Professional Documents

Culture Documents

Cottage Industry LBO Boom Platform Services Democratization Future

Uploaded by

Saurabh JainOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cottage Industry LBO Boom Platform Services Democratization Future

Uploaded by

Saurabh JainCopyright:

Available Formats

Cottage Industry LBO Boom Platform Services Democratization Future

Prominent VC

• Funds focused on

business model or

Funds

technology. For

example Pi-Ventures

in India, SaaStr and

Acceleprise.

• Democratization of

startup investments

• Proliferation of VC with more and more

• HNIs and Family funds non-traditional

• Rise of seed stage • Rise of micro-VC

Offices • Emergence of CVC investor

accelerators. funds.

• Limited supply of the • Changes in ERISA & DOT COM Bust participation.

• VCs started offering • Introduction of

capital Enactment of Revenue • Bigger fund sizes

Act other value added SAFE notes.

• Enactment of Small services along with (Softbank Vision

Business Investment • Market crash in 1987, • Founder friendly fund)

the capital.

act VC funds reported loss funds

due to increased • Data-driven, new

competition operating structure.

• New sources of

financing – revenue-

based, debt funds,

Companies

SPACs, ICO etc.

• Rise of platforms for

providing liquidity to

the investors.

1960- 1980 1981- 2000 2001- 2004 2005- 2012 2013- 2018 B ey o n d 2018

Investing Styles of VC Funds

People-first VC funds give utmost importance to the

INVESTING IN founding team. Professor Doriot puts it succinctly “Always

01 PEOPLE consider investing in a grade-A man with a grade-B

idea. Never invest in a grade-B man with a grade-A idea”.

Funds focused on investing in technology/product or idea

INVESTING IN give substantial weightage to technology. This sort of

02 TECHNOLOGY investing style was pioneered by Tom Perkins, the founder of

famous VC fund - Kleiner Perkins.

These VC funds looks for the opportunities that has a large

INVESTING IN total addressable market (or has a potential to reach there.

03 LARGE MARKET

OPPORTUNITIES

Typically $1 Bn+). In their view, technology and team will

evolve and improve. Don Valentine was one of the first

investor who exemplified this style of investing.

You might also like

- Transactions 2025 An Economic Times Report On The Future of Payments in IndiaDocument16 pagesTransactions 2025 An Economic Times Report On The Future of Payments in IndiaSaurabh JainNo ratings yet

- Lenovo EduTech Study - Summary ReportDocument6 pagesLenovo EduTech Study - Summary ReportSaurabh JainNo ratings yet

- PitchBook Analyst Note The Future of Taxis Is Electric and Asset Heavy 1Document8 pagesPitchBook Analyst Note The Future of Taxis Is Electric and Asset Heavy 1Saurabh JainNo ratings yet

- PB Analyst Note US PE Fund Performance by Investment StyleDocument8 pagesPB Analyst Note US PE Fund Performance by Investment StyleSaurabh JainNo ratings yet

- Rise of Gaming in ChinaDocument30 pagesRise of Gaming in ChinaSaurabh JainNo ratings yet

- GMAT Bulletin 2010 Scheduling FORMS FINALDocument4 pagesGMAT Bulletin 2010 Scheduling FORMS FINALSaurabh JainNo ratings yet

- SC Cheat SheetDocument1 pageSC Cheat SheetSaurabh JainNo ratings yet

- Very Good Job MaterialDocument115 pagesVery Good Job MaterialRajesh KumarNo ratings yet

- FIL - Warren Buffett and Interpretation of Financial Statements PDFDocument33 pagesFIL - Warren Buffett and Interpretation of Financial Statements PDFchard serdenNo ratings yet

- Cmo69 97Document82 pagesCmo69 97Saurabh JainNo ratings yet

- Stock Exchange QuizDocument4 pagesStock Exchange QuizSaurabh JainNo ratings yet

- Solving Quadratic Equations and Finding RootsDocument9 pagesSolving Quadratic Equations and Finding RootsSaurabh JainNo ratings yet

