Professional Documents

Culture Documents

Accounting Cycle of A Service Business

Uploaded by

Esmhel Briones0 ratings0% found this document useful (0 votes)

17 views12 pagesOriginal Title

Accounting Cycle of a Service Business

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views12 pagesAccounting Cycle of A Service Business

Uploaded by

Esmhel BrionesCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 12

Accounting Cycle of a Service Business

Learning Objectives

1. Prepare a worksheet.

2. Prepare closing entries.

3. Prepare a balance sheet and income

statement of a service business.

4. Prepare reversing entries.

Chapter 9: Accounting Cycle of a Service

Business (FAR by: Millan)

Worksheet

A worksheet is an analytical device used to

facilitate the gathering of data for

adjustments, the preparation of financial

statements, and closing entries.

Chapter 9: Accounting Cycle of a Service Business (FAR by: Millan)

Chapter 9: Accounting Cycle of a Service Business (FAR by: Millan)

Financial statements

• The financial statements are the end

product of the accounting process.

Information from the journal and the ledger

are meaningless to most users unless they

are summarized and communicated through

the financial statements.

Chapter 9: Accounting Cycle of a Service Business (FAR by: Millan)

The major processes in accounting are

summarized below:

Chapter 9: Accounting Cycle of a Service Business (FAR by: Millan)

Financial Statements

• Statement of financial position (or Balance

sheet) – shows information on assets,

liabilities and equity.

• Statement of profit or loss (or Income

statement) – shows information on income

and expenses, and consequently, the profit

or loss for the period.

Chapter 9: Accounting Cycle of a Service Business (FAR by: Millan)

Closing entries

• Closing entries are entries prepared at the

end of the accounting period to “zero out”

all nominal accounts in the ledger. This is

done so that the transactions during the

period will not commingle with the

transactions in the next period.

Chapter 9: Accounting Cycle of a Service Business (FAR by: Millan)

Closing entries

• Closing entries are prepared as follows:

a. All income accounts are debited and all

expense accounts are credited. The resulting

balance is recorded in a clearing account called

the “Income summary.”

b. The balance of “Income summary” is closed to

the “Owner’s capital” account.

c. Any balance in the “Owner’s drawings” account

is closed to the “Owner’s capital” account.

Chapter 9: Accounting Cycle of a Service Business (FAR by: Millan)

Chapter 9: Accounting Cycle of a Service Business (FAR by: Millan)

Reversing Entries

• Reversing entries are entries usually made

on the first day of the next accounting

period to reverse certain adjusting entries

made in the immediately preceding period.

Chapter 9: Accounting Cycle of a Service Business (FAR by: Millan)

Adjusting entries that may be reversed

1. Accruals for income or expense

2. Prepayments initially recorded using the

expense method

3. Advanced collections initially recorded

using the income method

Chapter 9: Accounting Cycle of a Service Business (FAR by: Millan)

END

Chapter 9: Accounting Cycle of a Service

Business (FAR by: Millan)

You might also like

- Chapter 8 Adjusting EntriesDocument19 pagesChapter 8 Adjusting EntriesBLANKNo ratings yet

- 2022 PPT Topic 1 V2 Effects of Changes in Foreign Exchange RatesDocument31 pages2022 PPT Topic 1 V2 Effects of Changes in Foreign Exchange RatesDarryl AgustinNo ratings yet

- Reviewer For Liabilities and Substantive Test of LiabilitiesDocument4 pagesReviewer For Liabilities and Substantive Test of LiabilitiesErica FlorentinoNo ratings yet

- Principles of Working Capital ManagementDocument45 pagesPrinciples of Working Capital ManagementSohini ChakrabortyNo ratings yet

- Accounting Concepts and PrinciplesDocument41 pagesAccounting Concepts and PrinciplesDon Jack Caalim100% (1)

- Financing and Investing CycleDocument38 pagesFinancing and Investing CycleMarisa LeeNo ratings yet

- CH 08Document37 pagesCH 08France SerdeniaNo ratings yet

- Accounting For Non-AccountantsDocument10 pagesAccounting For Non-AccountantsMelojane BarcelonaNo ratings yet

- Enterprise Resource PlanningDocument22 pagesEnterprise Resource Planningravi_84No ratings yet

- Irr Racc Nfjpia 1718Document13 pagesIrr Racc Nfjpia 1718Karen AguinaldoNo ratings yet

- Audit Under Computerized Information System CISDocument59 pagesAudit Under Computerized Information System CISJohn David Alfred EndicoNo ratings yet

