Professional Documents

Culture Documents

Chapter 10 Inventories

Uploaded by

Cheska Agrabio0 ratings0% found this document useful (0 votes)

14 views11 pagesOriginal Title

CHAPTER-10-INVENTORIES

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views11 pagesChapter 10 Inventories

Uploaded by

Cheska AgrabioCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 11

INVENTORIES

INVENTORIES

ARE AS ASSETS:

Held for sale in the ordinary course of business;

In the process of production for such sale; or

In the form of materials or supplies to be consumed in the production process

or in the rendering of services

RECOGNITION

When they meet the definition of inventory

Obtained “legal title”.

MEASUREMENT

Inventories are measured at the lower of cost and net realizable value (LCNRV).

COST

a. Purchase cost (net of trade discounts) – includes purchase price, import duties, non-

refundable taxes, transport, handling cost & other costs directly attributable to the

acquisition of inventory.

b. Conversion costs – include direct labor & production overhead costs

c. Other costs necessary in bringing the inventories to their present location and condition

NET REALIZABLE VALUE

- is the estimated selling price less the estimated cost of completion and the estimated

cost of disposal.

Goods included in the inventory:

1. Goods owned and on hand

2. Goods in transit and sold FOB Destination

3. Goods in transit and purchased FOB Shipping point

4. Goods out on consignment

Consignment is the act of leaving goods with someone else to sell

while retaining ownership until the goods are sold.

5. Goods in the hands of salesmen or agents

6. Goods held by customers on approval or trial

EXCLUDED FROM THE COST OF

INVENTORIES

• Abnormal amounts of wasted materials, labor or other production

costs

• Selling costs

• Administrative overheads that do not contribute to bringing

inventories to their present location and condition

• Storage costs for completed goods

ILLUSTRATION 1: TOTAL INVENTORY

ABC Co. provided the following information for the purpose of determining the amount of its

inventory as of December 31, 2021:

Goods located at the warehouse (physical count) 3,800,000

Goods located at the sales department(at cost) 13,600,000

Goods in transit purchased FOB Destination 1,600,000

Goods in transit purchased FOB Shipping point 2,100,000

Freight incurred under “freight prepaid” for the

goods purchased under FOB Shipping point 60,000

Goods held on consignment from 3D, Inc. 1,800,000

How much is the total inventory on Dec. 31, 2021?

ILLUSTRATION 2: GOODS IN TRANSIT

The balance in Page Company’s inventory account on December 31, 2021 was

P1,225,000 before the following information was considered:

Goods shipped FOB destination, on December 20, 2021 from a vendor to

Page were lost in transit. The invoice cost of P45,000 was not recorded by

Page. On December 28, 2021, Page notified the vendor of the lost shipment.

Goods were in transit from a vendor to Page on December 31, 2021. The

invoice cost was P60,000 and the goods were shipped FOB shipping point on

December 28, 2021. Page received the goods on January 4, 2022.

What amount of inventory should be reported in the December 31, 2021

statement of financial position?

ILLUSTRATION 3: CONSIGNED GOODS

Birlin Co. consigned goods costing P10,000 to Loyda, Inc. Transportation

costs of delivering the goods to Loyda totaled P2,000. Repair costs for

goods damaged during the transportation, P500. To induce Loyda Inc. in

accepting the consigned goods, Birlin Co. gave P1,000 representing an

advance commission. How much is the cost of the consigned goods?

ILLUSTRATION 4:

Power Company reviewed its year-end and found the following items:

a. A package containing a product costing P81,600 was standing the shipping area when the physical

inventory was conducted. This was not included in the inventory because it was marked “Hold for

shipping instructions”. The purchase order was dated December 19 but the package was shipped and

the customer was billed January 2, 2022.

b. A special machine, fabricated to order for a particular customer, was finished and in the shipping

room on December 30, 2021. The customer was billed on that date and the machine was excluded in

the inventory. The machine costing P230,000 was shipped January 2, 2022.

c. Merchandise costing P23,500 was received on January 3, 2022 and the related purchase invoice was

recorded January 5, 2022. The invoice showed the shipment was made December 20, 2021, FOB

Destination.

d. Goods costing P150,00 were sold and delivered on December 20, 2021. The sale was accompanied

by a repurchase agreement that Power will buy back the inventory in February 2022.

How much is the inventory adjustment on December 31, 2021?