- ManhantanCAT DS and PS QuestionsDocument10 pagesManhantanCAT DS and PS QuestionsSaurabh JainNo ratings yet

- AWA TemplatesDocument1 pageAWA TemplatesAyush PorwalNo ratings yet

- Tones of PassagesDocument10 pagesTones of Passageseswaraamaraneni100% (1)

- Tones of PassagesDocument10 pagesTones of Passageseswaraamaraneni100% (1)

- Maths@Wordpandit - How To Find Number of Solutions of Equation Involving Difference of Perfect SquaresDocument15 pagesMaths@Wordpandit - How To Find Number of Solutions of Equation Involving Difference of Perfect SquaresSaurabh JainNo ratings yet

- Maths by Amiya 2014-1-50MATHS BY AMIYA 2014 - 1-50.pdfMATHS BY AMIYA 2014 - 1-50.pdfMATHS BY AMIYA 2014 - 1-50.pdfMATHS BY AMIYA 2014 - 1-50.pdfMATHS BY AMIYA 2014 - 1-50.pdfMATHS BY AMIYA 2014 - 1-50.pdfMATHS BY AMIYA 2014 - 1-50.pdfDocument13 pagesMaths by Amiya 2014-1-50MATHS BY AMIYA 2014 - 1-50.pdfMATHS BY AMIYA 2014 - 1-50.pdfMATHS BY AMIYA 2014 - 1-50.pdfMATHS BY AMIYA 2014 - 1-50.pdfMATHS BY AMIYA 2014 - 1-50.pdfMATHS BY AMIYA 2014 - 1-50.pdfMATHS BY AMIYA 2014 - 1-50.pdfअजय प्रताप सिंहNo ratings yet

- English 100 Error Detection & Correction For All Exams by Das Sir (09038870684)Document19 pagesEnglish 100 Error Detection & Correction For All Exams by Das Sir (09038870684)Vijay Vikram Singh100% (1)

- Clocks and CalendersDocument3 pagesClocks and CalendersSandeep KumarNo ratings yet

- FDI in Life Insurance - Dr. Vijay KumbharDocument4 pagesFDI in Life Insurance - Dr. Vijay KumbharSaurabh JainNo ratings yet

- Home - Permutations and CombinationsDocument7 pagesHome - Permutations and CombinationsSaurabh JainNo ratings yet

- Fact, Inference and Judgement ExplainedDocument3 pagesFact, Inference and Judgement ExplainedSaurabh JainNo ratings yet

- Sentence Correction Questions by e GMAT 10Document18 pagesSentence Correction Questions by e GMAT 10Saurabh JainNo ratings yet

- Coal Bed Methane in India-Difficulties and Prospects PDFDocument5 pagesCoal Bed Methane in India-Difficulties and Prospects PDFrafiz91No ratings yet

- Society of Petroleum Engineers - Technical Talk - CBMDocument2 pagesSociety of Petroleum Engineers - Technical Talk - CBMSaurabh JainNo ratings yet

- Confused Words ListDocument5 pagesConfused Words ListAshwani RanaNo ratings yet

- Laboratory Drillling Completion Techniques Used in CBM PPTC SE Conference 2005Document39 pagesLaboratory Drillling Completion Techniques Used in CBM PPTC SE Conference 2005Saurabh JainNo ratings yet

- JPT2002 02 Techtoday SeriesDocument3 pagesJPT2002 02 Techtoday SeriesSaurabh JainNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Chuo CityDocument8 pagesChuo CityEfra ReyNo ratings yet

- Herb Fitch 1993 Chicago SeminarDocument131 pagesHerb Fitch 1993 Chicago SeminarLeslie BonnerNo ratings yet

- How To Use The CS-MMEL Method For Passenger Reduction Calculation With One Exit Inoperative Under Mmel?Document7 pagesHow To Use The CS-MMEL Method For Passenger Reduction Calculation With One Exit Inoperative Under Mmel?Syed Zeeshan UddinNo ratings yet

- North Carolina Cherokee IndiansDocument7 pagesNorth Carolina Cherokee IndiansLogan ShaddenNo ratings yet

