Professional Documents

Culture Documents

Solutions For CH 9 2-26-14

Solutions For CH 9 2-26-14

Uploaded by

DIEGO BECERRAOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solutions For CH 9 2-26-14

Solutions For CH 9 2-26-14

Uploaded by

DIEGO BECERRACopyright:

Available Formats

Exercise 9-16

Variable and absorption costing, explaining operating-

income differences Nascar Motors assembles and sells

motor vehicles and uses standard costing. Actual data

relating to April and May 2011 are:

© 2012 Pearson Prentice Hall. All rights reserved. 9-1

The following information is available:

The selling price per vehicle is $24,000. The

budgeted level of production used to calculate the

budgeted fixed manufacturing cost per unit is 500

units. There are no price, efficiency, or spending

variances. Any production-volume variance is

written off to cost of goods sold in the month in

which it occurs.

© 2012 Pearson Prentice Hall. All rights reserved. 9-2

1. Prepare April and May 2011 income

statements for Nascar Motors under:

(a) variable costing

(b) absorption costing

© 2012 Pearson Prentice Hall. All rights reserved. 9-3

(a) variable costing

© 2012 Pearson Prentice Hall. All rights reserved. 9-4

(b) absorption costing

© 2012 Pearson Prentice Hall. All rights reserved. 9-5

2. Prepare a numerical reconciliation and

explanation of the difference between operating

income for each month under variable costing and

absorption costing.

The difference between absorption and variable costing is due solely to

moving fixed manufacturing costs into inventories as inventories increase (as

in April) and out of inventories as they decrease (as in May).

© 2012 Pearson Prentice Hall. All rights reserved. 9-6

Pr. 9-17 Continued from 9-16

1. April 2011 May 2011

Revenuesa $8,400,000 $12,480,000

Direct material cost of goods sold

Beginning inventory $ 0 $1,005,000

Direct materials in goods manufactured b

3,350,000 2,680,000

Cost of goods available for sale 3,350,000 3,685,000

Deduct ending inventoryc (1,005,000) (201,000)

Total direct material cost of goods sold 2,345,000 3,484,000

Throughput margin 6,055,000 8,996,000

Other costs

Manufacturing costs 3,650,000d 3,320,000e

Other operating costs 1,650,000f 2,160,000g

Total other costs 5,300,000 5,480,000

Operating income $ 755,000 $ 3,516,000

a e

$24,000 × 350; $24,000 × 520 ($3,300 × 400) + $2,000,000

b f

$6,700 × 500; $6,700 × 400 ($3,000 × 350) + $600,000

c g

$6,700 × 150; $6,700 × 30 ($3,000 × 520) + $600,000

d

($3,300 × 500) + $2,000,000

© 2012 Pearson Prentice Hall. All rights reserved. 9-7

Pr. 9-17 Concluded

April May

Variable costing $1,250,000 $3,120,000

Absorption costing 1,850,000 2,640,000

Throughput costing 755,000 3,516,000

2. In April, throughput costing has the lower operating income,

and in May throughput costing has the higher income. Throughput

costing puts greater emphasis on sales as the source of operating

income than does either absorption or variable costing.

3. Throughput costing penalizes production without a

corresponding sale in the same period. Costs other than direct

materials that are variable with respect to production are

expensed in the period incurred, but under variable costing they

would be capitalized. So, TP costing removes the incentive to

build up inventory.

© 2012 Pearson Prentice Hall. All rights reserved. 9-8

Denominator Level Concepts

9-25 (10 min.) Capacity management, denominator-level capacity conce

1. a, b

2. a

3. d

4. c, d

5. c

6. d

7. a

8. b (or a)

9. b

10. c, d

11. a, b

© 2012 Pearson Prentice Hall. All rights reserved. 9-9

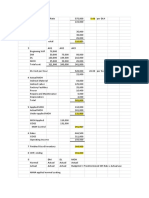

9-26--Denominator Level Issues

Budgeted

Budgeted Fixed Fixed

Denominator Manufacturing Budgeted Manufacturing

Level Capacity Overhead per Capacity Overhead Cost

Concept Period Level Rate

Theoretical $ 6,480,000 5,400 $ 1,200.00

Practical $6,480,000 3,840 $1,687.50

Normal $6,480,000 3,240 $2,000.00

Master-budget $6,480,000 3,600 $1,800.00

2. The variances that arise from use of the theoretical or practical

level concepts will signal that there is a divergence between the

supply of capacity and the demand for capacity. This is useful input

to managers. As a general rule, however, it is important not to

place undue reliance on the production volume variance as a

measure of the economic costs of unused capacity.