ILLUSTRATION 5: COST OF PURCHASE

Liwa Co., a VAT payer, imported goods from a foreign supplier and incurred the following

costs:

Purchase price P100,000

Import duties 10,000

Value added tax 13,000

Commission to broker 2,000

Transportation costs 5,000

Total 130,000

How much is the cost of purchase of the imported goods?

You might also like

- Inventory Acctg 5Document2 pagesInventory Acctg 5Deceryl AdaponNo ratings yet

- 10 Questions Inventories 1Document2 pages10 Questions Inventories 1bernadeth.lorzanoNo ratings yet

- Problems Chapter 7 Inventories October 5Document7 pagesProblems Chapter 7 Inventories October 5sabina del monteNo ratings yet

- Activity 8Document3 pagesActivity 8MAYETTE CHIONGNo ratings yet

- Audit of Inventories Problem 1: Requirement: Compute The Correct Amount of InventoryDocument4 pagesAudit of Inventories Problem 1: Requirement: Compute The Correct Amount of InventoryGet BurnNo ratings yet

- Intermediate Accounting 1 - InventoriesDocument9 pagesIntermediate Accounting 1 - InventoriesLien LaurethNo ratings yet

- InventoriesDocument3 pagesInventoriesJane TuazonNo ratings yet

- Inventories - Practice Set - Questionnaire-1Document5 pagesInventories - Practice Set - Questionnaire-1ashleydelmundo14No ratings yet

- Inventories NotesDocument7 pagesInventories NotesJessel Ann MontecilloNo ratings yet

- Chapter 3 Audit of InventoriesDocument26 pagesChapter 3 Audit of InventoriesSteffany Roque100% (1)

- Inventories Quiz 1Document5 pagesInventories Quiz 1Kasey PastorNo ratings yet

- File 1069803342Document31 pagesFile 1069803342Angelica TolinNo ratings yet

- Inventory Quiz 1 Part 2Document4 pagesInventory Quiz 1 Part 2Angelica PagaduanNo ratings yet

- 3.1.5 Audit of Inventories ANSWERDocument38 pages3.1.5 Audit of Inventories ANSWERAnna TaylorNo ratings yet

- 1 CA51010 InventoriesDocument4 pages1 CA51010 InventoriesatashaNo ratings yet

- Sample Problems - Inventories Problem 1Document4 pagesSample Problems - Inventories Problem 1krizzmaaaayNo ratings yet

- 5 Questions InventoryDocument15 pages5 Questions Inventoryyousef0% (1)

- SUBJECT: Accounting 13 NC Descriptive Title: Auditing and Assurance Concepts and Applications 1Document5 pagesSUBJECT: Accounting 13 NC Descriptive Title: Auditing and Assurance Concepts and Applications 1Prince CalicaNo ratings yet

- Inventories QuizDocument4 pagesInventories QuizIvy Salise100% (1)

- Chapter 5 InventoriesDocument48 pagesChapter 5 InventoriesJude Joaquin SanchezNo ratings yet

- 162.material.011 InventoryDocument7 pages162.material.011 InventoryAngelli LamiqueNo ratings yet

- Audit of Inventories: Problem No. 1Document272 pagesAudit of Inventories: Problem No. 1Aldrin Zolina100% (11)

- PRACTICE SET-Inventories (Problems)Document8 pagesPRACTICE SET-Inventories (Problems)polxrixNo ratings yet

- Module 1 - Problems and Exercises 1Document11 pagesModule 1 - Problems and Exercises 1christine peredoNo ratings yet

- Audit Accounts PayableDocument3 pagesAudit Accounts Payablenicole bancoroNo ratings yet

- Audit of Inventories Problems CompressDocument19 pagesAudit of Inventories Problems CompressSajj PrrtyNo ratings yet

- Inventory - Cost Flow - Estimation.ValuationDocument8 pagesInventory - Cost Flow - Estimation.ValuationJoanne Jean Ibonia RosarioNo ratings yet

- FINANCIAL ACCOUNTING INVENTORY REPORTINGDocument10 pagesFINANCIAL ACCOUNTING INVENTORY REPORTINGLorenzo LapuzNo ratings yet

- Audit of Inventories - Part 1Document5 pagesAudit of Inventories - Part 1Mark Lawrence YusiNo ratings yet

- Inventory Problem 1: (Document Title)Document4 pagesInventory Problem 1: (Document Title)Marper GalangNo ratings yet