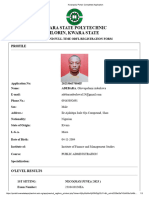

- Kwarapoly Portal - Completed ApplicationDocument3 pagesKwarapoly Portal - Completed ApplicationosinoluwatosinNo ratings yet

- Novartis Hyderabad: Job Application FormDocument5 pagesNovartis Hyderabad: Job Application FormjustindianNo ratings yet

- Constitutional Law 1 Syllabus SY 2023Document7 pagesConstitutional Law 1 Syllabus SY 2023Nash PungsNo ratings yet

- Laws Affecting Nursing PracticeDocument65 pagesLaws Affecting Nursing PracticeDave MismanNo ratings yet

- Corazon Aquino's powerful speech to CongressDocument10 pagesCorazon Aquino's powerful speech to CongressInga Budadoy NaudadongNo ratings yet

- David Vs ArroyoDocument2 pagesDavid Vs ArroyoAjpadateNo ratings yet

- Pakistani Companies and Their CSR ActivitiesDocument15 pagesPakistani Companies and Their CSR ActivitiesTayyaba Ehtisham100% (1)

- Wedding ScriptDocument9 pagesWedding ScriptMyn Mirafuentes Sta AnaNo ratings yet

- Things Fall Apart Reading GuideDocument8 pagesThings Fall Apart Reading GuideJordan GriffinNo ratings yet

- Review Nikolaus Pevsner Pioneers of Modern Design: From William Morris To Walter GropiusDocument8 pagesReview Nikolaus Pevsner Pioneers of Modern Design: From William Morris To Walter GropiusTomas Aassved HjortNo ratings yet

- Rizal's 3 Essays on Filipino SocietyDocument7 pagesRizal's 3 Essays on Filipino SocietyNathaniel PulidoNo ratings yet

- Punjab National Bank Punjab National Bank Punjab National BankDocument1 pagePunjab National Bank Punjab National Bank Punjab National BankHarsh ChaudharyNo ratings yet

- HR GDDocument8 pagesHR GDNisheeth BeheraNo ratings yet

- Eticket MR GOVINDAN UDHAYAKUMARDocument4 pagesEticket MR GOVINDAN UDHAYAKUMARNaveen SNo ratings yet

- Belbin Team Roles QuestionnaireDocument3 pagesBelbin Team Roles Questionnaireapi-248119294No ratings yet

- HRMT 623 Hamid Kazemi AssignmentDocument14 pagesHRMT 623 Hamid Kazemi AssignmentAvneet Kaur SranNo ratings yet

- 3 Factors That Contribute To Gender Inequality in The ClassroomDocument3 pages3 Factors That Contribute To Gender Inequality in The ClassroomGemma LynNo ratings yet

- Now You Can: Music in Your LifeDocument1 pageNow You Can: Music in Your LifeDiana Carolina Figueroa MendezNo ratings yet

- 8 Critical Change Management Models To Evolve and Survive - Process StreetDocument52 pages8 Critical Change Management Models To Evolve and Survive - Process StreetUJJWALNo ratings yet

- Constitutional Law II Digest on Poe vs. Comelec and TatadDocument49 pagesConstitutional Law II Digest on Poe vs. Comelec and TatadMica Joy FajardoNo ratings yet

- MandwaDocument4 pagesMandwaMadhu KumarNo ratings yet

- Draft Letter To Sophia Wisniewska (00131538xBF0F1)Document3 pagesDraft Letter To Sophia Wisniewska (00131538xBF0F1)sarah_larimerNo ratings yet

- PV Technologies Fights to Win Back Biggest ClientDocument33 pagesPV Technologies Fights to Win Back Biggest ClientFloyd Fernz100% (1)

- Understanding Diverse LearnersDocument13 pagesUnderstanding Diverse LearnersMerry Grace Aballe Abella100% (2)

- Share Curriculum Vitae Ahmed SaadDocument7 pagesShare Curriculum Vitae Ahmed SaadDR ABO HAMZANo ratings yet

- Life and General InsuranceDocument28 pagesLife and General InsuranceAravinda ShettyNo ratings yet