- General Controls: (Acc 401B - Auditing EDP Environment)Document9 pagesGeneral Controls: (Acc 401B - Auditing EDP Environment)Pines MacapagalNo ratings yet

- Module 1 Overview of Auditing Merged 1Document61 pagesModule 1 Overview of Auditing Merged 1Rhejean LozanoNo ratings yet

- Robert Z. San Juan Management Consultancy Chapter 14-15 May 1, 2020Document13 pagesRobert Z. San Juan Management Consultancy Chapter 14-15 May 1, 2020Parki jiminsNo ratings yet

- Analysis For Cash FlowDocument31 pagesAnalysis For Cash FlowRaja Tejas YerramalliNo ratings yet

- Shamoon SultanDocument15 pagesShamoon SultanSaher FatimaNo ratings yet

- Adjusting Entries QuizDocument2 pagesAdjusting Entries QuizOfelia YanosNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument13 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionMarielle Mae BurbosNo ratings yet

- Sample Exam 2Document16 pagesSample Exam 2Zenni T XinNo ratings yet

- Adjusting EntriesDocument43 pagesAdjusting EntriesCH Umair MerryNo ratings yet

- 13Document63 pages13amysilverbergNo ratings yet

- CHAPTER 10: Capital Budgeting Techniques: Annual Net IncomeDocument2 pagesCHAPTER 10: Capital Budgeting Techniques: Annual Net IncomeSeresa EstrellasNo ratings yet

- Revision Notes: Auditing and Investigations Audit ObjectivesDocument51 pagesRevision Notes: Auditing and Investigations Audit ObjectivesGeraldwerreNo ratings yet

- MERCHANDISING BUSINESS (Periodic Vs Perpetual)Document3 pagesMERCHANDISING BUSINESS (Periodic Vs Perpetual)Laurence Karl CurboNo ratings yet

- PAS 01 Presentation of FSDocument12 pagesPAS 01 Presentation of FSRia GayleNo ratings yet

- Exam 1 - Key AnswersDocument23 pagesExam 1 - Key Answersarlynajero.ckcNo ratings yet

- AFAR 2305 Not-for-Profit OrganizationsDocument14 pagesAFAR 2305 Not-for-Profit OrganizationsDzulija TalipanNo ratings yet

- The Expenditure Cycle: Part I: Purchases and Cash Disbursements ProceduresDocument40 pagesThe Expenditure Cycle: Part I: Purchases and Cash Disbursements ProceduresstudentresearchonlyNo ratings yet

- MF Working CapitalDocument81 pagesMF Working CapitalJansen Alonzo BordeyNo ratings yet

- 01 Overview of Accounting PDFDocument18 pages01 Overview of Accounting PDFEdogawa SherlockNo ratings yet

- Audit CupDocument5 pagesAudit CupPhilip CastroNo ratings yet

- Long-Term FinancingDocument30 pagesLong-Term Financingmarkwillbalbas100% (1)

- Corporate LiquidationDocument16 pagesCorporate LiquidationRosalie E. BalhagNo ratings yet

- Presentation in Accounting & Financial AnalysisDocument55 pagesPresentation in Accounting & Financial AnalysisNamrata Gupta100% (1)

- Chapter 3 AccountingDocument11 pagesChapter 3 AccountingĐỗ ĐăngNo ratings yet

- 02 Introduction To Accounting Standards 1Document3 pages02 Introduction To Accounting Standards 1dria olivaNo ratings yet

- Audit in CIS QuizDocument3 pagesAudit in CIS QuizctcasipleNo ratings yet

- TOPIC 2 NOTES and LOANS PAYABLEDocument4 pagesTOPIC 2 NOTES and LOANS PAYABLEDustinEarth Buyo MontebonNo ratings yet

- Bsba - Bacc-1 - Midterm Exam - ADocument3 pagesBsba - Bacc-1 - Midterm Exam - AMechileNo ratings yet

- Practice Set Audit of PPEDocument1 pagePractice Set Audit of PPEAlexis BagongonNo ratings yet

- Chapter 4 Books of Accounts and Double Entry SystemDocument61 pagesChapter 4 Books of Accounts and Double Entry SystemMonica BuscatoNo ratings yet

- Topic 4 - Adjusting Accounts and Preparing Financial StatementsDocument18 pagesTopic 4 - Adjusting Accounts and Preparing Financial Statementsapi-388504348100% (1)

- 2.3.1 Working Capital ConceptsDocument7 pages2.3.1 Working Capital Concepts이시연100% (1)

- Cfas Paa 1 ReviewerDocument44 pagesCfas Paa 1 ReviewerGleah Mae GonzagaNo ratings yet

