Professional Documents

Culture Documents

Hedging Effectively: Derivatives For Energy Professionals

Hedging Effectively: Derivatives For Energy Professionals

Uploaded by

Cynthia Ann KaseOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hedging Effectively: Derivatives For Energy Professionals

Hedging Effectively: Derivatives For Energy Professionals

Uploaded by

Cynthia Ann KaseCopyright:

Available Formats

Hedging Effectively

Derivatives for Energy Professionals

Kase and Company, Inc.

Session 5

Statistical Review

Copyright Kase and Company, Inc. All rights reserved

THIS PRESENTATION DOWNLOADED FROM WWW.KASECO.COM

Basic Stats

Mean = The Arithmetic Average

Median = The Middle Value

Variance = Sum From 1 To N ((X1-Xm)2+(X2-Xm)2+...(Xn-Xm)2)/(n-1)

Standard Deviation = Square Root Of Variance

Normal Bell Curve

Random Motion

Brownian

Gaussian

Portfolio Diversification and Covariance

Risk of Event A OR Event B

Risk of Event A AND Event B

Copyright Kase and Company, Inc. All rights reserved

THIS PRESENTATION DOWNLOADED FROM WWW.KASECO.COM

A Basic Understanding of Statistics

is Necessary to Understand Risk

Assessment and Options

Volatility is a measure of standard deviation, so it is

proportional to the square root of time (or volume).

Any math (used for VAR, PAR or forecasts) must be

consistent with market cycle length as the standard

deviation will increase with time asymptotically.

The higher the standard deviation of a distribution, the

less % movement is needed to hit a particular price, so

options are more expensive at higher volatilities and

longer time frames.

Copyright Kase and Company, Inc. All rights reserved

THIS PRESENTATION DOWNLOADED FROM WWW.KASECO.COM

Volatility and Time

In a purely random time series,

volatility is proportional to the

square root of time.

Quarterly Volatility = Yearly / sqrt(4)

Monthly Volatility = Yearly / sqrt(12)

Daily Volatility = Yearly / sqrt(252)

Thus, the longer the risk is held,

the greater its value in absolute

terms.

Copyright Kase and Company, Inc. All rights reserved

THIS PRESENTATION DOWNLOADED FROM WWW.KASECO.COM

Normal Distributions

Price Distribution

Distance to Mean

• 1 StdDev = 34%

• 2/3 StdDev = 25%

• 1/2 StdDev = 19%

0 2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50

Price

Low Volatility, StdDev 3 Moderate Volatility, Std Dev 4.5 High Volatility, StdDev 6

Copyright Kase and Company, Inc. All rights reserved

THIS PRESENTATION DOWNLOADED FROM WWW.KASECO.COM

Distribution and Standard Deviations

Price Distribution

-3 -2 -1 +1 +2 +3

Tail StdDevs

50 0.000

15 1.033

5 1.645

2.5 1.960

0.1 3.090

10

14

16

18

20

22

24

26

28

30

32

34

38

40

42

44

46

48

12

36

0

2

4

6

8

Moderate Volatility, Std Dev 4.5

Copyright Kase and Company, Inc. All rights reserved

THIS PRESENTATION DOWNLOADED FROM WWW.KASECO.COM

Risk = Confidence Level

Price Distribution

-1.96 +1.96

2.5% 2.5%

12

16

18

20

22

24

26

28

30

32

34

36

40

44

46

10

14

38

42

48

0

2

4

6

8

Long Risk Short Risk

Copyright Kase and Company, Inc. All rights reserved

THIS PRESENTATION DOWNLOADED FROM WWW.KASECO.COM

Measuring Portfolio Risk

VAR measures worst expected loss over a given time interval under

defined conditions for a given confidence level.

Uses similar math as options valuations

VAR gives a summary measure of market risk

Value at Risk

difference between the starting price of day 1 and ending price of day n

standard deviation used to calculate the confidence level

volatility of the commodity, de-annualized to n days

Example

• Daily VAR of trading portfolio is $2MM at a 99% confidence level

• Means only 1 chance in 100 for a loss greater than $2MM to occur

• Can then decide whether they feel comfortable with this level of risk.

