Professional Documents

Culture Documents

Investment Management

Uploaded by

Vishal Malik0 ratings0% found this document useful (0 votes)

8 views10 pagesInvestment is committing funds to acquire financial assets to generate income/appreciation while managing risk. The objectives are maximizing return, minimizing risk, maintaining liquidity, and reducing taxes. Investments include fixed principal (savings accounts), variable principal (stocks), and indirect (mutual funds) options. Good investments provide safety, liquidity, stable income, purchasing power stability, legality, and low maintenance. The investment process involves setting a policy, analyzing and valuing assets, constructing a diversified portfolio, and regularly evaluating performance and making revisions.

Original Description:

jcdkd

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentInvestment is committing funds to acquire financial assets to generate income/appreciation while managing risk. The objectives are maximizing return, minimizing risk, maintaining liquidity, and reducing taxes. Investments include fixed principal (savings accounts), variable principal (stocks), and indirect (mutual funds) options. Good investments provide safety, liquidity, stable income, purchasing power stability, legality, and low maintenance. The investment process involves setting a policy, analyzing and valuing assets, constructing a diversified portfolio, and regularly evaluating performance and making revisions.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views10 pagesInvestment Management

Uploaded by

Vishal MalikInvestment is committing funds to acquire financial assets to generate income/appreciation while managing risk. The objectives are maximizing return, minimizing risk, maintaining liquidity, and reducing taxes. Investments include fixed principal (savings accounts), variable principal (stocks), and indirect (mutual funds) options. Good investments provide safety, liquidity, stable income, purchasing power stability, legality, and low maintenance. The investment process involves setting a policy, analyzing and valuing assets, constructing a diversified portfolio, and regularly evaluating performance and making revisions.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 10

What is investment?

• Investment is the commitment of funds in

the acquisition of financial assets for

securing a flow of income/capital

appreciation while keeping the risk within

manageable limits

Objectives of investment

management

• Maximize Return

• Minimize Risk

• Keep Liquidity

• Reduce Tax liability

Investment media

• Fixed principal investment-cash saving

account,savings certificates,Government

bonds.debentures

• Variable principal investments-equity

shares , preference shares, convertible

debentures

• Indirect investments- pension funds, mutual

funds.provident funds, insurance

Features of good investment

• Safety of principal

• Liquidity

• Income stability

• Appreciation and purchasing power

stability

• Legality and freedom from care

• tangibility

Process of investment

• Investment policy

• Investment valuation

• Investment analysis

• Portfolio construction

• Portfolio evaluation and revision

Investment policy

• Determination of investible wealth

• Determination of portfolio objectives

• Identification of potential investment assets

• Consideration of attributes of investment

assets

Investment valuation

• One must determine the intrinsic value of a

security and compare it with its market

value so as to decide whether to invest or

not.

Investment analysis

• Fundamental analysis consisting of

economy analysis, industry analysis and

company analysis

• Technical analysis to determine the

appropriate time for buying or selling

Portfolio construction

• Determination of risk return consideration

• Determination of diversification level

• Consideration of investment timing

• Selection of investment assets

• Allocation of funds to investment assets

Portfolio evaluation and revision

• Evaluation of portfolio

• Diagnosing reasons for favourable/

unfavourable performance

• Making appropriate changes in the portfolio

You might also like

- Investment Nature, Scope and Construction of PortfolioDocument16 pagesInvestment Nature, Scope and Construction of Portfoliogautam_usmsNo ratings yet

- Overview of InvestmentDocument27 pagesOverview of InvestmentNida JavedNo ratings yet

- Security Analysis & Portfolio ManagementDocument45 pagesSecurity Analysis & Portfolio ManagementVignesh PrabhuNo ratings yet

- Part - III and IVDocument88 pagesPart - III and IVEmuyeNo ratings yet

- Security and Portfolio Management: Facilitator-Praveen KumarDocument20 pagesSecurity and Portfolio Management: Facilitator-Praveen KumarSankaran ManickamNo ratings yet

- Investment ManagementDocument20 pagesInvestment ManagementShubham Singh100% (1)

- Investment MGT: An IntroductionDocument23 pagesInvestment MGT: An IntroductionNakul ParameswarNo ratings yet

