Professional Documents

Culture Documents

Baltic Dry Index

Uploaded by

Arshad Raeez0 ratings0% found this document useful (0 votes)

59 views8 pagesOriginal Title

BALTIC DRY INDEX

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

59 views8 pagesBaltic Dry Index

Uploaded by

Arshad RaeezCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 8

BALTIC DRY INDEX

INTRODUCTION

• The Baltic Dry Index (BDI) is an economic indicator

issued daily by the London-based Baltic Exchange.

• Not restricted to Baltic Sea countries, the index provides

"an assessment of the price of moving the major raw

materials by sea.

• Taking in 23 shipping routes measured on a timecharter

basis, the index covers Handysize, Supramax, Panamax,

and Capesize dry bulk carriers carrying a range of

commodities including coal, iron ore and grain.

CONT..

• It is a shipping and trade index created by the London-based Baltic

Exchange that measures changes in the cost to transport raw

materials such as metals, grains and fossil fuels by sea.

• The Baltic Exchange directly contacts shipping brokers to assess price

levels for a given route, product to transport and time to delivery

(speed).

• The Baltic Dry Index is a composite of three sub-indexes that measure

different sizes of dry bulk carriers (merchant ships) - Capesize,

Supramax and Panamax. Multiple geographic routes are evaluated for

each index to give depth to the index's composite measurement.

• It is also known as the "Dry Bulk Index".

How does it affect the shipping

companies?

• When the BDI increases, dry bulk ship owners

win. The increase in the index directly increases

their margins and revenues.

• An increase in revenue potentially means an

increase in share prices of the shipping

companies.

• The opposite also applies, i.e. A drop in the BDI

can signal a fall in the share price of shipping

companies.

Importance of BDI

• Most directly, the index measures the demand for

shipping capacity versus the supply of dry bulk carriers.

• The demand for shipping varies with the amount of cargo

that is being traded or moved in various markets (supply

and demand).

• The supply of cargo ships is generally both tight and

inelastic—it takes two years to build a new ship, and the

cost of laying up a ship is too high to take out of trade for

short intervals, the way you might park a car safely over

the winter.

• So, marginal increases in demand can push the index

higher quickly, and marginal demand decreases can

cause the index to fall rapidly.

Importance of BDI

• e.g. "if you have 100 ships competing for 99

cargoes, rates go down, whereas if you've 99

ships competing for 100 cargoes, rates go up.

• In other words, small fleet changes and logistical

matters can crash rates..."The index indirectly

measures global supply and demand for the

commodities shipped aboard dry bulk carriers,

such as building materials, coal, metallic ores,

and grains.

Importance of BDI

• Because dry bulk primarily consists of materials

that function as raw material inputs to the

production of intermediate or finished goods,

such as concrete, electricity, steel, and food; the

index is also seen as an efficient economic

indicator of future economic growth and

production.

• The BDI is termed a leading economic indicator

because it predicts future economic activity.

Analysis of BDI

You might also like

- Piata MaritimaDocument96 pagesPiata MaritimaAlin PieNo ratings yet

- Baltic Dry Index: Ximr Mms-Iii Roll No. - 527Document2 pagesBaltic Dry Index: Ximr Mms-Iii Roll No. - 527Melroy MirandaNo ratings yet

- Maritime Role in Globalized EconomyDocument40 pagesMaritime Role in Globalized EconomyAhmed Saeed SoudyNo ratings yet

- THE DETERMINANTS OF PRICES OF NEWBUILDING IN THE VERY LARGE CRUDE CARRIERS (VLCC) SECTORFrom EverandTHE DETERMINANTS OF PRICES OF NEWBUILDING IN THE VERY LARGE CRUDE CARRIERS (VLCC) SECTORNo ratings yet

- Maritime in The Globalized Economy Lec 3, 4Document39 pagesMaritime in The Globalized Economy Lec 3, 4Asmaa AbuelmagdNo ratings yet

- Low Cost Water TransportDocument22 pagesLow Cost Water TransportCouncil of Tourism StudentsNo ratings yet