Copyright Kase and Company, Inc. All rights reserved

THIS PRESENTATION DOWNLOADED FROM WWW.KASECO.COM

VAR Example

Let’s assume we buy ten natural gas futures at a price of $2.00

Futures contract have a volatility of 40% and have 16 days to

expiration.

We wish to find the VAR

95% confidence level corresponds to 1.65 standard deviations

97.5% confidence level corresponds to 1.96 standard deviations.

1. De-annualize the volatility by multiplying the volatility (0.40) by the

square root of (16/256) or 0.25.

2. (0.40)*( (16/256) = 0.40 * 0.25 = 0.10

3. 97.5% confidence level= (0.10)*(1.96)=0.196 = 0.196*$2.00 = $0.392.

4. 10,000 mmBtu/contract * 10 contracts * $0.392, the VAR is $39,200.

Copyright Kase and Company, Inc. All rights reserved

THIS PRESENTATION DOWNLOADED FROM WWW.KASECO.COM

VAR Example, Continued

5. 12 days later, price has moved up by $0.10 to $2.10.

6. Everything else remains unchanged.

7. The volatility on a de-annualized basis is now

(0.40)*( (4/256), or 0.40*0.125 = 0.05.

8. Thus the VAR on a mark to market basis is

$2.10*0.05*1.96*10*10,000 = 20,580.

9. Considering the “credit” gained, VAR is $20,580 less the

$10,000 gain, or $10,580.

Copyright Kase and Company, Inc. All rights reserved

THIS PRESENTATION DOWNLOADED FROM WWW.KASECO.COM

Difficulty in Calculating VAR

No industry-wide agreement as

duration

confidence levels to use

type of distribution to use

how to calculate volatility

Differing approaches to estimating methods.

Mathematical formulas

Historical data

Monte Carlo simulations.

Copyright Kase and Company, Inc. All rights reserved

THIS PRESENTATION DOWNLOADED FROM WWW.KASECO.COM

Calculating VAR on Outright Positions

Use simplified version of Ito’s Lemma.

Formula employs statistical model of the behavior of functions of

stochastic variables.

Function was “discovered” by K. Ito in 1951

Derivation is found in many finance books on derivative theory

K. Ito’s Lemma

Knowing the current price of a commodity, its price growth and its

volatility, Ito’s Lemma can be applied to obtain the probability

distribution of commodity prices on some future date or dates.

Copyright Kase and Company, Inc. All rights reserved

THIS PRESENTATION DOWNLOADED FROM WWW.KASECO.COM

The “Lemma” Formula

For a given confidence level (percent probability):

lnU +(m – n2/2)d – Kd < lnF < lnU +(m – n2/2)d+ Knd

Where:

U = the spot price of the commodity

F = the price of the commodity after d, days

d = the number of days elapsed

n = the non annualized price volatility

m = the growth rate of the commodity price

K = a nonnegative number, the deviate on a

standardized normal distribution corresponding

to a given confidence level

Copyright Kase and Company, Inc. All rights reserved

THIS PRESENTATION DOWNLOADED FROM WWW.KASECO.COM

Lemma Example: Natural Gas

Assumptions

1. Current position is short

2. , Volatility = 45%

3. U, Starting price = $3.50.

4. m, Bias = zero.

5. K, 95% confidence level, 1.65

6. d, Days = 10 days

Solving for the price of the underlying after 10 days, P10

P10 = eln(3.50) + (0 - (45% /252)^2) / 2)10 + 1.65(45% / 252)10= $4.04

VAR = $4.04 - $3.50 = $0.54 per mmBtu.

