Professional Documents

Culture Documents

Role and Responsibilities of The Board of Directors

Uploaded by

Anh Lý0 ratings0% found this document useful (0 votes)

9 views19 pagesOriginal Title

31225757

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views19 pagesRole and Responsibilities of The Board of Directors

Uploaded by

Anh LýCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 19

Role and Responsibilities

of the Board of Directors

Fiduciary Duties and

Independence of the Board

February 26 2004 Sophie L’Hélias

Fiduciary Duties

vs.

Director Duties

Directors’ Fiduciary Duties

• A legal concept that is pillar in Anglo-

American corporate governance

• A legal concept that does not exist per

se in many developed markets

• Shouldn’t we be addressing director

duties?

Director Duties Vary

• Economic environment

• Legal environment

• Cultural environment

• Shareholder base: a result of the above

Economic Environment

• Role of government

• Sources of capital

• Role of capital markets in economic

development

Legal Environment

• Regulators, codes and laws

• Courts and enforcement

• Civil vs. criminal actions

Cultural Environment

• Perception of capital markets by society

(population, courts, media, government)

• Proportion of population “tied” to capital

markets (retirement, investment)

• Free market vs. planed economy

Shareholder Base

• Government agencies

• Public institutional (pension funds)

• Private individual

• Family

• Domestic institutional

– Pension funds, mutual funds, alternative funds

• Foreign institutional:

– Pension funds, mutual funds, alternative funds

Comparing Shareholder Base

• Anglo-American • Continental European

– Domestic institutional: – Domestic institutional:

large limited

– Private individual: limited

– Private individual: large

– Public institutional:

– Public institutional: large limited

– Foreign institutional: – Foreign institutional:

limited large

Investor Remedies

Anglo-American Continental European

• Offers remedy to investors • Balances interests of the

who have been wronged company with other interests

– Numerous investor law suits – Few investor law suits

– Class action suits action – No class actions

– Large punitive damages – No punitive damages

– Extensive civil director liability – Limited civil director liability

– Limited criminal liability – Extensive criminal liability

Convergence of Duties ?

• Global investors’ expectations & demands

• Media exposure: domestic & international

• Competing for funds: domestic investors

• Corporate governance codes

• Laws (voting, proxies, etc)

Director Independence

Why is Independence

Important?

• Conflicts of interest hinder judgment and

affect decision-making

• Judgment and decision-making are what

directors are asked to do

• Directors must feel free to think, express,

question and decide in the interest of those

they represent

Box-Ticking vs. Effective

Independence

• Current definitions are based on

– Ownership of shares

– Contracts and services rendered

– Relationships

– Family ties

• What about effective independence?

– “Independent minded”

– Commitment (time and knowledge)

Importance of Selection

• Who selects directors?

• How are they selected (pool, resources,

interviews)?

• Who determines their independence?

• Who elects directors?

• Who evaluates directors?

• Who removes directors?

Independence of Directors

• Disclosing conflicts of interest:

– Does the Board have clear guidelines of

conflicts that must be disclosed?

– Who discloses conflicts?

– To whom are conflicts disclosed?

– What happens if conflicts are not disclosed?

• How is independence enforced?

– What if conflicts are disclosed later?

• good faith vs. bad faith

– What is disclosed to the Board and/or to

shareholders?

Board Committees

• What is their purpose?

• What is their power?

• How are members selected, renewed or

removed?

How Committees Operate

• Process:

– Setting the agenda

– Discussion, debate, vote, minutes

– Recommendation, decision, report

• Constraints:

– Budgetary and resources

– Access to outsiders: management, advisors, suppliers, etc.

• What happens to committee findings and

recommendations?

Conclusion: Several Models

with Converging Objectives

• Prevent (and react to) wrong-doing by

management, directors, advisors/suppliers,

partners and shareholders

• Ensure protection of shareholder interests

and rights

• Ensure the long term growth of the company

You might also like

- Leading Your HOA: A 1-Hour Guide to Being a Successful HOA Board MemberFrom EverandLeading Your HOA: A 1-Hour Guide to Being a Successful HOA Board MemberNo ratings yet

- Roles and Responsibilities of DirectorsDocument19 pagesRoles and Responsibilities of DirectorsMaster Dicks MfuneNo ratings yet

- Terms & Concepts Corporate GovernanceDocument46 pagesTerms & Concepts Corporate GovernanceImtiaz AhmadNo ratings yet

- Global Dimensions of ManagementDocument21 pagesGlobal Dimensions of ManagementSayli KarandikarNo ratings yet

