Professional Documents

Culture Documents

Green Banking Presentation B

Uploaded by

Alina niaz0 ratings0% found this document useful (0 votes)

11 views6 pagesThis document presents information on green banking guidelines from Pakistan, India, and Bangladesh. It discusses the guidelines implemented in each country, including Pakistan introducing guidelines in 2017 to promote environmental risk management and climate finance. It also provides a comparison of green financing and policies between the three countries. The document concludes that promoting green banking is important for sustainable development and reducing environmental impacts.

Original Description:

Original Title

Green banking presentation B

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document presents information on green banking guidelines from Pakistan, India, and Bangladesh. It discusses the guidelines implemented in each country, including Pakistan introducing guidelines in 2017 to promote environmental risk management and climate finance. It also provides a comparison of green financing and policies between the three countries. The document concludes that promoting green banking is important for sustainable development and reducing environmental impacts.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views6 pagesGreen Banking Presentation B

Uploaded by

Alina niazThis document presents information on green banking guidelines from Pakistan, India, and Bangladesh. It discusses the guidelines implemented in each country, including Pakistan introducing guidelines in 2017 to promote environmental risk management and climate finance. It also provides a comparison of green financing and policies between the three countries. The document concludes that promoting green banking is important for sustainable development and reducing environmental impacts.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 6

“SBP BSC Virtual Summer

Internship Presentation”

Green Banking Guidelines

Presenters

Group B

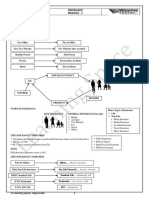

Green Banking Guidelines

• Green Banking is an emerging concept for Environment sustainability it

means promoting Environment friendly practices for sustainable growth and

reduces the carbon footprint from the banking industry.

• Green Banking acknowledges responsibility of the financial sector in

supporting policies initiatives for transforming a country’s economy towards

a low carbon and climate resilient economy. Green Banking envisions

fixation of environmental consciousness as part of organizational culture

and reorientation of banking products, services and operations to reduce

environmental impact of banks and the economy.

• Importance of GRG

• Green Banking Products and Services

• Challenges to the Green Banking Guidelines

Comparison

Green Banking in Green banking in India Green banking in

Pakistan Bangladesh

In 2017, the SBP launched The Government of India has The central bank of

green banking guidelines issued guidelines/instructions Bangladesh has issued

(GBGs) to promote to banks on Green Initiatives. policy guidelines for green

environmental risk In order to implement the

management within banks green initiatives of the

banking that aim to

and encourage climate government prevent environmental

finance which aims at degradation and ensure

reducing environmental sustainable banking

vulnerabilities practices.

These Guidelines deal with All public sector banks and The Guidelines cover the

the following three areas: all regional rural were asked incorporation of

Risk Management to: Enviromental risk

Business Facilitation • Increase use of Electronic management

• Own Impact Reduction Payment • Green financing

• Increase use of Core • Climate risk funds

Banking Solution (CBS) • Green marketing

• Enviromental • Online banking

sustainability • Environmental resource

• Offer centralized payment management

system

• Green

Green finance

Pakistan India Bangladesh

financing is to

The SBP introduced The State Bank of India Implemented a

increase level green banking guidelines introduced the Green comprehensive green

of financial to promote green finance Channel as an finance policy to

in the country safeguard environmental

flows (from initial step of green

degradation and ensure

banking. The State Bank

banking, included terms sustainable

micro-credit, of environmental risks for banking practices. Banks

assessing the borrowers have included

insurance and environmental and

investment) climate change risk as

from the part of existing risk

methodology to assess a

public, private potential borrower.

and not-for- Banks/DFIs are in As per the directives of The policy was divided

profit sectors process of the State Bank of India, into three phases. In

banks/DFIs phase I,

to sustainable formulating green have taken necessary banks/DFIs have to

development banking policies to measures for green develop green banking

be implemented for banking in terms of policy. Phase II suggests

priorities. promoting policies as well as the formulating sector-

sustainable banking branch banking. specific environmental

However, a lot more policies, In phase III,

efforts are required to banks/DFIs are expected

make this process to address the entire

rigorous. ecosystem

Possible policies for GBG

Policies for Green Banking:

1. The Bank would establish risk management procedures to identify, assess,

mitigate and monitor environmental risks arising from operations.

