Professional Documents

Culture Documents

The Stock Market: Bulls and Bears!

Uploaded by

wesel243240 ratings0% found this document useful (0 votes)

23 views15 pagesStock_Market

Original Title

Stock_Market

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentStock_Market

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

23 views15 pagesThe Stock Market: Bulls and Bears!

Uploaded by

wesel24324Stock_Market

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 15

The Stock Market

Bulls and Bears!

Stock

• Def. A portion of ownership in a

corporation. It is a way for a corporation to

raise money. Also known as shares or

equities.

Why should I buy stock?

Stockowners can earn a profit in two ways:

1. Dividends: portions of a corporation’s

profit. They are paid out to stockholders

of many corporations every quarter (3

months). The higher the corporate profit,

the higher the dividend. If a corporation

makes no profit, there is no dividend.

How to make a lot of money in the

Stock Market

The second way stockholders earn money:

2. Capital Gain: When a stock holder sells

stock for more than he or she paid for it.

Ex. I buy a share of Kodak stock for $20.

The value of the stock increases to $21,

and I sell it for a profit of $1.

When a stock holder sells stock for less

than he or she paid, it is a capital loss.

Stock goes up and down

Stock value increases and decreases

according to the company’s performance

and how people think the company will do

in the future.

Stock value goes up when a company has

good sales or invented a new product.

Stock value goes down if a company has to

lay off people, doesn’t sell much or does

not make a profit.

Making and losing money

Can you lose everything in the market?

• If you are foolish, yes. If you invest more

than you can afford to lose, and the stock

loses value, you are in trouble.

• But, if you invest only what you can afford,

and diversify your investments (buy stock

of many different companies), you can do

very well. If you diversify, even if one

investment loses money, the others will

still be okay. And, stock prices go up and

down a lot. If you lose money today, the

stock can still go up tomorrow. You only

lose if you sell!

So how do I make money?

• The smart stock strategy is to invest over

the long term. Diversify your portfolio (buy

a lot of different stock) and let the stock

price increase over time. Even if stocks go

down, it is okay- just wait until they go

back up. The market as a whole always

goes back up.

• Some people play the market like a

casino; they gamble on quick money. They

may get lucky, but it is VERY RISKY! One

bad move, and you lose all you invest.

Types of Stock

• Income Stock: stock that pays dividends at

regular times in a year

• Growth Stock: pays few to no dividends.

All profits are reinvested in the business.

Owners of growth stock are interested in

making money through capital gains.

• The company determines what stock it

offers.

Ownership of a Company

Stockholders are part owners of the

company, and as such have a say in

decisions the company makes. But, since

most companies have thousands of

shareholders with millions of shares, most

stockholders have little say in the

company.

• Controlling Share: Owning 50% of a

company’s stock. This person controls the

company.

Making ownership decisions

Common Stock: stockholders are voting

owners of the company.

But, most people own such a small percent

of a company’s shares, they do not wish to

vote on company decisions.

Preferred Stock: stockholders do not vote in

company decisions, but receive dividends

before owners of common stock.

Where are stocks traded?

• Stock Exchanges: markets where

businesses buy and sell stock. Most

industrialized nations have one. The U.S.

has several.

• In the U.S. the two largest are The New

York Stock Exchange (aka. Wall Street),

which represents the oldest and largest

corps. in the country. The NASDAQ in

Chicago represents newer companies.

How are stocks traded?

• Stockbroker: licensed intermediary

between buyers and sellers of stock

• Brokerage Firms: businesses which

specialize in trading stock.

• Daytrader: stockbrokers who buy and sell

large amounts of stock very quickly to turn

a profit in one day’s trading. (get it?)

Bull and Bear Markets

• Economists describe the stock market

activity as being a:

– Bull Market: steadily rising stock market

over time

– Bear Market: steadily falling stock

market over time

Stock Performance Indexes

• With thousands of publicly owned

corporations, selling billions of shares of

stock, it is impossible to keep track of how

the market is doing as a whole. Stock

Performance Indexes are used to look at

parts of the stock market to make a

generalization about the market as a

whole.

Two Stock Performance Indexes

The Dow Jones Industrial Average

• The Dow is an index that shows how 30

companies in various industries change in

value from day to day.

The S&P 500

• The S&P is an index that tracks the

performance of 500 different stocks.

• By watching the indexes, we can tell if it is

a Bull or Bear market, and when to invest

or not!

