Professional Documents

Culture Documents

Tax Report Sea Land

Uploaded by

ken0 ratings0% found this document useful (0 votes)

6 views5 pagesCopyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views5 pagesTax Report Sea Land

Uploaded by

kenCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 5

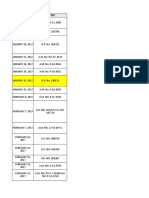

G.R. No.

122605 April 30, 2001

SEA-LAND SERVICE, INC., petitioner,

vs.

COURT OF APPEALS and COMMISSIONER OF

INTERNAL REVENUE, respondents.

Facts:

Sea-Land Service Incorporated (SEA-LAND), an American international shipping

company licensed by the Securities and Exchange Commission to do business in the

Philippines entered into a contract with the United States Government to transport military

household goods and effects of U.S. military personnel assigned to the Subic Naval Base.

From the aforesaid contract, SEA-LAND derived an income for the taxable year 1984

amounting to P58,006,207.54. During the taxable year in question, SEA-LAND filed with

the Bureau of Internal Revenue (BIR) the corresponding corporate Income Tax Return

(ITR) and paid the income tax due thereon of 1.5% as required in Section 25 (a)(2) of the

National Internal Revenue Code (NIRC) in relation to Article 9 of the RP-US Tax Treaty,

amounting to P870,093.12.

Claiming that it paid the aforementioned income tax by mistake, a written claim for

refund was filed with the BIR on 15 April 1987. However, before the said claim for refund

could be acted upon by public respondent Commissioner of Internal Revenue, petitioner-

appellant filed a petition for review with the CTA docketed as CTA Case No. 4149, to

judicially pursue its claim for refund and to stop the running of the two-year prescriptive

period under the then Section 243 of the NIRC.

Issue:

Whether or not the income that petitioner derived from services in transporting the

household goods and effects of U.S. military personnel falls within the tax exemption

provided in Article XII, paragraph 4 of the RP-US Military Bases Agreement.

Ruling:

Under Article XII (4) of the RP-US Military Bases Agreement, the Philippine

Government agreed to exempt from payment of Philippine income tax nationals of

the United States, or corporations organized under the laws of the United States,

residents in the United States in respect of any profit derived under a contract made

in the United States with the Government of the United States in connection with the

construction, maintenance, operation and defense of the bases.

It is obvious that the transport or shipment of household goods and effects of U.S.

military personnel is not included in the term "construction, maintenance, operation

and defense of the bases." Neither could the performance of this service to the U.S.

government be interpreted as directly related to the defense and security of the

Philippine territories. "When the law speaks in clear and categorical language, there

is no reason for interpretation or construction, but only for application."9 Any

interpretation that would give it an expansive construction to encompass petitioner’s

exemption from taxation would be unwarranted.

The avowed purpose of tax exemption “is some public benefit or interest, which

the lawmaking body considers sufficient to offset the monetary loss entailed in the

grant of the exemption.” The hauling or transport of household goods and personal

effects of U. S. military personnel would not directly contribute to the defense and

security of the Philippines.

You might also like

- The Present State of the British Interest in India: With a Plan for Establishing a Regular System of Government in That CountryFrom EverandThe Present State of the British Interest in India: With a Plan for Establishing a Regular System of Government in That CountryNo ratings yet

- Sea-Land Services, Inc. v. CADocument1 pageSea-Land Services, Inc. v. CAJ. LapidNo ratings yet

- Juris Against The Taxpayer and Liberally in Favor of The Taxing Power. Taxation IsDocument2 pagesJuris Against The Taxpayer and Liberally in Favor of The Taxing Power. Taxation Isbrian jay hernandezNo ratings yet

- Sea-Land Services, Inc. vs. Court of Appeals (April 30, 2001)Document5 pagesSea-Land Services, Inc. vs. Court of Appeals (April 30, 2001)Che Poblete CardenasNo ratings yet

- Sea-Land Service v. CA 357 SCRA 441Document2 pagesSea-Land Service v. CA 357 SCRA 441Kyle DionisioNo ratings yet

- Sea-Land Service v. CA 357 SCRA 441Document2 pagesSea-Land Service v. CA 357 SCRA 441Kyle DionisioNo ratings yet

- Petitioner Vs Vs Respondents: First DivisionDocument3 pagesPetitioner Vs Vs Respondents: First DivisionAnton TensuanNo ratings yet

- William Reagan v. Commissioner of Internal RevenueDocument1 pageWilliam Reagan v. Commissioner of Internal RevenueAleigh EsmileNo ratings yet

- Reagan vs. CIRDocument2 pagesReagan vs. CIRElle Alorra RubenfieldNo ratings yet

