Professional Documents

Culture Documents

Fundamental and Technical Analysis MOSFL

Uploaded by

Girish Vepoori0 ratings0% found this document useful (0 votes)

12 views9 pagesIn the company analysis, Fundamental and Technical Analysis plays a key role. i took one of the financial service providing company.

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIn the company analysis, Fundamental and Technical Analysis plays a key role. i took one of the financial service providing company.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views9 pagesFundamental and Technical Analysis MOSFL

Uploaded by

Girish VepooriIn the company analysis, Fundamental and Technical Analysis plays a key role. i took one of the financial service providing company.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 9

Fundamental and

Motilal Oswal Financial Services is

engaged in Broking business activity.

Further, through its subsidiaries

Technical

offers a diversified range of financial

products and services such as Loan

Analysis

against shares, Investment activities, By: V. GIRISH

Private wealth management, Asset Roll no 11

management business, Housing Sub: SAPM

finance, Institutional equities, Private

equity and Investment banking.

Company Analysis

Financial Factors Non Financial

Factors

Company has good consistent profit growth

of 32.17% over 5 years Research is the foundation of their business.

Company has been maintaining a healthy Promoters increasing shareholding

dividend payout of 28.01% Company with Zero Promoter Pledge

For last quarter revenue has been decreased FII / FPI or Institutions increasing their

to for 4.38%. shareholding

But company present into losses with Promoters hold 70% of shareholdings & Motilal

68.73cr. Oswal is the Managing Director and CEO

ROE: 7.11 % (MOFSL). He is a Chartered Accountant and

ROCE 11.23% started the business along with co-promoter,

Debt equity is 0.52 Raamdeo Agrawal.

Sales Growth (3Yrs): 31.64 % Promoter holdings is 69.7% as of now but in June

The effect of a buyback is to reduce the it 70.12% that’s why it going to buyback of

number of outstanding shares on the market, shares.

which increases the ownership stake of the

stakeholders. Shares 23,07,692 worth of INR

150,cr

Industry Analysis

Credit , insurance & investment

penetration is rising in rural area.

Moreover, the wealth management

segment has witnessed growing HNWI

participation.

India benefits from a large cross-

utilization of channels to expand reach of

financial services.

Rising incomes are driving the demand

for financial services across income

brackets but in situation it has been

decreased.

• Now India is 3.2 trillion

economy. while it has a 4.2% Economic

Analysis

of growth rate.

• Inflation rate compared to

previous year is 3.34%.+ve

• Because of this pandemic

situation most of the

domestic

savings are low.-ve

• India's trade deficit narrowed

to USD 6.76 billion in April

2020

• India's foreign reserves are

comfortably placed at $

461.2 billion as on

10/01/2020.

• foreign exchange

(Forex) reserves stand at

around US$ 501.703 billion

on 05th June 2020, the

highest ever.

SMA

Technical Analysis

If we observe

the line, its in

upward trend

ended with

546.9 which

is less than

opening price.

Actually it is

a positive

correlation

RSI

This is a powerful

indicator that signal

buying and selling.

Follows 70 30 rule

present RSI is 67.13

better to hold and observe

the market because its

near to overbought

Bollinger bands

Middle band

looking towards up

trend i.e. it seems to

be the stock has

been over bought so

the investor would

Sell those stock in

his portfolio.

MACD Line intersects above

line buy. If it is Below

the line it indicates

sell

In march the price has

been in down trend

due to pandemic

situation. But in June

trend is on Above the

line so buy stock.

You might also like

- Financial Distress: Group 5 ACT 4611 Seminar in AccountingsDocument38 pagesFinancial Distress: Group 5 ACT 4611 Seminar in AccountingsPj SornNo ratings yet

- Reliance Capital - Initiating Coverage - Centrum 06122012Document19 pagesReliance Capital - Initiating Coverage - Centrum 06122012nit111No ratings yet

- Treasury ManagementDocument40 pagesTreasury ManagementNiraj DesaiNo ratings yet

- DIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)From EverandDIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)No ratings yet

- Banking Terms and DefinitionsDocument36 pagesBanking Terms and DefinitionsARULSHANMUGAVEL S VNo ratings yet

