Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

4 viewsChapter 11final

Chapter 11final

Uploaded by

mohamedAccounting Course

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Insurgent Consumer Brands Playbook - 10 May 2023Document65 pagesThe Insurgent Consumer Brands Playbook - 10 May 20234rdw5xvx8gNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Exercises Lesson 3 0809Document11 pagesExercises Lesson 3 0809ChrisYapNo ratings yet

- Pregnancy and Stroke Risk in WomenDocument19 pagesPregnancy and Stroke Risk in WomengresiaNo ratings yet

- Cerebral Venous ThrombosisDocument19 pagesCerebral Venous ThrombosisgresiaNo ratings yet

- Acute Coronary in PregnancyDocument7 pagesAcute Coronary in PregnancygresiaNo ratings yet

- Radiology Journal ReadingDocument75 pagesRadiology Journal ReadinggresiaNo ratings yet

- Radiology Journal Reading 2Document75 pagesRadiology Journal Reading 2gresiaNo ratings yet

- Dr. Wahyudi Pulmonologi Dan Kedokteran RespirasiDocument31 pagesDr. Wahyudi Pulmonologi Dan Kedokteran RespirasigresiaNo ratings yet

- The Interrelations of Radiologic Findings andDocument34 pagesThe Interrelations of Radiologic Findings andgresiaNo ratings yet

- Pelvic Congestion SyndromeDocument47 pagesPelvic Congestion SyndromegresiaNo ratings yet

- Article Review JD Sports Fashion PLCDocument17 pagesArticle Review JD Sports Fashion PLCad2641aNo ratings yet

- Sample Only - Filikospick Status Moni TAYTAYDocument8 pagesSample Only - Filikospick Status Moni TAYTAYRestia SchleiferNo ratings yet

- Auditing A Practical Approach 1st Edition Moroney Solutions ManualDocument37 pagesAuditing A Practical Approach 1st Edition Moroney Solutions ManualAmandaPrestonqajbg100% (15)

- LTCC SeatworkDocument2 pagesLTCC SeatworkCaselyn Clyde UyNo ratings yet

- OSCM Unit-1Document57 pagesOSCM Unit-1Shubham ArgadeNo ratings yet

- Dissolution Practice Questions PDFDocument8 pagesDissolution Practice Questions PDFUmesh JaiswalNo ratings yet

- Overview of Capital MarketsDocument31 pagesOverview of Capital MarketsRheneir MoraNo ratings yet

- Concept of VMP and MRPDocument4 pagesConcept of VMP and MRPfanboxmushiNo ratings yet

- Annual ReportDocument256 pagesAnnual ReportKyeyune AbrahamNo ratings yet

- ACCA Question BankDocument66 pagesACCA Question Bankbbosatravo100% (1)

- 2010 07 HOS Overview Slides Abu Dhabi Rev 2Document20 pages2010 07 HOS Overview Slides Abu Dhabi Rev 2Mazen FakhfakhNo ratings yet

- Wa0099.Document10 pagesWa0099.Bhavika GholapNo ratings yet

- Module in Distribution ManagementDocument11 pagesModule in Distribution ManagementRoberto Velasco MabulacNo ratings yet

- Ma Cia-1Document10 pagesMa Cia-1Siddhant AggarwalNo ratings yet

- Assignment #1: Porter's Five Forces Analysis For Starbucks' Launch in PakistanDocument3 pagesAssignment #1: Porter's Five Forces Analysis For Starbucks' Launch in Pakistanmaryam sherazNo ratings yet

- Total Project CostDocument27 pagesTotal Project Costmae caminNo ratings yet

- Cost Question BankDocument3 pagesCost Question BankAtul ShivaNo ratings yet

- Fabm1 Module 1 Week 2Document5 pagesFabm1 Module 1 Week 2Alma A CernaNo ratings yet

- Strategic Audit NotesDocument3 pagesStrategic Audit Noteswords of Ace.No ratings yet

- Raja Electricals Consortium Brief Note 08 10 2021Document3 pagesRaja Electricals Consortium Brief Note 08 10 2021MSME SULABH TUMAKURUNo ratings yet

- Finding The Present Value For N Not An Integer: SolutionDocument7 pagesFinding The Present Value For N Not An Integer: Solutiondame wayneNo ratings yet

- Lecture 4 - Designing Distribution Networks and Application To Online SalesDocument20 pagesLecture 4 - Designing Distribution Networks and Application To Online SalesNadine AguilaNo ratings yet

