100% found this document useful (1 vote)

160 views10 pagesMarginal vs Absorption Costing Explained

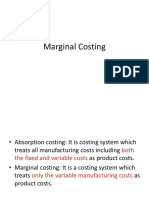

Marginal costing and absorption costing are two different methods of determining product costs. Under marginal costing, only variable costs are considered in calculating the cost of a product, while fixed costs are treated as period costs. Stocks are valued at marginal or variable cost only. Absorption costing determines product cost by considering both fixed and variable costs, with fixed costs apportioned over products. Stocks are valued at full works cost including a share of fixed costs. Profits may differ between the two methods.

Uploaded by

Faraz SiddiquiCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd

100% found this document useful (1 vote)

160 views10 pagesMarginal vs Absorption Costing Explained

Marginal costing and absorption costing are two different methods of determining product costs. Under marginal costing, only variable costs are considered in calculating the cost of a product, while fixed costs are treated as period costs. Stocks are valued at marginal or variable cost only. Absorption costing determines product cost by considering both fixed and variable costs, with fixed costs apportioned over products. Stocks are valued at full works cost including a share of fixed costs. Profits may differ between the two methods.

Uploaded by

Faraz SiddiquiCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd