCE - 9th SEMESTERDocument18 pagesCORPORATE GOVERNANCE - 9th SEMESTERAnand Hitesh SharmaNo ratings yet

- 04 CorporationsDocument76 pages04 Corporationsjustine reine cornicoNo ratings yet

- Office of The Government Chief Information Officer: Inf Ormation S Ecuri TyDocument119 pagesOffice of The Government Chief Information Officer: Inf Ormation S Ecuri TyAbery AuNo ratings yet

- Case Berkshire Hathaway Dividend Policy ParadigmDocument9 pagesCase Berkshire Hathaway Dividend Policy ParadigmHugoNo ratings yet

- Third Party Program Procedure ManualDocument66 pagesThird Party Program Procedure ManualAtul KulkarniNo ratings yet

- Madina Book 3 - English KeyDocument172 pagesMadina Book 3 - English KeyAhmed Khan100% (1)

- Chapter 3 SolutionsDocument8 pagesChapter 3 SolutionsViren DeshpandeNo ratings yet

- GNFP CH 3Document41 pagesGNFP CH 3Bilisummaa GeetahuunNo ratings yet

- Is WTO Still RelevantDocument1 pageIs WTO Still RelevantAnand Hitesh SharmaNo ratings yet

- Damodaram Sanjivayya National Law University VisakhapatnamDocument21 pagesDamodaram Sanjivayya National Law University VisakhapatnamAnand Hitesh SharmaNo ratings yet

- 5 Case AnalysisDocument6 pages5 Case AnalysisAnand Hitesh SharmaNo ratings yet

- Banking Project FinalDocument25 pagesBanking Project FinalAnand Hitesh SharmaNo ratings yet

- 2016-027 LAND LAWS (Project)Document10 pages2016-027 LAND LAWS (Project)Anand Hitesh SharmaNo ratings yet

- Corporate Governance (Project)Document12 pagesCorporate Governance (Project)Anand Hitesh SharmaNo ratings yet

- Citizenship & Immigration Laws ProjectDocument10 pagesCitizenship & Immigration Laws ProjectAnand Hitesh SharmaNo ratings yet

- 2016-027 Citizenship & Immigration Laws (Project)Document13 pages2016-027 Citizenship & Immigration Laws (Project)Anand Hitesh SharmaNo ratings yet

- Test Paper-2 Master Question PGBPDocument3 pagesTest Paper-2 Master Question PGBPyeidaindschemeNo ratings yet

- Altura Fan Light Kit Use and Care GuideDocument8 pagesAltura Fan Light Kit Use and Care GuideElsie HuppNo ratings yet

- Mabuhay Textile Mills Corporation vs. OngpinDocument15 pagesMabuhay Textile Mills Corporation vs. OngpinJane MaribojoNo ratings yet

- Progresul Grup de Lucru IDEP-APIT-Calea Ferata Privind Valorificarea Rutei Feroviare Iasi Chisinau OdessaDocument74 pagesProgresul Grup de Lucru IDEP-APIT-Calea Ferata Privind Valorificarea Rutei Feroviare Iasi Chisinau OdessaGrant ProiectNo ratings yet

- This Is An Auto-Generated Purchase Order Based On Online Tender DecisionDocument2 pagesThis Is An Auto-Generated Purchase Order Based On Online Tender DecisionTUff LabNo ratings yet

- RSG India 2010Document4 pagesRSG India 2010Barath_IyerNo ratings yet

- Building Construction Department: Construction of Vidhayak Awasan - MLA Parisar at Patna (Bihar)Document3 pagesBuilding Construction Department: Construction of Vidhayak Awasan - MLA Parisar at Patna (Bihar)PERVEZ AHMAD KHANNo ratings yet

- Ethical PrinciplesDocument16 pagesEthical PrinciplesSzántó OrsolyaNo ratings yet

- Sps. Buado vs. C.A. and Nicol, G.R. No. 145222, April 24, 2009Document1 pageSps. Buado vs. C.A. and Nicol, G.R. No. 145222, April 24, 2009Francise Mae Montilla MordenoNo ratings yet

- Offer Letter-2Document8 pagesOffer Letter-2avinash kowaleNo ratings yet

- Rib A StagesDocument1 pageRib A StagesHassan SesayNo ratings yet

- 02-02-11 - Carta Abierta de Lcda Judith BerkanDocument3 pages02-02-11 - Carta Abierta de Lcda Judith BerkanWilliam J GreenbergNo ratings yet

- THE CHARGE (Sec 211 To Sec 224) : ShardaDocument20 pagesTHE CHARGE (Sec 211 To Sec 224) : ShardaRohit GargNo ratings yet

- G.R. No. L-26096 - Director of Lands v. AbabaDocument12 pagesG.R. No. L-26096 - Director of Lands v. AbabalckdsclNo ratings yet

- Cullado V GutierrezDocument16 pagesCullado V GutierrezMara ClaraNo ratings yet

- Workshop History Paper 2024Document2 pagesWorkshop History Paper 2024aslamNo ratings yet

- Tax Form 15H PDFDocument4 pagesTax Form 15H PDFraviNo ratings yet

- Answers - 2 - The Great Diaper RacketDocument2 pagesAnswers - 2 - The Great Diaper RacketP RadhakrishnanNo ratings yet

- San Mateo Daily Journal 01-26-19 EditionDocument32 pagesSan Mateo Daily Journal 01-26-19 EditionSan Mateo Daily JournalNo ratings yet