- Nanyang Business School AB1201 Financial Management Tutorial 7: The Cost of Capital (Common Questions)Document3 pagesNanyang Business School AB1201 Financial Management Tutorial 7: The Cost of Capital (Common Questions)asdsadsaNo ratings yet

- Instance Medgenome 2020-21 ConsolidatedxmlDocument112 pagesInstance Medgenome 2020-21 ConsolidatedxmlSagar SangoiNo ratings yet

- Beryl's PPT - Group 1Document44 pagesBeryl's PPT - Group 1William Wong67% (3)

- Updates On PFRSDocument50 pagesUpdates On PFRSPrincess ElaineNo ratings yet

- Global Promotion MainDocument20 pagesGlobal Promotion MainAnjali Gurejani0% (1)

Chapter 11final

Chapter 11final

Uploaded by

mohamed0 ratings0% found this document useful (0 votes)

4 views32 pagesAccounting Course

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAccounting Course

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views32 pagesChapter 11final

Chapter 11final

Uploaded by

mohamedAccounting Course

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 32

Decision Making

and

Relevant Information

© 2009 Pearson Prentice Hall. All rights reserved.

Decision Models

A decision model is a formal method of making a

choice, often involving both quantitative and

qualitative analyses

Managers often use some variation of the Five-Step

Decision-Making Process

© 2009 Pearson Prentice Hall. All rights reserved.

Five-Step Decision-Making Process

Step 2:

Make Step 3: Step 4:

Step 1: Step 5:

Predictions Choose Implement

Obtain Evaluate

About An The

Information Performance

Future Alternative Decision

Costs

Feedback

© 2009 Pearson Prentice Hall. All rights reserved.

Relevance

Relevant Information has two characteristics:

It occurs in the future

It differs among the alternative courses of action

Relevant Costs – expected future costs

Relevant Revenues – expected future revenues

© 2009 Pearson Prentice Hall. All rights reserved.

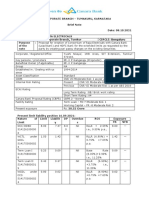

Relevant Cost Illustration

© 2009 Pearson Prentice Hall. All rights reserved.

Features of Relevant Information

© 2009 Pearson Prentice Hall. All rights reserved.

Irrelevance

Historical costs are past costs that are irrelevant to

decision making

Also called Sunk Costs

© 2009 Pearson Prentice Hall. All rights reserved.

A Starting Point: Absorption-Based

Budgeted Income Statement

© 2009 Pearson Prentice Hall. All rights reserved.

Types of Information

Quantitative factors are outcomes that can be

measured in numerical terms

Qualitative factors are outcomes that are difficult to

measure accurately in numerical terms, such as

satisfaction

Are just as important as quantitative factors even

though they are difficult to measure

© 2009 Pearson Prentice Hall. All rights reserved.

Terminology

Incremental Cost – the additional total cost incurred

for an activity

Differential Cost – the difference in total cost

between two alternatives

Incremental Revenue – the additional total revenue

from an activity

Differential Revenue – the difference in total revenue

between two alternatives

© 2009 Pearson Prentice Hall. All rights reserved.

Types of Decisions

One-Time-Only Special Orders

Insourcing vs. Outsourcing

Make or Buy

Product-Mix

Customer Profitability

Branch / Segment: Adding or Discontinuing

Equipment Replacement

© 2009 Pearson Prentice Hall. All rights reserved.

One-Time-Only Special Orders

Accepting or rejecting special orders when there is

idle production capacity and the special orders has no

long-run implications

Decision Rule: does the special order generate

additional operating income?

Yes – accept

No – reject

Compares relevant revenues and relevant costs to

determine profitability

© 2009 Pearson Prentice Hall. All rights reserved.

Special Order Illustration

© 2009 Pearson Prentice Hall. All rights reserved.

Make-or-Buy Illustration

© 2009 Pearson Prentice Hall. All rights reserved.

Make-or-Buy Illustration, Extended

© 2009 Pearson Prentice Hall. All rights reserved.

Potential Problems with

Relevant-Cost Analysis

Avoid incorrect general assumptions about

information, especially:

“All variable costs are relevant and all fixed costs are

irrelevant”

There are notable exceptions for both costs

© 2009 Pearson Prentice Hall. All rights reserved.