- Investment Options Physical and Financial Products Investment ManagementDocument24 pagesInvestment Options Physical and Financial Products Investment ManagementluvnehaNo ratings yet

- 1 Intro To Financial AnaysisDocument42 pages1 Intro To Financial AnaysisRaya Fitrian HernasaNo ratings yet

- Workshop Securities Market Awareness Campaign: WelcomeDocument30 pagesWorkshop Securities Market Awareness Campaign: WelcomekmralokkNo ratings yet

- Introduction To Investmentaa (Autosaved)Document56 pagesIntroduction To Investmentaa (Autosaved)Devesh AgrawalNo ratings yet

- 1.6 Overview of InvestmentsDocument19 pages1.6 Overview of InvestmentsNatasha GhazaliNo ratings yet

- Introduction To Investments (Chapter 1)Document10 pagesIntroduction To Investments (Chapter 1)sadamNo ratings yet

- Sa - Investment ScenarioDocument16 pagesSa - Investment Scenarioapi-3757629No ratings yet

- Need and Importance of Portfolio ManagementDocument5 pagesNeed and Importance of Portfolio Managementpoojaelango54No ratings yet

- Security Analysis AND Portfolio Management: Mba Iii Semester PristDocument15 pagesSecurity Analysis AND Portfolio Management: Mba Iii Semester PristSingh CharuNo ratings yet

- Chapter 2 - Asset Allocation DecisionDocument24 pagesChapter 2 - Asset Allocation DecisionImejah FaviNo ratings yet

- The Investment Environment - Topic OneDocument39 pagesThe Investment Environment - Topic OneRita NyairoNo ratings yet

- Portfolio ManagementDocument6 pagesPortfolio ManagementShilpiVaishkiyarNo ratings yet

- Project Report On Icici Bank: Made by Piyush PallwalDocument18 pagesProject Report On Icici Bank: Made by Piyush PallwalPiyushE63No ratings yet

- Unit 1 - IAPMDocument17 pagesUnit 1 - IAPMAmish QwertyNo ratings yet

- WIM - Alternative Investments Presentation - FinalDocument80 pagesWIM - Alternative Investments Presentation - FinalHiba AliNo ratings yet

- Investment Management: Soumendra Roy NimsDocument25 pagesInvestment Management: Soumendra Roy NimsNitesh KumarNo ratings yet

- Investment Management: We Shall Cover: Equity Portfolio Management Debt Portfolio ManagementDocument14 pagesInvestment Management: We Shall Cover: Equity Portfolio Management Debt Portfolio ManagementsidhanthaNo ratings yet

- Unit 5 IAPM FM 01Document21 pagesUnit 5 IAPM FM 01areumkim261No ratings yet

- Session 1-1 PDFDocument10 pagesSession 1-1 PDFSumayya KANo ratings yet

- Investment Analysis - Chapter 1Document18 pagesInvestment Analysis - Chapter 120070516 Phạm Mai LinhNo ratings yet

- Investment Management of BanksDocument28 pagesInvestment Management of BanksGragnor PrideNo ratings yet

- Investment Scenario: Savings and Investment - Two Sides of A CoinDocument37 pagesInvestment Scenario: Savings and Investment - Two Sides of A CoinLokesh GowdaNo ratings yet

- Security Analysis and Portfolio ManagementDocument24 pagesSecurity Analysis and Portfolio Managementkum_popNo ratings yet

- Investment Analysis: Company NameDocument11 pagesInvestment Analysis: Company Namehiteshmishra14No ratings yet

- Course: Mba Semester: Iii Subject Code: MF0001 Book Id: B1035 Subject Name: Sapm Unit Number: 1 Unit Title: Investment - A Conceptual FrameworkDocument20 pagesCourse: Mba Semester: Iii Subject Code: MF0001 Book Id: B1035 Subject Name: Sapm Unit Number: 1 Unit Title: Investment - A Conceptual FrameworkAjeet ParmarNo ratings yet

- Sapm PPT MonuDocument8 pagesSapm PPT MonuSruthy R NathNo ratings yet

- Invt IntroDocument25 pagesInvt IntroNishanthi PriyaNo ratings yet

- Basics of Valuation 03 12 10Document30 pagesBasics of Valuation 03 12 10CA Mohan SNo ratings yet