Copyright Kase and Company, Inc. All rights reserved

THIS PRESENTATION DOWNLOADED FROM WWW.KASECO.COM

Plotting Price at Confidence Level

Given the above example, we calculate the following:

Time Elapsed, Days 1 2 3 4 5 10 15 20 25 30

Price Underlying 3.67 3.74 3.79 3.84 3.88 4.04 4.17 4.28 4.38 4.47

VAR -0.17 -0.24 -0.29 -0.34 -0.38 -0.54 -0.67 -0.78 -0.88 -0.97

Price of Commodity versus Time Lapse

Starting @ $3.50, 45% Volatility

4.50

(F) Price of Commodity

4.25

4.00

3.75

3.50

0 5 10 15 20 25 30

Duration of Exposure, Days

Copyright Kase and Company, Inc. All rights reserved

THIS PRESENTATION DOWNLOADED FROM WWW.KASECO.COM

Lemma Example,

m=0, = 5%, U = $5.27

Ito's Lemma, Start from $5.27 @ 45% Volatility

No Bias (Black), Up (Red), Down (Blue)

10.00

Time, Days 5% 95%

9.00 0 5.27 5.27

10 4.52 6.09

8.00

20 4.24 6.45

7.00 30 4.02 6.74

Price

40 3.85 6.98

6.00 50 3.70 7.20

60 3.57 7.40

5.00

4.00

3.00

0 5 10 15 20 25 30 35 40 45 50 55 60 65

Days

Copyright Kase and Company, Inc. All rights reserved

THIS PRESENTATION DOWNLOADED FROM WWW.KASECO.COM

Raw Historical Volatility

The volatility over one day to the next (r), where

“today” is day n =

r = ln (Pn-1/Pn)

Where:

r = the day to day rate of change

P = the price of the underlying

n = today

Historical Ten Day Volatility =

, over (n-1) values of r

Copyright Kase and Company, Inc. All rights reserved

THIS PRESENTATION DOWNLOADED FROM WWW.KASECO.COM

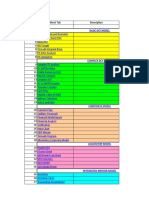

Historical 10-Day Volatility

Date Close ln(B[0]/B[1]) StdDev(C), 9 %,SQRT(252)*D

09/28/00 30.34 n/a n/a n/a

09/29/00 30.71 0.012 n/a n/a

10/02/00 31.86 0.037 n/a n/a

10/03/00 31.85 0.000 n/a n/a

10/04/00 31.24 0.019 n/a n/a

10/05/00 30.54 0.023 n/a n/a

10/06/00 30.91 0.012 n/a n/a

10/09/00 31.85 0.030 n/a n/a

10/10/00 33.07 0.038 n/a n/a

10/11/00 33.24 0.005 0.022 35%

10/12/00 35.72 0.072 0.030 48%

10/13/00 34.13 0.046 0.036 56%

10/16/00 32.39 0.052 0.041 65%

10/17/00 32.42 0.001 0.040 64%

10/18/00 32.47 0.002 0.039 62%

10/19/00 31.9 0.018 0.040 63%

10/20/00 32.95 0.032 0.040 63%

10/23/00 33.76 0.024 0.039 61%

10/24/00 33.37 0.012 0.039 62%

10/25/00 32.96 0.012 0.028 45%

10/26/00 33.71 0.022 0.026 42%

10/27/00 32.74 0.029 0.021 34%

StdDev(ln(Price[1]/Price[0]),9)*SQRT(252)

Copyright Kase and Company, Inc. All rights reserved

THIS PRESENTATION DOWNLOADED FROM WWW.KASECO.COM

Average Volatilities

Volatility on one day may not be representative

An average or weighted volatility may be better

Two types of weightings averages

Weighted

Exponentially weighted

Weighted Moving Average Volatility

The formula for the weighted moving average is thus:

n n

wtd ( ii ) /( j )

