Professional Documents

Culture Documents

Public Economics: Unit IV: General Equilibrium Analysis

Uploaded by

Kyrie Angelo0 ratings0% found this document useful (0 votes)

5 views9 pagesThis document discusses general equilibrium analysis in public economics. It summarizes that:

1) The economy is an interdependent system where prices of one product or factor are related to others, so changes in price or quantity of one thing affects others.

2) A product tax raises the price and lowers the quantity of the taxed product, burdening its consumers and suppliers. This causes consumers to buy less of the taxed product and more of substitutes, potentially raising their prices.

3) A factor tax lowers the supply of that factor, making other factors relatively less scarce and lowering their returns. This spreads the impact on earnings to other factors.

Original Description:

Here

Original Title

PE General Equilibrium Analyasis

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses general equilibrium analysis in public economics. It summarizes that:

1) The economy is an interdependent system where prices of one product or factor are related to others, so changes in price or quantity of one thing affects others.

2) A product tax raises the price and lowers the quantity of the taxed product, burdening its consumers and suppliers. This causes consumers to buy less of the taxed product and more of substitutes, potentially raising their prices.

3) A factor tax lowers the supply of that factor, making other factors relatively less scarce and lowering their returns. This spreads the impact on earnings to other factors.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views9 pagesPublic Economics: Unit IV: General Equilibrium Analysis

Uploaded by

Kyrie AngeloThis document discusses general equilibrium analysis in public economics. It summarizes that:

1) The economy is an interdependent system where prices of one product or factor are related to others, so changes in price or quantity of one thing affects others.

2) A product tax raises the price and lowers the quantity of the taxed product, burdening its consumers and suppliers. This causes consumers to buy less of the taxed product and more of substitutes, potentially raising their prices.

3) A factor tax lowers the supply of that factor, making other factors relatively less scarce and lowering their returns. This spreads the impact on earnings to other factors.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 9

Public Economics

Unit IV: General Equilibrium Analysis

Introduction

the economy is an interdependent system in which

all prices are related to each other.

Changes in the price and quantity of one product or

factor affect those of others.

Product Taxes

a product tax leads to a rise in the price of the taxed

product and to a decline in its quantity.

Thus consumers of the taxed product are burdened

from the uses side and suppliers from the sources

side.

Product Taxes

Turning now to repercussions in other markets, we see

that two further chains of adjustment result:

As consumers buy less of the taxed product, the

demand for other products is increased.

If production is subject to increasing cost, this will raise

their price, while lowering that of the taxed product.

Thus, the burden from the uses side will be spread to

consumers of other products.

Product Taxes

As the output mix changes, so does the derived demand for

various factors of production.

Suppose that the taxed product is highly capital-intensive

while products which are substituted for it are labor-

intensive.

Such substitution leads to an increase in the return to labor

and a decrease in the return to capital.

As a result, further effects from the earnings side come about.

Must we then conclude that nothing can be said about incidence?

Reasoning in the partial equilibrium setting, we concluded with a

strong presumption that the uses effect of product taxes is controlling,

so that substitution of a tax on luxuries for a tax on necessities will

render the tax structure more progressive, and vice versa.

We argued that unless there is specific evidence to the contrary, the

burden pattern on the uses side will not be canceled out by indirect

effects on the sources side and vice versa.

Allowing for the general equilibrium setting, we must now assume

further that secondary adjustments in other product and factor

markets being broadly diffused, will follow a more or less neutral

pattern.

Factor Taxes

As the supply of the taxed factor falls off, the relative scarcity

of other factors declines.

As a result, their rates of return will fall.

Thus, the impact on the earnings side, initially centered on the

taxed factor, comes to be shared to some extent by other

factors.

An especially important aspect of this mechanism arises with

the effects of capital taxes on capital accumulation, an aspect of

tax incidence which we will consider further later on.

As the prices of products which draw heavily upon

the taxed factor rise, their consumers will be

burdened.

As they tend to substitute other products, the prices

of such products will rise, thus spreading the burden

impact from the uses side among a broader group of

consumers.

THE END

You might also like

- Business Economics: Business Strategy & Competitive AdvantageFrom EverandBusiness Economics: Business Strategy & Competitive AdvantageNo ratings yet

- Explain The Effect of Taxation On: A, ProductionDocument10 pagesExplain The Effect of Taxation On: A, ProductionTony LithimbiNo ratings yet

- Sessions 03 - Incidence of TaxesDocument15 pagesSessions 03 - Incidence of Taxesskn092100% (2)

- Taxes and Subsidies-1Document5 pagesTaxes and Subsidies-1Fergus DeanNo ratings yet

- Chapter 8Document7 pagesChapter 8Jimmy LojaNo ratings yet

- Taxation 2Document39 pagesTaxation 2Drashti ChoudharyNo ratings yet

- BBEK1103Document8 pagesBBEK1103Faiqah AzmirNo ratings yet

- QUESTION: Explain How Elasticity of Demand Concept May Be Used by Government andDocument5 pagesQUESTION: Explain How Elasticity of Demand Concept May Be Used by Government andChitepo Itayi StephenNo ratings yet

- Public Finance and TaxationDocument14 pagesPublic Finance and Taxationnegussie birieNo ratings yet

- Consumer Surplus and Price Elasticity of DemandDocument8 pagesConsumer Surplus and Price Elasticity of Demandsweetice79No ratings yet

- JawapanDocument13 pagesJawapanmsfaziah.hartanahNo ratings yet

- As Level, Chapter3 (Revised)Document18 pagesAs Level, Chapter3 (Revised)reyanpun17No ratings yet

- Topic: Incidence of Taxes Submitted To: Sir Abdul RehmanDocument50 pagesTopic: Incidence of Taxes Submitted To: Sir Abdul RehmanAsadtabiNo ratings yet

- Economics Year 11 Wk2Document4 pagesEconomics Year 11 Wk2Miracle JosiahNo ratings yet

- Value Added Tax VAT - in View of Bangladesh PDFDocument11 pagesValue Added Tax VAT - in View of Bangladesh PDFSrabon BaruaNo ratings yet

- Economics 2Document3 pagesEconomics 2yoyoNo ratings yet

- Economics Word File Roll No 381 To 390Document19 pagesEconomics Word File Roll No 381 To 390Spandan ThakkarNo ratings yet

- Eco of Taxation NotesDocument17 pagesEco of Taxation NotesGaurav HandaNo ratings yet

- Incidence of TaxationDocument12 pagesIncidence of TaxationRajesh ShahiNo ratings yet

- EconomicsDocument5 pagesEconomicsMehedi Hasan DurjoyNo ratings yet

- Group-15: Presentation On Chapter 6 - Supply Demand and Government PoliciesDocument27 pagesGroup-15: Presentation On Chapter 6 - Supply Demand and Government PoliciestannuNo ratings yet

- Tax ShiftingDocument9 pagesTax ShiftingNøthîñgLîfè100% (1)

- Price ElasticityDocument4 pagesPrice ElasticityBrian NyamuzingaNo ratings yet

- 27-Tax-Tax Incidence Theory The Effects of Taxes On The Distribution of Income (Peter Mieszkowski 1969)Document23 pages27-Tax-Tax Incidence Theory The Effects of Taxes On The Distribution of Income (Peter Mieszkowski 1969)Orlando BookNo ratings yet

- Running Head: Market For EnergyDocument5 pagesRunning Head: Market For EnergyssakaNo ratings yet

- Yutae Lee - ECON 11 UNIT TEST On Government Intervention 60 MarksDocument1 pageYutae Lee - ECON 11 UNIT TEST On Government Intervention 60 Marks이유태No ratings yet

- UNIT-5 Incidence and Shifting of Taxes: FirstDocument44 pagesUNIT-5 Incidence and Shifting of Taxes: FirstmelaNo ratings yet

- Inflation 2-10-2011Document3 pagesInflation 2-10-2011Piya Piya TiwariNo ratings yet

- Taxation Is The ProcessDocument7 pagesTaxation Is The ProcessJaneil FrancisNo ratings yet

- Graf IceDocument5 pagesGraf IceTrifan_DumitruNo ratings yet

- Assignments ECO - 1Document8 pagesAssignments ECO - 1Nagamani RajeshNo ratings yet