2. The Bank would allocate funding resources for green business facilitation

that impact on improving the carbon foot print and is more resource efficient.

• 3. The Bank would setup its branches and offices in such a way that its

operations use minimum energy and other resources leading to own impact

reduction having minimum impact on the environment.

Conclusion

Conclusion

Promoting Green banking is the need of today’s world.

The disastrous impact of recent storms, floods, droughts, and excessive heat

that the world recently experienced, motivate us to think about reducing use of

Carbon to conserve our natural environment.

Green Banking concept will be beneficial for both the banking industries and

the economy. Not only “Green Banking” will ensure the greening of the

industries but it will also facilitate in improving the asset quality of the banks in

future.

• All this will ultimately lead to better human life and facilities as well as

sustainable developments without spoiling or destroying nature.

THANK YOU

You might also like

- 231FIN42A05 Group 9 Topic 6Document16 pages231FIN42A05 Group 9 Topic 623a7510168No ratings yet

- BankingDocument23 pagesBankingMohammad Raisul HasanNo ratings yet

- Project On Green BankingDocument12 pagesProject On Green Bankingmukul kumarNo ratings yet

- Bank Asia Ltd.Document3 pagesBank Asia Ltd.Naznin Alam Ria -62No ratings yet

- Green Banking Practices in BangladeshDocument6 pagesGreen Banking Practices in BangladeshIOSRjournal100% (1)

- India Banca VerdeDocument13 pagesIndia Banca Verdejamuel portilloNo ratings yet

- Green Banking ASSIGNMENTDocument8 pagesGreen Banking ASSIGNMENTRishabh kumarNo ratings yet

- A Comparative Analysis On Green Banking PDFDocument11 pagesA Comparative Analysis On Green Banking PDFmjoyroyNo ratings yet

- Synergy 21Document18 pagesSynergy 21Eddie BrockNo ratings yet

- Fareast International University: Course Title: BUS 2311 (Fundamental of Banking)Document23 pagesFareast International University: Course Title: BUS 2311 (Fundamental of Banking)Tanjila SathiNo ratings yet

- Green FinancingDocument26 pagesGreen Financingsajid bhattiNo ratings yet

- What Is Green Banking?Document4 pagesWhat Is Green Banking?Farjana Hossain DharaNo ratings yet

- Asian Journal of Multidisciplinary Studies: Green Banking: An OverviewDocument5 pagesAsian Journal of Multidisciplinary Studies: Green Banking: An OverviewS KhanNo ratings yet

- Body of Final Term PaperDocument33 pagesBody of Final Term PaperShibajit HalderNo ratings yet

- Green BankingDocument26 pagesGreen BankingAl-Nahian Bin HossainNo ratings yet

- Incorporating ESG Risk in Bank Lending I PDFDocument12 pagesIncorporating ESG Risk in Bank Lending I PDFMehedi Hasan MahirNo ratings yet

- Final MBA Green BankingDocument67 pagesFinal MBA Green Bankingjioun67% (3)

- Quarterly Review Report - Green Banking ActivitiesDocument16 pagesQuarterly Review Report - Green Banking Activitiestayef12345No ratings yet

- Green BankingDocument54 pagesGreen Bankingd_nayeemNo ratings yet

- A Study On Green Banking in India - An: Commerce Original Research PaperDocument3 pagesA Study On Green Banking in India - An: Commerce Original Research PaperAnitha RNo ratings yet

- Wa0014Document38 pagesWa0014anithaqmsNo ratings yet

- Green Banking in BangladeshDocument6 pagesGreen Banking in BangladeshmjoyroyNo ratings yet

- An Evaluation of Green Banking Practices in BangladeshDocument10 pagesAn Evaluation of Green Banking Practices in BangladeshAzdanaNo ratings yet

- A Study On Customers Awareness On Green Banking Initiatives in Selected Private Sector Banks With Reference To Kunnamkulam MunicipalityDocument3 pagesA Study On Customers Awareness On Green Banking Initiatives in Selected Private Sector Banks With Reference To Kunnamkulam MunicipalityArun Malaikandan SubramanianNo ratings yet