You might also like

- Wall Street Investing and Finance for Beginners: Step by Step Guide to Invest in the Stock Market and Get Passive IncomeFrom EverandWall Street Investing and Finance for Beginners: Step by Step Guide to Invest in the Stock Market and Get Passive IncomeNo ratings yet

- Stock Market BasicsDocument47 pagesStock Market BasicsHimanshu JhambNo ratings yet

- Lesson 3 - Stocks and Its ClassificationDocument40 pagesLesson 3 - Stocks and Its ClassificationJames Adam VecinoNo ratings yet

- Stock Market Investing for Beginners: How to Build Wealth and Achieve Financial Freedom with a Diversified Portfolio Using Index Funds, Technical Analysis, Options, Penny Stocks, Dividends, and REITS.From EverandStock Market Investing for Beginners: How to Build Wealth and Achieve Financial Freedom with a Diversified Portfolio Using Index Funds, Technical Analysis, Options, Penny Stocks, Dividends, and REITS.Rating: 5 out of 5 stars5/5 (54)

- Mid Term Report SOSDocument26 pagesMid Term Report SOSNeils BohrNo ratings yet

- How to Make Money Trading Stocks & Shares: A comprehensive manual for achieving financial success in the marketFrom EverandHow to Make Money Trading Stocks & Shares: A comprehensive manual for achieving financial success in the marketNo ratings yet

- Personal Finance Chapter 14 Part 1: CanadayDocument25 pagesPersonal Finance Chapter 14 Part 1: Canaday陈皮乌鸡No ratings yet

- Index Funds & Stock Market Investing: A Beginner's Guide to Build Wealth with a Diversified Portfolio Using ETFs, Stock Picking, Technical Analysis, Options Trading, Penny Stocks, Dividends, and REITSFrom EverandIndex Funds & Stock Market Investing: A Beginner's Guide to Build Wealth with a Diversified Portfolio Using ETFs, Stock Picking, Technical Analysis, Options Trading, Penny Stocks, Dividends, and REITSRating: 5 out of 5 stars5/5 (43)

- The Financial Health of A Company: Profitability, Quality of Management, Market ShareDocument34 pagesThe Financial Health of A Company: Profitability, Quality of Management, Market ShareDarius IakabosNo ratings yet

- FI - M Lecture 11-The Stock Market - PartialDocument29 pagesFI - M Lecture 11-The Stock Market - PartialMoazzam ShahNo ratings yet

- Investing In Stock Market For Beginners: understanding the basics of how to make money with stocksFrom EverandInvesting In Stock Market For Beginners: understanding the basics of how to make money with stocksRating: 4 out of 5 stars4/5 (13)

- Financial Management StocksDocument17 pagesFinancial Management StocksMelody Christy G. HambreNo ratings yet

- Stock Market Investing For Beginners The Definitive Stock Market Crash Course - From Zero To Hero. (Benjamin, Warren Ray) (Z-Library)Document86 pagesStock Market Investing For Beginners The Definitive Stock Market Crash Course - From Zero To Hero. (Benjamin, Warren Ray) (Z-Library)Aditya GautamNo ratings yet

- Chapter 26 - Saving, Investment, and The Financial SystemDocument66 pagesChapter 26 - Saving, Investment, and The Financial SystemFTU K59 Trần Yến LinhNo ratings yet

- Financial MNGMNT StocksDocument31 pagesFinancial MNGMNT StocksMelody Christy G. HambreNo ratings yet

- Welcome To Stock Market Trading Sharing SessionDocument47 pagesWelcome To Stock Market Trading Sharing SessionOlegario S. Sumaya IIINo ratings yet

- An Over View of Indian Share Market: David Ashirvadam Sharekhan PVT LTDDocument31 pagesAn Over View of Indian Share Market: David Ashirvadam Sharekhan PVT LTDDavid Thambu100% (1)

- Basics of Stock MarketDocument5 pagesBasics of Stock MarketJohn Mark TibusNo ratings yet

- Shareholders' EquityDocument120 pagesShareholders' EquitySsewa AhmedNo ratings yet

- Section 3 - Capital Market ProductsDocument29 pagesSection 3 - Capital Market ProductsABHINAV AGRAWALNo ratings yet

- 4 - Capital Market ProductsDocument40 pages4 - Capital Market ProductsPratik BafnaNo ratings yet

- Topic: Share Market in IndiaDocument31 pagesTopic: Share Market in IndiaParikshit RamjiyaniNo ratings yet

