Professional Documents

Culture Documents

The Holy

The Holy

Uploaded by

Sidhi Agarwal0 ratings0% found this document useful (0 votes)

8 views12 pagesOriginal Title

The holy ppt

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views12 pagesThe Holy

The Holy

Uploaded by

Sidhi AgarwalCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 12

Content

Scope of the study

Bharat Bijlee

Analysis

• 2007:

– Driven by low inflation and robust economy, year 2007-08 saw

Highest Sales and relatively low expenditures resulting in record 27%

growth in PAT.

• 2010:

– Although gross income increased by 20% PAT declined by 13%

– This was majorly driven by huge investment in purchase of Investing

Instruments (Specifically HDFC Floating Rate Income Fund - Short

Term Plan - Wholesale - Growth) which increased by 479%.

– These purchases were majorly funded by unsecured short term loan.

– High inflation of 2009 resulted in high input cost increasing the

expenditure by more than 24 % even though sales increased by 17%

hence depleting the PAT.

EMCO

Analysis

• 2008:

– Capital expenditure in long term asset building , resulted in increase in depreciation

2009 onwards by more than 65% (find assets built)

– Net borrowing in 2007 & 2008, 2009 onwards EMCO started offloading borrowings.

– On 25th March 2008 EMCO declared stock split in 1:5 increasing total shares

outstanding.

• 2009:

– MAT rates increased from 10% to 15% resulting in increase in Tax Expense by 80% even

though Sales declined in the period.

• 2010:

– Accounts receivable decreased approximately 66% suggesting lesser credit sales

shortening the cash cycle. This though affected the sales which declined by 11%

– Operating expense increased by 31% even while sales declined during the period.

– Even while Operating profit declined, EMCO posted a higher Net Income and an increase

in EPS from Rs. to Rs. 21. EMCO Energy Limited sold for Rs. 9849 Lakh reported as

earning from extra-ordinary item.

Crompton Greaves

Analysis

• In 2007, Crompton Greaves increased its market capitalization by

40% which remained constant for 3 years till 2009.

• New shares were issued and market capitalization was increased by

75% at the end of 2009.

• Conservatism convention was practised to a larger extent which

worked in their favour.Continuos increase in reserves can be

observed in all the years to the tune of around 40%.Contingent

liabilities seem to be increase by as high as 90% in 2007 and then

declined smoothly.

• There is a continuous decline in the debt structure of the

organisation. It portrays their strategy of offloading the debt

payments thereby reducing their interest payment obligations.

• As a result, even in recessionary times their debt-equity ratio and

debt-service ratio seems to be in good shape.

• A remarkable jump of 208% in 2007 in the “Capital work-in-

progress” shows the company’s initiative to build their

infrastructural facilities (highlights the long term perspective of the

company).It seems be financed partly by debt and partly by equity.

• A heavy Capex at the start of 2007 enabled them to sail fairly

throughout the recessionary pressures.In 2007,their net profit

increased by 48.2% and by 26.48% even in 2009.

• Their Policy of Prudency is once again reflected when they

increased their fixed deposits by a humungous rate of 506.54% in

2009.

• 70% manufacturing expenses increased at the start of 2008 which

induced a higher sales in comparison to the previous year.

• In 2008, they increased their provision to by 100%, to deal with the

impending recession. Thus, their Net Working Capital dipped by Rs.

37.72 crores and became negative.

ABB

Analysis

• Capital management: Company focuses on making company debt free to

reduce interest rate risks. Company in 2009 started investing in

government bonds to receive tax exemptions.

• 2008:

– ABB has focused initiatives on working capital management and

generation of adequate cash from operating activities to make

company debt-free. This reflects in strong retained earnings

• 2009:

– While sales declined by around 8% during the year, operating profit

before interest and depreciation declined more than 33%.

– In April 2009 ABB constructed 18 acre Factory near Bangalore

increasing its Tangible Factory Assets by around 30%.

– Large investments in Tax Free government bonds like 5.25% 10 Year

Tax Free Nuclear Power Corporation Limited Infrastructure Bonds.