- Finance EthicsDocument18 pagesFinance EthicsSimon GomesNo ratings yet

- 1 BusLawEthicsDocument29 pages1 BusLawEthicsGYEM LHAMNo ratings yet

- All Slides of PPDocument384 pagesAll Slides of PPMubashir EhsanNo ratings yet

- Week 1Document42 pagesWeek 1蔡俊榮No ratings yet

- Lecture 1Document44 pagesLecture 1Liyazhi LiuNo ratings yet

- Asia Pacific International College: Welcome To SBM3310 Corporations Law DR Pradip Royhan LecturerDocument48 pagesAsia Pacific International College: Welcome To SBM3310 Corporations Law DR Pradip Royhan LecturerSatrughan ThapaNo ratings yet

- Organizations and Their Objectives: Business EnvironmentDocument21 pagesOrganizations and Their Objectives: Business EnvironmentShim KoueiNo ratings yet

- Virtual Lecture 4 - Ethics and CSRDocument46 pagesVirtual Lecture 4 - Ethics and CSRJeason ChenNo ratings yet

- Why Operate International Business?Document15 pagesWhy Operate International Business?Mummy KevinNo ratings yet

- 1A. Business OrganizationsDocument12 pages1A. Business Organizationssymhout100% (1)

- St. Patrick'S College: Business Environment HNC Unit 4Document46 pagesSt. Patrick'S College: Business Environment HNC Unit 4Ratnesh PandeyNo ratings yet

- Lecture - 6 - Ethics, Social ResponsibilityDocument53 pagesLecture - 6 - Ethics, Social ResponsibilityRhea GaiaNo ratings yet

- Managing in Global EnvironmentDocument21 pagesManaging in Global EnvironmentShelvy SilviaNo ratings yet

- Corporate Governance: Terms & ConceptsDocument25 pagesCorporate Governance: Terms & ConceptsWaqar behzadNo ratings yet

- Aspects of Private Law and Corporate Law Blackboard VersionDocument23 pagesAspects of Private Law and Corporate Law Blackboard Versiondwandile12No ratings yet

- Chapter 4 - Ethics in International BusinessDocument4 pagesChapter 4 - Ethics in International Businessfirebirdshockwave67% (3)

- FMCHAPTER ONE - PPT Power PT Slides - PPT 2Document55 pagesFMCHAPTER ONE - PPT Power PT Slides - PPT 2Alayou TeferaNo ratings yet

- Business Ethics 2Document52 pagesBusiness Ethics 2mamtakmr2No ratings yet

- Individual Investors: Communication ChallengesDocument12 pagesIndividual Investors: Communication ChallengesSarada NagNo ratings yet

- Chapter 5Document17 pagesChapter 53399354264No ratings yet

- Ethics HandoutsDocument5 pagesEthics HandoutsRonamae VillanuevaNo ratings yet

- Class Notes: Set 1: Brief Overview of Finance BasicsDocument34 pagesClass Notes: Set 1: Brief Overview of Finance BasicsMuhammad Ikhlaq Ahmed KalrooNo ratings yet

- International ManagementDocument28 pagesInternational ManagementaxowirdNo ratings yet

- Session - 01 Introduction: Fundamentals of Finance and Financial ManagementDocument48 pagesSession - 01 Introduction: Fundamentals of Finance and Financial ManagementSamantha Meril PandithaNo ratings yet

- Session - 01 Introduction: Fundamentals of Finance and Financial ManagementDocument48 pagesSession - 01 Introduction: Fundamentals of Finance and Financial ManagementSamantha Meril PandithaNo ratings yet

- Corporate Governance: Week 2-LecDocument30 pagesCorporate Governance: Week 2-Leci533191No ratings yet

- The Role of Collective Management Organisations and The Importance of Good GovernanceDocument39 pagesThe Role of Collective Management Organisations and The Importance of Good Governancezinabu girmaNo ratings yet

- Global Environments and Role of CultureDocument50 pagesGlobal Environments and Role of CultureAim IbrahimNo ratings yet

- An Introduction To Corporate GovernanceDocument32 pagesAn Introduction To Corporate GovernanceKashaf FatimaNo ratings yet

- Mgmt&BusEco 2017spring 1st Midterm SlideshowIDocument76 pagesMgmt&BusEco 2017spring 1st Midterm SlideshowICihangir ŞahinNo ratings yet

- The Business Environment & Culture of The OrganizationDocument24 pagesThe Business Environment & Culture of The OrganizationFarva SaeedNo ratings yet

- Organizations and Their Structures: Lecture#2Document10 pagesOrganizations and Their Structures: Lecture#2M Yaseen AlmaniNo ratings yet

- Innovation at Work - Self Employment: Tutor'S Name HereDocument55 pagesInnovation at Work - Self Employment: Tutor'S Name HereAleksandar StojkovicNo ratings yet

- Business 8107 - Week 4Document58 pagesBusiness 8107 - Week 4khokhar.aizazNo ratings yet