- WORKING CAP MGMT AND FIN STATEMNTS ANALYSIS PDF 8708Document12 pagesWORKING CAP MGMT AND FIN STATEMNTS ANALYSIS PDF 8708lena cpa0% (1)

- Financial Statement AnalysisDocument62 pagesFinancial Statement AnalysisRajesh Lenka0% (1)

- AutoZone S Stock PDFDocument3 pagesAutoZone S Stock PDFGeorgina AlpertNo ratings yet

- June 2019 Investor LetterDocument7 pagesJune 2019 Investor LetterMohit AgarwalNo ratings yet

- Strategic Analysis of SBIMFDocument19 pagesStrategic Analysis of SBIMF26amitNo ratings yet

- VIB - Section2 - Group5 - Final Project - ReportDocument13 pagesVIB - Section2 - Group5 - Final Project - ReportShrishti GoyalNo ratings yet

- Epaperpdf 23052011 22main Edition-Pg13-0Document1 pageEpaperpdf 23052011 22main Edition-Pg13-0anon_534957202No ratings yet

- NewsDocument7 pagesNewsJignesh Jagjivanbhai PatelNo ratings yet

- Stock Market AnalysisDocument9 pagesStock Market AnalysisAvinash BabuNo ratings yet

- Year of Sip PresentationDocument16 pagesYear of Sip PresentationarchitNo ratings yet

- Oneliners P6Document8 pagesOneliners P6Nirvana BoyNo ratings yet

- ICICIdirect MonthlyMFReportDocument12 pagesICICIdirect MonthlyMFReportSagar KulkarniNo ratings yet

- Market Highlights PDFDocument8 pagesMarket Highlights PDFPranati BhattacharjeeNo ratings yet

- Empower June 2012Document68 pagesEmpower June 2012pravin963No ratings yet

- A Detailed Research Report On Motilal Oswal Financial Services LTDDocument19 pagesA Detailed Research Report On Motilal Oswal Financial Services LTDKushagra KejriwalNo ratings yet

- Advisorkhoj HSBC Mutual Fund ArticleDocument9 pagesAdvisorkhoj HSBC Mutual Fund ArticleJitender ChaudharyNo ratings yet

- BNP Paribas Mid Cap Fund: Young Spark Today. Grandmaster TomorrowDocument2 pagesBNP Paribas Mid Cap Fund: Young Spark Today. Grandmaster TomorrowPrasad Dhondiram Zinjurde PatilNo ratings yet

- Oneliners P1Document4 pagesOneliners P1Nirvana BoyNo ratings yet

- V GM PJD Dzi Fog 1602141681524Document8 pagesV GM PJD Dzi Fog 1602141681524Shilpi KumariNo ratings yet

- Portfolio Management (Component 4)Document12 pagesPortfolio Management (Component 4)Himanshu PandeyNo ratings yet

- Solidarity Is It Different This Time 19 Sep 2023Document5 pagesSolidarity Is It Different This Time 19 Sep 2023nuthan.10986No ratings yet

- GSEC BOND-A Turnaround May Be Around The Corner, Market Stats Show - The Economic TimesDocument1 pageGSEC BOND-A Turnaround May Be Around The Corner, Market Stats Show - The Economic TimessudhakarrrrrrNo ratings yet

- Empower July 2011Document74 pagesEmpower July 2011Priyanka AroraNo ratings yet

- Birla Sun Life Tax Relief 96Document5 pagesBirla Sun Life Tax Relief 96MANAV YADAVNo ratings yet

- Capital Letter November 2013Document6 pagesCapital Letter November 2013marketingNo ratings yet

- India - A Land of Many (Re) Turns: EquitiesDocument2 pagesIndia - A Land of Many (Re) Turns: EquitiesSaad AliNo ratings yet

- Indian Financial System-2Document5 pagesIndian Financial System-2Shreya MukherjeeNo ratings yet

- PMAS-Arid Agriculture University, Rawalpindi.: (Department of Management Sciences)Document7 pagesPMAS-Arid Agriculture University, Rawalpindi.: (Department of Management Sciences)muhammad farhanNo ratings yet

- Fixed Income: Market OutlookDocument4 pagesFixed Income: Market OutlookAnkitNo ratings yet