Potential Problems with

Relevant-Cost Analysis

Problems with using unit-cost data:

Including irrelevant costs in error

Using the same unit-cost with different output levels

Fixed costs per unit change with different levels of

output (Growth and expansion requires more

investments in fixed assets increasing total fixed cost)

© 2009 Pearson Prentice Hall. All rights reserved.

Avoiding Potential Problems with

Relevant-Cost Analysis

Focus on Total Revenues and Total Costs, not their

per-unit equivalents

Continually evaluate data to ensure that it meets the

requirements of relevant information

© 2009 Pearson Prentice Hall. All rights reserved.

Insourcing vs. Outsourcing

Insourcing – producing goods or services within an

organization

Outsourcing – purchasing goods or services from

outside vendors

Also called the “Make or Buy” decision

Decision Rule: Select the that option will provide the

firm with the lowest cost, and therefore the highest

profit.

© 2009 Pearson Prentice Hall. All rights reserved.

Qualitative Factors

Non-quantitative factors may be extremely important

in an evaluation process, yet do not show up directly

in calculations:

Quality Requirements

Reputation of Outsourcer

Employee Morale

Logistical Considerations – distance from plant, etc

© 2009 Pearson Prentice Hall. All rights reserved.

Opportunity Costs

Opportunity Cost is the contribution to operating

income that is foregone by not using a limited

resource in it’s next-best alternative use

“How much profit did the firm ‘lose out on’ by not selecting

this alternative?”

Special type of Opportunity Cost: Holding Cost for

Inventory. Funds tied up in inventory are not

available for investment elsewhere

© 2009 Pearson Prentice Hall. All rights reserved.

Product-Mix Decisions

The decisions made by a company about which

products to sell and in what quantities

Decision Rule (with a constraint): choose the

product that produces the highest contribution

margin per unit of the constraining resource:

machine hour, labor hour

© 2009 Pearson Prentice Hall. All rights reserved.

Adding or Dropping Customers

Decision Rule: Does adding or dropping a customer

add operating income to the firm?

Yes – add or don’t drop

No – drop or don’t add

Decision is based on profitability of the customer,

not how much revenue a customer generates

© 2009 Pearson Prentice Hall. All rights reserved.

Customer Profitability Analysis,

Illustrated

© 2009 Pearson Prentice Hall. All rights reserved.

Customer Profitability Analysis,

Extended

© 2009 Pearson Prentice Hall. All rights reserved.

Adding or Discontinuing

Branches or Segments

Decision Rule: Does adding or discontinuing a branch

or segment add operating income to the firm?

Yes – add or don’t discontinue

No – discontinue or don’t add

Decision is based on profitability of the branch or

segment, not how much revenue the branch or

segment generates

© 2009 Pearson Prentice Hall. All rights reserved.

Adding/Closing Offices or Segments,

Illustrated

© 2009 Pearson Prentice Hall. All rights reserved.

Equipment-Replacement Decisions

Sometimes difficult due to amount of information at

hand that is irrelevant:

Cost, Accumulated Depreciation and Book Value of

existing equipment

Any potential Gain or Loss on the transaction – a

Financial Accounting phenomenon only

Decision Rule: Select the alternative that will

generate the highest operating income

© 2009 Pearson Prentice Hall. All rights reserved.

Equipment-Replacement Decisions,

Illustrated

© 2009 Pearson Prentice Hall. All rights reserved.

Equipment-Replacement Decisions,

Illustrated (Relevant Costs Only)

© 2009 Pearson Prentice Hall. All rights reserved.

Behavioral Implications

Despite the quantitative nature of some aspects of

decision making, not all managers will choose the

best alternative for the firm

Managers could engage in self-serving behavior such

as delaying needed equipment maintenance in order

to meet their personal profitability quotas for bonus

consideration

© 2009 Pearson Prentice Hall. All rights reserved.

© 2009 Pearson Prentice Hall. All rights reserved.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Insurgent Consumer Brands Playbook - 10 May 2023Document65 pagesThe Insurgent Consumer Brands Playbook - 10 May 20234rdw5xvx8gNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Exercises Lesson 3 0809Document11 pagesExercises Lesson 3 0809ChrisYapNo ratings yet

- Pregnancy and Stroke Risk in WomenDocument19 pagesPregnancy and Stroke Risk in WomengresiaNo ratings yet

- Cerebral Venous ThrombosisDocument19 pagesCerebral Venous ThrombosisgresiaNo ratings yet

- Acute Coronary in PregnancyDocument7 pagesAcute Coronary in PregnancygresiaNo ratings yet

