Professional Documents

Culture Documents

L 7 (B)

Uploaded by

Aanya Chauhan0 ratings0% found this document useful (0 votes)

7 views3 pagesOriginal Title

L-7(B)

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views3 pagesL 7 (B)

Uploaded by

Aanya ChauhanCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 3

ECONOMIC LEGISLATION

1. Monetary policy cannot do anything about inflation

because food inflation is not under monetary policy

control.

2. In general, India’s inflation problems are deemed to

arise from supply constraints, so there is no need for the

central bank to tighten policy at all.

3. India’s fiscal deficit does not matter because the Indian

government borrows from Indians.

4. Indian banks do not have to worry about non-

performing assets because they have more than 20% in

government securities.

ECONOMIC LEGISLATION

5. India should have lower interest rates all the time because it

would boost investment and alleviate supply constraints.

6. Indian real estate prices can keep rising and will never come

down because India has demand all the time. Considerations like

affordability ratios do not apply to India and because property

prices should always be going higher, do not raise interest rates.

7. In India, higher interest rates will mean wider fiscal deficit

because the government’s interest rate burden would rise,

because the government will never reduce its market borrowing.

Therefore, do not raise interest rates.

8. India can have a combination of lower interest rates, high

inflation and cheap currency because India is unique.

ECONOMIC LEGISLATION

10. Savings rates stagnation does not matter for India’s growth because

India is India. Therefore, there is no need to raise interest rates.

11. India can simultaneously engage in loose monetary and fiscal policy

and the Indian currency would remain unaffected. Foreign direct

investment will keep pouring in because the world has no option but

to invest in India. Therefore, no need to raise interest rates.

12. Notwithstanding anything said above, we also believe that India is a

middle-income country and it is the world’s fastest growing large

economy.

13. We are Indians and we are different and hence we can

simultaneously believe in all of these without any fear of contradiction

or consistency of logic.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Moot Court MemoDocument24 pagesMoot Court MemoAanya Chauhan60% (5)

- Contract Moot Problem 1st YearDocument1 pageContract Moot Problem 1st YearAanya ChauhanNo ratings yet

- Moot Court Memo For PlaintiffDocument12 pagesMoot Court Memo For PlaintiffAanya Chauhan100% (5)

- DemocracyDocument17 pagesDemocracyAanya ChauhanNo ratings yet

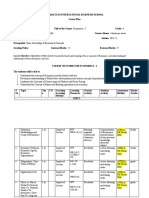

- Course Plan Eco-I BALLB Sem IIIDocument10 pagesCourse Plan Eco-I BALLB Sem IIIAanya ChauhanNo ratings yet

- L-5 (A) ECO - 1Document20 pagesL-5 (A) ECO - 1Aanya ChauhanNo ratings yet

- L-2 (A) Eco-IDocument31 pagesL-2 (A) Eco-IAanya ChauhanNo ratings yet