- Shoppers' Stop LTD.: TEAM ID - 2301Document25 pagesShoppers' Stop LTD.: TEAM ID - 2301jdsugunaNo ratings yet

- 036 Sbi Contra FundDocument19 pages036 Sbi Contra Fundashwini shuklaNo ratings yet

- HDFC - MangementMeetUpdate ICICI Feb 2012Document4 pagesHDFC - MangementMeetUpdate ICICI Feb 2012sankap11No ratings yet

- Analysis of Sbi ResultsDocument8 pagesAnalysis of Sbi ResultssrinaathmNo ratings yet

- Perspective of MF in IndiaDocument5 pagesPerspective of MF in Indiaranbirk82No ratings yet

- July 2019 NewsletterDocument6 pagesJuly 2019 NewsletterRaghav BehaniNo ratings yet

- Motilal Oswal Finance Services IPO Note Aug 07 EDELDocument17 pagesMotilal Oswal Finance Services IPO Note Aug 07 EDELKunal Maheshwari100% (1)

- Background of The Investor: Ketki Prabhat Roll No:44Document4 pagesBackground of The Investor: Ketki Prabhat Roll No:44Santosh KardakNo ratings yet

- Chapter - Iv Theoritical Framework On Equity SharesDocument16 pagesChapter - Iv Theoritical Framework On Equity ShareskhayyumNo ratings yet

- Marketing Brochure TradePlus S&P New China Tracker - July 2019 (English)Document14 pagesMarketing Brochure TradePlus S&P New China Tracker - July 2019 (English)Alyssa AnnNo ratings yet

- 103 Sbi Blue Chip FundDocument21 pages103 Sbi Blue Chip FundsagarNo ratings yet

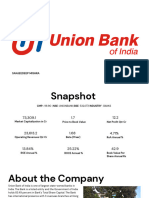

- Union BankDocument30 pagesUnion BankSanjeedeep Mishra , 315No ratings yet

- Do We Currently Reside in The Accumulation PhaseDocument4 pagesDo We Currently Reside in The Accumulation PhaseBinod DhunganaNo ratings yet

- Portfolio Management ProjectDocument7 pagesPortfolio Management ProjectDeepti MhatreNo ratings yet

- Acumen - RBI Monetary Policy Review - December 2019Document4 pagesAcumen - RBI Monetary Policy Review - December 2019mfsrajNo ratings yet

- Project ProposalDocument11 pagesProject Proposalvedang bhasinNo ratings yet

- Equity OutlookDocument1 pageEquity OutlooksieausNo ratings yet

- JainMatrix Investments Bajaj Finance Jan2012Document6 pagesJainMatrix Investments Bajaj Finance Jan2012Punit JainNo ratings yet

- 2010 Q4 Equity OutlookDocument8 pages2010 Q4 Equity Outlookglerner133926No ratings yet

- Piper Serica Monthly Portfolio NoteDocument2 pagesPiper Serica Monthly Portfolio NoteShankey VarmaNo ratings yet

- Aditya Birla Capital: Equentis Scale 1 2 3 4 5 Below Avg. Avg. Good Very Good ExcellentDocument2 pagesAditya Birla Capital: Equentis Scale 1 2 3 4 5 Below Avg. Avg. Good Very Good Excellentsayuj83No ratings yet

- Retail Investors Are The New Stars in India's $479B Mutual Fund ShowDocument24 pagesRetail Investors Are The New Stars in India's $479B Mutual Fund ShowVaibhav MittalNo ratings yet

- Mutual Fund Review: Equity MarketDocument11 pagesMutual Fund Review: Equity MarketNadim ReghiwaleNo ratings yet

- Definition of Mutual FundDocument12 pagesDefinition of Mutual FundArnab GangopadhyayNo ratings yet

- DLF Expansion Was A Boon, The Size Now A Bane: Quarterly SalesDocument2 pagesDLF Expansion Was A Boon, The Size Now A Bane: Quarterly SalesSubham MazumdarNo ratings yet

- 6 Lessons: Markets in 2018Document15 pages6 Lessons: Markets in 2018devdliveNo ratings yet

- HSL - Invest Right - March 2020 - New - 1-202003171449089436761Document14 pagesHSL - Invest Right - March 2020 - New - 1-202003171449089436761faizahamed111No ratings yet

