Professional Documents

Culture Documents

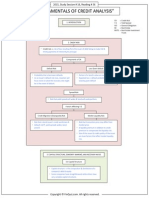

5 Cs of Credit.

5 Cs of Credit.

Uploaded by

loy zihong0 ratings0% found this document useful (0 votes)

8 views7 pagesThe document discusses the 5 'C's of credit that lenders assess when evaluating borrowers - Character, Capacity, Capital, Conditions, and Collateral. Character examines integrity and management style. Capacity assesses ability to repay through cash flow analysis. Capital evaluates financial commitment relative to assets. Conditions consider external influences. Collateral provides compensation for weaknesses and comfort to lenders.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses the 5 'C's of credit that lenders assess when evaluating borrowers - Character, Capacity, Capital, Conditions, and Collateral. Character examines integrity and management style. Capacity assesses ability to repay through cash flow analysis. Capital evaluates financial commitment relative to assets. Conditions consider external influences. Collateral provides compensation for weaknesses and comfort to lenders.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views7 pages5 Cs of Credit.

5 Cs of Credit.

Uploaded by

loy zihongThe document discusses the 5 'C's of credit that lenders assess when evaluating borrowers - Character, Capacity, Capital, Conditions, and Collateral. Character examines integrity and management style. Capacity assesses ability to repay through cash flow analysis. Capital evaluates financial commitment relative to assets. Conditions consider external influences. Collateral provides compensation for weaknesses and comfort to lenders.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 7

5 ‘C’ s of Credit .

CHARACTER

Character addresses areas such as

integrity , management style (aggressive,

speculative, prudent or conservative),

management lifestyle ( thrifty or

extravagant) and willingness to repay.

CAPACITY

Lenders need to assess the borrowers’

ability to generate the necessary cash

flows to repay borrowings. The

assessment often takes some form of

cash flow projection analysis.

CAPITAL

Lenders need to assess the sufficiency of

shareholders or owners’ financial commitment

in their business relative to the permanent

assets owned by the business. Financial

commitment is often measured by

shareholders’ funds in the business and third

party collateral provided by the owners

themselves.

CONDITIONS

This factor deals with external influences that can affect

the borrowers’ ability to honour their obligations to the

lenders. Macro issues such as globalization, foreign

currency markets, economies of major trading

partners, legislative and regulatory frame works and

social trend cannot be ignored. It is also important to

assess the technological environment to ensure that the

borrower remains relevant in the industry.

Collateral

It is meant to compensate for any

weakness in the other four ‘C’ s, and

provide lenders with more comfort.

At best, collateral is a second way out

not the first way out.

REASONS WHY DIFFICULTIES AT A

BANK MAY GIVE RISE TO PUBLIC

POLICY CONCERNS:-

• HIGH PROBABILITY OF BANK RUNS

• HIGH PROBABILITY OF CONTAGION EFFECT

• HIGH COST OF BAILING OUT

• HIGH PROBABILITY OF WIDESPREAD

MACROECONOMIC CONSEQUENCES FROM

INSTABILITY IN THE FINANCIAL SECTOR

• LOSS OF CONFIDENCE IN FINANCIAL

INTERMEDIATION MAY RESULT IN SUB-OPTIMAL

LEVELS OF SAVINGS AND INVESTMENTS.

You might also like

- Loan Policy GuidelinesDocument4 pagesLoan Policy GuidelinesNauman Malik100% (1)

- FinQuiz - Smart Summary - Study Session 16 - Reading 56Document7 pagesFinQuiz - Smart Summary - Study Session 16 - Reading 56Rafael100% (1)

- "Credit Rating Process" What Is A RatingDocument9 pages"Credit Rating Process" What Is A RatingSheetal IyerNo ratings yet

- Credit Rating ProcessDocument25 pagesCredit Rating ProcessMonaaa100% (11)

- BWBB3033 Topic 5 Edie A201 Part 2Document19 pagesBWBB3033 Topic 5 Edie A201 Part 2Santhiya MogenNo ratings yet

- Banking Risks Week 5Document30 pagesBanking Risks Week 5Shawn AbokNo ratings yet

- Project 3Document11 pagesProject 3Goku NarutoNo ratings yet

- Debt Analysis and ManagementDocument47 pagesDebt Analysis and ManagementRahul AtodariaNo ratings yet

- Mod 1Document41 pagesMod 1Raghav Mehra100% (2)

- Introduction To Lending - Topic 1Document78 pagesIntroduction To Lending - Topic 1SAMSONI lucasNo ratings yet

- Credit AppraisalDocument10 pagesCredit AppraisalDivya ValsanNo ratings yet

- Credit Risk ManagementDocument63 pagesCredit Risk ManagementNagireddy KalluriNo ratings yet

- Relative Value Methodologies For Global Credit Bond Portfolio ManagementDocument13 pagesRelative Value Methodologies For Global Credit Bond Portfolio ManagementeucludeNo ratings yet

- Appendix 2 Writeup From ASIC and ACRADocument4 pagesAppendix 2 Writeup From ASIC and ACRADarren LowNo ratings yet

- Credit AppraisalDocument6 pagesCredit AppraisalAnjali Angel ThakurNo ratings yet

- Unit 2 Risk in Banking BusinessDocument20 pagesUnit 2 Risk in Banking Businessrabin neupaneNo ratings yet

- Chapter Six: Credit Risk ManagementDocument23 pagesChapter Six: Credit Risk Managementalee789No ratings yet

- FM 05 Unit IDocument9 pagesFM 05 Unit IMO. SHAHVANNo ratings yet

- Credit and Risk AnalysisDocument15 pagesCredit and Risk AnalysiswarrenmachiniNo ratings yet