- 02 142056-1969-Reagan v. Commissioner of Internal Revenue20180922-5466-Xjqae2Document8 pages02 142056-1969-Reagan v. Commissioner of Internal Revenue20180922-5466-Xjqae2aspiringlawyer1234No ratings yet

- KIENERDocument14 pagesKIENERKIM KARBBY ROXASNo ratings yet

- 4) Reagan vs. Commissioner of Internal RevenueDocument10 pages4) Reagan vs. Commissioner of Internal RevenueElsha DamoloNo ratings yet

- 017-CIR v. Tokyo Co., LTD., Et. Al., 244 SCRA 33Document4 pages017-CIR v. Tokyo Co., LTD., Et. Al., 244 SCRA 33Jopan SJNo ratings yet

- CIR Vs BOAC-Collector Vs LaraDocument6 pagesCIR Vs BOAC-Collector Vs LaraEmmanuel OrtegaNo ratings yet

- Cases Taxation2Document70 pagesCases Taxation2SheilaPoncePerezNo ratings yet

- 1.2 Reagan vs. CIRDocument1 page1.2 Reagan vs. CIRCassandra MagabilinNo ratings yet

- Reagan v. CIRDocument8 pagesReagan v. CIRDomski Fatima CandolitaNo ratings yet

- Republic V GonzalesDocument2 pagesRepublic V GonzalesSocNo ratings yet

- 4 Reagan v. Commissioner of Internal Revenue - Digested CaseDocument2 pages4 Reagan v. Commissioner of Internal Revenue - Digested CaseEmmanuel Burcer100% (3)

- Consti 1.sovereignty CdsDocument14 pagesConsti 1.sovereignty CdsApple Ke-eNo ratings yet

- Reagan vs. Commissioner of Internal RevenueDocument2 pagesReagan vs. Commissioner of Internal RevenueAngelica Joyce BelenNo ratings yet

- National Development Company V CIR (1987)Document2 pagesNational Development Company V CIR (1987)BernadetteGaleraNo ratings yet

- G.R. No. L-26379 December 27, 1969 WILLIAM C. REAGAN, ETC., Petitioner, vs. Commissioner of Internal Revenue, Respondent. Fernando, J.Document5 pagesG.R. No. L-26379 December 27, 1969 WILLIAM C. REAGAN, ETC., Petitioner, vs. Commissioner of Internal Revenue, Respondent. Fernando, J.Hetty HugsNo ratings yet

- Reagan V CIR 30 SCRA 968 27 December 1969Document8 pagesReagan V CIR 30 SCRA 968 27 December 1969raynan francis100% (3)

- William C. Reagan, Petitioner V Commissioner of Internal Revenue, Respondent GR No: L-26379. December 27, 1969 FactsDocument2 pagesWilliam C. Reagan, Petitioner V Commissioner of Internal Revenue, Respondent GR No: L-26379. December 27, 1969 FactsDean CainilaNo ratings yet

- Delaware Realty & Investment Company v. Commissioner of Internal Revenue, 234 F.2d 911, 3rd Cir. (1956)Document5 pagesDelaware Realty & Investment Company v. Commissioner of Internal Revenue, 234 F.2d 911, 3rd Cir. (1956)Scribd Government DocsNo ratings yet

- Case Digest FormatDocument1 pageCase Digest FormatAb RilNo ratings yet

- Garrison Vs CADocument2 pagesGarrison Vs CAannabanana07100% (1)

- Taxing Authority A. Organizational Structure and Functions of The BIR B. Jurisdiction, Power, and Functions of The Commissioner of Internal RevenueDocument2 pagesTaxing Authority A. Organizational Structure and Functions of The BIR B. Jurisdiction, Power, and Functions of The Commissioner of Internal RevenueRalph MondayNo ratings yet

- Doctrine: An Alien Actually Present in The Philippines Who Is Not A Mere Transient or Sojourner IsDocument12 pagesDoctrine: An Alien Actually Present in The Philippines Who Is Not A Mere Transient or Sojourner IsGui EshNo ratings yet

- Reagan Vs Commissioner of Internal Revenue2023Document2 pagesReagan Vs Commissioner of Internal Revenue2023KIM ROY IBALLANo ratings yet

- Reagan Vs Commissioner of Internal RevenueDocument1 pageReagan Vs Commissioner of Internal RevenueMuhammad Abundi Malik50% (2)

