Professional Documents

Culture Documents

Presentation On Business Mathematics Difference Between Simple and Compound Interest

Uploaded by

Yash Soni0 ratings0% found this document useful (0 votes)

6 views7 pagesFgddfokbvcdf. Cfghjjvvccgjhgcc. Hj

Original Title

maths

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFgddfokbvcdf. Cfghjjvvccgjhgcc. Hj

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views7 pagesPresentation On Business Mathematics Difference Between Simple and Compound Interest

Uploaded by

Yash SoniFgddfokbvcdf. Cfghjjvvccgjhgcc. Hj

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 7

JAIPUR NATIONAL

UNIVERSITY

PRESENTATION ON BUSINESS MATHEMATICS

Difference between simple and compound interest

Submitted to- Submitted by-

Mr. Dhruv sir Yash soni

BBA-1-A

INTEREST-

Interest is payment from a borrower or deposit-

taking financial institution to a lender or depositor of

an amount above repayment of the principal sum

(i.e. the amount borrowed). It is distinct from a fee

which the borrower may pay the lender or some

third party.

SIMPLE INTEREST-

Simple interest is a quick method of calculating

the interest charge on a loan. Simple interest is

determined by multiplying the daily interest rate by

the principal by the number of days that elapse

between payments.

COMPOUND INTEREST

Compound interest is the addition ofinterest to the

principal sum of a loan or deposit, or in other

words, intereston interest. It is the result of

reinvesting interest, rather than paying it out, so

that interest in the next period is then earned on the

principal sum plus previously-accumulatedinterest.

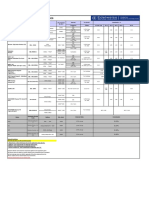

DIFFERENCE

The interest is typically expressed as a

percentage and can be

either simple or compounded. Simple interest is

only based on the principal amount of a loan,

while compound interest is based on the

principal amount and the accumulatedinterest.

BASIS FOR COMPARISON SIMPLE INTEREST COMPOUND INTEREST

Simple Interest refers to an Compound Interest refers to an

interest that is calculated as a interest which is calculated as a

Meaning percentage of the principal percentage of principal and

amount. accrued interest.

Return Less Comparatively high

Principal Constant Goes on changing during the

entire borrowing period.

Growth Remains uniform Increases rapidly

Interest charged on Principal Principal + Accumulated Interest

Formula Simple Interest = P*r*n Compound Interest = P*(1 + r)^nk

THANK YOU

You might also like

- Indian Financial SystemDocument7 pagesIndian Financial SystemYash SoniNo ratings yet

- Travel by Jaitik Group: Sedan TaxiDocument2 pagesTravel by Jaitik Group: Sedan TaxiYash SoniNo ratings yet

- Directory of Its Officers and Employees As of 31-03-2019Document5,163 pagesDirectory of Its Officers and Employees As of 31-03-2019Yash SoniNo ratings yet

- THINK INDIA (Quarterly Journal) : A Study of Consumer Loyalty Towards Fitness Centers in Jaipur CityDocument22 pagesTHINK INDIA (Quarterly Journal) : A Study of Consumer Loyalty Towards Fitness Centers in Jaipur CityYash Soni100% (1)

- Kinds of FireworksDocument13 pagesKinds of FireworksYash SoniNo ratings yet

- Pizza Center: Mobile - 8233332666Document2 pagesPizza Center: Mobile - 8233332666Yash SoniNo ratings yet

- ZP Eligibility CalculatorDocument11 pagesZP Eligibility CalculatorYash SoniNo ratings yet

- Allowed List Not Allowed List: Minimum Education QualificationDocument2 pagesAllowed List Not Allowed List: Minimum Education QualificationYash SoniNo ratings yet

- Travel by Jaitik Group: TR IPDocument7 pagesTravel by Jaitik Group: TR IPYash SoniNo ratings yet

- FD & Bond Brokerage July 20Document1 pageFD & Bond Brokerage July 20Yash SoniNo ratings yet

- Phone Directory RVUNL 2020-21Document118 pagesPhone Directory RVUNL 2020-21Yash SoniNo ratings yet

- Steps To Achieving Work-Life BalanceDocument18 pagesSteps To Achieving Work-Life BalanceYash Soni100% (2)

- How To Make Payment - SGB Series XII: Direct ModeDocument3 pagesHow To Make Payment - SGB Series XII: Direct ModeYash SoniNo ratings yet

- Jaipur PPN List of HospitalsDocument7 pagesJaipur PPN List of HospitalsYash SoniNo ratings yet

- SGB - Product Note With PriceDocument9 pagesSGB - Product Note With PriceYash SoniNo ratings yet

- Jaipur Circle & BranchesDocument174 pagesJaipur Circle & BranchesYash SoniNo ratings yet

- Delhi List of Doctors-2020Document5 pagesDelhi List of Doctors-2020Yash Soni67% (6)

- RCDF Detailed AdvertisementDocument84 pagesRCDF Detailed AdvertisementYash SoniNo ratings yet

- Cosmetics Manufacturing Units in RajasthanDocument11 pagesCosmetics Manufacturing Units in RajasthanYash Soni100% (1)

- Architects in JaipurDocument10 pagesArchitects in JaipurYash Soni100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)