- Radiology Journal ReadingDocument75 pagesRadiology Journal ReadinggresiaNo ratings yet

- Radiology Journal Reading 2Document75 pagesRadiology Journal Reading 2gresiaNo ratings yet

- Dr. Wahyudi Pulmonologi Dan Kedokteran RespirasiDocument31 pagesDr. Wahyudi Pulmonologi Dan Kedokteran RespirasigresiaNo ratings yet

- The Interrelations of Radiologic Findings andDocument34 pagesThe Interrelations of Radiologic Findings andgresiaNo ratings yet

- Pelvic Congestion SyndromeDocument47 pagesPelvic Congestion SyndromegresiaNo ratings yet

- Article Review JD Sports Fashion PLCDocument17 pagesArticle Review JD Sports Fashion PLCad2641aNo ratings yet

- Sample Only - Filikospick Status Moni TAYTAYDocument8 pagesSample Only - Filikospick Status Moni TAYTAYRestia SchleiferNo ratings yet

- Auditing A Practical Approach 1st Edition Moroney Solutions ManualDocument37 pagesAuditing A Practical Approach 1st Edition Moroney Solutions ManualAmandaPrestonqajbg100% (15)

- LTCC SeatworkDocument2 pagesLTCC SeatworkCaselyn Clyde UyNo ratings yet

- OSCM Unit-1Document57 pagesOSCM Unit-1Shubham ArgadeNo ratings yet

- Dissolution Practice Questions PDFDocument8 pagesDissolution Practice Questions PDFUmesh JaiswalNo ratings yet

- Overview of Capital MarketsDocument31 pagesOverview of Capital MarketsRheneir MoraNo ratings yet

- Concept of VMP and MRPDocument4 pagesConcept of VMP and MRPfanboxmushiNo ratings yet

- Annual ReportDocument256 pagesAnnual ReportKyeyune AbrahamNo ratings yet

- ACCA Question BankDocument66 pagesACCA Question Bankbbosatravo100% (1)

- 2010 07 HOS Overview Slides Abu Dhabi Rev 2Document20 pages2010 07 HOS Overview Slides Abu Dhabi Rev 2Mazen FakhfakhNo ratings yet

- Wa0099.Document10 pagesWa0099.Bhavika GholapNo ratings yet

- Module in Distribution ManagementDocument11 pagesModule in Distribution ManagementRoberto Velasco MabulacNo ratings yet

- Ma Cia-1Document10 pagesMa Cia-1Siddhant AggarwalNo ratings yet

- Assignment #1: Porter's Five Forces Analysis For Starbucks' Launch in PakistanDocument3 pagesAssignment #1: Porter's Five Forces Analysis For Starbucks' Launch in Pakistanmaryam sherazNo ratings yet

- Total Project CostDocument27 pagesTotal Project Costmae caminNo ratings yet

- Cost Question BankDocument3 pagesCost Question BankAtul ShivaNo ratings yet

- Fabm1 Module 1 Week 2Document5 pagesFabm1 Module 1 Week 2Alma A CernaNo ratings yet

- Strategic Audit NotesDocument3 pagesStrategic Audit Noteswords of Ace.No ratings yet

- Raja Electricals Consortium Brief Note 08 10 2021Document3 pagesRaja Electricals Consortium Brief Note 08 10 2021MSME SULABH TUMAKURUNo ratings yet

- Finding The Present Value For N Not An Integer: SolutionDocument7 pagesFinding The Present Value For N Not An Integer: Solutiondame wayneNo ratings yet

- Lecture 4 - Designing Distribution Networks and Application To Online SalesDocument20 pagesLecture 4 - Designing Distribution Networks and Application To Online SalesNadine AguilaNo ratings yet

- Nanyang Business School AB1201 Financial Management Tutorial 7: The Cost of Capital (Common Questions)Document3 pagesNanyang Business School AB1201 Financial Management Tutorial 7: The Cost of Capital (Common Questions)asdsadsaNo ratings yet

- Instance Medgenome 2020-21 ConsolidatedxmlDocument112 pagesInstance Medgenome 2020-21 ConsolidatedxmlSagar SangoiNo ratings yet

- Beryl's PPT - Group 1Document44 pagesBeryl's PPT - Group 1William Wong67% (3)

- Updates On PFRSDocument50 pagesUpdates On PFRSPrincess ElaineNo ratings yet

- Global Promotion MainDocument20 pagesGlobal Promotion MainAnjali Gurejani0% (1)