- Stock Market: Presented By:-Krishna Giri Chief Operating Officer Prabhu Capital LimitedDocument130 pagesStock Market: Presented By:-Krishna Giri Chief Operating Officer Prabhu Capital LimitedidkrishnaNo ratings yet

- MAIN PPT Stock Exchange of India - pptmATDocument42 pagesMAIN PPT Stock Exchange of India - pptmATAnkit Jain100% (1)

- Types of Shares and DebenturesDocument6 pagesTypes of Shares and Debentureskirang gandhi100% (7)

- Basics of Stock MarketDocument5 pagesBasics of Stock MarketArun KC0% (1)

- Fmi Lecture 4Document23 pagesFmi Lecture 4shakirNo ratings yet

- Basic - Co - TradeDocument5 pagesBasic - Co - Tradethejasvinay07No ratings yet

- Stockening WarriorDocument48 pagesStockening Warriorroby csNo ratings yet

- Stock Exchange: - InmantecDocument44 pagesStock Exchange: - InmantecmbpmbaNo ratings yet

- FIL Stock MarketDocument16 pagesFIL Stock MarketJRNo ratings yet

- 40 - How To Buy & Sell Shares For ProfitDocument70 pages40 - How To Buy & Sell Shares For ProfitKudzai ManyanyeNo ratings yet

- Invesments: BY: Group 2 MembersDocument13 pagesInvesments: BY: Group 2 MembersAnnisha Seftiani ArifinNo ratings yet

- FIL Stock MarketDocument15 pagesFIL Stock Marketrahulak57No ratings yet

- FIL Stock MarketDocument15 pagesFIL Stock MarketArun VarshneyNo ratings yet

- Basics of Share Market PDFDocument15 pagesBasics of Share Market PDFKallol MaityNo ratings yet

- FIL - Stock Market PDFDocument15 pagesFIL - Stock Market PDFRamJiNo ratings yet

- Stock Market Investment Course - 1Document33 pagesStock Market Investment Course - 1N RajasubaNo ratings yet

- Share Market BasicsDocument15 pagesShare Market BasicsPandu RamNo ratings yet

- How Do Equity Shares Work?: MarketDocument4 pagesHow Do Equity Shares Work?: MarketCarol RodriguesNo ratings yet

- The Stock Market For Dummies PDFDocument2 pagesThe Stock Market For Dummies PDFJoe D100% (1)

- Chapter 3 Investing in StockDocument66 pagesChapter 3 Investing in StockHalisa HassanNo ratings yet

- SAPMDocument41 pagesSAPMR.SenthilNo ratings yet

- Stock Exchange: - InmantecDocument44 pagesStock Exchange: - InmantecKashmir FactsNo ratings yet

- Stock Exchange: - InmantecDocument44 pagesStock Exchange: - InmantecSarita MohantyNo ratings yet

- Stock Exchange: - InmantecDocument44 pagesStock Exchange: - InmantecNoor UddinNo ratings yet

- Stock Exchange: - InmantecDocument44 pagesStock Exchange: - InmantecRahul NarendraNo ratings yet

- Stock Exchange: - InmantecDocument44 pagesStock Exchange: - InmantecAnkit JainNo ratings yet

- Stock Exchange: - InmantecDocument44 pagesStock Exchange: - InmantecsurfboardshaunNo ratings yet

- Stock Exchange: - InmantecDocument44 pagesStock Exchange: - InmantecAmit SatwaniNo ratings yet

- Stock Exchange: - InmantecDocument44 pagesStock Exchange: - InmantecShourabh BhushanNo ratings yet

- Trading Stocks & Options 101-Min 2Document34 pagesTrading Stocks & Options 101-Min 2AjayNo ratings yet

- Stock Exchange: - InmantecDocument44 pagesStock Exchange: - InmantecHardeep SinghNo ratings yet

- Stock Exchange: - InmantecDocument44 pagesStock Exchange: - InmanteceaktaNo ratings yet

- Stock Exchange: - InmantecDocument44 pagesStock Exchange: - InmantecSohrab AshrafiNo ratings yet

- Stock Exchange: - InmantecDocument44 pagesStock Exchange: - InmantecankitmaalikNo ratings yet

- Stock Exchange: - InmantecDocument44 pagesStock Exchange: - InmantecRahul NarendraNo ratings yet

- Stock Exchange: - InmantecDocument44 pagesStock Exchange: - InmantecAkaririnkute MerikameikazukaNo ratings yet

