Professional Documents

Culture Documents

EP508 PowerpointFa

EP508 PowerpointFa

Uploaded by

natalia harini0 ratings0% found this document useful (0 votes)

5 views13 pagesOriginal Title

EP508-PowerpointFa

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views13 pagesEP508 PowerpointFa

EP508 PowerpointFa

Uploaded by

natalia hariniCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 13

Accruals and Prepayments

Accruals basis of accounting

• The accruals basis of accounting means that to calculate the profit for

the period, we must include all the income and expenditure relating

to the period, whether or not the cash has been received or paid or

an invoice received.

• Profit is therefore:

Income earned X

Expenditure incurred (X)

Profit X

Accrued expenditure

• An accrual arises where expenses of the business, relating to the year, have

not been paid by the year end.

• In this case, it is necessary to record the extra expense relevant to the year

and create a corresponding statement of financial position liability (called an

accrual):

Dr Expense account X

Cr Accrual X

• An accrual will therefore reduce profit in the income statement.

Illustration 1

• A business’ electricity charges amount to Rs.12,000 pa. In the year to

31 December 20X5, Rs.9,000 has been paid. The electricity for the

final quarter is paid in January 20X6.

• What year-end accrual is required and what is the electricity expense

for the year?

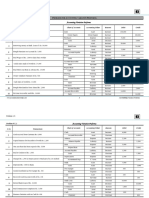

• John Simnel’s business has an accounting year end of 31 December 20X1. He

rents factory space at a rental cost of Rs.5,000 per quarter, payable in arrears.

• During the year to 31 December 20X1 his cash payments of rent have been as

follows:

• 31 March (for the quarter to 31 March 20X1) Rs.5,000

• 29 June (for the quarter to 30 June 20X1) Rs.5,000

• 2 October (for the quarter to 30 September 20X1) Rs.5,000

• The final payment due on 31 December 20X1 for the quarter to that date was

not paid until 4 January 20X2.

• Show the ledger accounts required to record the above transactions.

Prepaid expenditure

• A prepayment arises where some of the following year’s expenses

have been paid in the current year.

• In this case, it is necessary to remove that part of the expense which

is not relevant to this year and create a corresponding statement of

financial position asset (called a prepayment):

Dr Prepayment X

Cr Expense account X

• A prepayment will therefore increase profit in the income statement.

Illustration 2

• The annual insurance charge for a business is Rs.24,000 pa. Rs.30,000

was paid on 1 January 20X5 in respect of future insurance charges.

• What is the year-end prepayment and what is the insurance expense

for the year?

• Tubby Wadlow pays the rental expense on his market stall in advance.

He starts business on 1 January 20X5 and on that date pays Rs.1,200 in

respect of the first quarter’s rent. During his first year of trade he also

pays the following amounts:

• 3 March (in respect of the quarter ended 30 June) Rs.1,200

• 14 June (in respect of the quarter ended 30 September) Rs.1,200

• 25 September (in respect of the quarter Rs.1,400 ended 31 December)

• 13 December (in respect of the first quarter of 20X6) Rs.1,400

• Show these transactions in the rental expense account.

• On 1 January 20X5, Willy Mossop owed Rs.2,000 in respect of the previous

year’s electricity. Willy made the following payments during the year ended

31 December 20X5:

• 6 February Rs.2,800

• 8 May Rs.3,000

• 5 August Rs.2,750

• 10 November Rs.3,100

• At 31 December 20X5, Willy calculated that he owed Rs.1,800 in respect of

electricity for the last part of the year.

• What is the electricity charge to the income statement?

Accrued income

• Accrued income arises where income has been earned in the

accounting period but has not yet been received.

• In this case, it is necessary to record the extra income in the income

statement and create a corresponding asset in the statement of

financial position (called accrued income):

Dr Accrued income (SFP) X

Cr Income (IS) X

• Accrued income creates an additional current asset on our Statement

of financial position. It also creates additional income on our Income

statement, and hence this will increase overall profits.

Illustration 3

• A business earns bank interest income of Rs.300 per month. Rs.3,000

bank interest income has been received in the year to 31 December

20X5.

• What is the year-end asset and what is the bank interest income for

the year?

Prepaid income

• Prepaid income arises where income has been received in the

accounting period but which relates to the next accounting period.

• In this case, it is necessary to remove the income not relating to the

year from the income statement and create a corresponding liability

in the statement of financial position (called prepaid income):

Dr Income X

Cr Prepaid Income X

• A business rents out a property at an income of Rs.4,000 per month.

Rs.64,000 has been received in the year ended 31 December 20X5.

• What is the year-end liability and what is the rental income for the

year?