Where: i 1 j 1

n = number of days in the calculation

i = weighting factor (from 1 to n days) for the numerator

j = weighting factor (from 1 to n days) for the denominator

Copyright Kase and Company, Inc. All rights reserved

THIS PRESENTATION DOWNLOADED FROM WWW.KASECO.COM

“Median” Expectations

Ito's Lemma, Start from $5.25 @ 45% Volatility

No Bias (Black), Up (Red), Down (Blue) Expected Prices

In 3 Months, d = 63

8.00

First Nearby, U = $5.25

7.50 = 45%

7.00

6.50

Scenario Price

6.00 Strong Down $3.30

Normal Down $4.50

Price

5.50

5.00 Normal Up $6.60

4.50 Strong Up $8.00

4.00

3.50

3.00

0 5 10 15 20 25 30 35 40 45 50 55 60

Days

Copyright Kase and Company, Inc. All rights reserved

THIS PRESENTATION DOWNLOADED FROM WWW.KASECO.COM

Exponentially Weighted Volatility

exponential, n = (2exponential, n+1+ (1 - )r2)

All the terms are as defined above, and

Where = smoothing factor

And = 10-3/n

Smoothing factor,

As the number of days increases, approaches 1.0

As the number of days declines, approaches 0

For 100 days, is equal to 0 .933

For 10 days, is equal to 0.50

Copyright Kase and Company, Inc. All rights reserved

THIS PRESENTATION DOWNLOADED FROM WWW.KASECO.COM

Correcting Data to Calculate Volatility

False Outliers on Rollover Gaps,

where (n) is the day after rollover

Historic and the weighted - delete “rn” when (n)

Exponential - substitute “rn+1” for “rn” when (n).

Seed Value

For the exponential, seed value for the initial is required.

Use instance of historic volatility calculable after initial 10-day period.

Variables Used

For historical volatility, one and three month averages

Smoothing factors of 0.94 and 0.97 for 112 and 226 days

Copyright Kase and Company, Inc. All rights reserved

THIS PRESENTATION DOWNLOADED FROM WWW.KASECO.COM

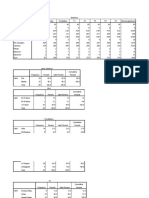

Annualized Volatility, Last Four Years to 03/01/02

Typical Raw

Value

22 Day

WMA

63 Day

WMA

0.94

EMA.

0.97

EMA

Results of

Average 53 53 53 59 59

StdDev 24 20 17 19 16

Percentile

Volatility Minimum

50

60

15

48

53

23

48

54

28

51

55

29

56

61

33

57

61

Study 70

80

90

61

68

87

62

69

80

60

67

78

66

73

88

66

73

83

95 108 95 82 98 89

Maximum 142 116 107 124 109

10 Day Historical Volatility

Contract Second Fourth Sixth Ninth Twelfth

Average 48 38 31 27 23

StdDev 20 16 15 16 14

Percentile

Minimum 14 7 6 3 2

50 44 35 29 24 20

60 48 39 32 29 24

65 51 42 35 31 28

70 55 44 37 34 30

80 61 52 43 40 35

90 75 59 52 47 42

95 86 67 56 54 49

Maximum 129 88 100 101 74

Copyright Kase and Company, Inc. All rights reserved

THIS PRESENTATION DOWNLOADED FROM WWW.KASECO.COM

Correlation, Volatility vs. Trend

Volatility is about the same, independent of degree of trend

Percentile of Trend Volatility Annualized

2.5 0.040 64

5 0.042 67

10 0.038 61

25 0.037 59

50 0.039 62

55 0.035 55

75 0.034 54

95 0.039 62

Copyright Kase and Company, Inc. All rights reserved

THIS PRESENTATION DOWNLOADED FROM WWW.KASECO.COM

True Range Proportional

to Volatility with Right Skew

NGM12, Double True Range

Percentiles

0 0.01

350 120%

10 0.04

300 100% 20 0.06

250

80%

30 0.07

40 0.09

Frequency

200

60%

150 50 0.10

100

40% 60 0.12

20%

70 0.14

50

80 0.17

0 0%

0.03 0.04 0.06 0.07 0.09 0.10 0.11 0.13 0.14 0.15 0.17 0.18 0.19 0.21 0.22 0.24 0.25 0.26 0.28 0.29