- Freight MarketDocument8 pagesFreight MarketBishop TNo ratings yet

- BC CodeDocument18 pagesBC CodeKomet Helly TodinganNo ratings yet

- Day 1 RevisionDocument7 pagesDay 1 Revisionajay100% (1)

- Liner Logistics Unit-1Document61 pagesLiner Logistics Unit-1pranav2411No ratings yet

- Tanker MarketDocument14 pagesTanker MarketAbdel Nasser Al-sheikh YousefNo ratings yet

- SHIPB6001A - 2023 - T3 - Reading For Midterm QuizDocument9 pagesSHIPB6001A - 2023 - T3 - Reading For Midterm Quizshennny3No ratings yet

- Bil of LadingDocument61 pagesBil of LadingMdshajiNo ratings yet

- Oil CarrierDocument14 pagesOil CarrierStan CorneliaNo ratings yet

- The Organization of The Shipping MarketDocument44 pagesThe Organization of The Shipping MarketshannonNo ratings yet

- Topic 4 - Bulk and Liner Service - Abril23Document58 pagesTopic 4 - Bulk and Liner Service - Abril23Kawtar El Mouden DahbiNo ratings yet

- Sea Transport: An Overview of Operations and CostsDocument16 pagesSea Transport: An Overview of Operations and CostsJozee Johnson JosephNo ratings yet

- SEMO 3813 - Week 3 - Liner and Bulk Part 2Document15 pagesSEMO 3813 - Week 3 - Liner and Bulk Part 2NOOR AIMAN BIN MOHAMED A20EM0210No ratings yet

- International Ocean Transportation in 40 CharactersDocument12 pagesInternational Ocean Transportation in 40 CharactersDhanraj KumawatNo ratings yet

- Managing Price Risk in Volatile Commodity MarketsDocument7 pagesManaging Price Risk in Volatile Commodity Marketsamandeep.tiet5643No ratings yet

- ECN Lecture 1 Economic EnvironmentDocument39 pagesECN Lecture 1 Economic EnvironmentcarlosnavalmasterNo ratings yet

- The Tanker Shipping MarketDocument14 pagesThe Tanker Shipping MarketosmanyukseNo ratings yet

- Shipping FinaneDocument7 pagesShipping Finanetusharmitra12No ratings yet

- 2.1. Presentation - Principle of Maritime MarketDocument36 pages2.1. Presentation - Principle of Maritime MarketXydro XDNo ratings yet

- How Does The Shipping Industry WorkDocument11 pagesHow Does The Shipping Industry WorkP VinayakamNo ratings yet

- Introduction to Shipping and Martime LawDocument85 pagesIntroduction to Shipping and Martime LawNantenin MagassoubaNo ratings yet

- Commercial Operations, Accounting and Reconciliation Procedures in SCI (Bulk)Document62 pagesCommercial Operations, Accounting and Reconciliation Procedures in SCI (Bulk)safwan100% (1)

- Baltic Dry Index DataDocument85 pagesBaltic Dry Index DataHamdan BintaraNo ratings yet

- Economic Principles of Maritime TradeDocument20 pagesEconomic Principles of Maritime TradeRenz Cofreros100% (2)

- Liner Shipping and Tramp Shipping Services-Group 9Document31 pagesLiner Shipping and Tramp Shipping Services-Group 9Parth Chauhan100% (2)

- Freight DerivativeDocument42 pagesFreight Derivativearpit0805100% (2)

- Maritime Transport Part4 9781789662467Document22 pagesMaritime Transport Part4 9781789662467Filiz MizrakNo ratings yet

- Maritieme EconomieDocument25 pagesMaritieme Economienjirtak92No ratings yet

- CHATRTERINGDocument24 pagesCHATRTERINGSpergi JackNo ratings yet

- Linking Energy Trading and LogisticsDocument19 pagesLinking Energy Trading and LogisticsArunav BarooahNo ratings yet

- Liner Shipping: Introduction To Transportation and NavigationDocument17 pagesLiner Shipping: Introduction To Transportation and NavigationSha Eem100% (1)