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (347)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Michael March StatmentDocument11 pagesMichael March StatmentMucho Facerape100% (1)

- CH 09Document15 pagesCH 09Barry PatnettNo ratings yet

- Adjustments To Financial Statements: Edwin C. MbwamboDocument25 pagesAdjustments To Financial Statements: Edwin C. MbwamboBarry PatnettNo ratings yet

- Chapter 4: Adjustments, Financial Statements, and Financial ResultsDocument36 pagesChapter 4: Adjustments, Financial Statements, and Financial ResultsBarry PatnettNo ratings yet

- Accruals and PrepaymentsDocument7 pagesAccruals and PrepaymentsBarry PatnettNo ratings yet

- SCRIPT (Verbatim) :: ReminderDocument1 pageSCRIPT (Verbatim) :: ReminderBarry PatnettNo ratings yet

- Bonds PayableDocument7 pagesBonds PayableCarl Yry BitengNo ratings yet

- 11 PDFDocument3 pages11 PDFRohmat TullohNo ratings yet

- MUFTI - Credo Brands Marketing Limited ProspectusDocument410 pagesMUFTI - Credo Brands Marketing Limited ProspectusCornburn KNo ratings yet

- Starbucks Part IIDocument7 pagesStarbucks Part IIShuting QinNo ratings yet

- Derivative Market in India by ICICI, SBI & Yes Bank & Its BehaviorDocument90 pagesDerivative Market in India by ICICI, SBI & Yes Bank & Its BehaviorChandan Srivastava100% (1)

- Finals - Assignment 4 PDFDocument2 pagesFinals - Assignment 4 PDFcharlies parrenoNo ratings yet

- 08 Handout 1 PDFDocument3 pages08 Handout 1 PDFJeffer Jay GubalaneNo ratings yet

- Corpo Prob and AnsDocument16 pagesCorpo Prob and AnsILOVE MATURED FANSNo ratings yet

- Midterm Examination in Fundamentals of Accountancy Business Ang Management 2Document1 pageMidterm Examination in Fundamentals of Accountancy Business Ang Management 2Joan Mae Angot - VillegasNo ratings yet

- Bac 203 Business Finance 1Document3 pagesBac 203 Business Finance 1jacob kiokoNo ratings yet

- Page 1 of 4Document4 pagesPage 1 of 4Ayoub AouidNo ratings yet

- Answers EXERCISES For Online Quiz 2Document6 pagesAnswers EXERCISES For Online Quiz 2Alia HazwaniNo ratings yet

- Chapter 8 (T - F) FlashcardsDocument8 pagesChapter 8 (T - F) FlashcardsMaryane AngelaNo ratings yet

- A Synopsis Report ON Long Term Investment Decision AT Kesoram Cement LTDDocument10 pagesA Synopsis Report ON Long Term Investment Decision AT Kesoram Cement LTDMOHAMMED KHAYYUMNo ratings yet

- Management Accounting Chapter 4: Fund Flow Statement (FFS) : o o o o oDocument21 pagesManagement Accounting Chapter 4: Fund Flow Statement (FFS) : o o o o oHemantha RajNo ratings yet

- Tutorial 12Document3 pagesTutorial 12charlie simo100% (1)

- Corporate Governance ModelDocument24 pagesCorporate Governance ModelImran ShahaniNo ratings yet

- Answer SheetDocument49 pagesAnswer SheetMaryamKhalilahNo ratings yet

- Class Notes Redemption of Preference Share - PDFDocument4 pagesClass Notes Redemption of Preference Share - PDFBhavya MehtaNo ratings yet

- Financial StatementsDocument38 pagesFinancial StatementsRize TakatsukiNo ratings yet

- EXercise VC1Document6 pagesEXercise VC1Abdulmajed Unda Mimbantas100% (1)

- Accounting Imp 100 Q'sDocument159 pagesAccounting Imp 100 Q'sVijayasri KumaravelNo ratings yet

- Fundamentals of Corporate Finance Canadian 9Th Edition Ross Test Bank Full Chapter PDFDocument67 pagesFundamentals of Corporate Finance Canadian 9Th Edition Ross Test Bank Full Chapter PDFousleyrva9100% (10)

- Problems Accounting Variation Proforma 1 5 SolvedDocument5 pagesProblems Accounting Variation Proforma 1 5 SolvedSHORT VIDZNo ratings yet

- Vista VDocument3 pagesVista VPiyawatr ZenNo ratings yet

- Chapter 7 BankingDocument41 pagesChapter 7 BankingpiNo ratings yet

- Icbp LK TW Ii 2017Document116 pagesIcbp LK TW Ii 2017DS ReishenNo ratings yet

- Silabus Matematika Keuangan 260221Document5 pagesSilabus Matematika Keuangan 260221Garcia ZarathustraNo ratings yet