90 0.22

TRD, mmBtu 100 0.74

Copyright Kase and Company, Inc. All rights reserved

THIS PRESENTATION DOWNLOADED FROM WWW.KASECO.COM

Relationship of Volatility

Actual versus Normal Distribution

50

Percentile Ratio

2.5 0.67

40

5 0.70

10 0.79

15 0.84

30 20 0.92

25 1.03

30 1.16

35 1.36

40 1.75

20

45 2.70

50 0.00

45 -1.15

40 -0.12

10

35 0.33

30 0.52

25 0.68

20 0.86

0

15 0.96

-2.00

-1.50

-1.00

-0.50

0.00

0.50

1.00

1.50

2.00

2.50

10 1.11

5 1.18

2.5 1.29

Copyright Kase and Company, Inc. All rights reserved

THIS PRESENTATION DOWNLOADED FROM WWW.KASECO.COM

Monte Carlo Simulations

Controlled statistical sampling

“random” works better than

“hypercube”

Generates possible realizations of a system

Uses probability distributions and their relationships

Involves using random numbers

Samples many different paths underlying could follow….

Pe rpe tual Price Expectation, No Bias

Probability

1.0 1.2 1.7 2.1 2.6 3.0 3.5 3.9 4.4 4.8 5.3 5.7 6.2 6.6 7.1 7.5 8.0 8.4 8.9 9.3 10.0

Price

Copyright Kase and Company, Inc. All rights reserved

THIS PRESENTATION DOWNLOADED FROM WWW.KASECO.COM

“Real Life” Example

Run during the 4Q00 for First Nearby Contract

Percentile No Bias Weak Up Normal Up Strong Up

5 6.17 6.17 7.66 7.82

20 7.26 7.35 8.80 9.56

25 7.52 7.60 9.04 9.95

50 8.60 8.86 10.13 11.84

75 9.90 10.27 11.42 14.09

80 10.24 10.67 11.77 14.67

95 12.06 12.65 13.34 17.70

Copyright Kase and Company, Inc. All rights reserved

THIS PRESENTATION DOWNLOADED FROM WWW.KASECO.COM

Price Distributions

and Mean Reversion

Random processes form normal bell curves.

Comparison of Normal to Empirical about same.

Longer strips tend to form (more or less) log normal

distributions.

Prices mean revert but the mean may be trending.

Challenges are

Market may have multiple embedded cycles.

Determining which mean to use.

Copyright Kase and Company, Inc. All rights reserved

THIS PRESENTATION DOWNLOADED FROM WWW.KASECO.COM

Distributions of Actual to

Standard Curve

Standard Curve 250 Dev 999 Dev

% All Crude Gas

50

2.5 -15 -14 -9

5 -10 -8 -2

10 -8 -11 5

40

20 -1 -7 9

30 3 -1 7

40 16 24 14

30

50 -27 91 -55

60 -45 -56 -65

70 -26 -33 -39

80 -13 -19 -6

20

90 -11 -28 -3

95 12 16 5

97.5 13 16 7

10

0

2.50

0.00

0.50

1.00

1.50

2.00

-2.50

-2.00

-1.50

-1.00

-0.50

Copyright Kase and Company, Inc. All rights reserved

THIS PRESENTATION DOWNLOADED FROM WWW.KASECO.COM

You might also like

- Ac 4052 Coursework 2022 2023Document7 pagesAc 4052 Coursework 2022 2023giloyNo ratings yet

- Bidding For Antamina - : Applied Valuation Case at Handelshøyskolen BIDocument6 pagesBidding For Antamina - : Applied Valuation Case at Handelshøyskolen BIAnh ThoNo ratings yet