- Innovation Green Banking in Banking Service (Electronic Banking)Document4 pagesInnovation Green Banking in Banking Service (Electronic Banking)eurekadwiraNo ratings yet

- Report Topic: Sustainable Banking Adaptation in Pcbs of Bangladesh'Document4 pagesReport Topic: Sustainable Banking Adaptation in Pcbs of Bangladesh'S.M. Aminul HaqueNo ratings yet

- Green Banking-Towards Socially Resonsible Banking in BangladeshDocument46 pagesGreen Banking-Towards Socially Resonsible Banking in BangladeshNur AlamNo ratings yet

- Assignment On Green BankingDocument7 pagesAssignment On Green BankingMohd Tawher Ashraf Siddiqui SadatNo ratings yet

- Green Banking: A Conceptual Study On Its Issues, Challenges and Sustainable Growth in IndiaDocument6 pagesGreen Banking: A Conceptual Study On Its Issues, Challenges and Sustainable Growth in IndiaInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- Green-Banking NBLDocument39 pagesGreen-Banking NBLZordan Ri Z VyNo ratings yet

- An Evaluation of Green Banking Practices PDFDocument10 pagesAn Evaluation of Green Banking Practices PDFJunaeadHossainOlyNo ratings yet

- Challenges of Green Banking in The Context of BangladeshDocument19 pagesChallenges of Green Banking in The Context of BangladeshAshrafuzzaman AshiqNo ratings yet

- A Study On Customer Perception Towards Green Banking - A Special Reference To State Bank of India - Bangalore and Mysore CityDocument7 pagesA Study On Customer Perception Towards Green Banking - A Special Reference To State Bank of India - Bangalore and Mysore CityarcherselevatorsNo ratings yet

- Policy Brief - Greening The Financial System of PakistanDocument20 pagesPolicy Brief - Greening The Financial System of PakistanatiqNo ratings yet

- Green Banking For Green EnvironmentDocument13 pagesGreen Banking For Green EnvironmentRitesh KumarNo ratings yet

- Green Banking in Bangladesh 2013Document4 pagesGreen Banking in Bangladesh 2013Nafeesur Rahman KhanNo ratings yet

- Green Banking Issues and Challenges in IDocument3 pagesGreen Banking Issues and Challenges in Iakhil kumarNo ratings yet

- Green Banking in Bangladesh-A Comparative AnalysisDocument10 pagesGreen Banking in Bangladesh-A Comparative AnalysisMd.Hafizur RahamanNo ratings yet

- Ujaf9 12225784Document8 pagesUjaf9 12225784suci wulandariNo ratings yet

- Green-Central-Banking in Emerging Markets and Developing Country EconomiesDocument54 pagesGreen-Central-Banking in Emerging Markets and Developing Country EconomiesSương DiệpNo ratings yet

- Assignment On Green BankingDocument7 pagesAssignment On Green BankingRajesh Paul100% (1)

- Ew201605 01 000560Document4 pagesEw201605 01 000560comnguoiNo ratings yet

- Green Banking: Page - 1Document3 pagesGreen Banking: Page - 1Tufayel AhmedNo ratings yet

- Green Banking Practice, Status and Prospectus of Bangladesh-A Review and Summary of Green Banking Practice in BangladeshDocument15 pagesGreen Banking Practice, Status and Prospectus of Bangladesh-A Review and Summary of Green Banking Practice in BangladeshMd. Jisan AhmedNo ratings yet

- Green Banking and Its Impacts PDFDocument16 pagesGreen Banking and Its Impacts PDFMuhammad TamimNo ratings yet

- Green Banking India's Vision For Sustainable Finance in G20Document5 pagesGreen Banking India's Vision For Sustainable Finance in G20Editor IJTSRDNo ratings yet

- Vol 2+no 4+artikel+9Document14 pagesVol 2+no 4+artikel+9irwil satu kdpdttNo ratings yet

- Green FinDocument33 pagesGreen Finsajid bhattiNo ratings yet

- Role of Green Banking in Environment Sustainability - A Study of Selected Commercial Banks in Himachal PradeshDocument6 pagesRole of Green Banking in Environment Sustainability - A Study of Selected Commercial Banks in Himachal PradeshAnitha RNo ratings yet