- Sharaf Internship ReportDocument11 pagesSharaf Internship ReportSidharthNo ratings yet

- LNG Shipping MarketsDocument69 pagesLNG Shipping MarketsMarineTM0% (2)

- Lecture 2 - The ShipsDocument64 pagesLecture 2 - The Shipsshuting2teoh100% (2)

- DNV Bulk Carrier Update: Operational AspectsDocument32 pagesDNV Bulk Carrier Update: Operational AspectsGeorgios Papakostas100% (1)

- Maritime Economics - Chapter 3Document4 pagesMaritime Economics - Chapter 3Thanh Van LeNo ratings yet

- A Case Study On:: Utilisation of Container Movement-IRC: Import To ExportDocument22 pagesA Case Study On:: Utilisation of Container Movement-IRC: Import To ExportCHAHATNo ratings yet

- Maritime LogisticsDocument67 pagesMaritime LogisticsAnurag K89% (19)

- Elective 1 Module 1Document12 pagesElective 1 Module 1Geronimo LabadorNo ratings yet

- Supply of Sea TransportDocument4 pagesSupply of Sea Transportyesuplus2No ratings yet

- Econometric Modelling of Newbuilding and Secondhand Ship PricesDocument42 pagesEconometric Modelling of Newbuilding and Secondhand Ship PricesTVP_contechNo ratings yet

- Module 002 Overview of Global LogisticsDocument280 pagesModule 002 Overview of Global LogisticsPrem AnandNo ratings yet

- Tanker Chartering Types and ClassificationsDocument45 pagesTanker Chartering Types and ClassificationsRoushan100% (1)

- Maritime LogisticsDocument22 pagesMaritime LogisticsAnkita BediNo ratings yet

- 3 - Role of Transportation in Supply ChainDocument33 pages3 - Role of Transportation in Supply ChainHassan MansoorNo ratings yet

- Est May 2021Document5 pagesEst May 2021Laiq Ur RahmanNo ratings yet

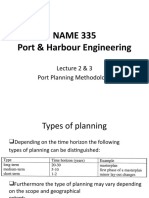

- NAME 335 Port & Harbour Engineering: Lecture 2 & 3 Port Planning MethodologyDocument11 pagesNAME 335 Port & Harbour Engineering: Lecture 2 & 3 Port Planning MethodologySazidul IslamNo ratings yet

- Liner TradeDocument35 pagesLiner TradeRoushanNo ratings yet

- Chapter 1 Shipping Market CycleDocument9 pagesChapter 1 Shipping Market CycleKhairil Azman100% (3)

- Surface and Sea TransportationDocument19 pagesSurface and Sea TransportationVijesh JainNo ratings yet

- How The BDI WorksDocument2 pagesHow The BDI WorksIvan OsipovNo ratings yet

- Dry Bulk ShippingDocument13 pagesDry Bulk Shippingkrutarthpatra100% (1)

- Shipping Practice - With a Consideration of the Law Relating TheretoFrom EverandShipping Practice - With a Consideration of the Law Relating TheretoNo ratings yet

- Class 12 Micro Economics Chapter 5 - Revision NotesDocument5 pagesClass 12 Micro Economics Chapter 5 - Revision NotesGreeshma V GowdaNo ratings yet

- UNIFAC Interaction PDFDocument16 pagesUNIFAC Interaction PDFesteban_jaramillo_12No ratings yet

- The Papa Bear PortfolioDocument2 pagesThe Papa Bear PortfolioRickardNo ratings yet

- Presentation Submitted By: Mustafa - M - MushrifDocument9 pagesPresentation Submitted By: Mustafa - M - MushrifpriNo ratings yet

- (Trading) A Beginners Guide To Investing in GoldDocument12 pages(Trading) A Beginners Guide To Investing in GoldMiklós GrécziNo ratings yet

- DOWs THEORYDocument4 pagesDOWs THEORYHemant SinghNo ratings yet

- Supply Demand IndefferenceDocument15 pagesSupply Demand IndefferenceBHARATH KUMAR SIVASANKARANNo ratings yet