- The Effect of Tax Changes On Consumer Spending: in Economics and FinanceDocument6 pagesThe Effect of Tax Changes On Consumer Spending: in Economics and FinanceFarah RiderNo ratings yet

- Economics: Dhrashti Sanghvi, 16Bls028 A1Document17 pagesEconomics: Dhrashti Sanghvi, 16Bls028 A1Dhrashti SanghviNo ratings yet

- Assesment 3Document7 pagesAssesment 3brian mochez01No ratings yet

- Govt PoliciesDocument8 pagesGovt PoliciesDanyal TahirNo ratings yet

- Chapter 34 FixDocument2 pagesChapter 34 Fixfadiah putri khalisahNo ratings yet

- Do Comparative Statics With Respect To Fiscal Policy Variables and Explain Your AnswerDocument2 pagesDo Comparative Statics With Respect To Fiscal Policy Variables and Explain Your AnswerGIDEON OFOSUHENENo ratings yet

- Trade & DevelopmentDocument4 pagesTrade & DevelopmentAli HasnainNo ratings yet

- Legal Entity State: Government ActivityDocument3 pagesLegal Entity State: Government ActivityEunice Bucao BuesaNo ratings yet

- TaxesDocument4 pagesTaxesnenzzmariaNo ratings yet

- Mixed Economic SystemDocument4 pagesMixed Economic SystemsharonNo ratings yet

- Principles of Microeconomics-57375Document15 pagesPrinciples of Microeconomics-57375msfaziah.hartanahNo ratings yet

- Business Economics: Q1. Calculate The FollowingDocument10 pagesBusiness Economics: Q1. Calculate The FollowingkwladiiNo ratings yet

- Economics AssignmentDocument10 pagesEconomics AssignmentVivek GhuleNo ratings yet

- Mohd Ayaz Raza BM 111 Asssingment 1Document7 pagesMohd Ayaz Raza BM 111 Asssingment 1Mohd Ayaz RazaNo ratings yet

- 6 Product MarketDocument13 pages6 Product MarketSachin MethreeNo ratings yet

- 408 Demand Negative SlopesDocument2 pages408 Demand Negative Slopesgame caperNo ratings yet

- Docket Term - 1: Business and Economics ForumDocument40 pagesDocket Term - 1: Business and Economics ForumAanchal MahajanNo ratings yet

- Price Elasticity of Demand ApplicationsDocument5 pagesPrice Elasticity of Demand ApplicationsramkrishnagnNo ratings yet

- IGCSE Economics NotesDocument26 pagesIGCSE Economics NotesEsheng100% (1)

- Econ DefinitionsDocument11 pagesEcon DefinitionsGeorge FaridNo ratings yet

- Economics TheoryDocument19 pagesEconomics TheoryadiNo ratings yet

- Tax Systems and Taxes: Course Title: Advanced Taxation Instructor: Dr. Ahmed FDocument88 pagesTax Systems and Taxes: Course Title: Advanced Taxation Instructor: Dr. Ahmed FabateNo ratings yet

- Submitted To - : Saksham SrivastavaDocument10 pagesSubmitted To - : Saksham SrivastavaAnonymous VeEGIjNo ratings yet

- Effect of TaxDocument2 pagesEffect of TaxrudraarjunNo ratings yet

- Public Economics 3 Summary Notes: Black Et Al, Chapter 9Document17 pagesPublic Economics 3 Summary Notes: Black Et Al, Chapter 9stanely ndlovuNo ratings yet

- Effect of TaxDocument3 pagesEffect of TaxrudraarjunNo ratings yet

- Economics HW 13dec21Document2 pagesEconomics HW 13dec21Krishen GoindenNo ratings yet

- Igcse Economics Notes On Market Failure and Government InterventionDocument6 pagesIgcse Economics Notes On Market Failure and Government InterventionYuwu24No ratings yet

- Taxation JunaDocument551 pagesTaxation JunaJuna DafaNo ratings yet

- A Qualitative Study of Spending BehaviorDocument8 pagesA Qualitative Study of Spending BehaviorKPOP LOVER100% (2)