- Reagan Vs CIR TaxDocument2 pagesReagan Vs CIR TaxMilcah LisondraNo ratings yet

- TaxDocument7 pagesTaxArvi April NarzabalNo ratings yet

- Air Canada V CIRDocument2 pagesAir Canada V CIRNikita BayotNo ratings yet

- G.R. No. L-68252Document4 pagesG.R. No. L-68252Klein Carlo100% (1)

- CIR vs. S. C. Johnson and Son, Inc. (G.R. No. 127105 June 25, 1999) - H DIGESTDocument3 pagesCIR vs. S. C. Johnson and Son, Inc. (G.R. No. 127105 June 25, 1999) - H DIGESTHarleneNo ratings yet

- Digest TaxDocument10 pagesDigest TaxDominic EmbodoNo ratings yet

- G.R. No. L-26379 December 27, 1969 WILLIAM C. REAGAN, ETC., Petitioner, vs. Commissioner of Internal Revenue, Respondent. Fernando, J.Document5 pagesG.R. No. L-26379 December 27, 1969 WILLIAM C. REAGAN, ETC., Petitioner, vs. Commissioner of Internal Revenue, Respondent. Fernando, J.eizNo ratings yet

- 7-National Development Company vs. Commissioner of Internal RevenueDocument7 pages7-National Development Company vs. Commissioner of Internal RevenuefloravielcasternoboplazoNo ratings yet

- #180,192,204Document6 pages#180,192,204Erneylou RanayNo ratings yet

- 6608 Exhibit AB 20191229 2Document6 pages6608 Exhibit AB 20191229 2EmiR KaRaNo ratings yet

- CIR vs. Tokyo Shipping, GR#68252, May 26, 1995 224 SCRA 332Document5 pagesCIR vs. Tokyo Shipping, GR#68252, May 26, 1995 224 SCRA 332Khenlie VillaceranNo ratings yet

- Reagan Vs CirDocument1 pageReagan Vs CirJennelie jandusay100% (2)

- 14 - Standard Oil Company of New York v. Posadas, 55 Phil. 715 - Exemption - Government IntrumentalitiesDocument1 page14 - Standard Oil Company of New York v. Posadas, 55 Phil. 715 - Exemption - Government IntrumentalitiesIVYJEAN LAGURANo ratings yet

- United States Court of Appeals Second Circuit.: No. 427, Docket 32007Document10 pagesUnited States Court of Appeals Second Circuit.: No. 427, Docket 32007Scribd Government DocsNo ratings yet

- 116-Bisaya Land Transportation Co., Inc. v. CIR, 105 Phil. 1338Document1 page116-Bisaya Land Transportation Co., Inc. v. CIR, 105 Phil. 1338Jopan SJ100% (1)

- 155-CIR v. P.J. Kiener Co., LTD., Et. Al., July 18, 1975Document5 pages155-CIR v. P.J. Kiener Co., LTD., Et. Al., July 18, 1975Jopan SJNo ratings yet

- NDC V CIRDocument5 pagesNDC V CIRjonbelzaNo ratings yet

- Com Vs PJ KienerDocument8 pagesCom Vs PJ KienerMabelle ArellanoNo ratings yet

- Reagan v. Commissioner of Internal Revenue GR L-26379Document1 pageReagan v. Commissioner of Internal Revenue GR L-26379Charles BayNo ratings yet

- Facts:: 1. Fisher vs. Trinidad G.R. No. L-17518, October 30, 1922Document10 pagesFacts:: 1. Fisher vs. Trinidad G.R. No. L-17518, October 30, 1922Kaemy MalloNo ratings yet

- 88 Cir Vs Robertson DigestDocument2 pages88 Cir Vs Robertson DigestJann Tecson-Fernandez100% (1)

- Draft Income TaxDocument124 pagesDraft Income TaxLeidi Chua BayudanNo ratings yet

- United Airlines v. CIRDocument2 pagesUnited Airlines v. CIRedrixcNo ratings yet

- CIR Vs SC JohnsonDocument2 pagesCIR Vs SC JohnsonArra Balahadia dela PeñaNo ratings yet

- Republic v. GonzalesDocument12 pagesRepublic v. GonzalesJ. JimenezNo ratings yet

- Reagan V CoIR Notes and Case DigestDocument2 pagesReagan V CoIR Notes and Case DigestAtheena MondidoNo ratings yet

- National Development Company (NDC) Vs Commissioner of Internal Revenue (CIR) 151 SCRA 472Document4 pagesNational Development Company (NDC) Vs Commissioner of Internal Revenue (CIR) 151 SCRA 472Mark Gabriel B. MarangaNo ratings yet

- Standard Oil Company of New York v. Juan Posadas, JR., 55 Phil. 715Document2 pagesStandard Oil Company of New York v. Juan Posadas, JR., 55 Phil. 715Icel LacanilaoNo ratings yet

