Professional Documents

Culture Documents

IAS 38 Intangeble

Uploaded by

Sebesebie Fassil0 ratings0% found this document useful (0 votes)

3 views14 pagesAgricultural asset recognitions

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAgricultural asset recognitions

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views14 pagesIAS 38 Intangeble

Uploaded by

Sebesebie FassilAgricultural asset recognitions

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 14

IAS 38 Intangeble

What is an intangible asset?

Well, according to IAS 38, it’s an identifiable non-monetary asset without physical substance, such as a

licence, patent or trademark.

There are critical attributes of intangible asset are:

1. Identifiability

2. Control (power to obtain benefits from the asset)

3. Future economic benefits

The three critical attributes of an intangible

assets are

1. Identifiability

2. Control (power to obtain benefits from the asset)

3. Future economic benefits

What is identifiable means?

Well it just means the asset is one of 2 things:

1. It is SEPARABLE, meaning it can be sold or rented to another party

on its own (rather than as part of a business) or

2. It arises from contractual or other legal rights.

It is the lack of identifiability which prevents internally generated

goodwill being recognised. It is not separable and does not arise from

contractual or other legal rights

Example

Employees can never be recognised as an asset; they are not under the

control of the employer, are not separable and do not arise from legal

rights• A taxi licence can be an intangible asset as they are controlled,

can be sold/ exchanged/transferred and arise from a legal right (The

intangible doesn’t have to be separable AND arise from a legal right,

just one or the other is enough).

When can you recoginise an IA and for how

much?

1. When it is probable that future economic benefits attributable to

the asset will flow to the entity

2. The cost of the asset can be measured reliably

Purchase price plus directly attributable costs

Remember that directly attributable means costs which otherwise

would not have been paid, so often staff costs are excluded.

IA acquire as part of a business combination

Well this time, the intangible asset (other than goodwill ) should

initially be recognised at its fair value.

If the FV cannot be ascertained then it is not reliably measurable and so

cannot be shown in the accounts.In this case by not showing it, this

means that goodwill becomes higher

Research and Development costs

Research costs are always expensed in the income statement

Development costs are capitalised only after technical and commercial

feasibility of the asset for sale or use have been established.

This means that the enterprise must intend and be able to complete

the intangible asset and either use it or sell it and be able to

demonstrate how the asset will generate future economic benefits.

If entity cannot distinguish between research and development - treat

as research and expense

Research and Development acquired in a

business combination

Recognised as an asset at cost, even if a component is

research.Subsequent expenditure on that project is accounted for as

any other research and development cost

Internally generated Brands, lists

Should not be recognised as assets - expense them as there is no reliable measure

If purchased: capitalise as an IA

Operating system for hardware: include in hardware cost

If internally developed: charge to expense until

technological feasibility,

probable future benefits,

intent and ability to use or sell the software,

resources to complete the software, and

ability to measure cost.

Always expense the following

1. Internally generated goodwill

2. Start-up, pre-opening, and pre-operating costs

3. Training cost

4. Advertising and promotional cost, including mail order catalogues

5. Relocation costs

Intangible Assets –Future measurement

We can use either historic cost or revaluation

historic cost (and amortize)

Generally intangible assets should be amortised over their useful economic life.

1. If has a useful economic life

Amortise over UEL

Residual values should be assumed to be nil, except in the rare circumstances when an active

market exists or there is a commitment by a third party to purchase the asset at the end of its

useful life.

2. If has an indefinite UEL

Check for impairment every year

There should also be an annual review to see if the indefinite life assessment is still

appropriate.

Revaluation (and amortise)

This model can only be adopted if an active market exists for that type

of asset.

Revaluing Intangibles is hard, because there is no physical substance,

and so a reliable measure is tricky.

1. There MUST be an active market

2. The item MUST be unique

Research & development

Research is expensed. Development is often an asset.

Research

Research is investigation to get new knowledge and understanding

So all the expenditure will go to I/S

Development

Under IAS 38, an intangible asset must demonstrate all of the following criteria:(use pirate as a memory jogger)

1. Pobable future economic benefits

2. Intention to complete and use or sell the asset

3. Resources (technical, financial and other resources) are adequate and available to complete and use the asset

4. Ability to use or sell the asset

5. Technical feasibility of completing the intangible asset (so that it will be available for use or sale)

6. Expenditure can be measured reliablyOnce capitalised they should be amortised.Amortisation begins when

commercial production has commenced.

Once capitalized they should be amortised

The cost of the development expenditure should be amortised over the useful life.

Therefore, the cost of the development expenditure is matched against the revenue it

produces.

Amortisation must only begin when the asset is available for use (hence matching the

income and expenditure to the period in which it relates).

It is an expense in the income statement:

Dr Amortisation expense (I/S)

Cr Accumulated amortisation (SFP)

It must be reviewed at the year-end to check it still is an asset and not an expense.