You might also like

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Budgeting SlidesDocument12 pagesBudgeting SlidesAdeel AhmadNo ratings yet

- Financial Risk Management (FRM) Detailed Guide With Latest 2020 Exam InformationDocument5 pagesFinancial Risk Management (FRM) Detailed Guide With Latest 2020 Exam InformationrohitNo ratings yet

- Syndicated Term Loan Agreement - Vetting SessionDocument86 pagesSyndicated Term Loan Agreement - Vetting SessionYash MayekarNo ratings yet

- Relic Spotter Inc. Case: Transaction 1: - (1) Sell Shares To InvestorsDocument16 pagesRelic Spotter Inc. Case: Transaction 1: - (1) Sell Shares To InvestorsLegendForeverNo ratings yet

- Macro Economy Today 14th Edition Schiller Test Bank Full Chapter PDFDocument67 pagesMacro Economy Today 14th Edition Schiller Test Bank Full Chapter PDFcarlarodriquezajbns100% (12)

- Insurance Ucpb 356 Scra 307Document10 pagesInsurance Ucpb 356 Scra 307Amicus CuriaeNo ratings yet

- How Operations Research Is Applied in Industry BusinessDocument19 pagesHow Operations Research Is Applied in Industry BusinessInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Survival - How ToDocument7 pagesSurvival - How ToAllen Carlton Jr.92% (12)

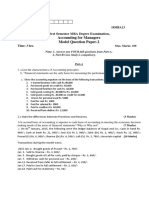

- Accounting For Managers Model Question Paper-2: First Semester MBA Degree ExaminationDocument5 pagesAccounting For Managers Model Question Paper-2: First Semester MBA Degree ExaminationRohan Chaugule0% (1)

- Module 1 - Introduction To Cost AccountingDocument4 pagesModule 1 - Introduction To Cost AccountingArrianne CuetoNo ratings yet

- Central Banking and Monetary PolicyDocument13 pagesCentral Banking and Monetary PolicyLuisaNo ratings yet

- 2017 WB 2633 QuantInsti TradingusingRonInteractiveBrokersDocument23 pages2017 WB 2633 QuantInsti TradingusingRonInteractiveBrokersvirtualrealNo ratings yet

- ITR Compilation 4u5346Document4 pagesITR Compilation 4u5346akhil kwatraNo ratings yet

- Income Tax AY 18-19 Vol I PDFDocument224 pagesIncome Tax AY 18-19 Vol I PDFAashish Kumar SinghNo ratings yet

- Special Transactions Chapter 6Document3 pagesSpecial Transactions Chapter 6Maria DyNo ratings yet

- Hedge Funds GuideDocument224 pagesHedge Funds GuideisranidilipNo ratings yet

- Shell Graduate Programme e Brochure 3Document26 pagesShell Graduate Programme e Brochure 3Davide BoreanezeNo ratings yet

- NISM SORM Certification Question BankDocument12 pagesNISM SORM Certification Question Banksimplypaisa67% (6)

- Limit Chart Under Companies Act, 2013 and SEBI RegulationsDocument7 pagesLimit Chart Under Companies Act, 2013 and SEBI RegulationsItiNo ratings yet

- Economics of Money and BankingDocument196 pagesEconomics of Money and BankingDenisse Garza100% (3)

- The Determinants of Intermediation Margins in Islamic and Conventional Banksmanagerial FinanceDocument18 pagesThe Determinants of Intermediation Margins in Islamic and Conventional Banksmanagerial FinanceHeriyanto UIRNo ratings yet

- Carter Hawley Hale Versus Marshall Field Rev 1Document4 pagesCarter Hawley Hale Versus Marshall Field Rev 1serigalagurunNo ratings yet

- Week 6 FABM 1Document27 pagesWeek 6 FABM 1Efrelyn ParaleNo ratings yet

- Cash BudgetDocument8 pagesCash BudgetKei CambaNo ratings yet

- CFP Mock Test Investment PlanningDocument7 pagesCFP Mock Test Investment PlanningDeep Shikha100% (4)

- Principles of Finance: Helmut ElsingerDocument260 pagesPrinciples of Finance: Helmut ElsingernikowawaNo ratings yet

- Sale Order 23 27-03-2024Document1 pageSale Order 23 27-03-2024Rajat AggarwalNo ratings yet

- Prepare Adjusting Journal Entries For The Year Ended December 31Document1 pagePrepare Adjusting Journal Entries For The Year Ended December 31Let's Talk With HassanNo ratings yet

- AB-EB-Unlocking-Operational-Risk-Management-Empower-the-Front Line to-Effectively-Manage-RiskDocument12 pagesAB-EB-Unlocking-Operational-Risk-Management-Empower-the-Front Line to-Effectively-Manage-RiskSirak AynalemNo ratings yet

- SodaPDF-converted-3months StatementDocument7 pagesSodaPDF-converted-3months StatementHariharanNo ratings yet