- Portfolio Mgt11Document15 pagesPortfolio Mgt11Orange NoidaNo ratings yet

- Module 1 A Investment ProcessDocument46 pagesModule 1 A Investment ProcesssateeshjorliNo ratings yet

- Mutual Funds in IndiaDocument26 pagesMutual Funds in IndiaAnjali RajNo ratings yet

- Investment Banking - SMG 211Document32 pagesInvestment Banking - SMG 211Hesham Abd-AlrahmanNo ratings yet

- Registration Fee - 1721415 PDFDocument12 pagesRegistration Fee - 1721415 PDFSumaiya RahmanNo ratings yet

- Understanding Investment Investment Decision ProcessDocument31 pagesUnderstanding Investment Investment Decision ProcessjunaidNo ratings yet

- Capital Market FinalsDocument8 pagesCapital Market FinalsJ15 Clothing ApparelNo ratings yet

- InvestmentsDocument60 pagesInvestmentsKristy SullivanNo ratings yet

- Sessions 1 & 2Document22 pagesSessions 1 & 2Bhavya JainNo ratings yet

- Financial Management - Importance: - Financial Management Is Indispensable To Any Organization As It Helps inDocument37 pagesFinancial Management - Importance: - Financial Management Is Indispensable To Any Organization As It Helps insvsrnbNo ratings yet

- Unit - 4 Mutual Funds Credit RatingDocument10 pagesUnit - 4 Mutual Funds Credit RatingKarthick NaikNo ratings yet

- Content For Bridge CourseDocument43 pagesContent For Bridge CourseAlinaNo ratings yet

- Investment Decision and Portfolio Management (ACFN 632)Document25 pagesInvestment Decision and Portfolio Management (ACFN 632)yebegashetNo ratings yet

- 3 - Slides-The Financial InstitutionsDocument17 pages3 - Slides-The Financial InstitutionsMuhammad UmarNo ratings yet

- SAPM Mod. 1Document24 pagesSAPM Mod. 1jabeanonionNo ratings yet

- Investment Management: - Asset Allocation DecisionDocument23 pagesInvestment Management: - Asset Allocation DecisionyebegashetNo ratings yet

- 1.3 Overview of Investments - Financial MarketDocument31 pages1.3 Overview of Investments - Financial MarketNatasha GhazaliNo ratings yet

- Investment Analysis and Portfolio ManagementDocument70 pagesInvestment Analysis and Portfolio ManagementSwapnil BhattacharyaNo ratings yet

- Investments:: Analysis and ManagementDocument20 pagesInvestments:: Analysis and ManagementPhaul QuicktrackNo ratings yet

- Investment Decision and Portfolio Management (ACFN 632)Document23 pagesInvestment Decision and Portfolio Management (ACFN 632)habtamuNo ratings yet

- SAPM I Unit Anna UniversityDocument28 pagesSAPM I Unit Anna UniversitystandalonembaNo ratings yet

- 1understanding InvestmentDocument33 pages1understanding InvestmentSyra Mae CruzNo ratings yet

- 3 BondsDocument16 pages3 BondsSrinithi kesavadossNo ratings yet

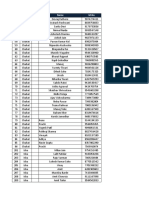

- S.No. Recruiter Date Name M.NoDocument27 pagesS.No. Recruiter Date Name M.NoVishal MalikNo ratings yet

- HSB 14th Conference Book - Quintessential Reflections-21-33-1 - CompressedDocument13 pagesHSB 14th Conference Book - Quintessential Reflections-21-33-1 - CompressedVishal MalikNo ratings yet

- 1.1 Product Life Cycle Costing in The Changing Industrial ScenarioDocument10 pages1.1 Product Life Cycle Costing in The Changing Industrial ScenarioVishal MalikNo ratings yet

- DessertationDocument86 pagesDessertationVishal MalikNo ratings yet

- FSA AssignmentDocument19 pagesFSA AssignmentVishal MalikNo ratings yet

- Behavioural Finance MCom (H) 2020 PDFDocument5 pagesBehavioural Finance MCom (H) 2020 PDFVishal MalikNo ratings yet

- 09 - Chapter 3 PDFDocument40 pages09 - Chapter 3 PDFVishal MalikNo ratings yet