- Lecture 4 Structure of Organization 01112021 114040amDocument22 pagesLecture 4 Structure of Organization 01112021 114040amMaham uroojNo ratings yet

- Entrepreneurship BBA - 2008 - Spring Semester: Salmaan Rahman What Is Business? A Thumbnail ViewDocument19 pagesEntrepreneurship BBA - 2008 - Spring Semester: Salmaan Rahman What Is Business? A Thumbnail ViewMaaz RaeesNo ratings yet

- Human Rights Tool KitsDocument52 pagesHuman Rights Tool Kitsarakanoilwatch100% (1)

- States and NonprofitDocument14 pagesStates and NonprofitGeorge KolbaiaNo ratings yet

- Understanding Business Environment:: Unit TwoDocument37 pagesUnderstanding Business Environment:: Unit TwoAbdiNo ratings yet

- Ethics in International BusinessDocument38 pagesEthics in International BusinessEsha DewanNo ratings yet

- Unit IDocument99 pagesUnit IpazilarspNo ratings yet

- Chapter 3 Integrative Managerial IssuesDocument38 pagesChapter 3 Integrative Managerial IssuesNiz IsmailNo ratings yet

- Chapter 1 - Introduction To Corporate Financial ManagementDocument31 pagesChapter 1 - Introduction To Corporate Financial ManagementBoateng SilvestaNo ratings yet

- CoursDocument24 pagesCoursmelvin.bergeretNo ratings yet

- Business Ethics: Lecturer: Eko Suwardi, PH.DDocument46 pagesBusiness Ethics: Lecturer: Eko Suwardi, PH.DahyaniluthfianasariNo ratings yet

- CF Session1 PKDocument25 pagesCF Session1 PKAntoineBillarantNo ratings yet

- Blockchain and FinTech - Lecture 1 Courses 2022Document75 pagesBlockchain and FinTech - Lecture 1 Courses 2022puhao yeNo ratings yet

- Besr ReviewerDocument41 pagesBesr ReviewerZabeth villalonNo ratings yet

- Introduction To Financial Management (Lecture 01) : by Dr. Trilochan TripathyDocument25 pagesIntroduction To Financial Management (Lecture 01) : by Dr. Trilochan TripathyJosine JonesNo ratings yet

- Business Ethics and Corporate GovernanceDocument22 pagesBusiness Ethics and Corporate Governancenehashri163100% (1)

- MGX9660: International Business Theory & PracticeDocument33 pagesMGX9660: International Business Theory & PracticeripeNo ratings yet

- Positive Political Economy: Freedom and Rational Choice TheoryDocument37 pagesPositive Political Economy: Freedom and Rational Choice TheoryRhodaNo ratings yet

- Chapter 1 FIN3004Document29 pagesChapter 1 FIN3004Phương ThảoNo ratings yet

- BankingDocument21 pagesBankingJhensele S42noNo ratings yet

- Introduction To Corporate Finance: Mcgraw-Hill/IrwinDocument22 pagesIntroduction To Corporate Finance: Mcgraw-Hill/IrwinMazmur Hamonangan DamanikNo ratings yet

- Session 8Document32 pagesSession 8Aaron ChanNo ratings yet

- Chapter 14Document47 pagesChapter 14Anh LýNo ratings yet

- StudentDocument30 pagesStudentAnh Lý100% (1)

- Chapter 6 Multiple Choice T F Test QuestionsDocument6 pagesChapter 6 Multiple Choice T F Test QuestionsAnh LýNo ratings yet

- Multiple Choice Questions: Analyzing Operating ActivitiesDocument22 pagesMultiple Choice Questions: Analyzing Operating ActivitiesAnh LýNo ratings yet

- Fpt Group Financial Statement Analysis: Trường Đại Học Kinh Tế Tp.HcmDocument22 pagesFpt Group Financial Statement Analysis: Trường Đại Học Kinh Tế Tp.HcmAnh LýNo ratings yet

- Investment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownDocument97 pagesInvestment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownAnh LýNo ratings yet

- Ch05 - Antitakeover MeasuresDocument57 pagesCh05 - Antitakeover MeasuresAnh Lý100% (1)

- Syllabus of Multination Business Finance SubjectDocument2 pagesSyllabus of Multination Business Finance SubjectAnh LýNo ratings yet

- Financial Accounting: Weygandt KimmelDocument59 pagesFinancial Accounting: Weygandt KimmelAnh LýNo ratings yet

- Lecture Note Multinational Corporations and Global Financial EnvironmentDocument3 pagesLecture Note Multinational Corporations and Global Financial EnvironmentAnh LýNo ratings yet