- Nursing Documentation Course 2020Document36 pagesNursing Documentation Course 2020Marianne Laylo100% (1)

- Physical Education 10 WEEK 2Document10 pagesPhysical Education 10 WEEK 2Israel MarquezNo ratings yet

- The Intelligent Investor NotesDocument19 pagesThe Intelligent Investor NotesJack Jacinto100% (6)

- Educational Psychology EDU-202 Spring - 2022 Dr. Fouad Yehya: Fyehya@aust - Edu.lbDocument31 pagesEducational Psychology EDU-202 Spring - 2022 Dr. Fouad Yehya: Fyehya@aust - Edu.lbLayla Al KhatibNo ratings yet

- Description of Medical Specialties Residents With High Levels of Workplace Harassment Psychological Terror in A Reference HospitalDocument16 pagesDescription of Medical Specialties Residents With High Levels of Workplace Harassment Psychological Terror in A Reference HospitalVictor EnriquezNo ratings yet

- CaseDocument2 pagesCaseKimi Walia0% (2)

- Oral Communication in Context Quarter 2: Week 1 Module in Communicative Strategies 1Document10 pagesOral Communication in Context Quarter 2: Week 1 Module in Communicative Strategies 1Agatha Sigrid GonzalesNo ratings yet

- What Is A Business IdeaDocument9 pagesWhat Is A Business IdeaJhay CorpuzNo ratings yet

- Beginner Levels of EnglishDocument4 pagesBeginner Levels of EnglishEduardoDiazNo ratings yet

- TSH TestDocument5 pagesTSH TestdenalynNo ratings yet

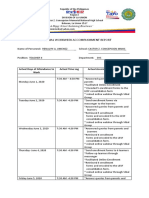

- Individual Workweek Accomplishment ReportDocument16 pagesIndividual Workweek Accomplishment ReportRenalyn Zamora Andadi JimenezNo ratings yet

- Investment Opportunities: Equity MarketsDocument38 pagesInvestment Opportunities: Equity MarketsRanjeet SinghNo ratings yet

- Universal Declaration of Human Rights - United NationsDocument12 pagesUniversal Declaration of Human Rights - United NationsSafdar HussainNo ratings yet

- DR LukeDocument126 pagesDR Lukegabryelbarretto7No ratings yet

- Ponty Maurice (1942,1968) Structure of BehaviorDocument131 pagesPonty Maurice (1942,1968) Structure of BehaviorSnorkel7No ratings yet

- Current MBA GradesDocument2 pagesCurrent MBA GradesDiptarghya KunduNo ratings yet

- Anais Nin - Under A Glass Bell-Pages-29-32 WordDocument6 pagesAnais Nin - Under A Glass Bell-Pages-29-32 WordArmina MNo ratings yet

- Sales Purchases Returns Day BookDocument8 pagesSales Purchases Returns Day BookAung Zaw HtweNo ratings yet

- 50 Life Secrets and Tips - High ExistenceDocument12 pages50 Life Secrets and Tips - High Existencesoapyfish100% (1)

- 21st Century NotesDocument3 pages21st Century NotesCarmen De HittaNo ratings yet

- 87844-Chapter 1. The Psychology of TourismDocument28 pages87844-Chapter 1. The Psychology of TourismVENA LANDERONo ratings yet

- English VowelDocument6 pagesEnglish Vowelqais yasinNo ratings yet

- MIL Q3 Module 5 REVISEDDocument23 pagesMIL Q3 Module 5 REVISEDEustass Kidd68% (19)

- An Objective of Dress Code PolicyDocument4 pagesAn Objective of Dress Code PolicySiddhraj Singh KushwahaNo ratings yet

- Florida Firearm Bill of SaleDocument4 pagesFlorida Firearm Bill of SaleGeemoNo ratings yet

- Management of Breast CancerDocument53 pagesManagement of Breast CancerGaoudam NatarajanNo ratings yet

- Grátis ExamDocument26 pagesGrátis ExamMaurilioNo ratings yet

- The Novel TodayDocument3 pagesThe Novel Todaylennon tanNo ratings yet

- The Saving Cross of The Suffering Christ: Benjamin R. WilsonDocument228 pagesThe Saving Cross of The Suffering Christ: Benjamin R. WilsonTri YaniNo ratings yet

- Low Intermediate Korean Vocabulary and GrammarDocument10 pagesLow Intermediate Korean Vocabulary and GrammarTuong Van Nguyen100% (3)