- NUS Personal Data Consent For Job ApplicantsDocument2 pagesNUS Personal Data Consent For Job ApplicantsPrashant MittalNo ratings yet

- Tweets PDFDocument181 pagesTweets PDFJaya KohliNo ratings yet

- Hilltop Responsive RecordsDocument2,206 pagesHilltop Responsive RecordsJake OffenhartzNo ratings yet

- Benabaye vs. People, 752 SCRA 26, G.R. No. 203466, February 25, 2015Document3 pagesBenabaye vs. People, 752 SCRA 26, G.R. No. 203466, February 25, 2015Angelette BulacanNo ratings yet

- 35intercontinental Broadcasting Corporation VDocument2 pages35intercontinental Broadcasting Corporation Vcrisanto perezNo ratings yet

- Publication PDFDocument108 pagesPublication PDFAnonymous JL0l1aVKWW100% (1)

- Fin e 42514 2013Document11 pagesFin e 42514 2013Papu KuttyNo ratings yet

- ADNM LAW UNIT 1 CASE Kriti PDFDocument3 pagesADNM LAW UNIT 1 CASE Kriti PDFguytdyNo ratings yet

- Chapter 1Document4 pagesChapter 1ThabisoNo ratings yet

- De MinimisDocument5 pagesDe MinimisRosemarie CruzNo ratings yet

- Law 126: Evidence Ma'am Victoria Avena: Drilon1Document37 pagesLaw 126: Evidence Ma'am Victoria Avena: Drilon1cmv mendozaNo ratings yet

- Luz Vs Ermita Memorandum On Appeal FinalDocument35 pagesLuz Vs Ermita Memorandum On Appeal Finalayane_sendoNo ratings yet

- Dwnload Full Statistics For Business and Economics 13th Edition Mcclave Solutions Manual PDFDocument32 pagesDwnload Full Statistics For Business and Economics 13th Edition Mcclave Solutions Manual PDFthomasstonetyy6100% (8)

- People VS BatinDocument2 pagesPeople VS Batinvincent nifas100% (2)

- History Ch-1 (MCQS) (Nakshatra Paliwal 10th A)Document31 pagesHistory Ch-1 (MCQS) (Nakshatra Paliwal 10th A)Nakshatra PaliwalNo ratings yet

- Essential Commodities ACT, 1955: Consumer Law ProjectDocument46 pagesEssential Commodities ACT, 1955: Consumer Law ProjectKirti MahapatraNo ratings yet

- Construing Urban Space As Public' inDocument14 pagesConstruing Urban Space As Public' inArun FizardoNo ratings yet

- Datatreasury Corporation v. Wells Fargo & Company Et Al - Document No. 628Document5 pagesDatatreasury Corporation v. Wells Fargo & Company Et Al - Document No. 628Justia.comNo ratings yet

- (Sia vs. Court of Appeals, 222 SCRA 24 (1993) )Document16 pages(Sia vs. Court of Appeals, 222 SCRA 24 (1993) )Jillian BatacNo ratings yet

- Parreno Vs COADocument1 pageParreno Vs COAPortia WynonaNo ratings yet

- Summary of The UN Convention On The Rights of The ChildDocument5 pagesSummary of The UN Convention On The Rights of The Childია ჯეჯელავაNo ratings yet

- Functionality of Barangay Development CouncilDocument2 pagesFunctionality of Barangay Development Councilxilver0092% (25)

- Puno CaseDocument9 pagesPuno CaseRA De JoyaNo ratings yet

- Notification Indian Air Force LDC MTD Cook Other PostsDocument1 pageNotification Indian Air Force LDC MTD Cook Other PostsAbhijit SawantNo ratings yet

- Facie Evidence of A Continuation of The PartnershipDocument3 pagesFacie Evidence of A Continuation of The PartnershipLenmariel GallegoNo ratings yet

- Agcaoili LTD PDFDocument32 pagesAgcaoili LTD PDFruss8dikoNo ratings yet

- Uy v. CA, 314 SCRA 69Document8 pagesUy v. CA, 314 SCRA 69JNo ratings yet

- The Laws of Cricket The Preamble - The Spirit ofDocument3 pagesThe Laws of Cricket The Preamble - The Spirit ofapi-19711076No ratings yet

- Islamic Directorate of The Philippines v. CADocument6 pagesIslamic Directorate of The Philippines v. CAbearzhugNo ratings yet

- Political Law Digests Carreon (Marla)Document209 pagesPolitical Law Digests Carreon (Marla)gabNo ratings yet