- Review of The Accounting ProcessDocument10 pagesReview of The Accounting ProcessFranz TagubaNo ratings yet

- Financial Statement Assertions... Auditing Ass. (Nikita, Pooja, Shivani)Document9 pagesFinancial Statement Assertions... Auditing Ass. (Nikita, Pooja, Shivani)Brahamdeep KaurNo ratings yet

- Accounting Concepts and Accounting Equation DrillsDocument3 pagesAccounting Concepts and Accounting Equation Drillsken garciaNo ratings yet

- Parnership Ans CorpDocument23 pagesParnership Ans CorpJoshGarciaNo ratings yet

- Conceptual Framework and Accounting StandardDocument16 pagesConceptual Framework and Accounting StandardAya AlayonNo ratings yet

- Basic Accounting Level 1 Quiz Instructions: Started: Dec 26 at 5:20amDocument24 pagesBasic Accounting Level 1 Quiz Instructions: Started: Dec 26 at 5:20amVhia Rashelle GalzoteNo ratings yet

- AFAR Test BankDocument57 pagesAFAR Test BankandengNo ratings yet

- IAS-36 (Impairment of Assets)Document10 pagesIAS-36 (Impairment of Assets)Nazmul HaqueNo ratings yet

- Taxation of Income of Individuals IDocument61 pagesTaxation of Income of Individuals ICaroline Muthoni Mwangi100% (1)

- Chapter 3-Adjusting The AccountsDocument26 pagesChapter 3-Adjusting The Accountsbebybey100% (1)

- PA 231 Session 10 Government Auditing April 25Document29 pagesPA 231 Session 10 Government Auditing April 25Reina Regina S. CamusNo ratings yet

- At 9401Document12 pagesAt 9401Luzviminda SaspaNo ratings yet

- Chapter 1 Approaches To OaDocument5 pagesChapter 1 Approaches To OaChristlyn Joy BaralNo ratings yet

- Excel Professional Services, Inc.: Discussion QuestionsDocument5 pagesExcel Professional Services, Inc.: Discussion QuestionskæsiiiNo ratings yet

- Chapter 9 - Accounting Cycle of A Service BusinessDocument15 pagesChapter 9 - Accounting Cycle of A Service Businessgeyb away0% (1)

- Chapter 9Document14 pagesChapter 9lovelyangelptrinidadNo ratings yet

- CH 04 Work Related AttitudeDocument32 pagesCH 04 Work Related AttitudeEsmhel BrionesNo ratings yet

- CH 06 Groups and TeamsDocument23 pagesCH 06 Groups and TeamsEsmhel BrionesNo ratings yet

- CH 01 Introduction To Organizational BehaviorDocument45 pagesCH 01 Introduction To Organizational BehaviorEsmhel BrionesNo ratings yet

- CH 03 MotivationDocument30 pagesCH 03 MotivationEsmhel BrionesNo ratings yet

- CH 08 Prosocial BehaviorDocument22 pagesCH 08 Prosocial BehaviorEsmhel BrionesNo ratings yet

- Building An Organization Capable of Good Strategy Execution: People, Capabilities, and StructureDocument47 pagesBuilding An Organization Capable of Good Strategy Execution: People, Capabilities, and StructureEsmhel BrionesNo ratings yet

- Building Organization Capable Good Strategy ExecutionDocument46 pagesBuilding Organization Capable Good Strategy ExecutionEsmhel BrionesNo ratings yet

- Ma 04 Strategic Business AnalysisDocument6 pagesMa 04 Strategic Business AnalysisEsmhel BrionesNo ratings yet

- DiagnosticQuiz PM1Document3 pagesDiagnosticQuiz PM1Esmhel BrionesNo ratings yet

- Week 1 - Introduction To Pricing StrategyDocument6 pagesWeek 1 - Introduction To Pricing StrategyEsmhel BrionesNo ratings yet

- MngtScience Week1 2Document12 pagesMngtScience Week1 2Esmhel BrionesNo ratings yet

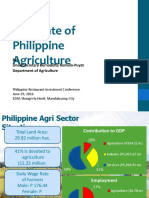

- The State of Philippine Agriculture: By: Undersecretary Bernadette Romulo-Puyat Department of AgricultureDocument28 pagesThe State of Philippine Agriculture: By: Undersecretary Bernadette Romulo-Puyat Department of AgricultureEsmhel BrionesNo ratings yet