- Nucleon CaseDocument6 pagesNucleon CaseshagunparmarNo ratings yet

- 2023 L1 SeminarsDocument47 pages2023 L1 Seminarsrezaekapangestu1No ratings yet

- Sheiko Intermedios Mas 80 KGDocument16 pagesSheiko Intermedios Mas 80 KGRonny AlbanNo ratings yet

- 2024 L1 SeminarsDocument47 pages2024 L1 Seminarshamna wahabNo ratings yet

- Current Ratio % Total Liabilities To Asset Ratio % Total Liabilities To Equity Ratio %Document1 pageCurrent Ratio % Total Liabilities To Asset Ratio % Total Liabilities To Equity Ratio %Nur Rochman MuhNo ratings yet

- One Factor and Two Factor Interest Rate Modeling: Presented ByDocument24 pagesOne Factor and Two Factor Interest Rate Modeling: Presented ByRahul JainNo ratings yet

- DivisionDocument2 pagesDivisionWafaa Al MuhairiNo ratings yet

- Lecture - 01 - REVIEW MATERIAL - Quantitative - Review 8801Document35 pagesLecture - 01 - REVIEW MATERIAL - Quantitative - Review 8801GeraldiNo ratings yet

- Statistics Assignment 1Document18 pagesStatistics Assignment 1RAVI RANJAN CHOUDHARINo ratings yet

- STAT Module-1: Summarizing: One Variable and Relationship Between Two Variables Pr. Tounkara January 18, 2022Document39 pagesSTAT Module-1: Summarizing: One Variable and Relationship Between Two Variables Pr. Tounkara January 18, 2022expertDiedhiouNo ratings yet

- Useful Stuff ChartsDocument5 pagesUseful Stuff ChartsDevilish LuciferNo ratings yet

- Tugas Statistik TGL 29 AprilDocument8 pagesTugas Statistik TGL 29 AprilSarazara IsaNo ratings yet

- E 07 HistDocument26 pagesE 07 Histwilliamlord8No ratings yet

- Know Your Weapon 2Document16 pagesKnow Your Weapon 2vegawizard100% (4)

- Population Ageing Trend of Hong KongDocument14 pagesPopulation Ageing Trend of Hong KongMishu DianaNo ratings yet

- 2022 LI SeminarsDocument47 pages2022 LI SeminarsАндрей Б-нNo ratings yet

- Absolved (P 6) : # Speed Last Race # Prime Power # Class Rating # Best Speed at DistDocument29 pagesAbsolved (P 6) : # Speed Last Race # Prime Power # Class Rating # Best Speed at DistAndres de LidiceNo ratings yet

- Yield Curves RiskWorXDocument7 pagesYield Curves RiskWorXraghu_prabhuNo ratings yet

- Division G3Document17 pagesDivision G3Shane RajapakshaNo ratings yet

- MADERAZO, Dheine Louise - Modmath - MMMDocument8 pagesMADERAZO, Dheine Louise - Modmath - MMMDheine MaderazoNo ratings yet

- Frequency Dist and GraphsDocument2 pagesFrequency Dist and GraphsAhmed HassanNo ratings yet

- Topic 2 Quality Specification Lectures Mr. Mohd Syafarim B. MD IshakDocument45 pagesTopic 2 Quality Specification Lectures Mr. Mohd Syafarim B. MD IshakFares IzuanNo ratings yet

- Corporate Valuation ConceptsDocument810 pagesCorporate Valuation ConceptsSupplies DepotNo ratings yet

- StatisticsDocument13 pagesStatisticsNeniDiazRakhmanNo ratings yet

- Pep Id-smk-some-2040-Xxxxxx - Rev0.1 Methodology For Tie in Tp-04)Document15 pagesPep Id-smk-some-2040-Xxxxxx - Rev0.1 Methodology For Tie in Tp-04)m khaeronNo ratings yet

- Chart Title: Bin FrequencyDocument6 pagesChart Title: Bin FrequencyTran KhoaNo ratings yet