© 2012 Pearson Prentice Hall. All rights reserved. 9-10

Master Budget as Level?

• Will lead to high prices when demand is low (more fixed

costs allocated to the individual product level), further

eroding demand; and to low prices when demand is

high, forgoing profits.

– This is the “downward demand spiral”—the continuing reduction

in demand that occurs when the prices of competitors are not

met and demand drops, resulting in even higher unit costs and

even more reluctance to meet the prices of competitors.

• The positive aspects:

– based on demand for the product and indicates the price at

which all costs per unit would be recovered to enable the

company to make a profit.

– is also a good benchmark against which to evaluate

performance.

© 2012 Pearson Prentice Hall. All rights reserved. 9-11

9-32 Alternative denominator-level capacity

concepts, effect on operating income

Budgeted Fixed

Budgeted Fixed Days of Hours of Budgeted Manufacturing

Denominator-Level Manuf. Overhead Production Production Barrels Denominator Level Overhead Rate

Capacity Concept per Period per Period per Day per Hour (Barrels) per Barrel

(1) (2) (3) (4) (5) =2 x 3 x 4 (6) = (1)/ (5)

Theoretical capacity $28,000,000 360 24 540 4,665,600 $ 6.00

Practical capacity 28,000,000 350 20 500 3,500,000 8.00

Normal capacity utilization 28,000,000 350 20 400 2,800,000 10.00

Master-budget utilization

(a) January-June 2012 14,000,000 175 20 320 1,120,000 12.50

(b) July-December 2012 14,000,000 175 20 480 1,680,000 8.33

The theoretical and practical capacity concepts emphasize supply factors

and are consequently higher, while normal capacity utilization and master-

budget utilization emphasize demand factors.

The two separate six-month rates for the master-budget utilization concept

differ because of seasonal differences in budgeted production.

© 2012 Pearson Prentice Hall. All rights reserved. 9-12

9-32 Resulting Volume Variance

Per Barrel

Budgeted Budgeted Budgeted Fixed Mfg. Fixed

Fixed Mfg. Variable Total Mfg Overhead Mfg. Overhead

Overhead Mfg. Cost Cost Rate Costs Allocated Variance

Denominator-Level Rate per Barrel Rate (8) = (9) = (10) =

Capacity Concept (6) (7) (6) + (7) 2,600,000 (6) $27,088,000 – (9)

Theoretical capacity $6.00 $30.20a $36.20 $15,600,000 $11,488,000 U

Practical capacity 8.00 30.20 38.20 20,800,000 6,288,000 U

Normal capacity utilization 10.00 30.20 40.20 26,000,000 1,088,000 U

a

$78,520,000 2,600,000 barrels

© 2012 Pearson Prentice Hall. All rights reserved. 9-13

9-32 Resulting Income

Normal

Theoretical Practical Capacity

Capacity Capacity Utilization

Revenues (2,400,000 bbls. $45 per bbl.) $108,000,000 $108,000,000 $108,000,000

Cost of goods sold

Beginning inventory 0 0 0

Variable mfg. costs 78,520,000 78,520,000 78,520,000

Fixed mfg. overhead costs allocated

(2,600,000 units $6.00; $8.00; $10.00 per unit) 15,600,000 20,800,000 26,000,000

Cost of goods available for sale 94,120,000 99,320,000 104,520,000

Deduct ending inventory

(200,000 units $36.20; $38.20; $40.20 per unit) (7,240,000) (7,640,000) (8,040,000)

Adjustment for variances (add: all unfavorable) 11,488,000U 6,288,000U 1,088,000U

Cost of goods sold 98,368,000 97,968,000 97,568,000

Gross margin 9,632,000 10,032,000 10,432,000

Other costs 0 0 0

Operating income $ 9,632,000 $ 10,032,000 $ 10,432,000

Pr. 9-33: Discuss Motivational Considerations

© 2012 Pearson Prentice Hall. All rights reserved. 9-14

Pr. 9-33: Discuss Motivational Considerations

9-33 (20 min.) Motivational considerations in denominator-level capacity selection

(continuation of 9-32).

1. If the plant manager gets a bonus based on operating income, he/she will prefer the

denominator-level capacity to be based on normal capacity utilization (or master-budget

utilization). In times of rising inventories, as in 2012, this denominator level will maximize the

fixed overhead trapped in ending inventories and will minimize COGS and maximize operating

income. Of course, the plant manager cannot always hope to increase inventories every period,

but on the whole, he/she would still prefer to use normal capacity utilization because the smaller

the denominator, the higher the amount of overhead costs capitalized for inventory units. Thus, if

the plant manager wishes to be able to “adjust” plant operating income by building inventory,

normal capacity utilization (or master-budget capacity utilization) would be preferred.