- Finity e Book Revised Recovered 1Document15 pagesFinity e Book Revised Recovered 1investorNo ratings yet

- Bajaj Finance Plans To Raise $1.2 Billion - The Economic TimesDocument2 pagesBajaj Finance Plans To Raise $1.2 Billion - The Economic TimeslalitNo ratings yet

- Knowledge Initiative - July 2014Document10 pagesKnowledge Initiative - July 2014Gursimran SinghNo ratings yet

- Bba Unit IvDocument31 pagesBba Unit IvShubham PrasadNo ratings yet

- Accounts AssignmentDocument22 pagesAccounts AssignmentRaheel IqbalNo ratings yet

- CH 5Document11 pagesCH 5yebegashetNo ratings yet

- Epec Eurostat Statistical GuideDocument156 pagesEpec Eurostat Statistical Guidegabryela.518No ratings yet

- Reinforcement Activity 2 Part BDocument21 pagesReinforcement Activity 2 Part BmattbtaitNo ratings yet

- Chapter 15 Questions V1Document6 pagesChapter 15 Questions V1coffeedanceNo ratings yet

- Module 14 EquityDocument17 pagesModule 14 EquityZyril RamosNo ratings yet

- Answer BookDocument6 pagesAnswer BookMuneebah HajatNo ratings yet

- Business CombinationDocument40 pagesBusiness Combinationjulia4razoNo ratings yet

- Cor Acc Unit 01Document19 pagesCor Acc Unit 01vignesh iyerNo ratings yet

- Corpuz, Aily F-Fm2-2-Midterm Practice ProblemDocument5 pagesCorpuz, Aily F-Fm2-2-Midterm Practice ProblemAily CorpuzNo ratings yet

- Jadwa Investment Annual Report 2007 - EnglishDocument22 pagesJadwa Investment Annual Report 2007 - Englishanwar187No ratings yet

- Uds Business Plan Presentation FinalDocument21 pagesUds Business Plan Presentation FinalAdams Yussif KwajaNo ratings yet

- A Summer Internship ReportDocument55 pagesA Summer Internship ReportShyam C A100% (1)

- Co-Op Financial Statement: Understanding ADocument8 pagesCo-Op Financial Statement: Understanding ARJ Randy JuanezaNo ratings yet

- Project Brief - Ice Cream Making Iligan Sorbetes Producers CoopDocument12 pagesProject Brief - Ice Cream Making Iligan Sorbetes Producers CoopMuneer HinayNo ratings yet

- List of Ratio Analysis Formulas and ExplanationsDocument18 pagesList of Ratio Analysis Formulas and ExplanationsCharish Jane Antonio CarreonNo ratings yet

- FM Question BookletDocument66 pagesFM Question Bookletdeepu deepuNo ratings yet

- CFAS - Statement of Changes in Equity and Notes To FS - Quiz 4 - SY2019 2020Document19 pagesCFAS - Statement of Changes in Equity and Notes To FS - Quiz 4 - SY2019 2020Ivy RosalesNo ratings yet

- 2024 Acc GR 12 T1 Revision Activity Book ENGDocument21 pages2024 Acc GR 12 T1 Revision Activity Book ENGsisikelelwen05No ratings yet

- Advacc Chapter 13& 14Document80 pagesAdvacc Chapter 13& 14ZEEKIRANo ratings yet

- Bsa SM 1 1 Set ADocument10 pagesBsa SM 1 1 Set ARicaRhayaMangahasNo ratings yet

- Bermejo, Hannah Jean - FM 315 - Activity 1,2,3Document3 pagesBermejo, Hannah Jean - FM 315 - Activity 1,2,3Shiella Mae DesalesNo ratings yet

- Matching Assets-Liabilities ExercisesDocument3 pagesMatching Assets-Liabilities ExercisesWill KaneNo ratings yet

- Adoption of Accounting On Small Scale Businesses 2Document29 pagesAdoption of Accounting On Small Scale Businesses 2In studio ExquisiteNo ratings yet

- Advanced Financial Accounting-Part 2Document4 pagesAdvanced Financial Accounting-Part 2gundapola83% (6)