- Ê They Are Simply Opinions, Based On Analysis of The RiskDocument13 pagesÊ They Are Simply Opinions, Based On Analysis of The RiskMegha ChhabraNo ratings yet

- 419 USBrok 071Document89 pages419 USBrok 071ANo ratings yet

- Core Risks in BankingDocument52 pagesCore Risks in BankingSoloymanNo ratings yet

- Changing Face of Risk ManagmentDocument31 pagesChanging Face of Risk ManagmentGauri MittalNo ratings yet

- Roll Number - 15 To 21 - Credit Rating AgencyDocument26 pagesRoll Number - 15 To 21 - Credit Rating AgencyHIMANSHU DUTTANo ratings yet

- Credit PolicyDocument10 pagesCredit PolicyAyesha KhanNo ratings yet

- Credit Risk ManagementDocument4 pagesCredit Risk ManagementlintoNo ratings yet

- CH 10Document20 pagesCH 10NGỌC ĐẶNG HỒNGNo ratings yet

- UNIT 5 TR SirDocument25 pagesUNIT 5 TR SirgauthamNo ratings yet

- Chapter 2Document8 pagesChapter 2Pradeep RajNo ratings yet

- CAMELS Ratings: What They Mean and Why They Matter: PublicationsDocument3 pagesCAMELS Ratings: What They Mean and Why They Matter: PublicationsVladimir MarquezNo ratings yet

- Risk ManagementDocument14 pagesRisk ManagementMichelle TNo ratings yet

- Capital: Owner About Their Stake Hence More Safeguard Will Be The Borrowed FundsDocument28 pagesCapital: Owner About Their Stake Hence More Safeguard Will Be The Borrowed FundsMdramjanaliNo ratings yet

- Credit Rating: Dr. Kanhaiya SinghDocument30 pagesCredit Rating: Dr. Kanhaiya SinghVidisha SinghalNo ratings yet

- Types of Risks in Banking Sector: DR - SMDocument30 pagesTypes of Risks in Banking Sector: DR - SMPriya DharshiniNo ratings yet

- Unit 2 Risk in Banking BusinessDocument20 pagesUnit 2 Risk in Banking BusinessSudhakar PokhrelNo ratings yet

- Risk ManagementDocument23 pagesRisk ManagementMonal ChawdaNo ratings yet

- Credit Process and Credit Appraisal of A CommercialDocument26 pagesCredit Process and Credit Appraisal of A CommercialLiza Ahmed100% (2)

- Credit Risk in BanksDocument87 pagesCredit Risk in BanksKaushik BhattacharjeeNo ratings yet

- 02 Guide Questions - AUDIT OF THE FINANCIAL STATEMENTS OF BANKS (Part 1)Document4 pages02 Guide Questions - AUDIT OF THE FINANCIAL STATEMENTS OF BANKS (Part 1)Jhoanne Marie TederaNo ratings yet

- Credit RiskDocument14 pagesCredit RiskPRANSHU VERMANo ratings yet

- Credit Card Securitization ManualDocument18 pagesCredit Card Securitization ManualRahmi Elsa DianaNo ratings yet

- 5cs CreditDocument6 pages5cs CreditiftikharchughtaiNo ratings yet

- Corporate Credit Rating Methodology, Jul 2019 (Archived)Document16 pagesCorporate Credit Rating Methodology, Jul 2019 (Archived)maheshNo ratings yet

- Plugin-2009 CFO Forum Exec SummDocument6 pagesPlugin-2009 CFO Forum Exec SummmosshoiNo ratings yet

- Hedge Fund Leverage Counterparty NegotiationsDocument16 pagesHedge Fund Leverage Counterparty NegotiationsJason GoldenNo ratings yet

- Credit Risk ManagementDocument3 pagesCredit Risk Managementamrut_bNo ratings yet

- Session-2 Introduction To Credit RiskDocument40 pagesSession-2 Introduction To Credit RiskSagar KansalNo ratings yet

- Principles of Sound Lending, Credit PolicyDocument54 pagesPrinciples of Sound Lending, Credit Policyrajin_rammsteinNo ratings yet

- Sta 2322 Risk Management in Financial Institutions IntroductionDocument7 pagesSta 2322 Risk Management in Financial Institutions Introductionmurayadennis215No ratings yet

- Chapter 1Document17 pagesChapter 1Muhammad HanifNo ratings yet

- Due Diligence TechGuide ENGDocument58 pagesDue Diligence TechGuide ENGWulan Daryoco BetrisNo ratings yet

- Corporate Governance Case Study AjkDocument2 pagesCorporate Governance Case Study Ajkabhishekjkoshi12No ratings yet

- Credit Risk ManagementDocument14 pagesCredit Risk ManagementSandy XavierNo ratings yet

- Risk Protection and MitigationDocument114 pagesRisk Protection and MitigationomoyegunNo ratings yet

- Bank Lending: Policies & Procedures: M. Morshed 1Document26 pagesBank Lending: Policies & Procedures: M. Morshed 1musansuNo ratings yet

- Introduction To Bank Credit ManagementDocument26 pagesIntroduction To Bank Credit ManagementNeeRaz KunwarNo ratings yet

- Ratio AnalysisDocument8 pagesRatio AnalysisAbdul RehmanNo ratings yet

- Customer Responsiveness: It Could Be Argued Out That Services Are Easier Than Products To AdaptDocument1 pageCustomer Responsiveness: It Could Be Argued Out That Services Are Easier Than Products To AdaptMane DaralNo ratings yet

- Credit Policy GuidelinesDocument4 pagesCredit Policy Guidelinesnazmul099No ratings yet

- Credit Risk Assessment: The New Lending System for Borrowers, Lenders, and InvestorsFrom EverandCredit Risk Assessment: The New Lending System for Borrowers, Lenders, and InvestorsNo ratings yet