2. Given the data in this question, the theoretical capacity concept reports the lowest operating

income and thus (other things being equal) the lowest tax bill for 2012. Lucky Lager benefits by having

deductions as early as possible. The theoretical capacity denominator-level concept maximizes the

deductions for manufacturing costs.

3. The IRS may restrict the flexibility of a company in several ways:

a. Restrict the denominator-level concept choice (to say, practical capacity).

b. Restrict the cost line items that can be expensed rather than inventoried.

c. Restrict the ability of a company to use shorter write-off periods or more accelerated

write-off periods for inventoriable costs.

d. Require proration or allocation of variances to represent actual costs and actual

capacity used.

© 2012 Pearson Prentice Hall. All rights reserved. 9-15

You might also like

- Cummins NTC 350 Big Cam EngineDocument2 pagesCummins NTC 350 Big Cam Enginedavid hernandez56% (9)

- Model Solution - Assessment 2Document12 pagesModel Solution - Assessment 2rajeshkinger_1994100% (2)

- Solution Manual For Managerial Accounting 7th Edition James Jiambalvo DownloadDocument25 pagesSolution Manual For Managerial Accounting 7th Edition James Jiambalvo DownloadGaryLeemtno100% (47)

- M 2011 Dec PDFDocument26 pagesM 2011 Dec PDFMoses LukNo ratings yet

- ACT320 CHAPTER 9 - AssignmentDocument4 pagesACT320 CHAPTER 9 - AssignmentCoci KhouryNo ratings yet

- MAs and Cost 2Document17 pagesMAs and Cost 2VtgNo ratings yet

- Review Brown, Raymond, An Introduction To The New TestamentDocument2 pagesReview Brown, Raymond, An Introduction To The New Testamentgersand6852No ratings yet

- CH 9 Key Ans and Practice QuestionsDocument19 pagesCH 9 Key Ans and Practice QuestionsNCTNo ratings yet

- Tutorial 2 - SolutionsDocument15 pagesTutorial 2 - SolutionsLijing CheNo ratings yet

- Prob 2Document2 pagesProb 2Elliot RichardNo ratings yet

- Cost Management Problems CA FinalDocument266 pagesCost Management Problems CA Finalksaqib89100% (1)

- Assgnment 2 (f5) 10341Document11 pagesAssgnment 2 (f5) 10341Minhaj AlbeezNo ratings yet

- t7 2009 Dec QDocument8 pagest7 2009 Dec Q595580No ratings yet

- ACC2125 L3 Flexed Budget, Interpreting Variances Controllability Principle 2021-22Document42 pagesACC2125 L3 Flexed Budget, Interpreting Variances Controllability Principle 2021-22Shruthi RameshNo ratings yet

- ACC221 Quiz1Document10 pagesACC221 Quiz1milkyode9No ratings yet

- XYZ Energy ROIDocument27 pagesXYZ Energy ROIWei ZhangNo ratings yet

- P1 May 2012 AnswersDocument14 pagesP1 May 2012 AnswersPaulusNo ratings yet

- Horngren 16e 2017-547-995 (001-035) (18-20)Document3 pagesHorngren 16e 2017-547-995 (001-035) (18-20)ReynoldNo ratings yet

- Managerial Accounting 5th Edition Jiambalvo Solutions ManualDocument25 pagesManagerial Accounting 5th Edition Jiambalvo Solutions Manualnhattranel7k1100% (29)

- MS-1stPB 10.22Document12 pagesMS-1stPB 10.22Harold Dan Acebedo0% (1)

- Sample D - Exam SolutionsDocument8 pagesSample D - Exam SolutionsJaden EuNo ratings yet

- Advance Cost & Management AccountingDocument3 pagesAdvance Cost & Management AccountingRana Adnan SaifNo ratings yet

- Cost Classification: Total Product/ ServiceDocument21 pagesCost Classification: Total Product/ ServiceThureinNo ratings yet

- Practice ManualDocument679 pagesPractice ManualSaikrishna AlluNo ratings yet

- Individual Assignment (Fall 2023) 2Document11 pagesIndividual Assignment (Fall 2023) 2RealGenius (Carl)No ratings yet

- The Financial Case For Contract ManufacturingDocument4 pagesThe Financial Case For Contract ManufacturingAshok Kumar VaradarajanNo ratings yet

- Milestone Four MBA705Document10 pagesMilestone Four MBA705Real PharelNo ratings yet