- Parcel Tracking System For Courier CompaDocument49 pagesParcel Tracking System For Courier CompaBashir IdrisNo ratings yet

- PPG - Vigor ZN 302 SR - EnglishDocument5 pagesPPG - Vigor ZN 302 SR - EnglisherwinvillarNo ratings yet

- Leveraging AI in Electronic CommerceDocument4 pagesLeveraging AI in Electronic CommerceNaman JainNo ratings yet

- Internship Report of YamahaDocument46 pagesInternship Report of YamahaSurya PrakashNo ratings yet

- Sir AnsleyDocument2 pagesSir Ansleyqf2008802No ratings yet

- Acc Quiz Class 12thDocument3 pagesAcc Quiz Class 12thTilak DudejaNo ratings yet

- Information Technology Auditing 4th Edition Hall Test BankDocument38 pagesInformation Technology Auditing 4th Edition Hall Test Bankapostemegudgeon8ew9100% (15)

- Avsharn Bachoo FNB Optimizes Retail Banking Product Offers Using Real-Time Propensity Models Rules and EventsDocument28 pagesAvsharn Bachoo FNB Optimizes Retail Banking Product Offers Using Real-Time Propensity Models Rules and EventsAvsharnNo ratings yet

- Complete IELTS Unit 06 (Pp. 57-67)Document11 pagesComplete IELTS Unit 06 (Pp. 57-67)rifqi bambangNo ratings yet

- PROPERTYDocument8 pagesPROPERTYHyder KhanNo ratings yet

- RAD TorqueDocument16 pagesRAD TorqueRaziel Postigo MezaNo ratings yet

- Undergraduate Programmes Fee Schedule: (International Only)Document12 pagesUndergraduate Programmes Fee Schedule: (International Only)GodlyNoobNo ratings yet

- Why Did Kylie Start Her Business?: What Kind of Business Does Kylie Jenner Have?Document2 pagesWhy Did Kylie Start Her Business?: What Kind of Business Does Kylie Jenner Have?RIANNE MARIE REYNANTE RAMOSNo ratings yet

- Banitog - Chapter 6 (Problem 1)Document3 pagesBanitog - Chapter 6 (Problem 1)MyunimintNo ratings yet

- Act2 1Document6 pagesAct2 1Kath LeynesNo ratings yet

- Annual Report Icici BankDocument132 pagesAnnual Report Icici BankMohit MaheshwariNo ratings yet

- Reasons For Not Getting A COVID-19 Vaccine.Document536 pagesReasons For Not Getting A COVID-19 Vaccine.Frank MaradiagaNo ratings yet

- RBI To Roll Back CRR Cut in Phases, Assures Liquidity: Expert Panel Rejects Pfizer's Application For Covid VaccineDocument17 pagesRBI To Roll Back CRR Cut in Phases, Assures Liquidity: Expert Panel Rejects Pfizer's Application For Covid VaccineJeevan JoshiNo ratings yet

- 10112-Clarifying Cloud ERP EDI Capabilities-Presentation - 169Document30 pages10112-Clarifying Cloud ERP EDI Capabilities-Presentation - 169ootydev2000100% (2)

- ProductsDocument7 pagesProductsDnyana RaghunathNo ratings yet

- Finmkt FinalsDocument6 pagesFinmkt FinalsMary Elisha PinedaNo ratings yet

- Client Number:: To Contact Us Visit WWW - Workandincome.govt - Nz/contactDocument3 pagesClient Number:: To Contact Us Visit WWW - Workandincome.govt - Nz/contactRupert GilliandNo ratings yet

- VRIO AnalysisDocument2 pagesVRIO AnalysisrenjuannNo ratings yet

- 1330 Sarevsh Shinde Pptx. HRM IIDocument9 pages1330 Sarevsh Shinde Pptx. HRM IIsarvesh shindeNo ratings yet

- News Release On Arrest of Patrick OkiDocument2 pagesNews Release On Arrest of Patrick OkiHonolulu Star-AdvertiserNo ratings yet

- Charles P. Jones, Investments: Analysis and Management, 12th Edition, John Wiley & SonsDocument19 pagesCharles P. Jones, Investments: Analysis and Management, 12th Edition, John Wiley & Sonssarah123No ratings yet

- DownloadDocument2 pagesDownloadJOCKEY 2908No ratings yet

- The Power of ReflectionDocument12 pagesThe Power of Reflectionxandie_sacroNo ratings yet

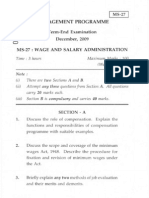

- MS 27dec09Document6 pagesMS 27dec09Richa ShrivasravaNo ratings yet

- Leadership With Trust: ST THDocument7 pagesLeadership With Trust: ST THSurabhi VermaNo ratings yet