- Effects of Errors 2021Document2 pagesEffects of Errors 2021Ali SwizzleNo ratings yet

- AP 9206-1 InventoriesDocument5 pagesAP 9206-1 InventoriesmiobratataNo ratings yet

- MidtermS2 InventoriesDocument11 pagesMidtermS2 InventoriesQueenie Dayagro0% (2)

- InventoryDocument10 pagesInventoryGirlie Ann JimenezNo ratings yet

- Inventories ExercisesDocument11 pagesInventories ExercisesVincrsp BogukNo ratings yet

- aUDIT OF INVENTORYDocument33 pagesaUDIT OF INVENTORYJoseph SalidoNo ratings yet

- Process of Production For Such Sale or in The Form of Materials or Supplies To Be Consumed in The Production Process or in The Rendering of ServicesDocument11 pagesProcess of Production For Such Sale or in The Form of Materials or Supplies To Be Consumed in The Production Process or in The Rendering of ServicesRyan Prado AndayaNo ratings yet

- ACCTG102 MidtermQ2 InventoriesDocument10 pagesACCTG102 MidtermQ2 InventoriesDayan DudosNo ratings yet

- AssignmentDocument6 pagesAssignmentIryne Kim PalatanNo ratings yet

- QUIZ 3. Audit of Inventories ManuscriptDocument3 pagesQUIZ 3. Audit of Inventories ManuscriptJulie Mae Caling MalitNo ratings yet

- Problem: A) B) C) D) E)Document1 pageProblem: A) B) C) D) E)leshz zynNo ratings yet

- INVENTORIES2Document18 pagesINVENTORIES2Katherine MagpantayNo ratings yet

- InventoryDocument8 pagesInventoryJoana Marie Mara SorianoNo ratings yet

- Ap-500Q: Quizzer On Purchasing/Disbursement Production and Revenue/Receipt Cycles: Audit of Inventories, Receivables and Cash and Cash EquivalentsDocument27 pagesAp-500Q: Quizzer On Purchasing/Disbursement Production and Revenue/Receipt Cycles: Audit of Inventories, Receivables and Cash and Cash Equivalentsruel c armillaNo ratings yet

- INVENTORY ADJUSTMENTSDocument6 pagesINVENTORY ADJUSTMENTSDrie LimNo ratings yet

- Ae 13 Inventories: InventoryDocument11 pagesAe 13 Inventories: InventorySaclao John Mark GalangNo ratings yet

- Inventory Inclusion and ExclusionDocument11 pagesInventory Inclusion and ExclusionKimberly Claire AtienzaNo ratings yet

- Key To CorrectionDocument10 pagesKey To CorrectionSaeym SegoviaNo ratings yet

- Inventory Problems SEODocument3 pagesInventory Problems SEOLarpii MonameNo ratings yet

- Inventories Supplementary MaterialsDocument3 pagesInventories Supplementary MaterialsdayanNo ratings yet

- Inventories Test Bank PDFDocument13 pagesInventories Test Bank PDFAB CloydNo ratings yet

- Inventories Problems To DiscussDocument6 pagesInventories Problems To Discusskeisha santosNo ratings yet

- Sarmiento, Shayne Angela - Exercises-Inventories P-1Document4 pagesSarmiento, Shayne Angela - Exercises-Inventories P-1SHAYNE ANGELA SARMIENTONo ratings yet

- AP 5905 InventoriesDocument9 pagesAP 5905 Inventoriesxxxxxxxxx67% (3)

- Chapter 8 Supplemental Questions: E8-1 (Inventoriable Costs)Document7 pagesChapter 8 Supplemental Questions: E8-1 (Inventoriable Costs)Dyan NoviaNo ratings yet

- Handout No. 3Document6 pagesHandout No. 3Villena Divina VictoriaNo ratings yet

- File 7595477826281120346Document13 pagesFile 7595477826281120346sunshineNo ratings yet

- Inventory CalculationsDocument3 pagesInventory CalculationsAleiza MalaluanNo ratings yet

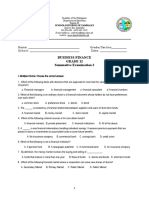

- Republic of the Philippines Department of Education examDocument4 pagesRepublic of the Philippines Department of Education examCheska AgrabioNo ratings yet