- ABC MedTech ROIDocument27 pagesABC MedTech ROIWei ZhangNo ratings yet

- MASDocument7 pagesMASHelen IlaganNo ratings yet

- Ch5 LimitingFactorsDocument19 pagesCh5 LimitingFactorsali202101No ratings yet

- Activity-Based Costing and ManagementDocument22 pagesActivity-Based Costing and ManagementDaniel John Cañares LegaspiNo ratings yet

- Management Information May-Jun 2016Document2 pagesManagement Information May-Jun 2016SomeoneNo ratings yet

- Additional Exercises For Mid Term Test 1Document42 pagesAdditional Exercises For Mid Term Test 1Nguyen Hoang Tram AnhNo ratings yet

- Tutorial 5 - CHAPTER 9 - QDocument13 pagesTutorial 5 - CHAPTER 9 - QThuỳ PhạmNo ratings yet

- CH 05Document3 pagesCH 05Gus JooNo ratings yet

- Individual Assignment (Fall 2023) 2.docx2Document10 pagesIndividual Assignment (Fall 2023) 2.docx2RealGenius (Carl)No ratings yet

- Session 4 Practice ProblemsDocument11 pagesSession 4 Practice ProblemsRishika RathiNo ratings yet

- Managerial Accounting 6th Edition Jiambalvo Solutions ManualDocument24 pagesManagerial Accounting 6th Edition Jiambalvo Solutions Manualgenevievetruong9ajpr100% (29)

- Ebook Cornerstones of Managerial Accounting Canadian 3Rd Edition Mowen Solutions Manual Full Chapter PDFDocument51 pagesEbook Cornerstones of Managerial Accounting Canadian 3Rd Edition Mowen Solutions Manual Full Chapter PDFxaviaalexandrawp86i100% (13)

- CH 11 - CF Estimation Mini Case Sols Word 1514edDocument13 pagesCH 11 - CF Estimation Mini Case Sols Word 1514edHari CahyoNo ratings yet

- Lecture 15Document20 pagesLecture 15Riaz Baloch NotezaiNo ratings yet

- Questions Chapter 3 No.11: PEROT CORPORATION - Patay2 Chip ProjectDocument6 pagesQuestions Chapter 3 No.11: PEROT CORPORATION - Patay2 Chip ProjectddNo ratings yet

- 7 2010 Jun QDocument8 pages7 2010 Jun QWeezy360No ratings yet

- Soultions - Chapter 3Document8 pagesSoultions - Chapter 3Naudia L. TurnbullNo ratings yet

- 107-W7-8-Variable cost-chp05-STDocument48 pages107-W7-8-Variable cost-chp05-STmargaret mariaNo ratings yet

- Solutions CH 6Document40 pagesSolutions CH 6Ehrom SaidovNo ratings yet

- BKM 10e Chap014Document8 pagesBKM 10e Chap014jl123123No ratings yet

- Absorption and Variable Costing, and Inventory Management: Discussion QuestionsDocument28 pagesAbsorption and Variable Costing, and Inventory Management: Discussion QuestionsParth GandhiNo ratings yet

- Jawaban Kuis UTS - LengkapDocument4 pagesJawaban Kuis UTS - Lengkapdago atasNo ratings yet

- No Te'::': ': "I :' :: " Jl,'il, I I,, "I",,' J, L,!J'JL C A RR YDocument6 pagesNo Te'::': ': "I :' :: " Jl,'il, I I,, "I",,' J, L,!J'JL C A RR YreliableplacementNo ratings yet

- Target Costing and Cost Analysis For Pricing DecisionsDocument5 pagesTarget Costing and Cost Analysis For Pricing DecisionsBarisqi Januar RomaldoNo ratings yet

- CH 3Document19 pagesCH 3hey100% (1)

- Part A: Managerial Accounting Assessment - ACC720 - March 2020Document4 pagesPart A: Managerial Accounting Assessment - ACC720 - March 2020Helmy YusoffNo ratings yet

- Final 2Document13 pagesFinal 2ميدوو سعيدNo ratings yet

- SD17 Hybrid F5 Section C Answers Clean Proof PDFDocument12 pagesSD17 Hybrid F5 Section C Answers Clean Proof PDFShaksham SharmaNo ratings yet

- SCM Discussion5Document13 pagesSCM Discussion5Villanueva, Jane G.No ratings yet

- MCQ Abs & MarDocument10 pagesMCQ Abs & MarDeeraj Neerunjun100% (1)

- This Study Resource Was: Question 3. Blindfold Technologies Inc. (BTI) Is Considering Whether To Introduce A NewDocument2 pagesThis Study Resource Was: Question 3. Blindfold Technologies Inc. (BTI) Is Considering Whether To Introduce A NewFaradibaNo ratings yet