If the criteria are no longer met, then the previously capitalised costs must be written

off to the statement of profit or loss immediately.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Income Tax Worksheet For The Financial Year APR-2019 To MAR-2020Document1 pageIncome Tax Worksheet For The Financial Year APR-2019 To MAR-2020SHIBANI CHOUDHURYNo ratings yet

- Actividad 8 en ClaseDocument2 pagesActividad 8 en Claseluz_ma_6No ratings yet

- IFM-Chap 12Document19 pagesIFM-Chap 12devrajkinjalNo ratings yet

- P4 TextbookDocument400 pagesP4 TextbookSebesebie Fassil100% (1)

- How To Answer An Interest Rate Risk Management Question AFMDocument13 pagesHow To Answer An Interest Rate Risk Management Question AFMSebesebie FassilNo ratings yet

- ETH 2020 Excise Tax Proclamation 1186 - 2020Document34 pagesETH 2020 Excise Tax Proclamation 1186 - 2020Sebesebie Fassil100% (1)

- Eliab T Co Chart. Cer.2017/18: Customer ListDocument4 pagesEliab T Co Chart. Cer.2017/18: Customer ListSebesebie FassilNo ratings yet

- No. Item Description Reference Acquisition DateDocument35 pagesNo. Item Description Reference Acquisition DateSebesebie FassilNo ratings yet

- Agricultural Activity: Agricultural Activity Is The Management of Biological TDocument28 pagesAgricultural Activity: Agricultural Activity Is The Management of Biological TSebesebie FassilNo ratings yet

- How To Measure Fair Value in AgricultureDocument10 pagesHow To Measure Fair Value in AgricultureSebesebie FassilNo ratings yet

- DipIFR TextbookDocument381 pagesDipIFR TextbookSebesebie Fassil100% (1)

- FINAL Precedings WEBcopy2013!11!28Document320 pagesFINAL Precedings WEBcopy2013!11!28CRADALLNo ratings yet

- Form Ca Submission of Claim by Financial Creditors in A ClassDocument2 pagesForm Ca Submission of Claim by Financial Creditors in A ClassnamitaNo ratings yet

- Employer Specail Wage Report Social-Security-Form-SSA-131Document2 pagesEmployer Specail Wage Report Social-Security-Form-SSA-131DellComputer99No ratings yet

- Item 1. BusinessDocument222 pagesItem 1. BusinessVashirAhmadNo ratings yet

- Review Materials For Final ExamDocument3 pagesReview Materials For Final ExamLenen L. RabagoNo ratings yet

- Accounts AssignmentDocument7 pagesAccounts AssignmentMedha SinghNo ratings yet

- 1 GDP (NationalIncomeAccounting)Document53 pages1 GDP (NationalIncomeAccounting)smileseptemberNo ratings yet

- O-Train Confederation Line PA Feb 14 2018Document3 pagesO-Train Confederation Line PA Feb 14 2018Jon WillingNo ratings yet

- Business Letter Cum Form A2 For ICICI Bank LimitedDocument2 pagesBusiness Letter Cum Form A2 For ICICI Bank LimitedDevraj PatilNo ratings yet

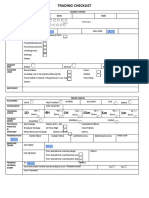

- Trading Checklist BH v2Document2 pagesTrading Checklist BH v2Tong SepamNo ratings yet

- 905pm - 10.EPRA JOURNALS 13145Document3 pages905pm - 10.EPRA JOURNALS 13145Mohammed YASEENNo ratings yet

- Fund Vintage Commitment Returns ROIDocument4 pagesFund Vintage Commitment Returns ROIJonas BrandonNo ratings yet

- REBUILDING HAITI IN THE MARTELLY ERA - June 23 2011Document61 pagesREBUILDING HAITI IN THE MARTELLY ERA - June 23 2011Laurette M. BackerNo ratings yet

- SynopsisDocument5 pagesSynopsisSrinivas Reddy100% (1)

- After The Storm FinalDocument106 pagesAfter The Storm FinalNye Lavalle100% (1)

- Visa Debit Cards - HMBDocument12 pagesVisa Debit Cards - HMBYasser AnwarNo ratings yet

- Capital Budgeting Examples - SolutionsDocument11 pagesCapital Budgeting Examples - Solutionsanik islamNo ratings yet

- 1.1) Introduction To Indian Financial SystemDocument34 pages1.1) Introduction To Indian Financial SystemrssishereNo ratings yet

- Interest & DiscountDocument5 pagesInterest & DiscountThur MykNo ratings yet

- Int To Security AnalysisDocument50 pagesInt To Security AnalysisMuhammad ZubairNo ratings yet

- Lecture 4 The Four Shipping MarketsDocument40 pagesLecture 4 The Four Shipping MarketsAhmed Saeed SoudyNo ratings yet

- Consumer Cards Overview Side by SideDocument6 pagesConsumer Cards Overview Side by SidewewaewaNo ratings yet

- Financial Accounting 4th Edition. Chapter 1 SummaryDocument13 pagesFinancial Accounting 4th Edition. Chapter 1 SummaryJoey TrompNo ratings yet

- CH 8 Sarbanes-Oxley, Internal Control, and Cash PDFDocument24 pagesCH 8 Sarbanes-Oxley, Internal Control, and Cash PDFJovita KhairunnisaNo ratings yet

- The Clearing and Settlement Process Is A Series of Complex TasksDocument2 pagesThe Clearing and Settlement Process Is A Series of Complex TasksHanzo vargasNo ratings yet

- Censof AR2020 (Bursa)Document190 pagesCensof AR2020 (Bursa)~yedNo ratings yet

- Problem CH 6,7,8 - Amelia Zulaikha Pratiwi - MAKSI43BDocument4 pagesProblem CH 6,7,8 - Amelia Zulaikha Pratiwi - MAKSI43Bamelia zulaikhaNo ratings yet