- Industrial Policy and Economic Reforms Papers 2Document59 pagesIndustrial Policy and Economic Reforms Papers 2Alberto LucioNo ratings yet

- Scott Sedam Margin GapDocument33 pagesScott Sedam Margin GapMark LynchNo ratings yet

- Lecture 8.2 (Capm and Apt)Document30 pagesLecture 8.2 (Capm and Apt)Devyansh GuptaNo ratings yet

- Market Analysis Course NotesDocument3 pagesMarket Analysis Course Notesudbhav786100% (1)

- Education and Job Match: The Relatedness of College Major and WorkDocument11 pagesEducation and Job Match: The Relatedness of College Major and WorkBieb de JongNo ratings yet

- Ge3 Midterm and FinalDocument60 pagesGe3 Midterm and FinalChristian SarteNo ratings yet

- Free Trade Vs Protection EconomicsDocument40 pagesFree Trade Vs Protection EconomicsRehan MistryNo ratings yet

- Ch10solution ManualDocument31 pagesCh10solution ManualJyunde WuNo ratings yet

- Unit1 Forms EnterprisesDocument16 pagesUnit1 Forms EnterprisesAnkitha VardhiniNo ratings yet

- 28 Rules For Successful TradingDocument3 pages28 Rules For Successful TradingEvangelioErnestNo ratings yet

- 1 - Black-Scholes Model PresentationDocument21 pages1 - Black-Scholes Model PresentationHammad ur Rab MianNo ratings yet

- Globalization and EducationDocument36 pagesGlobalization and EducationJhez de la PeñaNo ratings yet

- Micro Economics AssignmentDocument10 pagesMicro Economics AssignmentsipanjegivenNo ratings yet

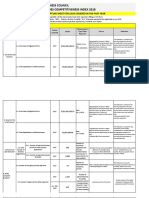

- National Competitiveness Council Cities and Municipalities Competitiveness Index 2018Document21 pagesNational Competitiveness Council Cities and Municipalities Competitiveness Index 2018Chen C AbreaNo ratings yet

- Group 3: Quizzer On Installment SalesDocument33 pagesGroup 3: Quizzer On Installment SalesKate Alvarez100% (2)

- Market For Factor InputsDocument9 pagesMarket For Factor InputsAkshay ModakNo ratings yet

- Institution Collects Funds Public Financial Assets Deposits Loans Bonds Tangible PropertyDocument4 pagesInstitution Collects Funds Public Financial Assets Deposits Loans Bonds Tangible PropertyDibakar DasNo ratings yet

- Keen 1980Document12 pagesKeen 1980Janaina AnicetoNo ratings yet

- Basic Concepts of Marketing: DR M.Meher KarunaDocument27 pagesBasic Concepts of Marketing: DR M.Meher KarunaHassan KhanNo ratings yet

- Cattle Pen Fattening Business Project Proposal: Promoter: - Beruf Fattening PLCDocument39 pagesCattle Pen Fattening Business Project Proposal: Promoter: - Beruf Fattening PLCDereje Abera90% (39)

- Guiding Principles of Monetary Administration by The Bangko SentralDocument8 pagesGuiding Principles of Monetary Administration by The Bangko SentralEuphoria BTSNo ratings yet

- 2018 Moed A CorrigéDocument18 pages2018 Moed A Corrigéluna dupontNo ratings yet

- Bài Tập Trắc Nghiệm Làm Trên LớpDocument10 pagesBài Tập Trắc Nghiệm Làm Trên LớpHoa Đào PhươngNo ratings yet

- 2019 Syllabus For MAS and AUDITINGDocument10 pages2019 Syllabus For MAS and AUDITINGChristopher NogotNo ratings yet

- Chapter FourDocument14 pagesChapter FourRawan YasserNo ratings yet

- IrrDocument5 pagesIrrMohmet SaitNo ratings yet

- Solutions To A2StudyPack2012Document21 pagesSolutions To A2StudyPack2012Juncheng WuNo ratings yet

- Derivatives & Risk Management SyllabusDocument2 pagesDerivatives & Risk Management SyllabusDivyeshNo ratings yet

- FA 7 - Forecasting and ValuationDocument2 pagesFA 7 - Forecasting and ValuationpurwadaNo ratings yet