- Budgetary Control Systems Answer To End of Chapter ExercisesDocument3 pagesBudgetary Control Systems Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- From Foraging To Autonoetic Consciousness: The Primal Self As A Consequence of Embodied Prospective ForagingDocument14 pagesFrom Foraging To Autonoetic Consciousness: The Primal Self As A Consequence of Embodied Prospective ForagingVegan BookNo ratings yet

- Alice L. Moe: Teacher CandidateDocument2 pagesAlice L. Moe: Teacher Candidateapi-525184502No ratings yet

- Math 10 Module - Q1, WK 1Document4 pagesMath 10 Module - Q1, WK 1Reygie FabrigaNo ratings yet

- Infinite SolutionsDocument42 pagesInfinite SolutionsGUNNAJ SINGH DUGGALNo ratings yet

- Promoting Fairness in Mobile Ad Hoc NetworksDocument4 pagesPromoting Fairness in Mobile Ad Hoc NetworksBONFRINGNo ratings yet

- Nokia 6.1 Plus (Black, 64 GB) : Grand Total 14999.00Document1 pageNokia 6.1 Plus (Black, 64 GB) : Grand Total 14999.00Udit PandeyNo ratings yet

- Instructional TechnologyDocument5 pagesInstructional Technologycrystine jaye senadreNo ratings yet

- Amt Ltrs Amt LTRS: Default Setting Is 1111"Document105 pagesAmt Ltrs Amt LTRS: Default Setting Is 1111"Mohammed AqeelNo ratings yet

- Big BusinessDocument2 pagesBig BusinessМилош ПезерNo ratings yet

- Chapter 1 Art AppreciationDocument52 pagesChapter 1 Art AppreciationPatrick Purino AlcosabaNo ratings yet

- Cannabis For Post-Traumatic StressDocument1 pageCannabis For Post-Traumatic StressprojectcbdNo ratings yet

- Verizon FIOS Digital Voice User GuideDocument45 pagesVerizon FIOS Digital Voice User Guidehutz5000No ratings yet

- Enrichment ActivityDocument2 pagesEnrichment ActivityMaxpeinzein KimNo ratings yet

- HRM ReviewerDocument9 pagesHRM ReviewerJenefer Diano100% (1)

- CELTA Online Unit 8 Task 11-3 - Your TurnDocument3 pagesCELTA Online Unit 8 Task 11-3 - Your TurnMaria AvilovaNo ratings yet

- General English AssignmentDocument2 pagesGeneral English AssignmentFizah ParkNo ratings yet

- Grimoirium MonstrumDocument45 pagesGrimoirium MonstrumTerrence Steele100% (1)

- Filter Implementation Using DSP KitDocument16 pagesFilter Implementation Using DSP KitPravin GondaliyaNo ratings yet

- Ultimate Moment, Axial Load and Analysis of ColumnDocument19 pagesUltimate Moment, Axial Load and Analysis of ColumnAnggi Novi AndriNo ratings yet

- School Safety Hazards PreparednessDocument26 pagesSchool Safety Hazards PreparednessMaxBalansagNo ratings yet

- Chapter 2:-Reciprocating Pump 2.1: IntroducationDocument7 pagesChapter 2:-Reciprocating Pump 2.1: IntroducationParth VyasNo ratings yet

- Lippincott Procedures - Surgical Asepsis Hand ScrubDocument9 pagesLippincott Procedures - Surgical Asepsis Hand Scrubahmadfadi343No ratings yet

- Kamatne Stope Na Depozite Fizickalica Vaze Od 24 10.2022 GodineDocument1 pageKamatne Stope Na Depozite Fizickalica Vaze Od 24 10.2022 Godinevlado bjelicaNo ratings yet

- Request For Rectification Admissions 2023 - International Degree ProgrammesDocument1 pageRequest For Rectification Admissions 2023 - International Degree ProgrammesadlfaNo ratings yet

- Liquid Smoke Encapsulation and Its Applications To Preserve The White TofuDocument15 pagesLiquid Smoke Encapsulation and Its Applications To Preserve The White TofuAmalia NidaNo ratings yet

- (First Revision) : Indian StandardDocument19 pages(First Revision) : Indian Standardvishal kumarNo ratings yet

- Friday 11th September 2015 Hyatt Regency - Weikfield It Park, Nagar Road, Pune 8.30am OnwardsDocument4 pagesFriday 11th September 2015 Hyatt Regency - Weikfield It Park, Nagar Road, Pune 8.30am OnwardsabidalidossaNo ratings yet

- Tba22 WBDocument150 pagesTba22 WBRaul HerreraNo ratings yet