0% found this document useful (0 votes)

310 views17 pagesMarginal Costing

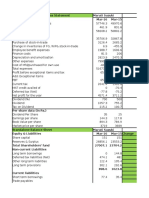

Marginal costing, also known as variable costing or direct costing, is an accounting technique that separates costs into fixed and variable components. It involves charging variable costs to cost units while writing off fixed costs in full against revenues for the period. This allows marginal costing to be useful for decision-making by focusing on the contribution margin of additional sales. Marginal cost is defined as variable cost plus the variable portion of overhead, and contribution is defined as revenues minus marginal costs. Marginal costing principles are based on the concepts of marginal costs and contribution margins.

Uploaded by

Garima Singh ChandelCopyright

© Attribution Non-Commercial (BY-NC)

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

310 views17 pagesMarginal Costing

Marginal costing, also known as variable costing or direct costing, is an accounting technique that separates costs into fixed and variable components. It involves charging variable costs to cost units while writing off fixed costs in full against revenues for the period. This allows marginal costing to be useful for decision-making by focusing on the contribution margin of additional sales. Marginal cost is defined as variable cost plus the variable portion of overhead, and contribution is defined as revenues minus marginal costs. Marginal costing principles are based on the concepts of marginal costs and contribution margins.

Uploaded by

Garima Singh ChandelCopyright

© Attribution Non-Commercial (BY-NC)

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd