Professional Documents

Culture Documents

Management and Cost Accounting: Colin Drury

Management and Cost Accounting: Colin Drury

Uploaded by

Yasmine MagdiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Management and Cost Accounting: Colin Drury

Management and Cost Accounting: Colin Drury

Uploaded by

Yasmine MagdiCopyright:

Available Formats

MANAGEMENT

AND COST

ACCOUNTING

SIXTH EDITION

COLIN DRURY

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

Part Two:

Cost accumulation for

inventory valuation and profit measurement

Chapter Five:

Process costing

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

5.1

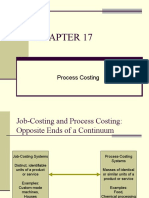

PROCESS COSTING

1. Job costing assigns costs to each individual unit of output because

each unit consumes different quantities of resources.

2. Process costing does not assign costs to each unit of output because

each unit is identical.Instead, average unit costs are computed.

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

5.2a

A comparison of job & process costing

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

5.2b

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

5.3a

Normal and abnormal losses

• Normal losses cannot be avoided –Cost is absorbed by good

production.

• Abnormal losses are avoidable –Cost is recorded separately

and treated as a period cost.

Example

Input = 1 200 litres at a cost of £1 200

Normal loss = 1/6 of input

Actual output = 900 litres

CPU = £1 200/Expected output (1 000 litres) = 1.20

Cost of completed

production = £1 080 (900 ×£1.20)

Cost of abnormal loss = £120 (100 × £1.20)

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

5.3b

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

5.4a

Sale proceeds from normal losses

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

5.4b

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

5.5a

Sale proceeds (normal and abnormal losses)

Example 2

As example 1 but output = 900 litres (abnormal loss = 100 litres)

CPU as example 1 = £1.10 per litre

The sales value of the abnormal loss should be offset against the

cost of the abnormal loss.

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

5.5b

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

5.5c

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

5.6a

Abnormal gains

Example

Input = 1 200 litres at a cost of £1 200

Output = 1 100 litres

Normal loss = 1/6 of input

Scrap value = £0.50 per litre

CPU = Cost of production less scrap value of normal loss

Expected output

= £1 100 /1 000 = £1.10 per litre

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

5.6b

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

5.6c

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

5.7a

Equivalent production & closing WIP

Partly completed units are expressed as fully completed equivalent

units in order to compute CPU (e.g. 1000 units 50% complete equls

500 equivalent production.

Example

Opening WIP Nil

Units introduced into the process 14 000

Units completed and trasferred to next process 10 000

Closing WIP (50% complete) 4 000

Materials cost (introduced at start) £70 000

Conversion cost £48 000

Note that materials are 100% complete.

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

5.7b

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

5.7b

Equivalent production and closing WIP

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

5.9a

Previous process cost

Costs transferred from a previous process are treated as a separate element of cost

(100% complete)

Example

Opening WIP Nil

Units transferred 10 000

Closing WIP *50% complete) 1 000

Completed units transferred to finished goods stock 9 000

Previous process cost £90 000

Conversion costs £57 000

Materials (introduced at end of process) £36 000

Note materials are zero complete and previous process cost 100% complete.

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

5.9b

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

5.10

Previous process cost

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

5.11

Example to illustrate weighted average and FIFO

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

5.12 and 5.13

Opening WIP-weighted average method

Use Overheads 5.12 & 5.13 as transparencies

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

5.14a

Opening WIP – FIFO method

The FIFO method assumes opening WIP is the first group of units to be completed.

Therefore, opening WIP is charged separately to completed production and CPU is

based on current period costs.

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

5.14b

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

5.15a

Opening WIP – FIFO method

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

5.15b

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

5.16

Losses in process and equivalent productions

Use Overhead 5.16 as transparency

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Management and Cost Accounting Chapter 3Document28 pagesManagement and Cost Accounting Chapter 3Muhammad SohailNo ratings yet

- Solow ModelDocument5 pagesSolow ModelChumba MusekeNo ratings yet

- ST76/96 Series InstructionsDocument22 pagesST76/96 Series Instructionsalguifarro0% (2)

- Cost and Management Accounting Chapter 06Document10 pagesCost and Management Accounting Chapter 06Muhammad SohailNo ratings yet

- Management and Cost Accounting Chapter 4Document24 pagesManagement and Cost Accounting Chapter 4Muhammad SohailNo ratings yet