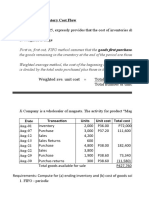

- High Low MethodDocument1 pageHigh Low MethodCheska AgrabioNo ratings yet

- High Low MethodDocument1 pageHigh Low MethodCheska AgrabioNo ratings yet

- High Low MethodDocument1 pageHigh Low MethodCheska AgrabioNo ratings yet

- AE23 Capital BudgetingDocument4 pagesAE23 Capital BudgetingCheska AgrabioNo ratings yet

- Summative Test 12 WEEK 4Document2 pagesSummative Test 12 WEEK 4Cheska AgrabioNo ratings yet

- Week 2Document2 pagesWeek 2Cheska AgrabioNo ratings yet

- Philippines Education Dept marketing testDocument3 pagesPhilippines Education Dept marketing testCheska AgrabioNo ratings yet

- DepEd Zambales Summative Assessment on Research MethodsDocument4 pagesDepEd Zambales Summative Assessment on Research MethodsCheska AgrabioNo ratings yet

- Chapter 4Document4 pagesChapter 4Cheska AgrabioNo ratings yet

- PHYSCI Q2 WHLP Week 2Document8 pagesPHYSCI Q2 WHLP Week 2Cheska AgrabioNo ratings yet

- Week 6 Q 1 Phil. Arts LASDocument9 pagesWeek 6 Q 1 Phil. Arts LASCheska AgrabioNo ratings yet

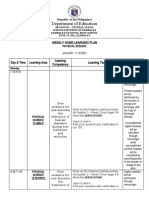

- Weekly home learning plan for Zambales National High SchoolDocument8 pagesWeekly home learning plan for Zambales National High SchoolCheska AgrabioNo ratings yet

- Chap6 Rizal ActivityDocument2 pagesChap6 Rizal ActivityCheska AgrabioNo ratings yet

- Chapter 5Document96 pagesChapter 5Cheska AgrabioNo ratings yet

- AE23 Capital BudgetingDocument4 pagesAE23 Capital BudgetingCheska AgrabioNo ratings yet

- Chapter 3Document5 pagesChapter 3Cheska AgrabioNo ratings yet

- Chapter 11: Inventory Cost FlowDocument12 pagesChapter 11: Inventory Cost FlowCheska AgrabioNo ratings yet

- GEC 3 A Global DividesDocument13 pagesGEC 3 A Global DividesCheska AgrabioNo ratings yet

- Chapter 8Document4 pagesChapter 8Cheska AgrabioNo ratings yet

- Chapter 7Document3 pagesChapter 7Cheska AgrabioNo ratings yet

- Physical Activity SheetDocument2 pagesPhysical Activity SheetCheska AgrabioNo ratings yet

- Assessment 2Document3 pagesAssessment 2Cheska AgrabioNo ratings yet

- Applied Economics Grade 12 Summative ExamDocument5 pagesApplied Economics Grade 12 Summative ExamCheska AgrabioNo ratings yet

- Investment in Equity Securities: Transactions Subsequent To Initial Recognition Share SplitDocument17 pagesInvestment in Equity Securities: Transactions Subsequent To Initial Recognition Share SplitCheska AgrabioNo ratings yet

- FAR-Chapter 4 Problems-SolutionsDocument24 pagesFAR-Chapter 4 Problems-SolutionsCheska AgrabioNo ratings yet

- Financial Assets at Fair Value CH 15Document14 pagesFinancial Assets at Fair Value CH 15Cheska AgrabioNo ratings yet

- Analyzing Financial StatementsDocument15 pagesAnalyzing Financial StatementsCheska AgrabioNo ratings yet

- Schools Division of ZambalesDocument17 pagesSchools Division of ZambalesCheska AgrabioNo ratings yet

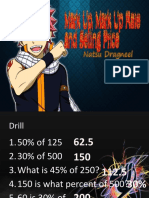

- Mark Up RateDocument21 pagesMark Up RatePadel RonelNo ratings yet

- Cost Accounting and Control: Joint and By-Products Standard CostingDocument6 pagesCost Accounting and Control: Joint and By-Products Standard CostingMaricon BerjaNo ratings yet

- Name - Shivangi Singh Class - Ty Baf-B ROLL NO. - 8286 Subject - Cost Accounting College - Pillai College of Arts, Commerce and Science (Autonomous), New PanvelDocument8 pagesName - Shivangi Singh Class - Ty Baf-B ROLL NO. - 8286 Subject - Cost Accounting College - Pillai College of Arts, Commerce and Science (Autonomous), New PanvelShivangi SinghNo ratings yet