- Nikita Green BankingDocument51 pagesNikita Green BankingAbdul Rasheed100% (1)

- Do Green Banking Activities ImDocument19 pagesDo Green Banking Activities Imsamina manzoorNo ratings yet

- Sustainability 14 00989Document18 pagesSustainability 14 00989hathu.bifaneuNo ratings yet

- Policy Guideline For Green BankingDocument11 pagesPolicy Guideline For Green BankingSyed RiponNo ratings yet

- Research Proposal Moonmoon MaamDocument4 pagesResearch Proposal Moonmoon MaamRofsana AkterNo ratings yet

- Green Banking: Farooq HossanDocument2 pagesGreen Banking: Farooq Hossanrezwan_haque_2No ratings yet

- Ghana Sustainable Banking Principles and Guidelines Book 1Document197 pagesGhana Sustainable Banking Principles and Guidelines Book 1yansahNo ratings yet

- Green Banking Research PaperDocument12 pagesGreen Banking Research PaperPoonam Ilag88% (8)

- Greening Development in the People’s Republic of China: A Dynamic Partnership with the Asian Development BankFrom EverandGreening Development in the People’s Republic of China: A Dynamic Partnership with the Asian Development BankNo ratings yet

- Greening the Financial System: Climate Financial Risks and How ADB Can HelpFrom EverandGreening the Financial System: Climate Financial Risks and How ADB Can HelpNo ratings yet

- Creativity and The Business DataDocument30 pagesCreativity and The Business DataAlina niazNo ratings yet

- Legal Issue For EntrepreneurDocument26 pagesLegal Issue For EntrepreneurAlina niazNo ratings yet

- First Meet UP-Peace-BDocument5 pagesFirst Meet UP-Peace-BAlina niazNo ratings yet

- EntrepreneurshipDocument21 pagesEntrepreneurshipAlina niazNo ratings yet

- IMChap 001Document17 pagesIMChap 001Alina niazNo ratings yet

- 427 - Impact of Mobile Banking On Overall Customer Satisfaction An Empirical StudyDocument10 pages427 - Impact of Mobile Banking On Overall Customer Satisfaction An Empirical StudyAlina niazNo ratings yet

- SSRN Id4132574Document39 pagesSSRN Id4132574Alina niazNo ratings yet

- An Analysisof Mobile Banking Acceptanceby PakistaniDocument10 pagesAn Analysisof Mobile Banking Acceptanceby PakistaniAlina niazNo ratings yet

- KumariDocument7 pagesKumariAlina niazNo ratings yet

- Glavee Geo2CShaikh2CKarjaluoto MobilebankingservicesadoptioninPakistanDocument36 pagesGlavee Geo2CShaikh2CKarjaluoto MobilebankingservicesadoptioninPakistanAlina niazNo ratings yet

- Entrepreneur AttentionDocument22 pagesEntrepreneur AttentionAlina niazNo ratings yet

- The Government Sadiq College Women UniversityDocument16 pagesThe Government Sadiq College Women UniversityAlina niazNo ratings yet

- Statement of Cash Flows: Mcgraw-Hill/IrwinDocument59 pagesStatement of Cash Flows: Mcgraw-Hill/IrwinAlina niazNo ratings yet

- Chapter No. 15 Fiscal Policy: Conceptual AspectsDocument28 pagesChapter No. 15 Fiscal Policy: Conceptual AspectsAlina niazNo ratings yet

- Impacts of Population Explosion On EnvironmentDocument14 pagesImpacts of Population Explosion On EnvironmentAlina niazNo ratings yet

- Environmental Impact Assessment (EIA)Document15 pagesEnvironmental Impact Assessment (EIA)Alina niazNo ratings yet

- Principles of Marketing: Marketing Channels and Supply Chain ManagementDocument22 pagesPrinciples of Marketing: Marketing Channels and Supply Chain ManagementAlina niazNo ratings yet

- Standard Specifications For Construction Works 2019 - Module 19Document964 pagesStandard Specifications For Construction Works 2019 - Module 19Craig LongNo ratings yet