- Organisation Structure in SAP Environment: Dattatraya Subhash ChoudhariDocument23 pagesOrganisation Structure in SAP Environment: Dattatraya Subhash Choudharirakeshbanik100% (2)

- Walmart Financial AnalysisDocument187 pagesWalmart Financial AnalysisKareem L SayidNo ratings yet

- Review of Financial StatementsDocument48 pagesReview of Financial StatementsJohn OpeñaNo ratings yet

- Working Capital Management (A Lecture)Document9 pagesWorking Capital Management (A Lecture)Anupam DeNo ratings yet

- Examination Question and Answers, Set E (Multiple Choice), Chapter 15 - Statement of Cash FlowDocument3 pagesExamination Question and Answers, Set E (Multiple Choice), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Partnership Liquidation: Atiqah Pertemuan Ke 3Document20 pagesPartnership Liquidation: Atiqah Pertemuan Ke 3Vania UtamiNo ratings yet

- AFM 3 4表格Document3 pagesAFM 3 4表格mincole17No ratings yet

- Introduction To The Functional Areas of Management: BY: Kian Danielle P. ValdezDocument30 pagesIntroduction To The Functional Areas of Management: BY: Kian Danielle P. ValdezMaricar RamirezNo ratings yet

- AFM Cash Flow StatementDocument13 pagesAFM Cash Flow StatementSusheel KumarNo ratings yet

- Ets MFTDocument64 pagesEts MFTfioNo ratings yet

- MBA 8 Year 2 Accounting For Decision Making Workbook January 2020Document94 pagesMBA 8 Year 2 Accounting For Decision Making Workbook January 2020weedforlifeNo ratings yet

- Financial Project Report On Asian PaintsDocument36 pagesFinancial Project Report On Asian Paintsdhartip_169% (13)

- (For Companies Other Than Companies Claiming Exemption Under Section 11) (Please See Rule 12 of The Income-Tax Rules, 1962)Document82 pages(For Companies Other Than Companies Claiming Exemption Under Section 11) (Please See Rule 12 of The Income-Tax Rules, 1962)Deeksha SinghNo ratings yet

- Vardhan Consulting Finance Internship Task 1Document6 pagesVardhan Consulting Finance Internship Task 1Ravi KapoorNo ratings yet

- Depreciation, Impairments, and Depletion - PART 1Document35 pagesDepreciation, Impairments, and Depletion - PART 1ditaadeliaNo ratings yet

- Rec Center News Sun City West May 2008Document24 pagesRec Center News Sun City West May 2008Del Webb Sun Cities MuseumNo ratings yet

- Income Statement of Apple IncDocument6 pagesIncome Statement of Apple IncBharat PanthiNo ratings yet

- Pract 1 - Exam1Document8 pagesPract 1 - Exam1MimiNo ratings yet

- Reviewer From Prelim To FinalsDocument324 pagesReviewer From Prelim To FinalsRina Mae Sismar Lawi-an100% (1)

- Cheating SheetDocument13 pagesCheating SheetAlfian Ardhiyana PutraNo ratings yet

- Organization Study At: Executive SummaryDocument55 pagesOrganization Study At: Executive SummaryRAMYAAAAA88% (8)

- Working Capital: MeaningsDocument57 pagesWorking Capital: MeaningsUtkalika PattanaikNo ratings yet

- Liaison Office: Steps To Be Taken To Open A Liaison OfficeDocument5 pagesLiaison Office: Steps To Be Taken To Open A Liaison OfficeSwapnilNo ratings yet

- Excel Solutions - CasesDocument25 pagesExcel Solutions - CasesJerry Ramos CasanaNo ratings yet

- Wiley Cmaexcel Learning System Exam Review 2020: Part 1: Financial Planning, Performance, and AnalyticsDocument152 pagesWiley Cmaexcel Learning System Exam Review 2020: Part 1: Financial Planning, Performance, and AnalyticsRoaa Al-Ayyat71% (7)

- IAS 16 - Property Plant and EquipmentDocument35 pagesIAS 16 - Property Plant and EquipmentlaaybaNo ratings yet

- La Sallian PrayerDocument5 pagesLa Sallian PrayersilentwattpadreaderNo ratings yet

- Fa2 BPP Kit 2017Document218 pagesFa2 BPP Kit 2017Five Fifth100% (2)

- BAFINMAX Handout Financial Planning and ForecastingDocument5 pagesBAFINMAX Handout Financial Planning and ForecastingDeo CoronaNo ratings yet

- (TEST BANK and SOL) Current LiabilitiesDocument5 pages(TEST BANK and SOL) Current LiabilitiesJhazz DoNo ratings yet