- Pessimism Overdone: Perspective On IT SectorDocument6 pagesPessimism Overdone: Perspective On IT Sectorsarvo_44No ratings yet

- CH 02Document104 pagesCH 02Tabish NomanNo ratings yet

- Fraction Decimal and Percent Conversions PracticeDocument4 pagesFraction Decimal and Percent Conversions Practiceapi-316619857No ratings yet

- 02H-T13-G65-20JI-MA-008 REV 0 Monorail CranesDocument8 pages02H-T13-G65-20JI-MA-008 REV 0 Monorail CranesShubhamYadavNo ratings yet

- Nfo Note HSBC Multi Asset Allocation FundDocument4 pagesNfo Note HSBC Multi Asset Allocation FundstudioarcdezineNo ratings yet

- Tristar AnswersDocument22 pagesTristar AnswersMine SayracNo ratings yet

- Cisco Switching Positioning Claro - Abril 2012 - (Consultores)Document39 pagesCisco Switching Positioning Claro - Abril 2012 - (Consultores)David EspinozaNo ratings yet

- Spurious RegressionsDocument15 pagesSpurious Regressionsafzalkhancss3311No ratings yet

- Chap 3 - The Cost of CapitalDocument37 pagesChap 3 - The Cost of Capitalrafat.jalladNo ratings yet

- Result 7Document2 pagesResult 7John Michael SibayanNo ratings yet

- 5A-Logistic Rregression Using PythonDocument9 pages5A-Logistic Rregression Using Pythonsai saravanaNo ratings yet

- DR Bo 0023Document8 pagesDR Bo 0023Rendy Dwi PrastyoNo ratings yet

- Verified Crypto Traders 2021 12 December Swing & Scalp ReportDocument4 pagesVerified Crypto Traders 2021 12 December Swing & Scalp ReportFurkan KarakurtNo ratings yet

- RCBDDocument6 pagesRCBDkasuwedaNo ratings yet

- HI Industry OverviewDocument7 pagesHI Industry OverviewUmangtarangNo ratings yet

- Characterization Impact of Positive Outcomes (Work Days) Impact of Negative Outcomes (Work Days)Document2 pagesCharacterization Impact of Positive Outcomes (Work Days) Impact of Negative Outcomes (Work Days)wafasaNo ratings yet

- Sandvik Off Highway Dump Trucks Spec 19f2aaDocument2 pagesSandvik Off Highway Dump Trucks Spec 19f2aaИгорь ИвановNo ratings yet

- Risk and Return Chapter 5Document55 pagesRisk and Return Chapter 5sundas younasNo ratings yet

- PAK Transformer Study 15Nov2019NREL v2Document33 pagesPAK Transformer Study 15Nov2019NREL v2Asim RiazNo ratings yet

- Example 1Document6 pagesExample 1edwinNo ratings yet

- ID SMK EM 2040 271711 - Rev0.1 - 2Document4 pagesID SMK EM 2040 271711 - Rev0.1 - 2skazevtoNo ratings yet

- Financial Report ExampleDocument18 pagesFinancial Report ExampleelizaroyNo ratings yet

- Calculator Founder Equity VC4A Startup AcademyDocument2 pagesCalculator Founder Equity VC4A Startup AcademyNew UserNo ratings yet

- Calculator Founder Equity VC4A Startup AcademyDocument2 pagesCalculator Founder Equity VC4A Startup AcademyKayode OgunladeNo ratings yet

- Demo ALL Odisha Math Previous Year Question 4000 PYQ by Tech of World AppDocument8 pagesDemo ALL Odisha Math Previous Year Question 4000 PYQ by Tech of World Appadityasahoo9348No ratings yet

- Growth and Interpretation of Growth Charts: Dr. Naveen Kumar Bhardwaj Associate Professor Department of PediatricsDocument23 pagesGrowth and Interpretation of Growth Charts: Dr. Naveen Kumar Bhardwaj Associate Professor Department of PediatricsAnshu SainiNo ratings yet