- Ahmad 2013Document44 pagesAhmad 2013Muhammad SohailNo ratings yet

- 13 Macroeconomic Analysis of India's Inclusive Growth - Sunil Bhardwaj - GM012Document9 pages13 Macroeconomic Analysis of India's Inclusive Growth - Sunil Bhardwaj - GM012Muhammad Sohail100% (1)

- The Lucas Asset Pricing Model: 1 Introduction/SetupDocument9 pagesThe Lucas Asset Pricing Model: 1 Introduction/SetupnencydhamejaNo ratings yet

- Business Studies Chapter 17 NotesDocument4 pagesBusiness Studies Chapter 17 NotesMuhammad Faizan Raza0% (1)

- Manufacturing Processes (Sme 2713) : Rozaimi Mohd SaadDocument34 pagesManufacturing Processes (Sme 2713) : Rozaimi Mohd SaadMuhammad HaziqNo ratings yet

- Macro Problem Set 5Document3 pagesMacro Problem Set 5ChangeBunnyNo ratings yet

- CHAPTER 1 Itroduction To Operations ManagementDocument35 pagesCHAPTER 1 Itroduction To Operations Managementmohammed mohammedNo ratings yet

- Horticulture at A Glance 2017 For Net Uplod - Page 46Document514 pagesHorticulture at A Glance 2017 For Net Uplod - Page 46Raghavendra GunnaiahNo ratings yet

- Circular Flow of Income, Expenditure and Output - A Level Economics B Edexcel Revision - Study RocketDocument4 pagesCircular Flow of Income, Expenditure and Output - A Level Economics B Edexcel Revision - Study RocketdhaiwatNo ratings yet

- Chapter 10-Standard Costing: A Managerial Control Tool: True/FalseDocument66 pagesChapter 10-Standard Costing: A Managerial Control Tool: True/FalseClarisse AlimotNo ratings yet

- SROI Methodology. An IntroductionDocument14 pagesSROI Methodology. An IntroductionDiagram_ConsultoresNo ratings yet

- Isoquants and IsocostsDocument28 pagesIsoquants and IsocostsCrystal Caralagh D'souzaNo ratings yet

- Working Capital RequirementDocument20 pagesWorking Capital RequirementKrishnakant Mishra100% (1)

- Acceleration Theory & Business Cycles: Sem Ii - MebeDocument14 pagesAcceleration Theory & Business Cycles: Sem Ii - MebePrabhmeet SethiNo ratings yet

- BUS 5110 Unit Written Assignment DONEDocument5 pagesBUS 5110 Unit Written Assignment DONESimran PannuNo ratings yet

- Cost Accounting SEM 5 (Sample Question Paper)Document10 pagesCost Accounting SEM 5 (Sample Question Paper)rohit bhoirNo ratings yet

- 3rd Week QuizDocument10 pages3rd Week QuizmEOW SNo ratings yet

- PROCESSDocument16 pagesPROCESSAsmita RangariNo ratings yet

- Snob Effect: - Negative Network Externality in Which A Consumer Wishes To Own An Exclusive or Unique GoodDocument24 pagesSnob Effect: - Negative Network Externality in Which A Consumer Wishes To Own An Exclusive or Unique GoodSanyam JainNo ratings yet

- Micro Economics IntroductionDocument9 pagesMicro Economics IntroductionMemo sapiensNo ratings yet

- CH 17Document15 pagesCH 17emmyindraNo ratings yet

- Econ201 - Lecture Notes - Production and CostDocument5 pagesEcon201 - Lecture Notes - Production and CostDoreen Platon EstalarNo ratings yet

- ChapterIII Theory of Production and Cost.Document25 pagesChapterIII Theory of Production and Cost.VirencarpediemNo ratings yet

- Finance Heads Meeting 2010Document22 pagesFinance Heads Meeting 2010doc_rose4709No ratings yet

- Problems - Module#1Document14 pagesProblems - Module#1Abdallah ClNo ratings yet

- Overhead Cost Variances: Unit 3 SectionDocument8 pagesOverhead Cost Variances: Unit 3 SectionBabamu Kalmoni JaatoNo ratings yet

- Ec311 - The Dd-Aa ModelDocument21 pagesEc311 - The Dd-Aa ModelVicky KhanNo ratings yet

- Chapter 10 Testbank Used For Online QuizzesDocument57 pagesChapter 10 Testbank Used For Online QuizzesTrinh Lê100% (1)

- Class Ec DevelopmentDocument109 pagesClass Ec DevelopmentJacques MUnyemanaNo ratings yet

- OMBC 104 Managerial EconomicsDocument22 pagesOMBC 104 Managerial EconomicsCelsozeca2011100% (1)