- F402 In-Class Exercise September 3, 2020Document2 pagesF402 In-Class Exercise September 3, 2020Harrison GalavanNo ratings yet

- May 30, 2017 Cedric Kamkoum International Business Oral Presentation, Pusan National University Course Lectured by Professor Eon-Seong LeeDocument30 pagesMay 30, 2017 Cedric Kamkoum International Business Oral Presentation, Pusan National University Course Lectured by Professor Eon-Seong Leeshyam JhalaniNo ratings yet

- EserciziDocument6 pagesEserciziAlessandro d'IserniaNo ratings yet

- Chap06 Pbms MBF12eDocument16 pagesChap06 Pbms MBF12eBeatrice BallabioNo ratings yet

- Business ValuationDocument24 pagesBusiness ValuationMota Tess TheressaNo ratings yet

- Convertibles Primer: Convertible SecuritiesDocument6 pagesConvertibles Primer: Convertible SecuritiesIsaac GoldNo ratings yet

- Valuing Corporations with P/E RatiosDocument24 pagesValuing Corporations with P/E RatiosUzzaam HaiderNo ratings yet

- Unit 6 Lesson ADocument6 pagesUnit 6 Lesson AAreli CollaoNo ratings yet

- Listening - Section 3 - HostelsDocument5 pagesListening - Section 3 - HostelsĐỗ QuỳnhNo ratings yet

- HO 11 - Inventory EstimationDocument4 pagesHO 11 - Inventory EstimationMakoy BixenmanNo ratings yet

- Activity On Short Run Costs and Output DecisionDocument5 pagesActivity On Short Run Costs and Output DecisionJane ButterfieldNo ratings yet

- Cellular Communications Manufactures Cell Phones and Two Cell PHDocument1 pageCellular Communications Manufactures Cell Phones and Two Cell PHAmit PandeyNo ratings yet

- Lecture Notes On Receivable FinancingDocument5 pagesLecture Notes On Receivable Financingjudel ArielNo ratings yet

- Entrepreneurship QuizDocument2 pagesEntrepreneurship Quizwindell arth MercadoNo ratings yet

- Portfolio Insurance: 100% in Risky Asset "Convex" PayoffDocument4 pagesPortfolio Insurance: 100% in Risky Asset "Convex" PayoffYanfei CHENNo ratings yet

- Pre FinalDocument8 pagesPre Finalpdmallari12No ratings yet

- Indian Institute of Foreign Trade EPGDIB HYBRID 19-20 Online Business and Ecommerce Term End ExaminationDocument3 pagesIndian Institute of Foreign Trade EPGDIB HYBRID 19-20 Online Business and Ecommerce Term End ExaminationShahanshah AlamNo ratings yet

- The Searle Company (SEARL) - Reinstating With A BuyDocument17 pagesThe Searle Company (SEARL) - Reinstating With A BuySHAHZAIB -No ratings yet

- The Deckel SO Grinder Buyer's Guide: by Phil Kerner, The Tool & Die GuyDocument6 pagesThe Deckel SO Grinder Buyer's Guide: by Phil Kerner, The Tool & Die GuyAnders LarssonNo ratings yet

- Addis Ababa City Adminstration Educational Bureau: Time Allowed: 2:30 Hours General DirectionsDocument14 pagesAddis Ababa City Adminstration Educational Bureau: Time Allowed: 2:30 Hours General DirectionsErmiasNo ratings yet

- Pages 436 To 478Document43 pagesPages 436 To 478sakthiNo ratings yet

- Mock Maths QPDocument21 pagesMock Maths QPArman JavedNo ratings yet

- M.COM PART II Advanced Cost Accounting Question BankDocument5 pagesM.COM PART II Advanced Cost Accounting Question BankPrathamesh ChawanNo ratings yet

- Module 3 - Real Financial LiteracyDocument1 pageModule 3 - Real Financial Literacyapi-527214044No ratings yet

- Vix CollectionDocument49 pagesVix Collectionfordaveb100% (1)

- BCG MatrixDocument2 pagesBCG Matrixgdpi09No ratings yet

- Black Friday Reading Activity Module 05 Unit 05Document3 pagesBlack Friday Reading Activity Module 05 Unit 05Ashly OrtegaNo ratings yet