- FM Topic 8 Lecture 2Document12 pagesFM Topic 8 Lecture 2xebulemNo ratings yet

- Çenti̇k Darbe Beli̇rsi̇zli̇ği̇Document6 pagesÇenti̇k Darbe Beli̇rsi̇zli̇ği̇Delil OzanNo ratings yet

- ConsumerDocument2 pagesConsumerapi-405686561No ratings yet

- Google Innovations in The Management of OperationsDocument13 pagesGoogle Innovations in The Management of OperationsJorge Yeshayahu Gonzales-LaraNo ratings yet

- HDFC C2R BrochureDocument16 pagesHDFC C2R Brochurevineeth vinnuNo ratings yet

- Intro To Credit Metrics - JP MorganDocument36 pagesIntro To Credit Metrics - JP MorganHaivaanNo ratings yet

- Manual To ShreveDocument64 pagesManual To ShreveIvan Tay100% (1)

- Ch.4 Redemption of DebenturesDocument14 pagesCh.4 Redemption of DebenturesNidhi LathNo ratings yet

- 5th Module FMDocument16 pages5th Module FMAbhishek SarafNo ratings yet

- Chapter 11 Derivatives Hedging - ReportingDocument9 pagesChapter 11 Derivatives Hedging - ReportingEricka AlimNo ratings yet

- Mutual Fund Set-2Document37 pagesMutual Fund Set-2royal62034No ratings yet

- Hedge Fund 220605 MLDocument40 pagesHedge Fund 220605 MLMozzam RangwalaNo ratings yet

- Zurich Personal Protection Target Market StatementDocument2 pagesZurich Personal Protection Target Market StatementKaran SardaNo ratings yet

- Swaptions & Interest Rate ModelingDocument24 pagesSwaptions & Interest Rate ModelingRanit BanerjeeNo ratings yet

- Financial Instruments of Oil TradingDocument9 pagesFinancial Instruments of Oil TradingKhurram JajjahNo ratings yet

- M11 - Final Mock Question J21Document12 pagesM11 - Final Mock Question J21jasonete12No ratings yet

- OMS Final Version 20220823 1Document46 pagesOMS Final Version 20220823 1helenpkusocNo ratings yet

- IAS 33 - Mul Choice - SVDocument5 pagesIAS 33 - Mul Choice - SVTuan Huy Cao pcpNo ratings yet

- SolDocument3 pagesSolilovevietnam007No ratings yet

- CIV2 CASES D-VOIDABLE (Contracts)Document82 pagesCIV2 CASES D-VOIDABLE (Contracts)Antonio SalvadorNo ratings yet

- Price ForcastDocument38 pagesPrice ForcastLalit GoyalNo ratings yet

- Screen Supp 103Document17 pagesScreen Supp 103Jessica PiNo ratings yet

- Apple IPO FilingDocument47 pagesApple IPO FilingEric FaderNo ratings yet

- REVIEWER - BUSLAW Law On SalesDocument8 pagesREVIEWER - BUSLAW Law On SalesJinnie TannieNo ratings yet

- The Value Line Sample Page: Johnson&JohnsonDocument2 pagesThe Value Line Sample Page: Johnson&Johnsonee1993No ratings yet

- Ice Examiners Report 2009Document86 pagesIce Examiners Report 2009Simon LaiNo ratings yet

- Valuation Objective QuestionsDocument13 pagesValuation Objective QuestionsRubina Hannure78% (9)

- Managing FOREX ExposureDocument23 pagesManaging FOREX ExposureCijil Diclause0% (1)

- CH 21Document11 pagesCH 21Hanif MusyaffaNo ratings yet

- Intro To Futures Trading - Canada - FDocument18 pagesIntro To Futures Trading - Canada - FRashawn AbrahawnNo ratings yet

- Bloomberg Cheat Sheet - EnglishDocument5 pagesBloomberg Cheat Sheet - EnglishNilanjan MaityNo ratings yet