- Employees Survival Guide BookDocument104 pagesEmployees Survival Guide Bookzvqyus77No ratings yet

- Narrative Report On Student Led Hazard MappingDocument2 pagesNarrative Report On Student Led Hazard MappingLoyvic GabitoNo ratings yet

- Rift Valley University Hawassa Campus Master of Business Administration Program Assignment On Human Resource ManagementDocument12 pagesRift Valley University Hawassa Campus Master of Business Administration Program Assignment On Human Resource ManagementHACHALU FAYENo ratings yet

- N M Rothschild LTD.... Annual Report 2012Document98 pagesN M Rothschild LTD.... Annual Report 2012Helen BlooreNo ratings yet

- MAC Tailings Guide Version 3 2 March 2021Document98 pagesMAC Tailings Guide Version 3 2 March 2021SafwatNo ratings yet

- Entrepreneurial Orientation and Business Performance of Small and Medium Scale Enterprises of Western Province in Sri LankaDocument18 pagesEntrepreneurial Orientation and Business Performance of Small and Medium Scale Enterprises of Western Province in Sri LankaLam Vu TruongNo ratings yet

- AdidasDocument11 pagesAdidasWarah RajabNo ratings yet

- ADB Concept PaperDocument34 pagesADB Concept PaperNidhi BahotNo ratings yet

- CH20Document6 pagesCH20Alex GomezNo ratings yet

- TR Beauty Care Services (Nail Care) NC IIDocument58 pagesTR Beauty Care Services (Nail Care) NC IILeah TallaNo ratings yet

- Insurance 5 Modules Learning SpaceDocument13 pagesInsurance 5 Modules Learning Spaceamit chawlaNo ratings yet

- Heat Stress GuidelinesDocument22 pagesHeat Stress Guidelinesgajeel1991No ratings yet

- 2012 Rand Rca Vol 2Document115 pages2012 Rand Rca Vol 2Ajit SinhaNo ratings yet

- Malelang, Roseanne Pearl, B. BSA 2-4Document9 pagesMalelang, Roseanne Pearl, B. BSA 2-4RoseanneNo ratings yet

- The Model For Use of Chemicals by Sugarcane Farmers For Reducing Health and Environmental Impacts in ThailandDocument5 pagesThe Model For Use of Chemicals by Sugarcane Farmers For Reducing Health and Environmental Impacts in ThailandInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Hazard Checklist and Production Risk AssessmentDocument3 pagesHazard Checklist and Production Risk Assessmentapi-388728409100% (1)

- FD32 - Configure and Customize SAP Automatic Credit ManagementDocument23 pagesFD32 - Configure and Customize SAP Automatic Credit ManagementAndres OrtizNo ratings yet

- BSBCRT611 Assessment 2 - FelipeDocument27 pagesBSBCRT611 Assessment 2 - FelipeAna Martinez90% (20)

- Shaminah 1-3Document47 pagesShaminah 1-3mulabbi brianNo ratings yet

- Principle of Banking & Insurance Quiz 3Document4 pagesPrinciple of Banking & Insurance Quiz 3Sohel MahmudNo ratings yet

- Top 8 Theories of ProfitDocument7 pagesTop 8 Theories of Profitrhena villapasNo ratings yet

- RA Overhead CraneDocument5 pagesRA Overhead CraneRandy Adisyah100% (2)

- Objective Analysis in Project Development and ManagementDocument35 pagesObjective Analysis in Project Development and ManagementEC PINTANo ratings yet

- Week 11Document12 pagesWeek 11Matthew MaNo ratings yet

- Chapter 7Document43 pagesChapter 7Vashna PrasadNo ratings yet

- Category & Commodity Procurement 1Document7 pagesCategory & Commodity Procurement 1reaoboka stanleyNo ratings yet

- Manual CivCity RomeDocument38 pagesManual CivCity RomeLuciana RodriguesNo ratings yet

- 1854-Article Text-18098-1-10-20201220Document13 pages1854-Article Text-18098-1-10-20201220Muhammad Hendrik KotoNo ratings yet

- Psychiatric Nursing Practice Test IDocument19 pagesPsychiatric Nursing Practice Test Igirl_fenolNo ratings yet