- The Bulletproof 100k Trading Plan Rockwell TradingDocument10 pagesThe Bulletproof 100k Trading Plan Rockwell TradingHigor ChamaneNo ratings yet

- MGT 203 Business Economics NotesDocument6 pagesMGT 203 Business Economics NotesSuzain Nath90% (10)

- Job CostingDocument18 pagesJob CostingBiswajeet DashNo ratings yet

- MC single correct item template optionsDocument15 pagesMC single correct item template optionsRohit ChellaniNo ratings yet

- Flows & Liquidity: Quant Funds' Role in Recent Market GyrationsDocument24 pagesFlows & Liquidity: Quant Funds' Role in Recent Market GyrationsForkLogNo ratings yet

- Mark Bet's Binary Trading Strategies [DIGITS, HIGH-LOW TICK, UP-DOWN .Binary Bet]Document35 pagesMark Bet's Binary Trading Strategies [DIGITS, HIGH-LOW TICK, UP-DOWN .Binary Bet]larrycruzer254No ratings yet

- Consumer Theory (Summary) Uc3mDocument12 pagesConsumer Theory (Summary) Uc3mlaraNo ratings yet

- UACE ECONOMICS PAPER 1: Oligopoly, Inflation, UnemploymentDocument2 pagesUACE ECONOMICS PAPER 1: Oligopoly, Inflation, UnemploymentJohn DoeNo ratings yet

- TradecraftDocument450 pagesTradecraftSonu KumarNo ratings yet

- SeasonalityDocument9 pagesSeasonalityTradingSystemNo ratings yet

- A Quick Guide To Floor PivotsDocument2 pagesA Quick Guide To Floor PivotsIridiumNo ratings yet

- Darjeeling Tea: Global Infringement and WTO: Prepared By: Group 2 Mba (Ib)Document7 pagesDarjeeling Tea: Global Infringement and WTO: Prepared By: Group 2 Mba (Ib)Aryan SharmaNo ratings yet

- R Yadhu Krishna Internship ReportDocument48 pagesR Yadhu Krishna Internship ReportVct26No ratings yet

- COMMODITY MARKETS Study Material (IV Mcom April-2020) PDFDocument118 pagesCOMMODITY MARKETS Study Material (IV Mcom April-2020) PDFSrinivasamurthy R100% (2)

- Managing Interest Rate Risk RevisedDocument32 pagesManaging Interest Rate Risk RevisedTowhidul IslamNo ratings yet

- PVC Pipes Safety and StandardsDocument12 pagesPVC Pipes Safety and StandardsWisam SafiNo ratings yet

- Kevin Haggerty - Trading With The Generals 2002Document233 pagesKevin Haggerty - Trading With The Generals 2002SIightly75% (4)

- I Nternati Onal Tradi NG Competi TI ON 2020: Case PackageDocument48 pagesI Nternati Onal Tradi NG Competi TI ON 2020: Case PackageMatheus LaranjaNo ratings yet

- Foreign Exchange Rates WorksheetDocument3 pagesForeign Exchange Rates Worksheethargun kaur gabaNo ratings yet

- Theory of Consumer BehaviorDocument4 pagesTheory of Consumer BehaviorKhai VeChainNo ratings yet

- Rsi 5 PDFDocument9 pagesRsi 5 PDFManoj RaiNo ratings yet

- Sheth T.J. Education Society’s Multiple Choice Questions of Business Economics VIDocument8 pagesSheth T.J. Education Society’s Multiple Choice Questions of Business Economics VIViraj RaneNo ratings yet

- MarkupmarkdowngrossmarginDocument38 pagesMarkupmarkdowngrossmarginhera laraquelNo ratings yet

![Mark Bet's Binary Trading Strategies [DIGITS, HIGH-LOW TICK, UP-DOWN .Binary Bet]](https://imgv2-2-f.scribdassets.com/img/document/721629517/149x198/97e796d250/1712706960?v=1)